Is CBC safe?

Pros

Cons

Is CBC Safe or a Scam?

Introduction

In the dynamic world of forex trading, the importance of selecting a trustworthy broker cannot be overstated. CBC, a broker that has emerged in this competitive landscape, claims to offer various trading services. However, the question that looms large is whether CBC is a reliable platform or a potential scam. Traders need to exercise caution as the forex market is rife with unscrupulous entities that can lead to significant financial losses. This article aims to provide a comprehensive analysis of CBC, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk assessment. Our investigation is based on a thorough examination of credible sources, user reviews, and regulatory databases to determine if CBC is safe or a scam.

Regulation and Legitimacy

The regulatory framework surrounding a broker is crucial as it ensures compliance with industry standards and offers a layer of protection to traders. Unfortunately, CBC does not hold a license from any major financial regulatory authority. This absence of regulation raises a significant red flag for potential investors.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The lack of oversight means that CBC is not subject to the rigorous standards imposed by top-tier regulators, such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia. This absence of regulation can lead to a higher risk of fraudulent activities, as there are no governing bodies to enforce accountability. Moreover, previous complaints about CBC suggest that traders have faced issues with fund withdrawals and customer service, further corroborating concerns regarding its legitimacy.

Company Background Investigation

CBC appears to have a vague company history, with limited information available about its ownership structure and management team. A broker's transparency is often indicative of its reliability, and CBC falls short in this regard. The lack of publicly available information about its founders or executive team raises questions about its operational integrity.

While some brokers provide detailed profiles of their management teams, including their qualifications and experiences, CBC does not offer such insights. This lack of transparency can be concerning for traders who wish to understand the team's expertise and the company's operational ethos. Additionally, there are no clear indicators of the company's financial backing or history of compliance, which further complicates the assessment of its trustworthiness.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer play a vital role in determining their reliability. CBC has been reported to have a convoluted fee structure, which may not be immediately apparent to new traders. Such practices can lead to unexpected charges that can significantly eat into profits.

| Fee Type | CBC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 1.5 pips |

| Commission Model | N/A | 0 - 0.5% |

| Overnight Interest Range | High | Low |

The spread on major currency pairs is reported to be variable, which can lead to increased trading costs, especially during volatile market conditions. Furthermore, the absence of a clear commission structure may confuse traders, as they might not fully understand how their trading costs are calculated. This lack of clarity in fees can be a potential indicator of a broker that may not have the best interests of its clients at heart.

Client Fund Safety

The safety of client funds is paramount in the forex trading industry. CBC has been criticized for its lack of robust security measures. There are no indications that client funds are kept in segregated accounts, which is a standard practice among reputable brokers.

Traders should be aware that the absence of fund segregation means that their money could be at risk in the event of the broker's insolvency. Additionally, there are no clear investor protection policies or negative balance protection measures in place, which further exacerbates the risk associated with trading on this platform. Historical complaints regarding fund withdrawal issues suggest that CBC has faced challenges in maintaining a secure environment for its clients' investments.

Customer Experience and Complaints

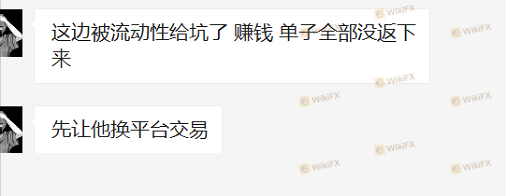

Analyzing customer feedback is crucial in understanding a broker's reliability. Unfortunately, reviews of CBC reveal a pattern of dissatisfaction among users. Many clients have reported difficulties in withdrawing their funds, with some claiming that their accounts were frozen without explanation.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delay | Medium | Poor |

| Account Freezing | High | Poor |

The severity of these complaints cannot be understated, as they directly impact traders' ability to access their funds. The company's response to these issues has been largely inadequate, with many users reporting a lack of communication from customer support. This pattern of customer dissatisfaction raises serious concerns about CBC's commitment to maintaining a positive trading environment.

Platform and Execution

The performance of a trading platform is another critical factor in assessing a broker's reliability. CBC's platform has been described as unstable, with users experiencing frequent disconnections and slow execution speeds. Such issues can lead to slippage and missed trading opportunities, which can be detrimental to traders, especially in fast-moving markets.

Furthermore, there are allegations of potential platform manipulation, raising concerns about the integrity of trade executions. Traders should be wary of brokers that do not provide transparent information about their order execution policies, as this can be indicative of deeper issues within the trading infrastructure.

Risk Assessment

The overall risk associated with trading through CBC is considerable. The lack of regulation, unclear fee structures, and negative customer experiences all contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated, no oversight |

| Financial Risk | High | No fund segregation, potential insolvency |

| Execution Risk | Medium | Platform instability, potential manipulation |

To mitigate these risks, traders should consider diversifying their investments and only trading with capital they can afford to lose. It is also advisable to seek out brokers that are regulated by reputable authorities, ensuring a higher level of accountability and protection.

Conclusion and Recommendations

In conclusion, the evidence suggests that CBC poses significant risks to potential traders. The absence of regulation, combined with numerous customer complaints and a lack of transparency, raises serious concerns about the broker's integrity. Therefore, it is prudent for traders to exercise caution and consider alternative options.

For those seeking reliable forex trading platforms, it is recommended to explore brokers that are regulated by top-tier authorities and have a proven track record of positive customer experiences. Brokers such as OANDA, IG, and Forex.com are known for their transparency, robust security measures, and commitment to customer service. In light of the findings, it is clear that CBC is not a safe option for traders looking to invest in the forex market.

Is CBC a scam, or is it legit?

The latest exposure and evaluation content of CBC brokers.

CBC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CBC latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.