Is Capitist safe?

Pros

Cons

Is Capitist A Scam?

Introduction

Capitist is an online forex broker that positions itself as a premier trading platform for both novice and experienced traders. With claims of transparency and a user-friendly interface, Capitist aims to attract a wide range of clients. However, the forex market is fraught with risks, and it is crucial for traders to exercise caution when selecting a broker. Given the prevalence of scams in the industry, evaluating a broker's legitimacy is essential for protecting one's investments. This article aims to investigate the safety and reliability of Capitist by analyzing its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

Regulation is a pivotal aspect of any trading platform, as it provides assurance that the broker adheres to certain standards and practices designed to protect traders. Capitist claims to be regulated by the Financial Services Commission (FSC) of Mauritius. However, the effectiveness of this regulation is often questioned due to the lax oversight typical of offshore jurisdictions.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSC Mauritius | GB21026886 | Mauritius | Unverified |

The FSC's regulatory framework does not provide the same level of investor protection as more stringent regulators like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). Furthermore, there are indications that Capitist does not appear in the FCA's register, raising concerns about its operational legitimacy. The lack of a solid regulatory framework means that traders using Capitist may be exposed to higher risks, particularly regarding fund safety and withdrawal processes.

Company Background Investigation

Capitist was established in December 2019, and its ownership structure includes several entities registered in offshore jurisdictions such as St. Vincent and the Grenadines and Mauritius. The company operates under the name Capitist Group, but detailed information about its management team and operational history remains sparse.

The anonymity surrounding its management raises red flags regarding transparency and accountability. A reputable broker typically provides clear information about its leadership, including professional backgrounds and experience in the financial sector. The absence of such information for Capitist could indicate a lack of professionalism and reliability, making it difficult for clients to ascertain who is managing their investments.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is vital for assessing its overall value. Capitist offers a minimum deposit of $100, which aligns with industry standards. However, the trading cost structure, including spreads and commissions, requires careful scrutiny.

| Cost Type | Capitist | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | 2.0 pips | 1.0-1.5 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While Capitist promotes a low entry barrier, the spreads it offers are relatively high compared to industry averages, which can significantly impact profitability. Additionally, the lack of transparency regarding commissions and overnight interest rates is concerning. Traders may find themselves facing unexpected fees that could erode their profits.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker. Capitist claims to implement certain safety measures; however, the lack of a robust regulatory framework raises questions about the effectiveness of these measures.

Capitist does not provide clear information regarding segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds. Furthermore, there is no mention of investor protection schemes, which are typically offered by regulated brokers to safeguard client assets in the event of insolvency.

Historically, offshore brokers like Capitist have been associated with fund safety issues, leading to significant losses for traders. The absence of a comprehensive safety net for customer funds suggests that traders should be cautious when considering Capitist as a trading platform.

Customer Experience and Complaints

User feedback is a valuable resource for understanding a broker's reliability. Reviews of Capitist reveal a pattern of negative experiences, particularly concerning withdrawal difficulties and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Poor |

| Misleading Promotions | High | Poor |

Common complaints include prolonged delays in processing withdrawals, which is a significant red flag indicating potential issues with fund management. Additionally, users have reported that customer support is unresponsive, particularly when inquiries involve withdrawal requests. One notable case involved a trader who was unable to withdraw funds for several months, ultimately leading to the conclusion that Capitist operates with deceptive practices.

Platform and Trade Execution

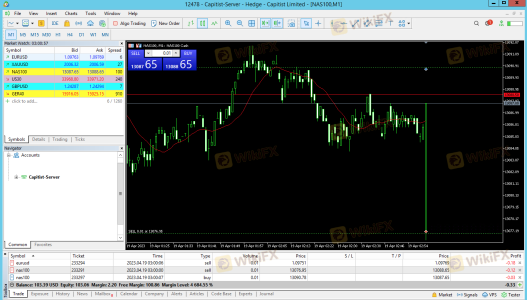

The trading platform provided by Capitist is MetaTrader 5 (MT5), a widely recognized platform that offers advanced trading features. However, user experiences regarding platform performance vary significantly. Many traders report issues with order execution quality, including slippage and rejected orders.

The presence of such issues can severely impact trading performance, especially for those employing high-frequency or algorithmic trading strategies. If traders suspect that their orders are being manipulated, it raises serious concerns about the integrity of the trading environment.

Risk Assessment

Using Capitist carries a range of risks that traders should be aware of before engaging with the platform.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated environment increases exposure to fraud. |

| Fund Safety Risk | High | Lack of segregation and protection for client funds. |

| Execution Risk | Medium | Reports of slippage and rejected orders. |

Given these risks, it is advisable for traders to consider alternative, more reputable brokers with established regulatory frameworks and a track record of positive customer experiences.

Conclusion and Recommendations

In conclusion, the evidence suggests that Capitist is not a safe trading platform. The combination of inadequate regulation, a lack of transparency, and a poor reputation among users indicates that it may be operating as a scam. Traders should exercise extreme caution when considering this broker, as the potential for financial loss is significant.

For those looking for safer alternatives, it is recommended to explore brokers that are well-regulated by reputable authorities, such as the FCA or ASIC. These brokers typically offer better protection for client funds, more transparent trading conditions, and a higher level of customer service. Ultimately, conducting thorough research and due diligence is essential for ensuring a secure trading experience in the forex market.

Is Capitist a scam, or is it legit?

The latest exposure and evaluation content of Capitist brokers.

Capitist Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Capitist latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.