Capitist 2025 Review: Everything You Need to Know

In 2025, the Capitist trading platform continues to generate mixed reviews among users and experts alike. While it offers a range of trading options and competitive leverage, concerns regarding its regulatory status and user experiences raise significant red flags. Notably, the platform operates under offshore regulations, which may expose traders to higher risks.

Note: It is crucial to understand that Capitist operates in various jurisdictions, and the regulatory scrutiny can differ significantly across regions. This review aims to provide a balanced overview based on the most recent findings to ensure fairness and accuracy.

Rating Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user reviews, expert opinions, and factual data regarding trading conditions.

Broker Overview

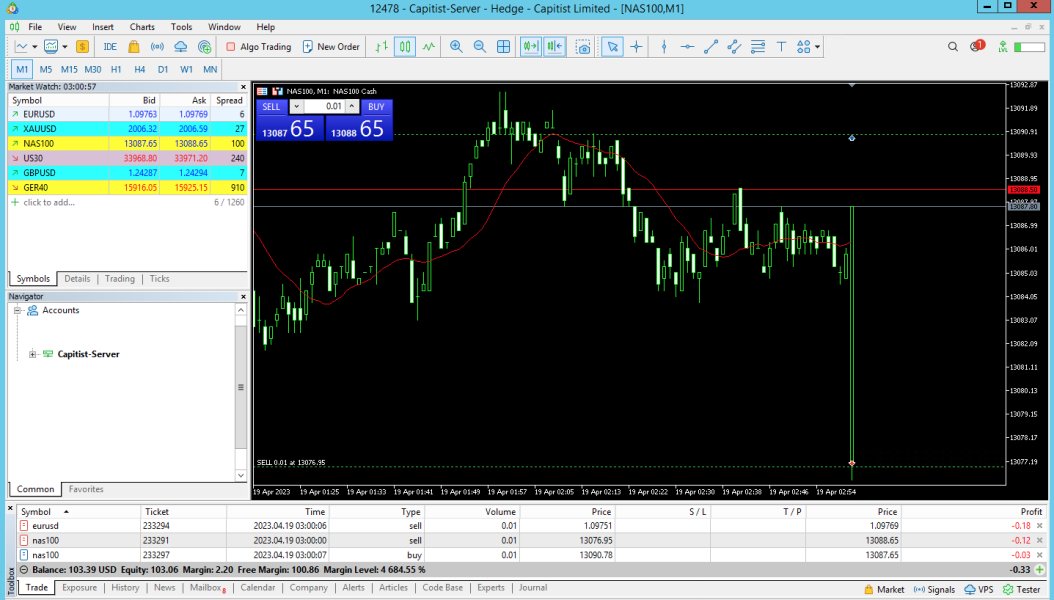

Founded between 2019 and 2021, Capitist is registered in Mauritius and claims to offer a regulated trading environment under the Financial Services Commission (FSC) of Mauritius. The platform primarily utilizes the MetaTrader 5 (MT5) trading platform, which is favored for its advanced features and user-friendly interface. Traders can access a diverse range of asset classes, including forex, cryptocurrencies, commodities, and stocks. However, the lack of stringent oversight raises concerns about the safety of user funds.

Detailed Breakdown

Regulatory Regions: Capitist claims to be regulated by the FSC of Mauritius, but many sources indicate that this regulation does not provide the same level of protection as those from top-tier jurisdictions like the FCA or ASIC. This has led to skepticism regarding its legitimacy and safety.

Deposit/Withdrawal Currencies/Cryptocurrencies: The platform supports multiple currencies, including USD, EUR, and various cryptocurrencies like Bitcoin and Ethereum. However, the lack of clarity regarding withdrawal processes and potential fees has been a point of contention among users.

Minimum Deposit: The minimum deposit requirement for a micro account is reported to be around $100, which is relatively low compared to other brokers. However, higher-tier accounts require significantly larger deposits, with premium accounts starting at $5,000.

Bonuses/Promotions: While Capitist offers various promotions, many users have reported that these bonuses come with stringent withdrawal conditions, making it difficult to access funds once deposited.

Asset Classes: Users can trade a wide array of assets, including forex pairs, commodities like gold and oil, cryptocurrencies, and stocks. However, the variety of instruments does not compensate for the concerns surrounding the broker's trustworthiness.

Costs (Spreads, Fees, Commissions): Capitist offers spreads that vary by account type, starting from 2.0 pips for micro accounts. However, the lack of transparency around additional fees and commissions has been a point of criticism among users.

Leverage: The platform offers leverage up to 1:500, which can amplify both potential gains and losses. This high leverage is particularly attractive to experienced traders but poses significant risks, especially for novices.

Permitted Trading Platforms: Capitist exclusively uses the MT5 platform, which is known for its advanced trading capabilities. However, the absence of additional platforms may limit options for some traders.

Restricted Regions: While Capitist claims to cater to a global audience, it is essential to check if your country of residence allows trading with this broker, as some jurisdictions may have restrictions.

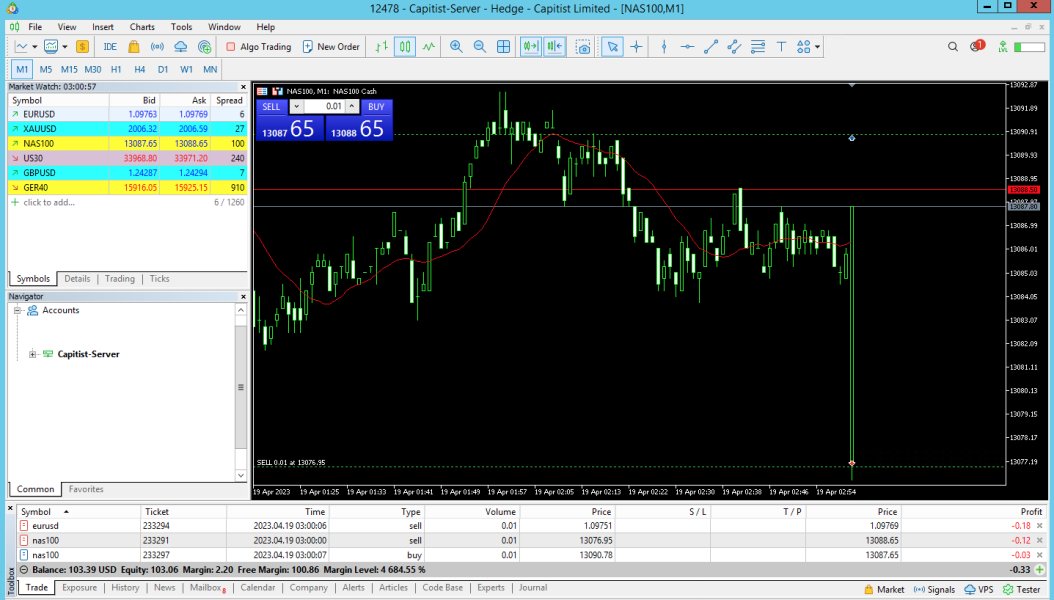

Available Customer Service Languages: Customer support is available in English, but many users have reported delays and unresponsive service when seeking assistance, which has contributed to the overall low rating in this category.

Final Rating Overview

Detailed Analysis

Account Conditions: The variety of account types is a positive aspect, catering to both novice and experienced traders. However, the high minimum deposit for premium accounts may deter some potential users.

Tools and Resources: Capitist provides educational resources and access to MT5, but many users feel that additional training materials could enhance their trading experience.

Customer Service and Support: The reported issues with customer service, including slow response times and unhelpful support, significantly impact user satisfaction.

Trading Experience: While the trading platform is robust, the lack of transparency regarding fees and withdrawal conditions diminishes the overall trading experience.

Trustworthiness: The offshore regulatory status and numerous user complaints raise significant concerns about the safety of funds and the overall integrity of the platform.

User Experience: Overall, user experiences are mixed, with some appreciating the low minimum deposit and asset variety, while others express frustration over withdrawal issues and customer support.

In conclusion, while Capitist offers various features and competitive conditions, potential users should proceed with caution. The regulatory concerns, coupled with mixed user reviews, suggest that thorough research is essential before engaging with this broker. Always consider the risks involved and consult with financial advisors if necessary.