Regarding the legitimacy of Cambridge FX forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is Cambridge FX safe?

Pros

Cons

Is Cambridge FX markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

CAMBRIDGE MERCANTILE (AUSTRALIA) PTY. LTD.

Effective Date:

2010-07-06Email Address of Licensed Institution:

compliance@cambridgefx.com.auSharing Status:

No SharingWebsite of Licensed Institution:

www.cambridgefx.com.auExpiration Time:

--Address of Licensed Institution:

DAVID BRITTEN, 'Citigroup Centre' Suite D Level 38, 2-26 Park Street SYDNEY NSW 2000, 212 King Street West Suite 400 Toronto, ON M5H 1K5, CanadaPhone Number of Licensed Institution:

0280766500Licensed Institution Certified Documents:

Is Cambridge FX A Scam?

Introduction

Cambridge FX, now known as Corpay, positions itself as a provider of integrated cross-border payment services and currency risk management solutions. Established in 2018, this broker operates primarily in the foreign exchange (forex) market, catering to businesses looking for effective currency management strategies. However, the forex market is rife with risks, and traders must exercise caution when selecting a broker. The potential for fraud and mismanagement is significant, making it essential for traders to conduct thorough due diligence before committing their funds. This article investigates the safety and reliability of Cambridge FX by examining its regulatory standing, company background, trading conditions, customer experiences, and overall risk profile.

Regulatory Status and Legitimacy

Regulation is a crucial aspect of any financial service provider, as it establishes a framework for operational standards and investor protection. Cambridge FX claims to be regulated by the Australian Securities and Investments Commission (ASIC), holding license number 351278. However, this license has been flagged as a suspicious clone, raising concerns about its legitimacy. The table below summarizes the core regulatory information for Cambridge FX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 351278 | Australia | Suspicious Clone |

The quality of regulation is vital as it directly impacts the safety of client funds. ASIC is known for its stringent regulatory standards; however, the allegations of Cambridge FX operating as a clone raise red flags. Moreover, there have been no significant negative regulatory disclosures reported against Cambridge FX, but the lack of transparency regarding its actual operational status is concerning. Traders should be wary of brokers that claim regulation but lack verifiable credentials.

Company Background Investigation

Cambridge FX was founded with the aim of providing innovative payment solutions and currency risk management services. The company operates under the umbrella of Fleetcor Technologies, a well-established entity in the payments industry. Despite its affiliation with a larger corporation, the transparency surrounding Cambridge FX's ownership structure and operational history remains limited.

The management team behind Cambridge FX is expected to possess relevant industry experience, yet specific details about their backgrounds and qualifications are scarce. This lack of information can be a cause for concern, as a strong management team is often indicative of a broker's reliability. Furthermore, the company's website offers minimal insight into its operational practices, which further diminishes its transparency and credibility in the eyes of potential clients.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Cambridge FX provides various trading instruments, including forex pairs, but details on its fee structure and trading costs are not abundantly clear. The following table summarizes the core trading costs associated with Cambridge FX:

| Fee Type | Cambridge FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.5% - 2.0% |

While Cambridge FX advertises competitive spreads, the variability can lead to unexpected costs, especially during volatile market conditions. Additionally, the absence of a clear commission structure may indicate hidden fees that could affect trading profitability. Traders should be cautious of brokers with ambiguous pricing policies, as they may lead to higher-than-expected trading costs.

Client Funds Security

The safety of client funds is paramount when evaluating a broker. Cambridge FX claims to implement several measures to safeguard client assets, including segregated accounts and investor protection policies. However, the details surrounding these safety measures are not well-documented.

Investors should be aware that the lack of a clear policy on negative balance protection can expose them to significant risks in volatile market conditions. Furthermore, historical complaints regarding withdrawal issues have surfaced, indicating that clients may have struggled to access their funds. Such incidents raise concerns about the overall reliability of a broker's fund management practices, emphasizing the importance of thoroughly investigating a broker's security protocols before entrusting them with capital.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's performance. In the case of Cambridge FX, user reviews indicate a mixed experience, with some clients reporting difficulties in withdrawing funds. The table below outlines the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Transparency Concerns | Medium | Inconsistent |

| Customer Service Delays | Medium | Average |

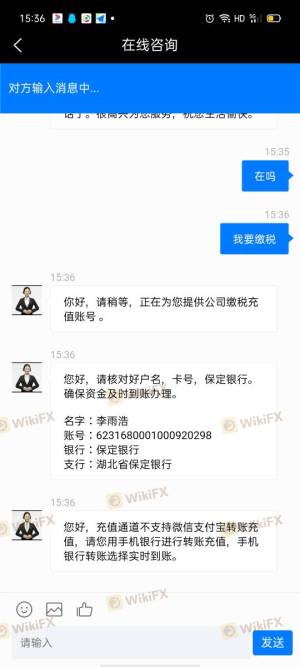

Several users have reported that their withdrawal requests were either delayed or denied, leading to frustration and distrust. One case involved a client who was told that taxes needed to be paid before they could access their funds, only to later face issues with their bank details being rejected. Such experiences highlight the importance of assessing a broker's customer service quality and responsiveness.

Platform and Execution

The trading platform is a critical component of the trading experience. Cambridge FX offers a proprietary platform, but details regarding its performance, stability, and user experience are limited. Traders have expressed concerns over order execution quality, including instances of slippage and order rejections. Without transparency in these areas, it is challenging to gauge the overall effectiveness of the trading platform.

Furthermore, any signs of potential market manipulation or unfair practices could significantly undermine a broker's credibility. Traders should be cautious of platforms that do not provide clear information on execution policies, as this could lead to unfavorable trading conditions.

Risk Assessment

Using Cambridge FX presents several risks that potential clients should consider. The following risk scorecard summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status and clone claims |

| Withdrawal Risk | High | Reports of withdrawal difficulties |

| Transparency Risk | Medium | Limited information disclosure |

| Execution Risk | Medium | Potential slippage and rejections |

To mitigate these risks, traders are advised to conduct thorough research, consider alternative brokers with better regulatory standing, and ensure they fully understand the terms and conditions of their trading agreements.

Conclusion and Recommendations

In conclusion, while Cambridge FX offers various services in the forex market, the evidence suggests that it may not be a safe choice for investors. The regulatory concerns, customer complaints, and lack of transparency raise significant red flags. Traders should exercise extreme caution and consider other options before investing with Cambridge FX. For those looking for reliable alternatives, brokers with solid regulatory oversight and positive customer feedback, such as HotForex or FXPrimus, may be more suitable choices. Ultimately, the decision to engage with Cambridge FX should be made with a comprehensive understanding of the associated risks and potential pitfalls.

Is Cambridge FX a scam, or is it legit?

The latest exposure and evaluation content of Cambridge FX brokers.

Cambridge FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Cambridge FX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.