Cambridge FX Review 2

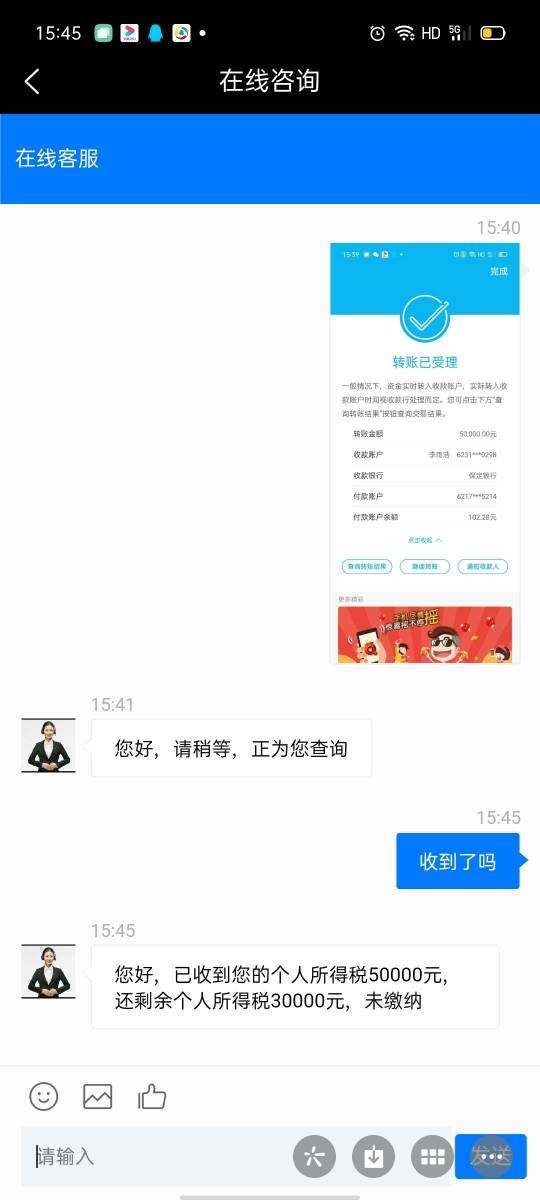

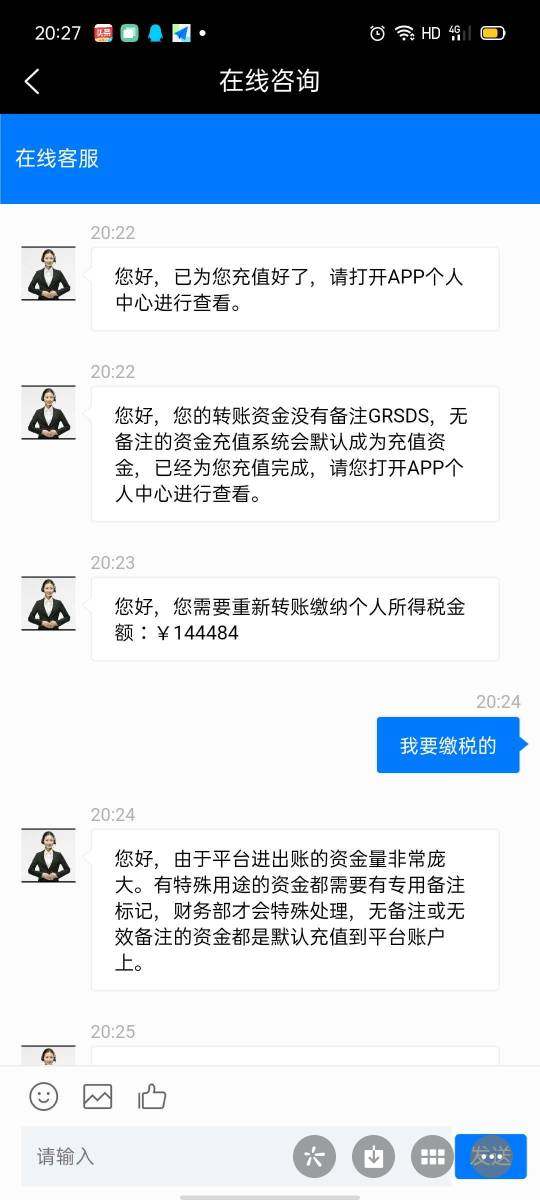

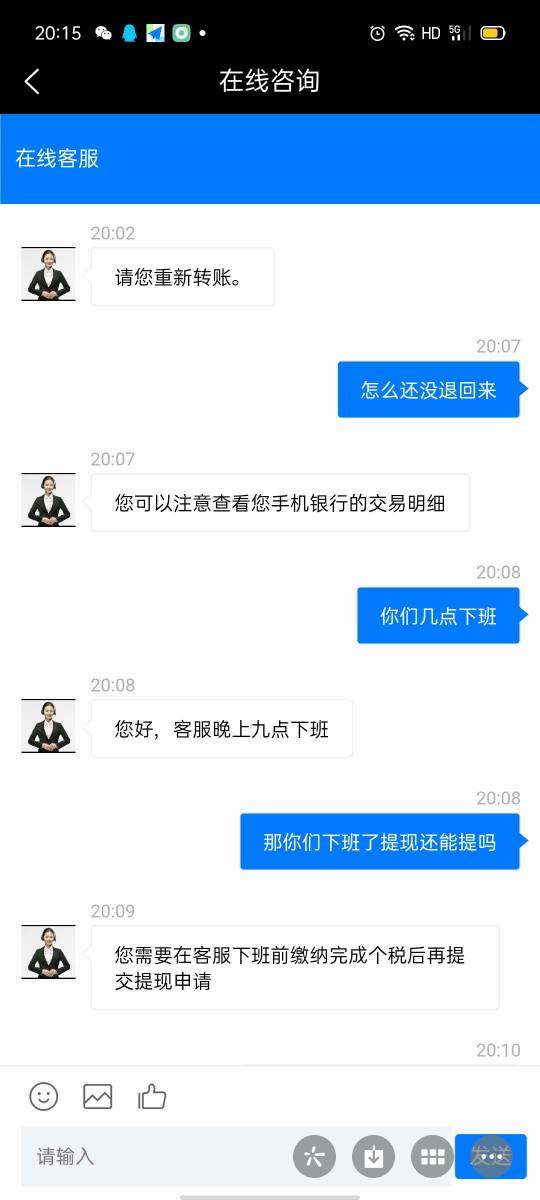

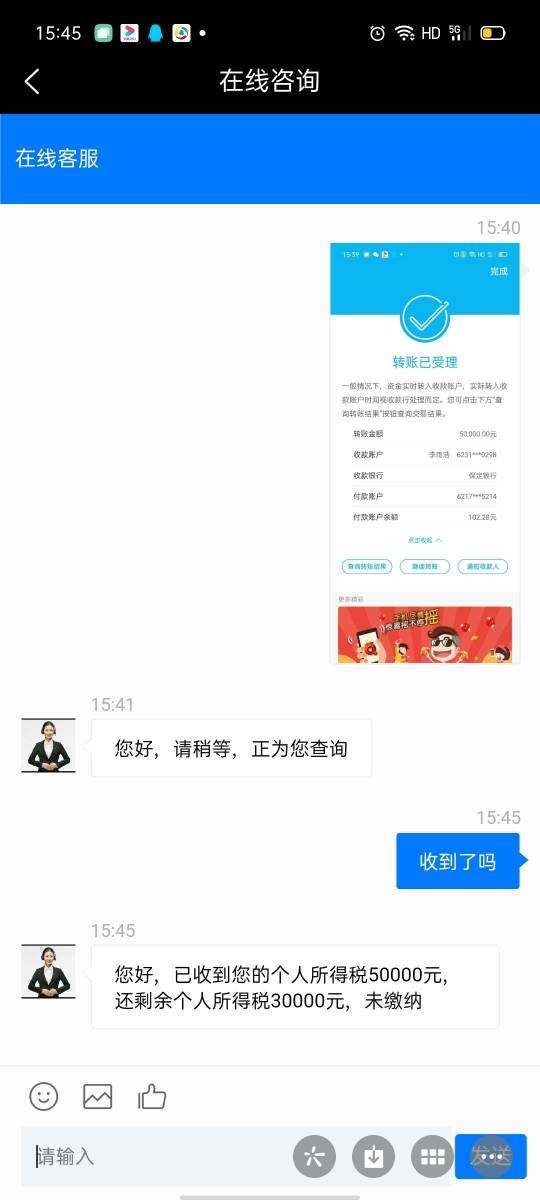

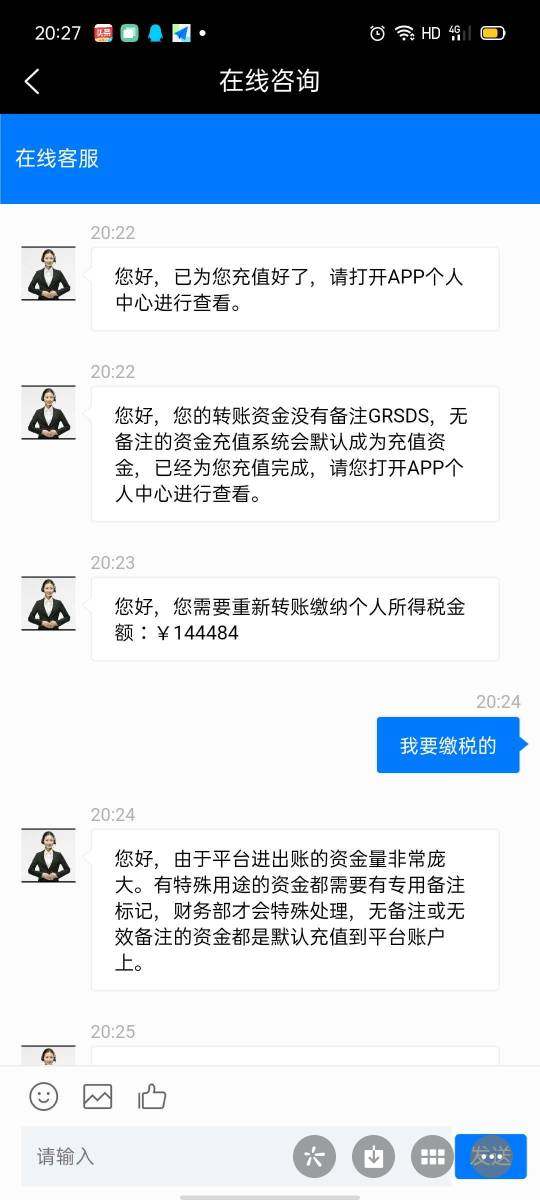

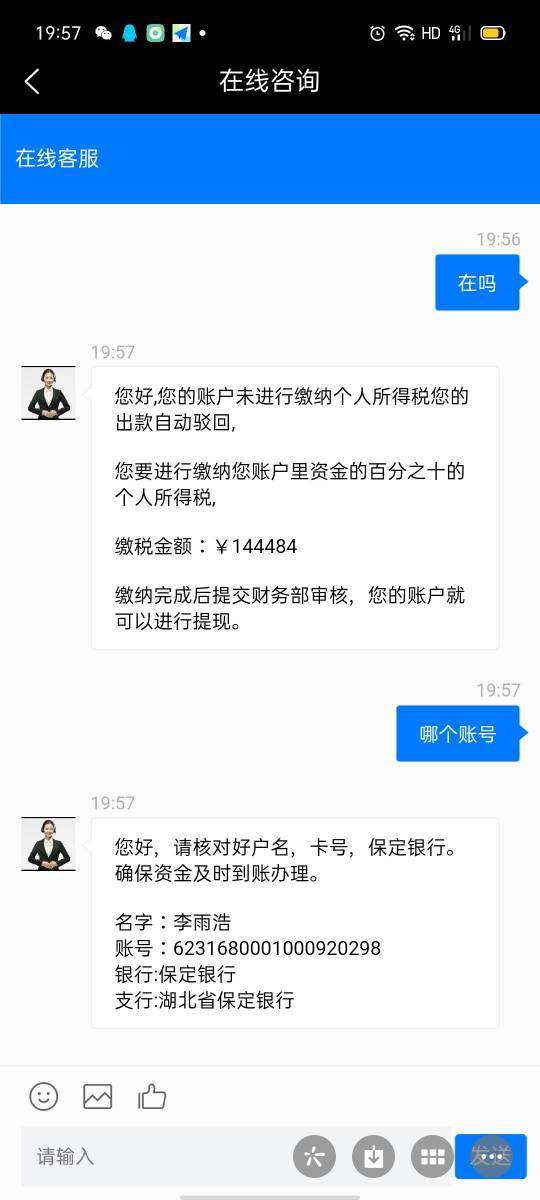

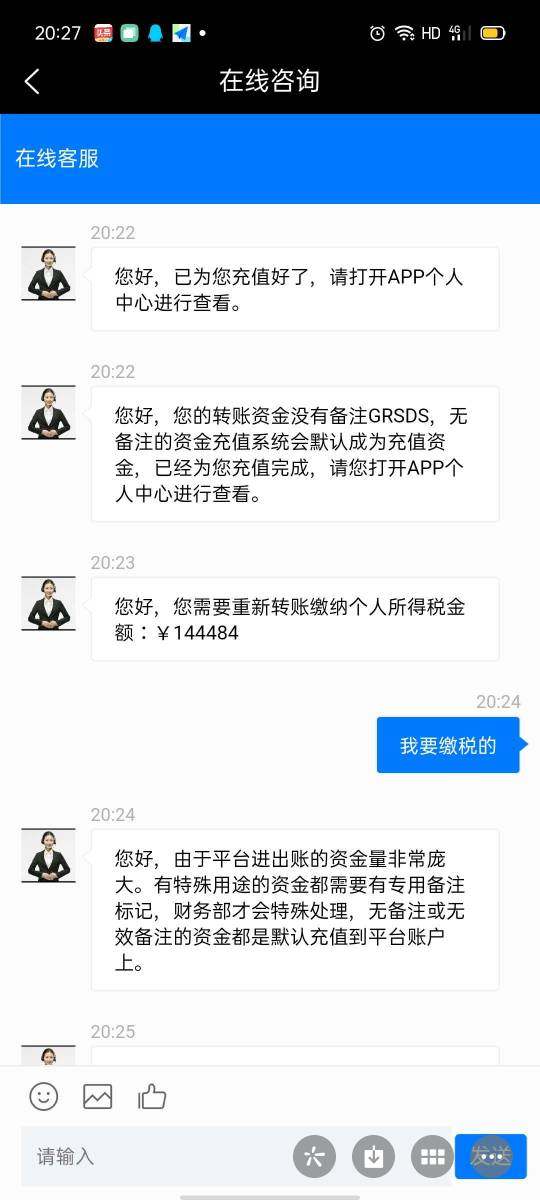

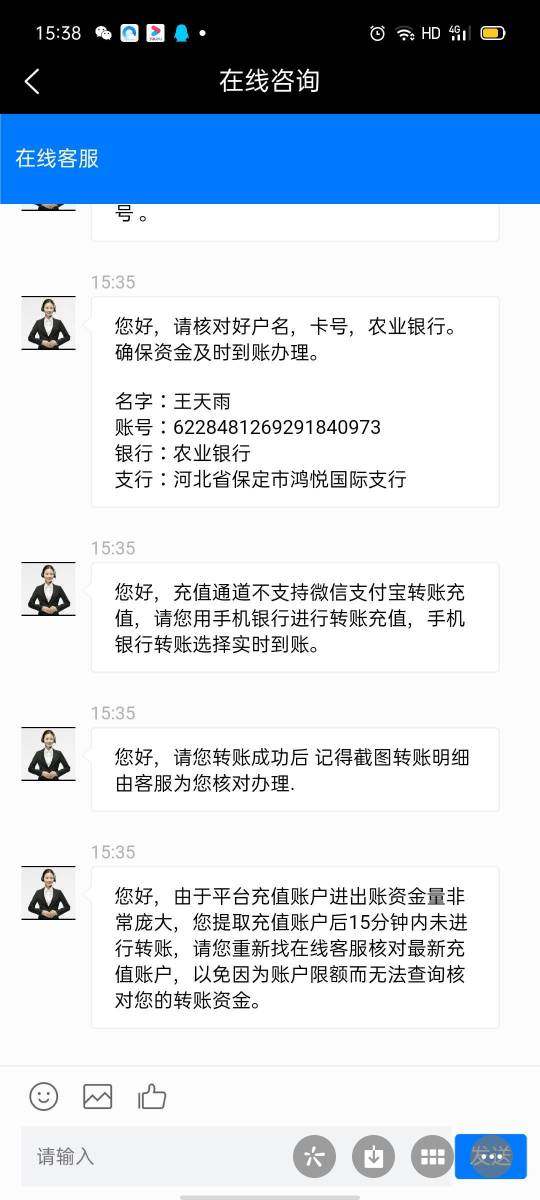

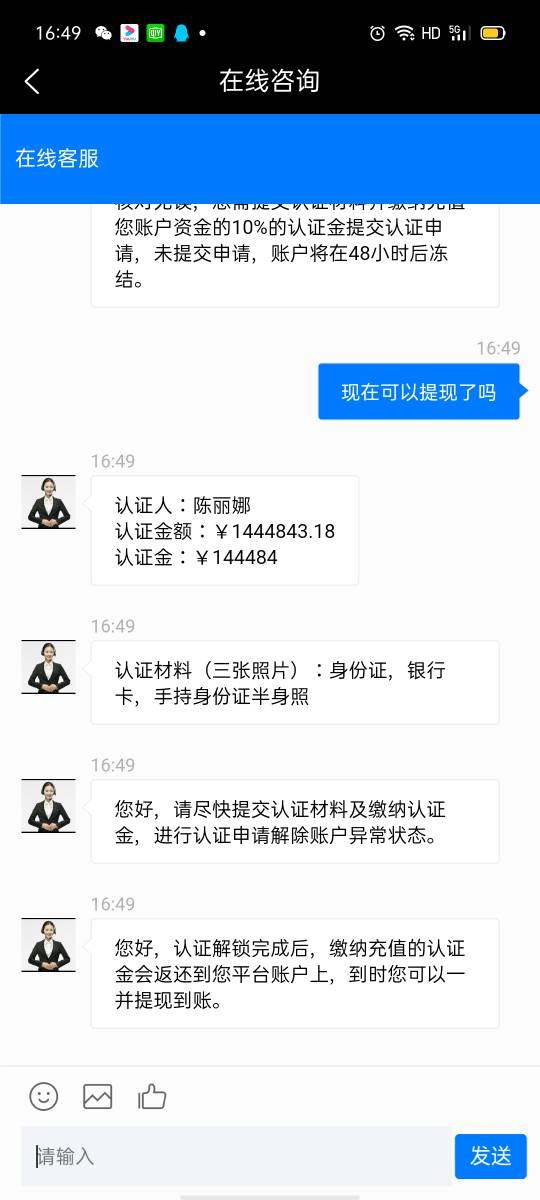

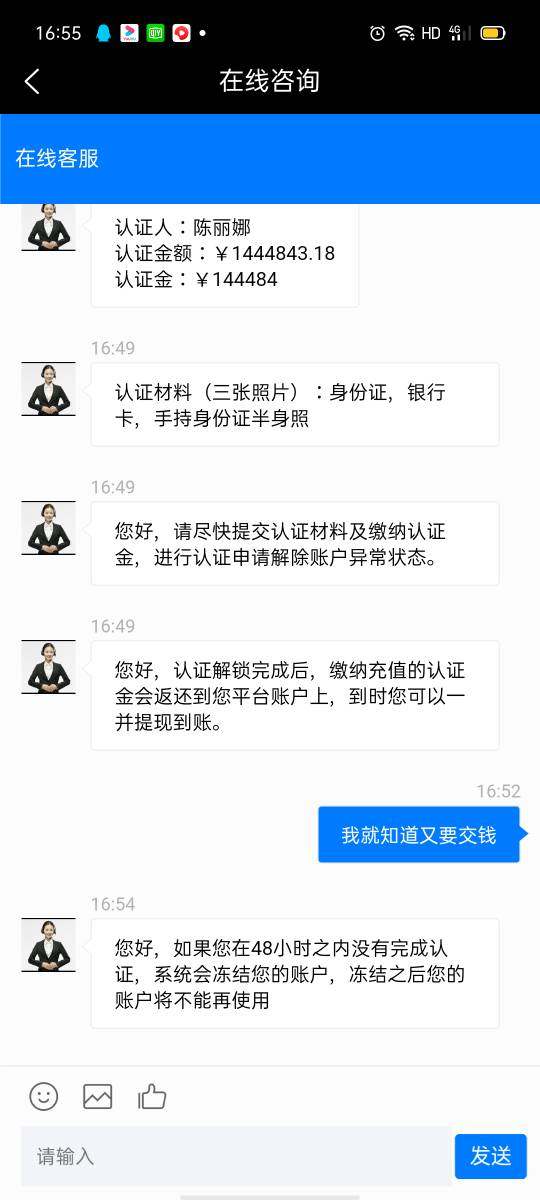

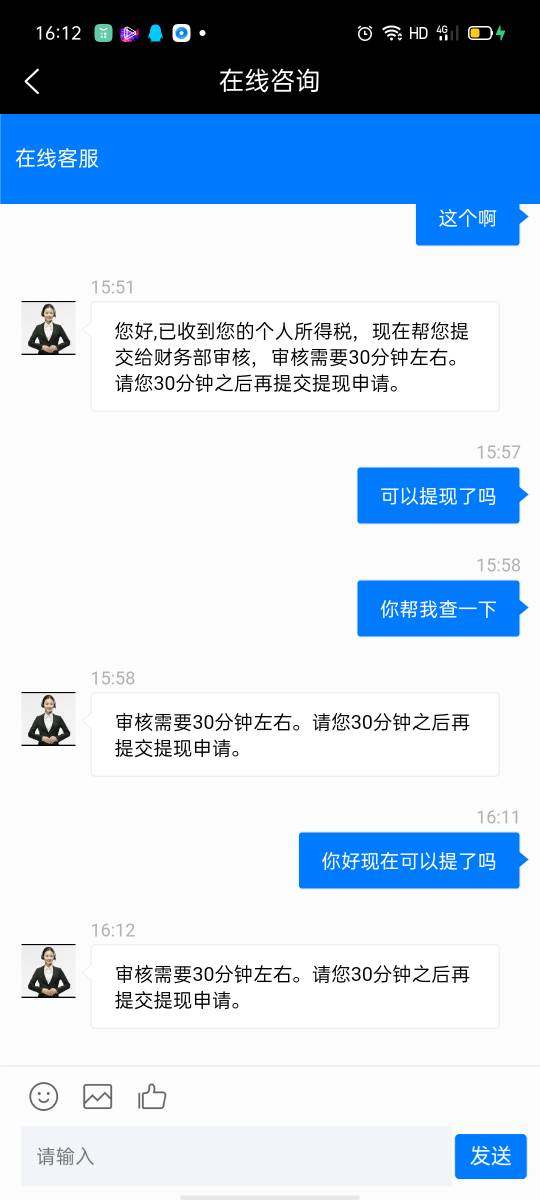

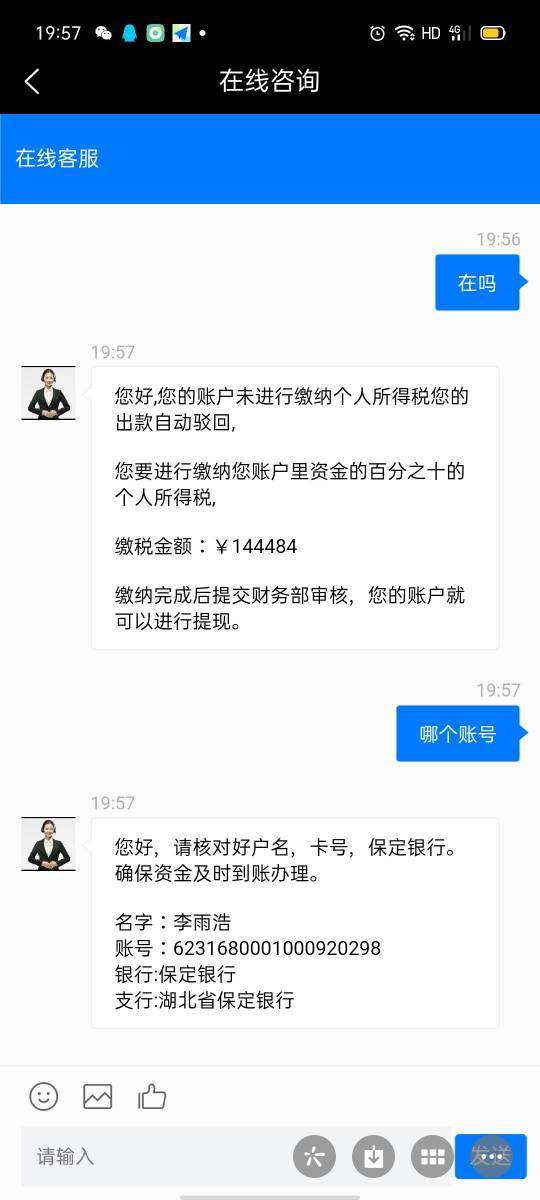

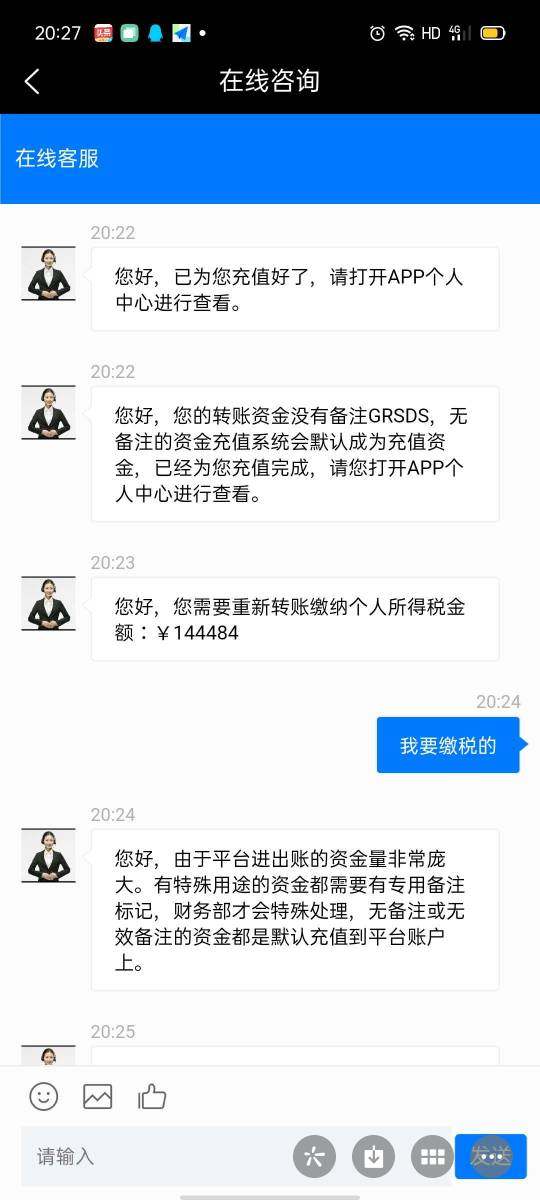

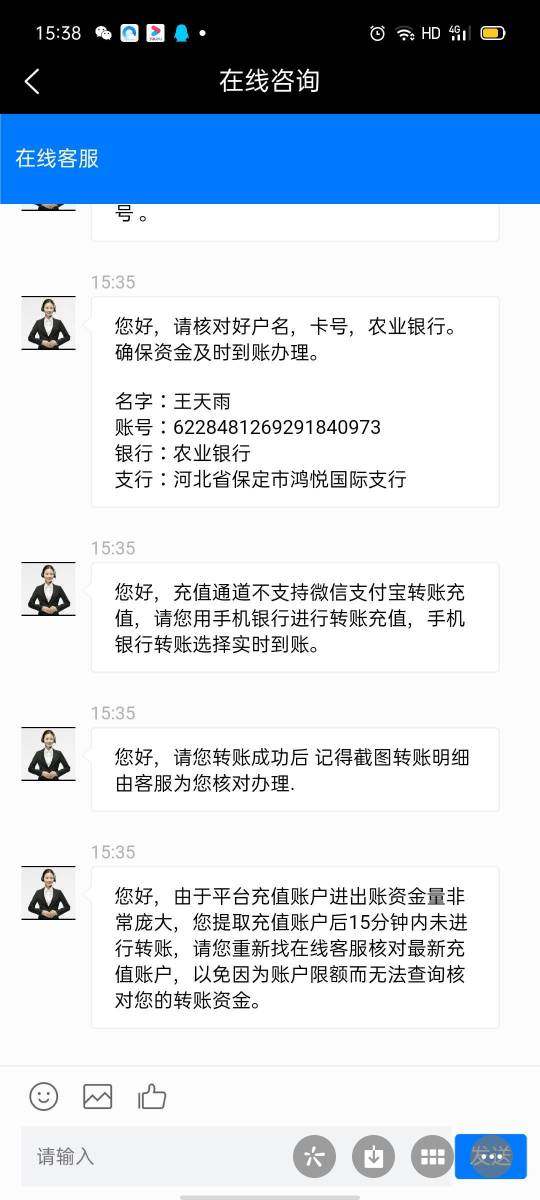

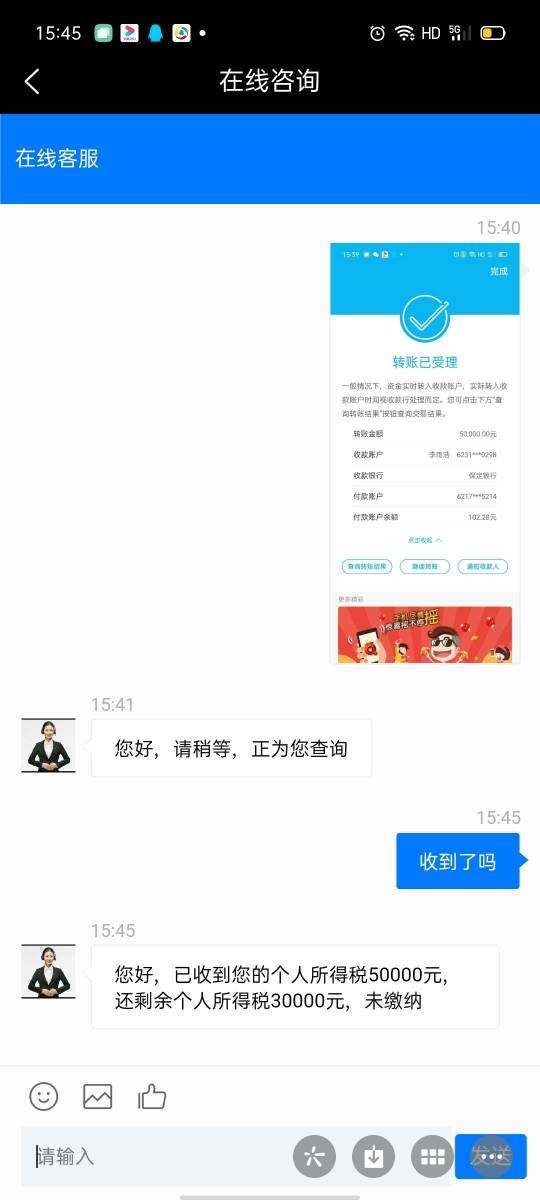

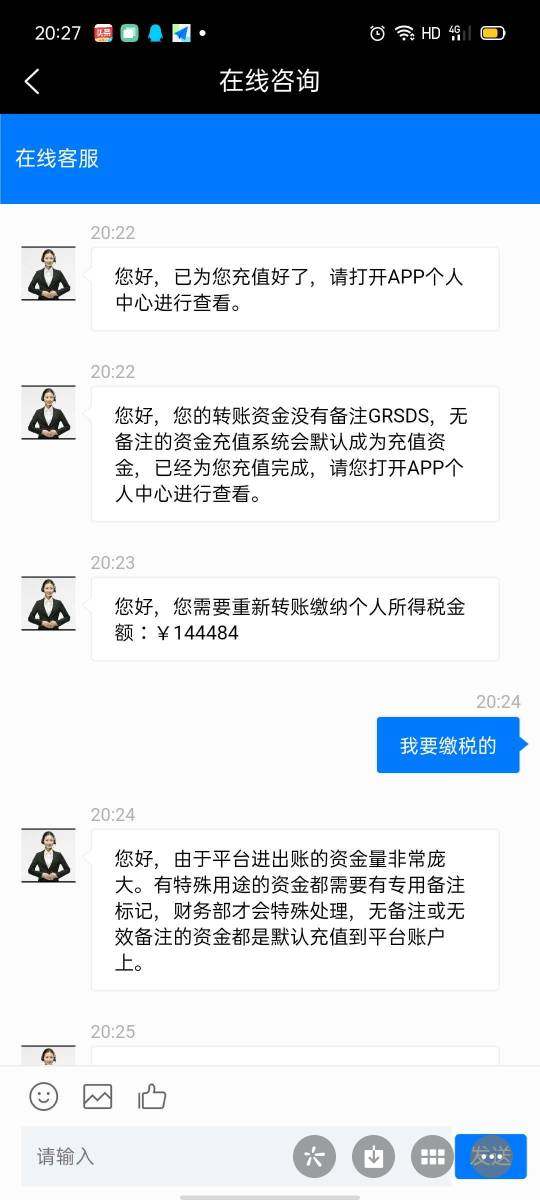

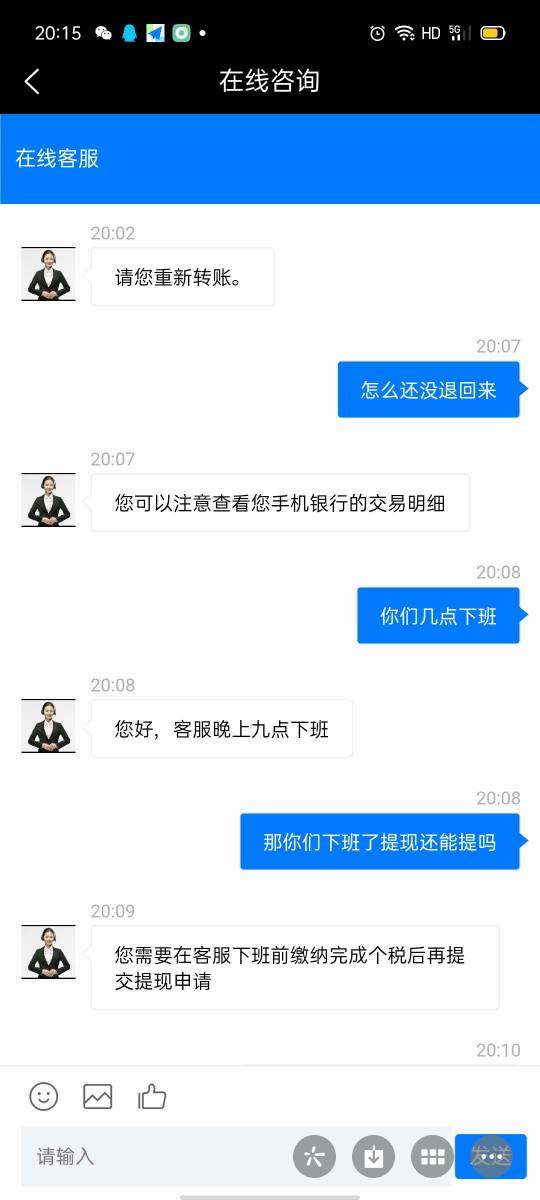

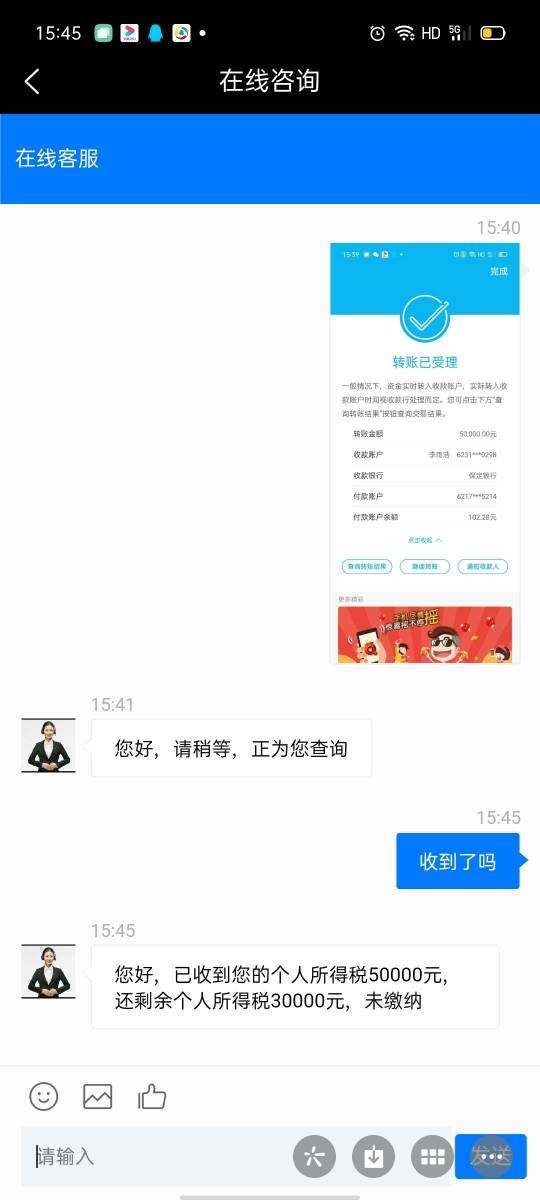

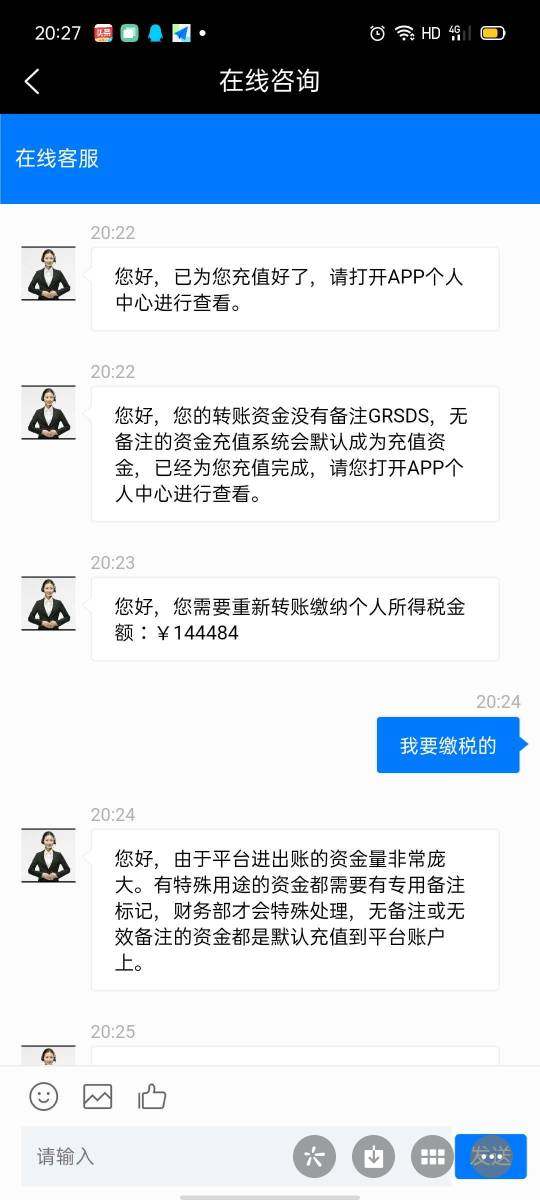

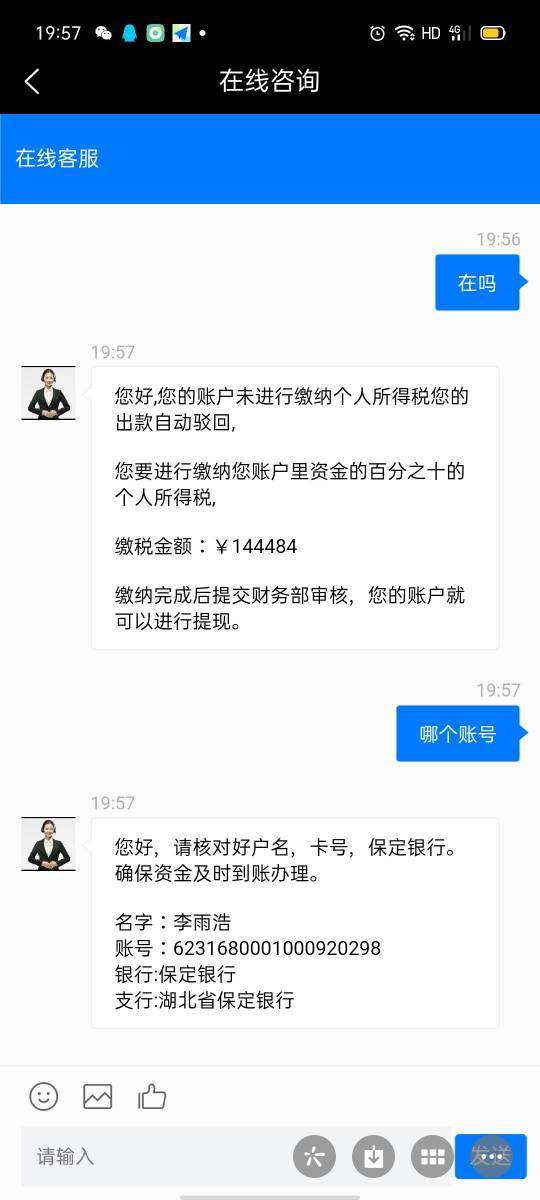

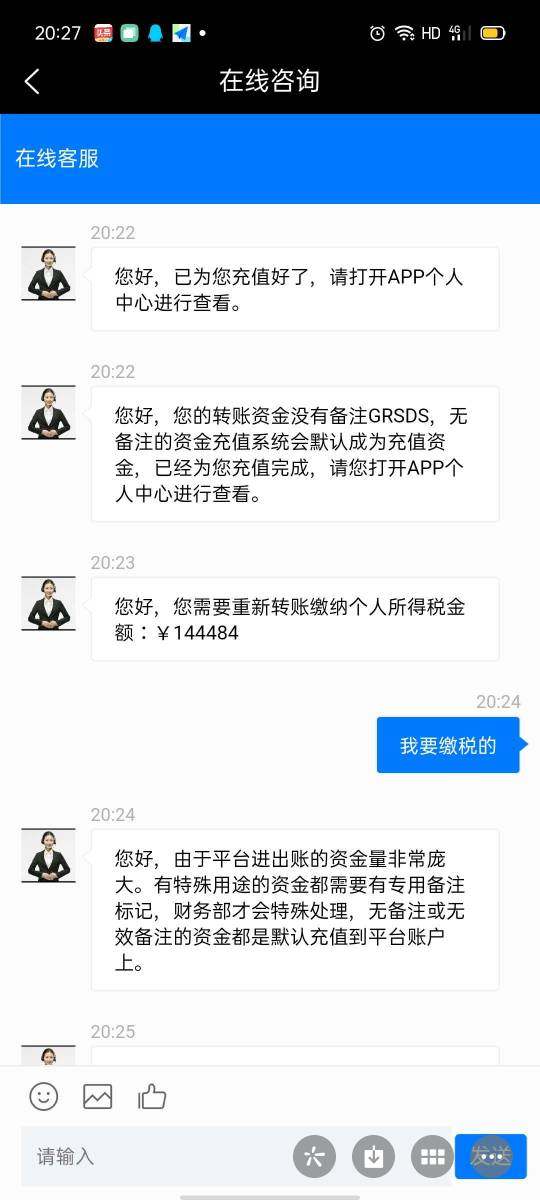

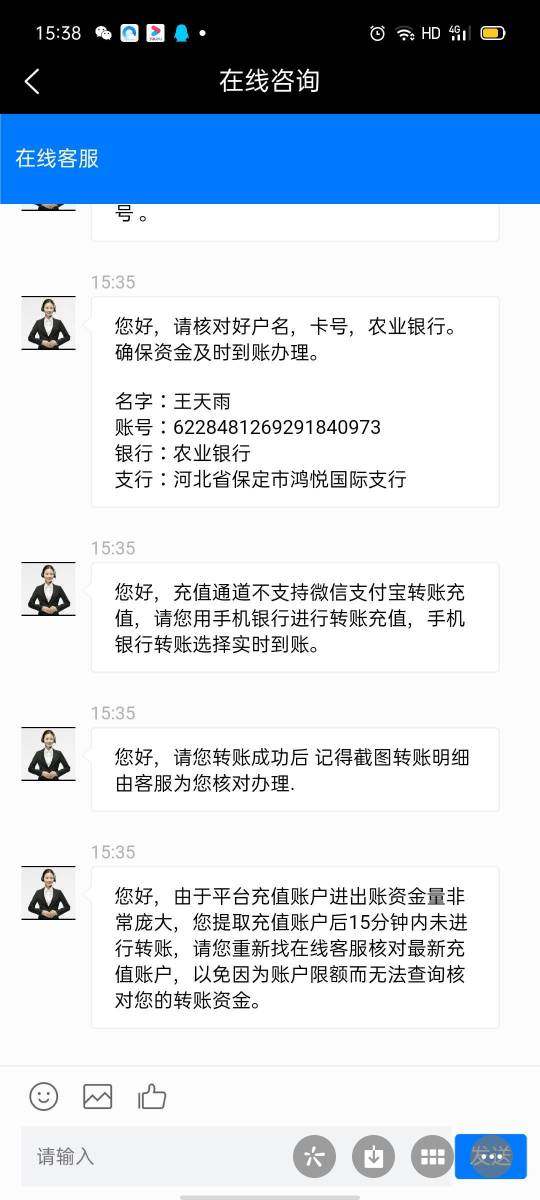

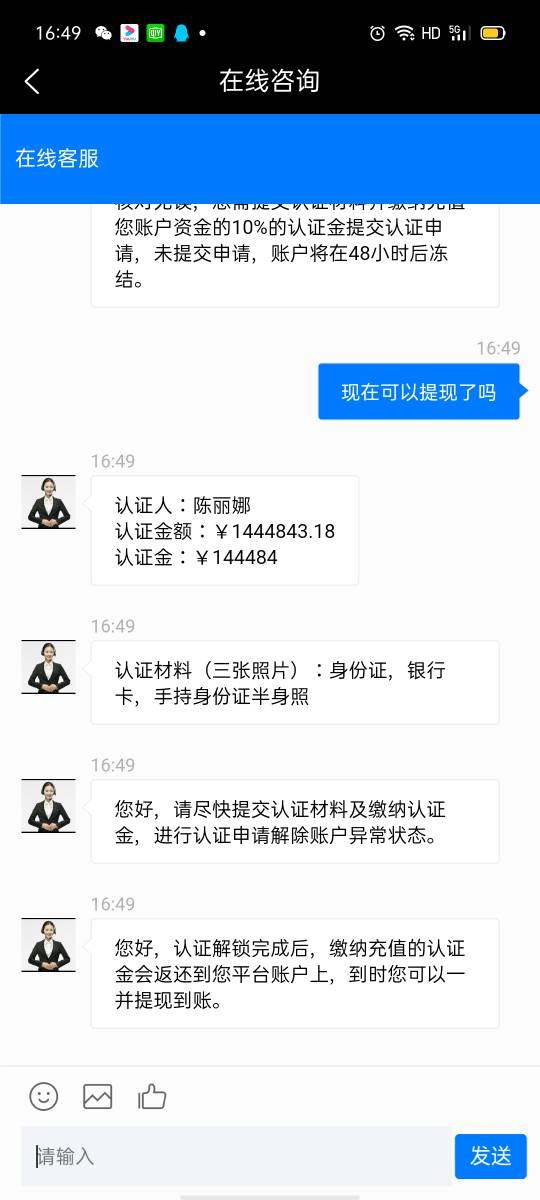

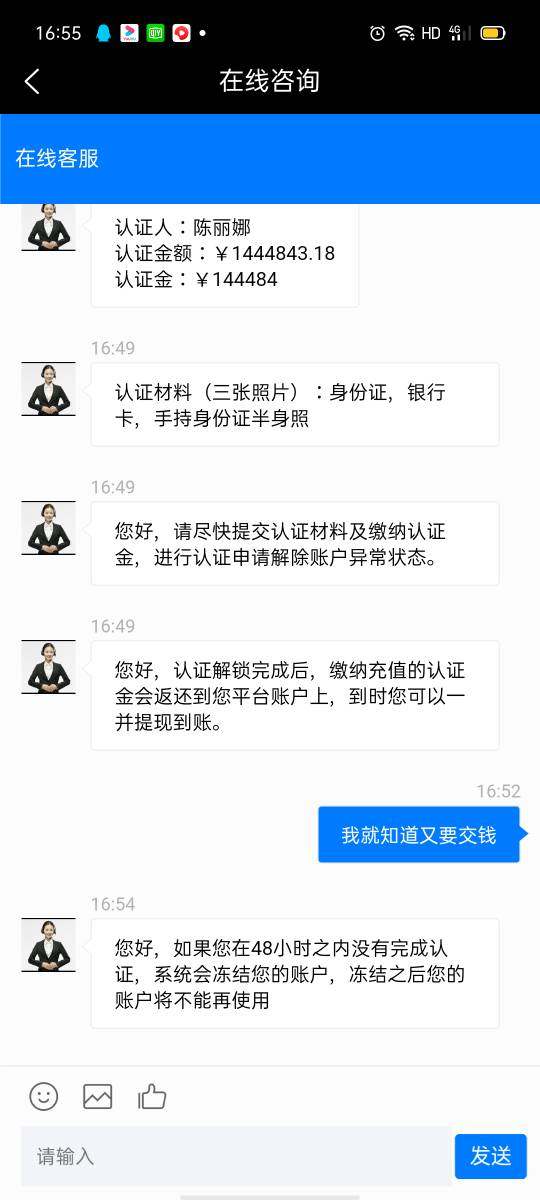

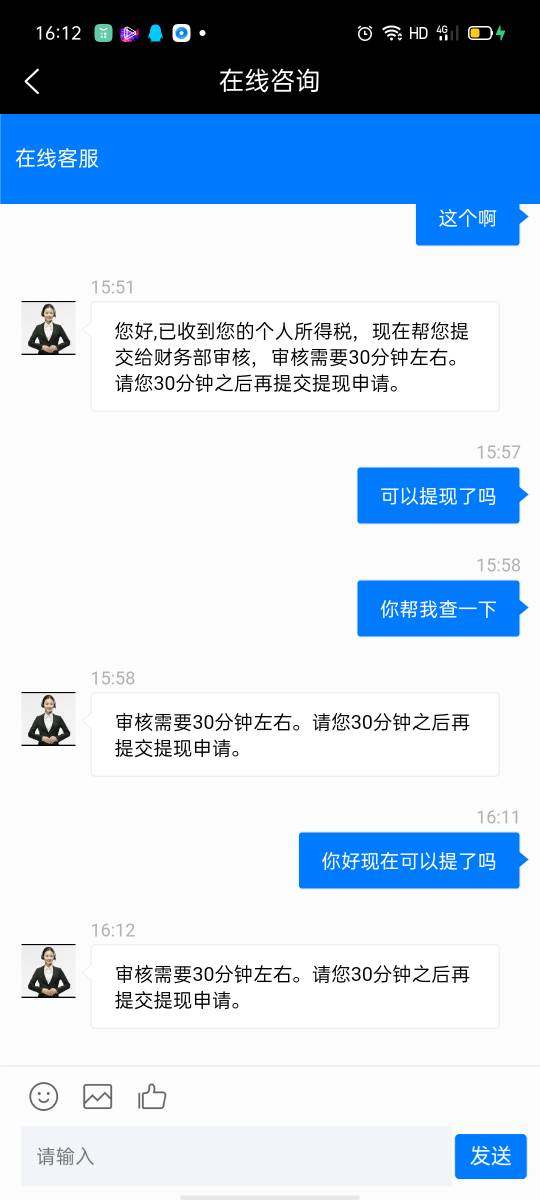

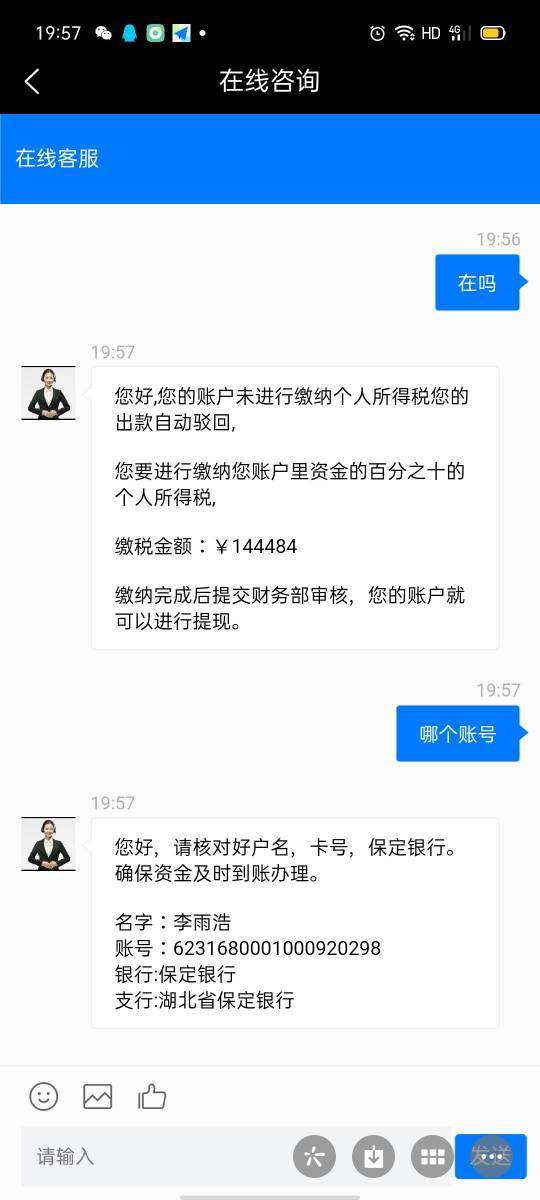

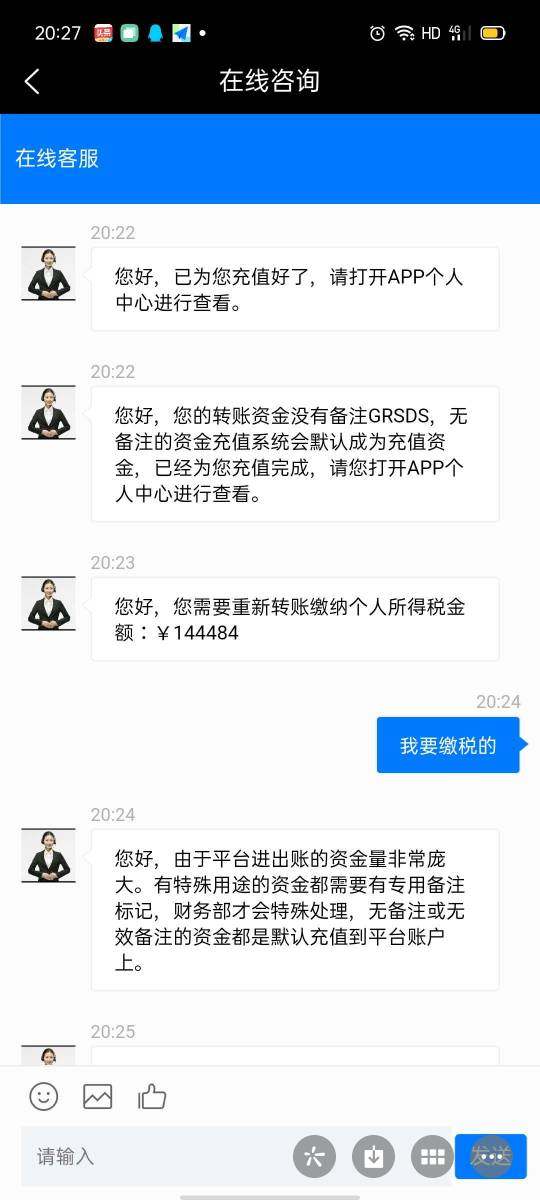

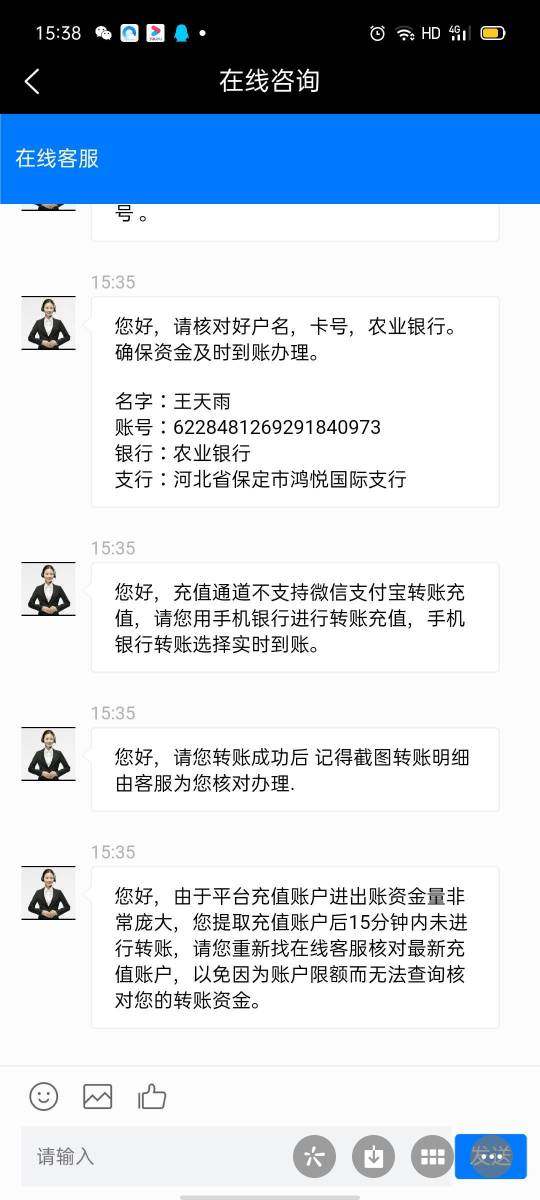

Taxes should be paid before withdrawing funds. But after that, I was told that my bank card number was wrong. And they froze my account. This company is not reliable.

Why did it scam when it has been regulated?

Cambridge FX Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Taxes should be paid before withdrawing funds. But after that, I was told that my bank card number was wrong. And they froze my account. This company is not reliable.

Why did it scam when it has been regulated?

Cambridge FX now operates as Corpay. This cambridge fx review shows a broker with limited transparency about its services, which creates challenges for traders who want complete information. The platform claims ASIC regulation. It also provides MetaTrader 4 trading capabilities, which are positive signs for regulatory compliance and platform reliability.

However, big information gaps exist about account conditions, trading costs, and customer service quality. User feedback appears mixed. No clear consensus exists on service quality or trading experience. The broker's positioning as a potentially unregulated offshore entity in some sources raises concerns about investor protection and fund safety.

Cambridge FX appears most suitable for traders who prioritize regulatory oversight. These traders must also be comfortable with MetaTrader 4 platform functionality. However, the lack of detailed information about trading conditions, fees, and customer support makes it challenging to recommend without reservations. Prospective clients should conduct thorough due diligence before committing funds.

Cambridge FX operations may vary significantly across different jurisdictions. Varying regulatory requirements and service offerings depend on your location. Traders should verify the specific regulatory status and available services in their region before opening an account.

This review is based on publicly available information and user feedback. This may not reflect individual trading experiences. Market conditions, regulatory changes, and company policies can affect the accuracy of this assessment. Potential clients should independently verify all information and consider their risk tolerance before trading.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 5/10 | Limited information available on spreads, commissions, minimum deposits, and leverage options |

| Tools and Resources | 6/10 | MetaTrader 4 platform provided, but specific asset classes and additional resources unclear |

| Customer Service | 5/10 | Mixed user feedback with no detailed customer support information available |

| Trading Experience | 6/10 | Stable platform offering but limited user experience details |

| Trust and Safety | 4/10 | Conflicting information about regulatory status raises safety concerns |

| User Experience | 5/10 | Mixed user reviews without specific satisfaction metrics |

Cambridge FX currently operates under the Corpay brand. It appears to be a relatively newer player in the forex brokerage market. The limited background information available makes it challenging to establish a comprehensive company profile. Available sources suggest the broker focuses on providing forex trading services alongside related financial products, though the exact scope of services remains unclear.

The company's evolution to Corpay indicates potential corporate restructuring or rebranding efforts. This may reflect business expansion or regulatory compliance improvements. However, the lack of detailed historical information about the company's founding, growth trajectory, and business milestones creates uncertainty about its market experience and operational stability.

Cambridge FX operates primarily through the MetaTrader 4 trading platform. This suggests a focus on traditional forex trading rather than proprietary technology solutions. The broker claims ASIC regulatory oversight, positioning itself within Australia's regulatory framework. However, conflicting information about its regulatory status in available sources requires careful verification by potential clients before account opening.

Regulatory Status: Cambridge FX claims ASIC regulation. However, specific license numbers are not readily available in public sources. This regulatory uncertainty requires prospective clients to verify current compliance status directly with the broker and relevant regulatory authorities.

Deposit and Withdrawal Methods: Information about available funding methods is not detailed in available sources. This makes it difficult to assess convenience and cost-effectiveness of money transfers.

Minimum Deposit Requirements: Specific minimum deposit amounts are not mentioned in available documentation. This prevents accurate assessment of account accessibility for different trader segments.

Promotional Offers: No information about bonus structures or promotional campaigns is available in current sources. This suggests either absence of such programs or limited marketing disclosure.

Tradeable Assets: Forex trading capabilities are implied. However, specific currency pairs, commodities, indices, or other asset classes offered are not detailed in available materials.

Cost Structure: Critical information about spreads, commissions, overnight fees, and other trading costs remains undisclosed in public sources. This makes cost comparison impossible.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available documentation. This limits assessment of trading flexibility.

Platform Options: MetaTrader 4 is confirmed as the primary trading platform. However, availability of web-based or mobile versions requires verification.

Geographic Restrictions: Specific country limitations or service availability by region is not detailed in current sources.

Customer Support Languages: Available support languages and communication channels are not specified in accessible materials.

This cambridge fx review highlights the significant information transparency challenges facing potential clients.

The account conditions evaluation for Cambridge FX reveals substantial information gaps. These gaps make comprehensive assessment challenging. Available sources do not specify the types of trading accounts offered, whether standard, premium, or professional account tiers exist, or what distinguishes different account categories if multiple options are available.

Minimum deposit requirements remain unspecified across available documentation. This prevents potential traders from understanding entry barriers or account accessibility. This lack of transparency extends to leverage options, margin requirements, and maximum position sizes, all critical factors for risk management and trading strategy development.

Account opening procedures and documentation requirements are not detailed in current sources. This makes it impossible to assess the complexity or time requirements for account activation. The absence of information about Islamic account availability also limits understanding of the broker's service inclusivity for different trader demographics.

Without specific details about account benefits, fee structures, or special features, potential clients cannot make informed comparisons with other brokers. This information deficit significantly impacts the broker's competitiveness in a market where transparency and clear account conditions are increasingly important for trader confidence.

The lack of publicly available account condition details in this cambridge fx review suggests potential clients should directly contact the broker for comprehensive information before making trading decisions.

Cambridge FX's tools and resources offering centers around the MetaTrader 4 platform. This is a well-established trading solution in the forex industry. MT4 provides standard charting capabilities, technical analysis tools, and automated trading support through Expert Advisors, which represents a solid foundation for forex trading activities.

However, beyond the basic MT4 offering, specific information about additional trading tools, research resources, or educational materials remains unclear from available sources. The absence of details about market analysis, economic calendars, trading signals, or proprietary research tools suggests either limited additional resources or insufficient disclosure of available services.

Educational support appears undocumented in current sources. This raises questions about the broker's commitment to trader development and learning resources. Modern traders often expect comprehensive educational materials, webinars, tutorials, and market analysis to support their trading decisions, but Cambridge FX's offerings in this area remain unspecified.

Automated trading capabilities through MT4's Expert Advisor functionality provide some advanced trading options. However, specific limitations, restrictions, or additional automation tools are not detailed. The platform's standard features include multiple timeframe analysis, custom indicators, and strategy testing capabilities.

The limited information about tools and resources beyond basic MT4 functionality represents a significant gap in understanding the broker's complete service offering and value proposition for traders seeking comprehensive trading support.

Customer service evaluation for Cambridge FX faces significant challenges. This is due to limited publicly available information about support structures, response times, and service quality metrics. Available sources do not specify primary communication channels, whether live chat, email, phone support, or help desk systems are available for client assistance.

Response time expectations and service availability hours remain unspecified. This makes it impossible to assess whether support meets modern trader expectations for quick problem resolution. The absence of information about dedicated account managers, technical support specialists, or multilingual support capabilities further limits understanding of service depth.

Service quality assessment relies on mixed user feedback mentioned in sources. However, specific examples of positive or negative support experiences are not detailed. Without concrete user testimonials or satisfaction ratings, it becomes difficult to gauge actual service performance or identify common support issues.

Problem resolution procedures and escalation processes are not documented in available materials. This leaves questions about how complex issues or disputes are handled. The lack of information about support documentation, FAQ resources, or self-service options also suggests potential gaps in comprehensive customer assistance.

The limited transparency around customer service capabilities represents a significant concern for potential clients who value responsive, professional support as part of their trading experience. Prospective traders should directly verify support quality and availability before committing to the platform.

The trading experience assessment for Cambridge FX relies primarily on the MetaTrader 4 platform's capabilities. However, specific performance metrics and user experience details remain limited in available sources. MT4's established reputation provides a foundation for stable trading operations, including reliable order execution and comprehensive charting functionality.

Platform stability and execution speed details are not specifically documented in current sources. This makes it impossible to assess performance during high-volatility periods or peak trading hours. The absence of information about slippage rates, requotes frequency, or execution quality metrics limits understanding of actual trading conditions experienced by users.

Order types availability, trade management features, and platform customization options follow standard MT4 functionality. However, any broker-specific enhancements or limitations are not detailed. The platform's standard features include pending orders, stop-loss and take-profit settings, and one-click trading capabilities.

Mobile trading experience assessment is constrained by lack of specific information about mobile app availability, functionality, or user interface design. Modern traders increasingly rely on mobile platforms for market monitoring and trade management, making this information gap particularly relevant.

User feedback about trading experience appears mixed according to available sources. However, specific examples of positive or negative trading experiences are not provided. Without detailed user testimonials or performance data, it becomes challenging to assess real-world trading conditions and user satisfaction levels.

This cambridge fx review emphasizes the need for potential clients to test platform performance through demo accounts before live trading.

Trust and safety evaluation for Cambridge FX reveals concerning inconsistencies in regulatory status information. These require careful consideration by potential clients. While some sources indicate ASIC regulation, others suggest the broker operates as an unregulated offshore entity, creating significant uncertainty about investor protection levels.

The absence of specific regulatory license numbers or detailed compliance information makes independent verification challenging. ASIC regulation, if confirmed, would provide substantial investor protections including segregated client funds, dispute resolution mechanisms, and regulatory oversight. However, the conflicting information about regulatory status raises red flags about transparency and compliance.

Fund safety measures, including client money segregation, deposit protection schemes, and bank relationships, are not detailed in available sources. These protections are crucial for trader confidence and fund security. The absence of this information from public sources is particularly concerning.

Company transparency regarding financial reporting, ownership structure, and business operations appears limited based on available documentation. Modern regulatory frameworks typically require substantial disclosure, and the lack of readily available compliance information suggests potential transparency issues.

The broker's industry reputation remains unclear due to limited operational history and mixed information sources. Without clear regulatory standing, verified compliance records, or comprehensive transparency measures, the trust and safety profile presents significant concerns for potential clients considering fund deposits.

Prospective traders should prioritize direct verification of regulatory status and fund protection measures before engaging with the platform.

User experience evaluation for Cambridge FX faces substantial limitations. This is due to the absence of detailed user feedback, satisfaction metrics, or comprehensive experience documentation in available sources. The mixed user reviews mentioned lack specific details about satisfaction levels, common complaints, or positive experience highlights.

Interface design and usability assessment relies primarily on MetaTrader 4's standard functionality. However, any broker-specific customizations or interface enhancements are not documented. MT4's familiar interface provides consistency for experienced traders but may present learning curves for newcomers to forex trading.

Registration and account verification processes are not detailed in current sources. This prevents assessment of onboarding efficiency or documentation requirements. Modern traders expect streamlined, digital-first account opening procedures, but Cambridge FX's specific processes remain unclear.

Fund management experience, including deposit and withdrawal procedures, processing times, and fee structures, lacks documentation in available materials. These operational aspects significantly impact overall user satisfaction and trading convenience. The absence of this information from public sources is concerning.

Common user complaints or recurring issues are not specified in current sources. However, the mixed feedback suggests varying experiences among different user segments. Without specific examples of positive features or problematic areas, it becomes impossible to identify the broker's strengths or improvement opportunities.

The limited user experience documentation suggests potential clients should seek direct user testimonials or trial periods to assess platform suitability for their specific trading needs and preferences.

This comprehensive cambridge fx review reveals a broker with significant transparency challenges. These challenges limit confident assessment of its services and suitability for different trader segments. While Cambridge FX claims ASIC regulation and provides MetaTrader 4 platform access, the substantial information gaps regarding account conditions, costs, and customer service create uncertainty for potential clients.

The broker may be suitable for traders who prioritize regulatory oversight and are comfortable with MT4's functionality. These traders must be particularly willing to conduct extensive due diligence before account opening. However, the mixed user feedback and conflicting regulatory information suggest caution is warranted.

Key advantages include potential ASIC regulation and established platform technology. Significant disadvantages include limited transparency, unclear cost structures, and insufficient publicly available information about service quality. Prospective traders should prioritize direct broker contact for detailed information verification and consider alternative brokers with more comprehensive disclosure practices.

FX Broker Capital Trading Markets Review