Is AMEGA safe?

Pros

Cons

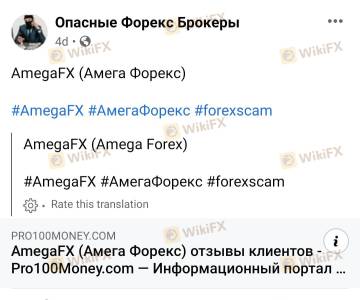

Is AMEGA A Scam?

Introduction

AMEGA is an online forex and CFD broker that has positioned itself as a contender in the trading market since its inception in 2018. Operating under the auspices of the Financial Services Commission of Mauritius, AMEGA offers a range of trading instruments, including forex, commodities, indices, and cryptocurrencies. However, the rise of online trading has also brought with it a plethora of unregulated brokers, making it imperative for traders to conduct thorough evaluations before committing their funds. This article aims to objectively analyze whether AMEGA is a scam or a legitimate trading platform by examining its regulatory status, company background, trading conditions, customer fund safety, and user experiences.

Regulation and Legitimacy

The regulatory framework under which a broker operates is crucial in determining its legitimacy and safety for traders. AMEGA is registered with the Financial Services Commission (FSC) in Mauritius, which is often regarded as a lower-tier regulatory authority compared to more stringent regulators such as the FCA (UK) or ASIC (Australia). This raises concerns about the level of oversight and investor protection available to clients.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FSC (Mauritius) | GB22200548 | Mauritius | Verified |

While AMEGA claims to adhere to the regulations set forth by the FSC, the reputation of offshore regulators is often questioned due to their lenient regulatory standards. A lack of robust regulatory oversight can expose traders to significant risks, including potential fraud and the inability to recover funds in case of broker insolvency. As such, is AMEGA safe? The answer is complicated; while it is regulated, the quality of that regulation is questionable.

Company Background Investigation

AMEGA was established in 2018 and has since developed a reputation for providing a user-friendly trading platform with competitive trading conditions. The broker operates under the ownership of AMEGA Global Ltd, which is based in Mauritius. However, the companys transparency is limited, with scant information available regarding its management team and their professional backgrounds. This lack of transparency can be a red flag for potential investors, as it complicates the assessment of the broker's credibility.

The broker claims to prioritize customer satisfaction and has implemented various measures to enhance user experience. However, the absence of a well-defined leadership structure and the limited disclosure of operational practices may lead traders to question the broker's commitment to ethical business practices. Therefore, while AMEGA may appear legitimate on the surface, the lack of transparency raises concerns about its overall trustworthiness.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. AMEGA offers commission-free trading with spreads that start as low as 0.1 pips, which is competitive compared to industry standards. However, the lack of a demo account may deter novice traders who wish to practice before investing real money.

| Fee Type | AMEGA | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.1 pips | 0.3 - 0.5 pips |

| Commission Model | $0 | Varies |

| Overnight Interest Range | Varies | Varies |

Despite attractive trading conditions, some users have reported unexpected fees or difficulties during the withdrawal process. These issues can lead to significant frustration and financial loss, prompting traders to question whether is AMEGA safe for conducting transactions.

Customer Fund Safety

The safety of customer funds is paramount in the trading industry. AMEGA claims to implement several safety measures, including segregated accounts for client funds and negative balance protection. Segregating client funds ensures that traders‘ money is kept separate from the broker’s operational funds, which is a standard practice among reputable brokers.

However, the question remains: how reliable are these safety measures? The lack of a compensation fund, which is typically offered by higher-tier regulators, means that if AMEGA were to face financial difficulties, clients might have little recourse to recover their investments. Historical complaints about withdrawal issues further exacerbate concerns regarding fund safety, leading many to wonder if is AMEGA safe for trading.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. AMEGA has received mixed reviews, with some users praising its low spreads and user-friendly platform, while others have expressed dissatisfaction regarding withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

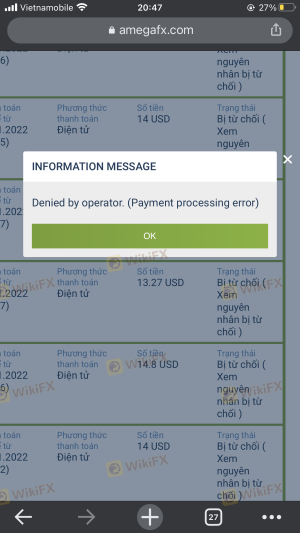

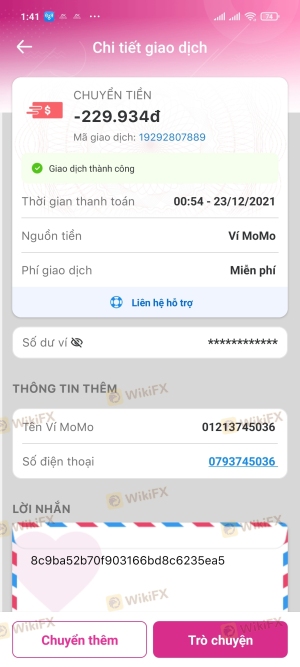

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Support | Medium | Average |

| Platform Stability | Low | Generally Stable |

Typical complaints include difficulties in withdrawing funds, with some users alleging that their requests have been delayed or denied. These issues raise significant doubts about the broker's commitment to customer service and fund safety, leading many to question whether is AMEGA safe for trading.

Platform and Trade Execution

AMEGA utilizes the MetaTrader 5 platform, which is widely recognized for its advanced trading capabilities and user-friendly interface. The platform provides various analytical tools and supports automated trading through Expert Advisors (EAs). However, concerns have been raised about order execution quality, including instances of slippage and re-quotes.

A reliable platform should offer swift execution speeds and minimal slippage, enabling traders to capitalize on market opportunities effectively. AMEGA claims to have an execution speed of 0.1 seconds, yet user reports of delayed executions may indicate underlying issues that could affect trading outcomes.

Risk Assessment

When considering AMEGA, it is essential to assess the overall risk involved in trading with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation with limited oversight. |

| Fund Safety Risk | Medium | Segregated accounts but no compensation fund. |

| Customer Service Risk | Medium | Mixed reviews and common complaints about withdrawals. |

Given these factors, potential traders should approach AMEGA with caution. It is advisable to implement risk management strategies, such as limiting capital exposure and using stop-loss orders, to mitigate potential losses when trading with this broker.

Conclusion and Recommendations

In conclusion, while AMEGA offers appealing trading conditions such as low spreads and commission-free trading, significant concerns regarding its regulatory status, fund safety, and customer service persist. The lack of robust regulatory oversight and mixed customer feedback suggest that traders should exercise caution when considering this broker.

For those seeking a safer trading environment, it may be prudent to explore alternatives that are regulated by reputable authorities, such as FCA or ASIC. Brokers like FP Markets and Black Bull Markets offer more stringent regulatory frameworks, which can provide greater peace of mind for traders. Ultimately, whether is AMEGA safe depends on individual risk tolerance and trading objectives, but the evidence suggests a need for careful consideration before proceeding.

Is AMEGA a scam, or is it legit?

The latest exposure and evaluation content of AMEGA brokers.

AMEGA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AMEGA latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.