Is ESTAR safe?

Pros

Cons

Is Estar Safe or a Scam?

Introduction

Estar is a forex broker that has garnered attention in the trading community for its offerings in the foreign exchange market. As with any trading platform, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with potential risks, including unregulated brokers and scams that can lead to significant financial losses. This article aims to provide a comprehensive evaluation of Estar's legitimacy, focusing on its regulatory status, company background, trading conditions, customer fund safety, and user experiences. Our analysis is based on a review of multiple sources, including regulatory databases, user reviews, and industry reports.

Regulation and Legitimacy

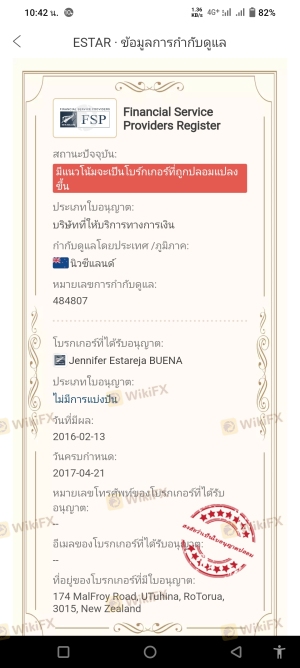

Understanding the regulatory framework governing a forex broker is essential for assessing its safety. Regulation serves as a protective measure for traders, ensuring that brokers adhere to specific standards and practices. Estar claims to operate under the jurisdiction of the United Kingdom, but there are red flags regarding its regulatory status.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Financial Conduct Authority (FCA) | N/A | United Kingdom | Suspicious Clone |

The FCA is known for its stringent regulations, and any broker operating under its authority must meet high standards of transparency and accountability. However, Estar has been flagged as a "suspicious clone" firm, indicating that it may not be operating legitimately under the FCA's oversight. This raises concerns about the quality of regulation and compliance history of Estar, suggesting that traders should exercise caution when considering this broker.

Company Background Investigation

A thorough investigation into Estar's company history reveals that it was established to cater primarily to the Chinese market. However, details regarding its ownership structure and management team remain ambiguous. The lack of transparency in ownership can be a warning sign, as reputable brokers typically disclose their management teams and corporate structure to instill trust among clients.

The absence of a well-defined management team with verifiable experience in the financial sector further complicates the assessment of Estar's legitimacy. Without clear information about the individuals behind the company, it is challenging to gauge the broker's reliability and commitment to ethical trading practices. Estar's lack of transparency raises significant concerns about its trustworthiness.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is paramount. Estar's fee structure appears to be competitive at first glance, but potential traders should be wary of any unusual or hidden fees that could impact their profitability.

| Fee Type | Estar | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Varies | 1-2 pips |

| Commission Structure | None | $5-10 per lot |

| Overnight Interest Range | High | Moderate |

The spreads offered by Estar may initially seem attractive; however, the absence of a commission structure raises questions about how the broker generates revenue. Additionally, reports of high overnight interest rates suggest that traders could incur significant costs if they hold positions overnight. Such practices could lead to unexpected financial burdens, making it essential for traders to fully understand the fee structure before engaging with Estar.

Customer Fund Safety

The safety of customer funds is a critical aspect of evaluating any forex broker. Estar claims to implement various security measures to protect client funds, but details on these measures are scarce. The broker's website does not provide clear information on whether it segregates client funds from operational funds or offers negative balance protection.

In the event of financial disputes or insolvency, the lack of investor protection schemes could put traders' funds at significant risk. Historical incidents involving fund safety issues with similar brokers underscore the importance of this aspect. Estar's vague policies regarding fund safety should raise alarms for potential clients.

Customer Experience and Complaints

Analyzing customer feedback is crucial for understanding the overall user experience with a broker. Reviews of Estar reveal mixed experiences, with some users reporting satisfactory trading conditions while others express concerns over withdrawal issues and customer service responsiveness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Customer Service | Medium | Poor |

| Account Management Issues | High | Average |

Common complaints include difficulties in withdrawing funds and unresponsive customer service. These issues can significantly affect a trader's experience and trust in the broker. For instance, one user reported being unable to withdraw their funds for several weeks, while another faced challenges in receiving timely support for account-related inquiries. Such complaints highlight potential operational deficiencies within Estar, warranting caution from prospective traders.

Platform and Trade Execution

The performance of the trading platform is another vital factor in assessing a broker's reliability. Estar offers a trading platform that purportedly provides stability and a user-friendly interface. However, reports of slippage and order rejections have emerged, raising concerns about the quality of trade execution.

Traders have reported instances where their orders were not executed at the desired price, leading to unexpected losses. Such occurrences can be particularly detrimental in a volatile market environment where timely execution is essential. The presence of these issues suggests that traders may experience challenges when using Estar's platform.

Risk Assessment

Using Estar as a trading platform presents various risks that traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of clear regulation and clone status. |

| Fund Safety Risk | High | Vague policies on fund protection. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

Given the high regulatory risk and concerns regarding fund safety, it is advisable for traders to be cautious when using Estar. To mitigate these risks, traders should consider using smaller amounts for initial trades while closely monitoring their experiences with the broker.

Conclusion and Recommendations

In conclusion, the evidence suggests that Estar may not be a safe option for forex trading. The broker's dubious regulatory status, lack of transparency, and mixed customer feedback raise significant concerns. Potential traders should be wary of the risks associated with using Estar, particularly regarding fund safety and trade execution.

For those seeking reliable trading options, it is recommended to consider brokers regulated by top-tier authorities such as the FCA or ASIC, which offer more robust protections for traders. Alternatives like IG, OANDA, or Forex.com may provide safer trading environments with better customer support and regulatory oversight.

Ultimately, traders must conduct their own research and remain vigilant to avoid potential scams in the forex market. Is Estar safe? The evidence suggests otherwise, and caution is advised.

Is ESTAR a scam, or is it legit?

The latest exposure and evaluation content of ESTAR brokers.

ESTAR Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ESTAR latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.