AMEGA 2025 Review: Everything You Need to Know

Executive Summary

AMEGA stands out as a forex broker that has gained positive feedback from its users. The company has built itself into a strong player in the global trading market. This AMEGA review shows that the broker's best features include zero-commission trading and very fast withdrawals, which have impressed traders at all skill levels.

The broker works through two main companies - Amega Markets LLC and Amega Global Ltd - giving traders access to many types of assets like currencies, commodities, and indices. AMEGA appeals most to traders who want low-cost trading with high leverage options, making it good for both new traders watching costs and experienced traders who want to trade more efficiently.

User feedback on different review sites shows that AMEGA has reliable execution speeds and keeps fund management simple. The broker's zero-commission model cuts trading costs by a lot, while the quick withdrawal process solves one of the biggest problems forex traders face - getting their money when they need it.

Important Disclaimers

Traders should know that AMEGA operates in different countries, with Amega Markets LLC registered in Saint Vincent and the Grenadines. Rules may be different between regions, and investors should check the rules that apply to their location before opening an account.

This review uses public information, user feedback from review sites, and data from the company. Trading has big risks, and past results don't promise future success. The broker does not serve people from the United States, North Korea, and Iran, following international rules.

Rating Overview

Broker Overview

AMEGA works as an international forex broker through two companies, Amega Markets LLC and Amega Global Ltd. The specific founding year is not listed in available documents, but the broker has built a presence in the competitive forex market by focusing on low-cost trading and efficient service.

The company's business model centers on zero-commission trading across many asset types, which saves active traders a lot of money. This approach, combined with competitive spreads and fast execution, makes AMEGA a value-focused broker for traders who want cost efficiency without giving up execution quality.

AMEGA's trading environment includes many financial instruments like major and minor currency pairs, commodities, and market indices. The broker's setup emphasizes direct market access, letting traders benefit from institutional-grade execution speeds and pricing transparency. With Amega Markets LLC registered in Saint Vincent and the Grenadines, the broker operates under that jurisdiction's financial services framework, though specific regulatory details need more clarification for complete transparency.

Regulatory Status: AMEGA operates with Amega Markets LLC registered in Saint Vincent and the Grenadines, though specific regulatory body details and license numbers are not well documented in available materials.

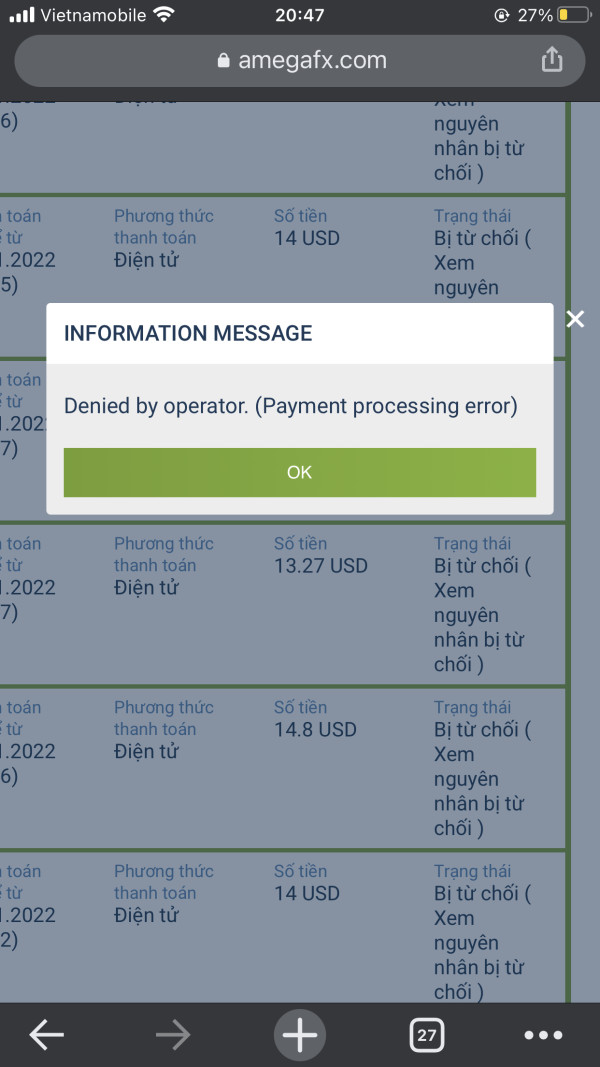

Deposit and Withdrawal Methods: While the broker emphasizes fast withdrawals in user feedback, specific payment methods and processing times for deposits are not fully outlined in current documentation.

Minimum Deposit Requirements: Specific minimum deposit amounts are not detailed in available information, requiring direct contact with the broker for accurate requirements.

Promotional Offers: Current bonus and promotional structures are not specified in available materials, suggesting traders should ask directly about any available incentives.

Tradeable Assets: The broker provides access to multiple asset classes including major and exotic currency pairs, precious metals, energy commodities, and major stock indices, offering diverse trading opportunities.

Cost Structure: AMEGA's zero-commission model represents its main cost advantage, though specific spread information and any additional fees require clarification through direct broker contact.

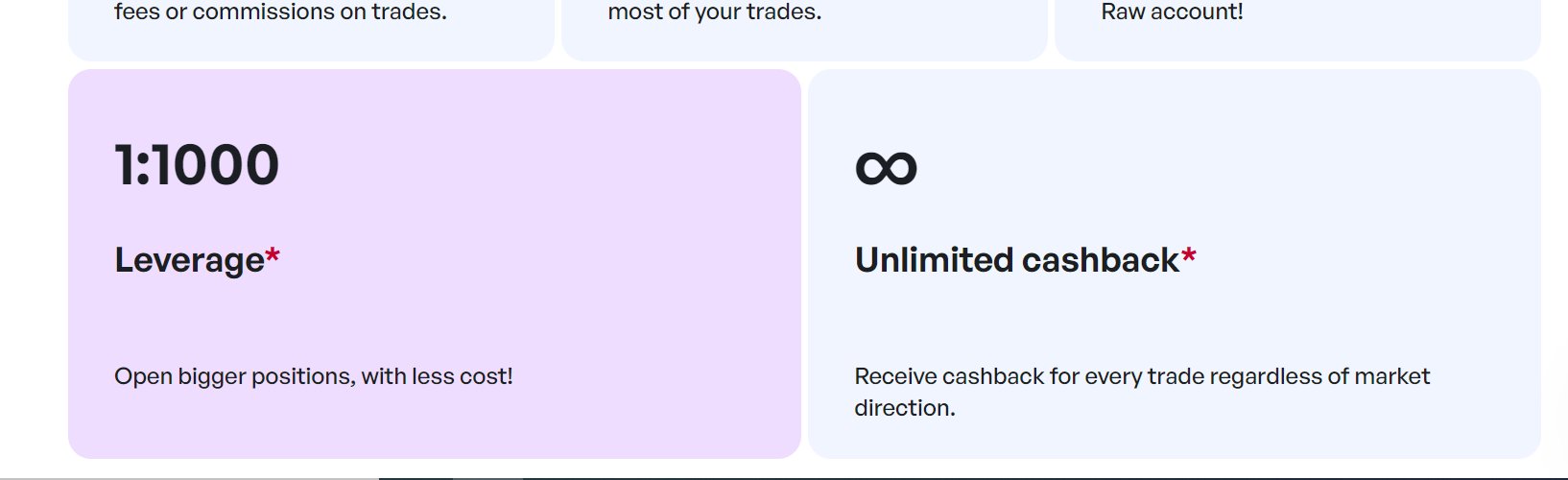

Leverage Options: High leverage is available, though specific maximum leverage ratios are not detailed in current documentation and may vary by account type and jurisdiction.

Platform Selection: Specific trading platform details are not extensively covered in available materials, requiring further investigation for comprehensive platform analysis.

Geographic Restrictions: The broker clearly excludes residents of the United States, North Korea, and Iran from its services.

Customer Support Languages: Supported languages for customer service are not specified in available documentation.

This AMEGA review shows that while the broker offers competitive core features, some operational details require direct verification with the company for complete accuracy.

Detailed Rating Analysis

Account Conditions Analysis (7/10)

AMEGA's account structure centers around its zero-commission trading model, which sets it apart from many competitors who charge fees for each trade. This approach cuts trading costs significantly for active traders, especially those using scalping or high-frequency trading strategies. The broker's competitive fee structure has received positive mentions in user reviews, with traders liking the cost transparency.

However, specific details about account types, minimum deposit requirements, and tier-based benefits are not well documented in available materials. This lack of detailed information hurts the overall rating, as traders typically want comprehensive account specifications before choosing a broker. The absence of information about Islamic accounts or other specialized account types also limits access for certain trader groups.

User feedback suggests that account opening processes are fairly straightforward, though specific verification requirements and timeframes are not detailed. The broker's approach to account management appears user-friendly based on withdrawal speed feedback, showing efficient back-office operations.

Compared to industry standards, AMEGA's zero-commission model provides a competitive advantage, particularly for traders who focus on cost efficiency. This AMEGA review finds that while the core account conditions are attractive, more detailed account specification transparency would boost trader confidence and help with decision-making.

AMEGA provides access to multiple asset classes, letting traders diversify their portfolios beyond traditional forex pairs. The availability of commodities, indices, and various currency pairs suggests a comprehensive trading environment suitable for different trading strategies and market conditions. User feedback shows that the broker offers direct market access, which typically means better pricing and execution quality.

The broker's execution infrastructure appears strong based on user reports of fast execution speeds, suggesting investment in quality technology and server infrastructure. This technical capability is crucial for traders who rely on precise timing and minimal slippage for their trading strategies.

However, specific information about research tools, market analysis resources, and educational materials is not well detailed in available documentation. Modern traders often expect comprehensive analytical tools, economic calendars, and educational content to support their trading decisions. The absence of detailed information about these resources impacts the overall assessment.

Trading automation support and API availability are not specified, which may limit appeal for algorithmic traders and those using expert advisors. Despite these information gaps, user feedback suggests satisfaction with the overall trading environment and tool access.

Customer Service and Support Analysis (6/10)

Customer service represents a mixed picture for AMEGA, with user feedback showing both positive and negative experiences. The most consistently praised aspect is the fast withdrawal processing, which shows efficient back-office operations and responsiveness to client fund requests. This efficiency in financial operations often reflects broader customer service capabilities.

However, the presence of negative reviews, including some one-star ratings, suggests inconsistencies in service delivery or communication effectiveness. The specific nature of customer complaints is not detailed in available materials, making it hard to assess whether issues relate to communication barriers, response times, or service quality.

Available documentation does not specify customer support channels, operating hours, or multilingual support capabilities. Modern forex traders typically expect 24/5 support during market hours, multiple communication channels including live chat, and support in their native languages. The absence of this information impacts the overall service assessment.

Response time data and problem resolution case studies are not available in current materials, limiting the ability to assess service quality comprehensively. While withdrawal speed suggests operational efficiency, broader customer service metrics require additional verification for complete evaluation.

Trading Experience Analysis (8/10)

The trading experience with AMEGA receives positive feedback mainly due to fast execution speeds and the zero-commission structure that reduces trading costs. User reviews consistently mention quick order execution, which is crucial for effective trading, particularly in volatile market conditions. This execution quality suggests strong technical infrastructure and proper liquidity arrangements.

The low-cost trading environment created by zero commissions improves the overall trading experience, allowing traders to focus on market movements rather than fee calculations. This cost structure is particularly helpful for scalping strategies and high-frequency trading approaches where commission costs can significantly impact profitability.

However, specific platform functionality details, including charting capabilities, order types, and mobile trading features, are not well documented. Modern traders expect comprehensive platform features including advanced charting, multiple order types, and seamless mobile integration. The absence of detailed platform specifications limits the complete assessment of trading experience quality.

Technical performance data such as uptime statistics, slippage measurements, and latency information are not provided in available materials. While user feedback suggests satisfactory performance, quantitative performance metrics would strengthen the AMEGA review assessment. The overall trading environment appears good for effective trading based on user reports.

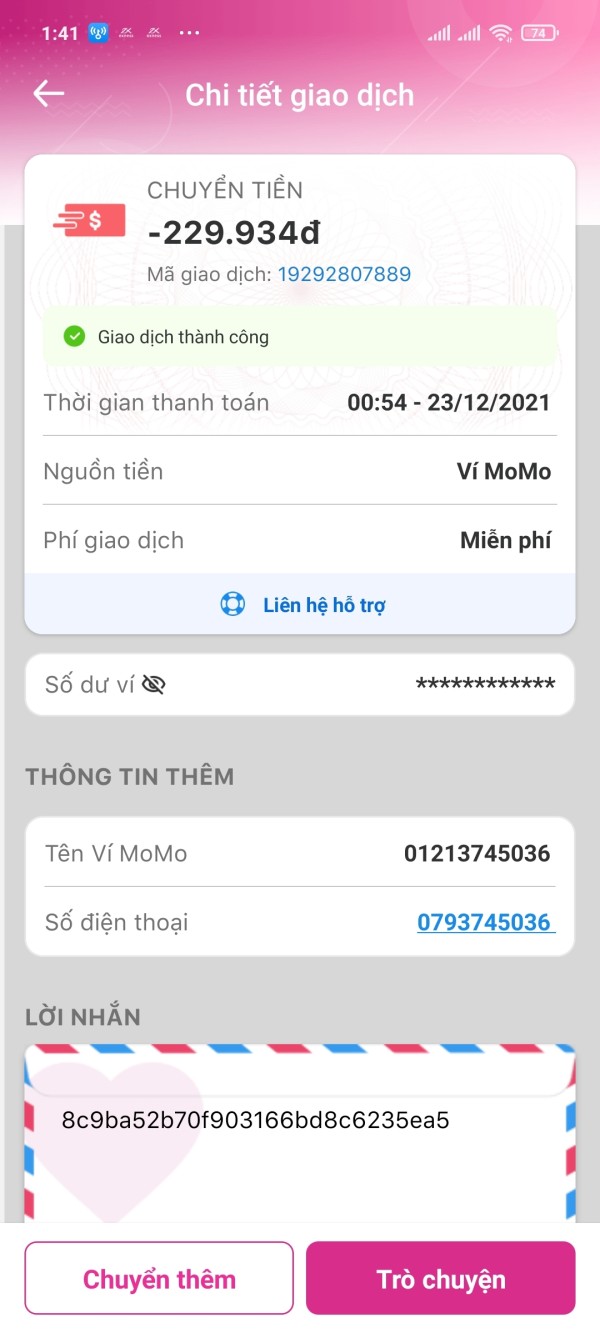

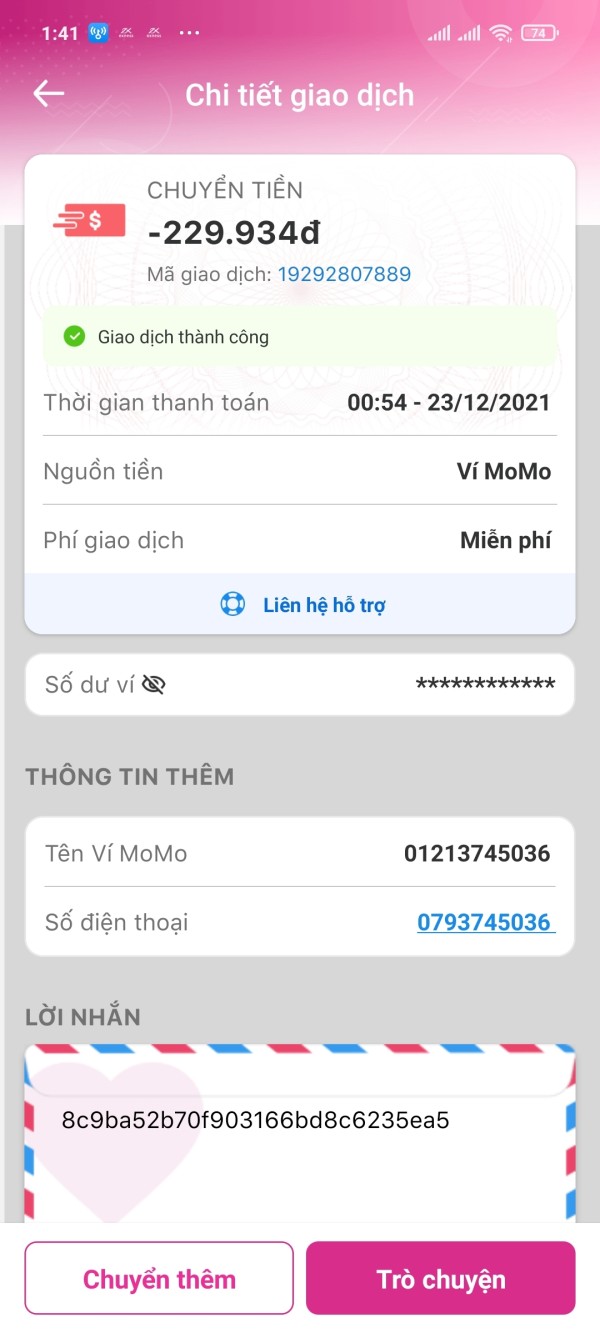

Trustworthiness Analysis (5/10)

AMEGA's trustworthiness assessment reveals several areas needing attention. While the broker is registered through Amega Markets LLC in Saint Vincent and the Grenadines, specific regulatory license numbers and oversight details are not clearly documented. This regulatory transparency gap impacts trader confidence, as comprehensive regulatory information is typically expected from reputable brokers.

The presence of negative reviews and one-star ratings on review platforms raises questions about consistency in service delivery and client satisfaction. While negative reviews are common across all brokers, the specific nature and frequency of complaints would require detailed analysis to assess their significance and the broker's response to client concerns.

Fund security measures, segregated account policies, and client money protection schemes are not detailed in available documentation. These security features are fundamental to broker trustworthiness, and their absence from public information impacts the overall trust assessment. Traders typically expect clear information about how their funds are protected and managed.

Industry reputation and third-party certifications are not well documented, limiting the ability to assess the broker's standing within the professional trading community. While user feedback includes positive experiences, the mixed review profile and limited regulatory transparency contribute to a moderate trustworthiness rating.

User Experience Analysis (7/10)

Overall user satisfaction with AMEGA appears generally positive, with particular praise for withdrawal efficiency and execution speed. These operational aspects significantly impact daily trading experience and trader satisfaction. The zero-commission structure also contributes positively to user experience by simplifying cost calculations and improving trading economics.

However, the presence of negative reviews shows that user experience is not uniformly positive across all clients. The specific nature of user complaints is not detailed in available materials, making it hard to assess whether issues are systematic or isolated incidents. Understanding complaint patterns would help evaluate service consistency and improvement areas.

Interface design and platform usability information is not extensively available, though user feedback suggests general satisfaction with the trading environment. Modern traders expect intuitive interfaces, responsive design, and comprehensive functionality. The absence of detailed platform reviews impacts the complete user experience assessment.

Registration and verification processes are not detailed in available documentation, though the efficient withdrawal feedback suggests streamlined operational procedures. Account funding and management experiences appear satisfactory based on user reports, though specific procedural details would enhance the assessment. The broker appears suitable for traders prioritizing cost efficiency and execution quality, though comprehensive platform evaluation requires additional investigation.

Conclusion

This comprehensive AMEGA review reveals a broker with several compelling advantages, particularly its zero-commission trading model and fast withdrawal processing, which address two primary concerns for many forex traders. The broker demonstrates operational efficiency and appears well-suited for traders who prioritize cost-effective trading environments and reliable fund management.

AMEGA is most appropriate for both novice and experienced traders seeking low-cost trading solutions without compromising execution quality. The broker's high leverage offerings and multiple asset classes provide flexibility for various trading strategies and experience levels.

However, the assessment also identifies areas requiring improvement, particularly regarding regulatory transparency and customer service consistency. While the core trading features are competitive, enhanced transparency in regulatory status, account specifications, and comprehensive customer service information would strengthen trader confidence and market positioning.