Is FOMOSO safe?

Pros

Cons

Is Fomoso Safe or a Scam?

Introduction

Fomoso is a forex broker that emerged in the financial markets with the promise of providing a comprehensive trading experience. Established in 2017 and operating primarily in the United States, Fomoso offers various trading instruments, including forex, commodities, and indices. However, as with any trading platform, it is crucial for traders to exercise caution and conduct thorough due diligence before committing their funds. The forex market is rife with unregulated brokers and scams, making it imperative for traders to evaluate the legitimacy and safety of their chosen broker. This article aims to explore the safety and reliability of Fomoso by analyzing its regulatory status, company background, trading conditions, customer experiences, and overall risk profile.

Regulation and Legitimacy

Understanding a broker's regulatory status is fundamental in assessing its safety. Regulation serves as a protective measure for traders, ensuring that brokers adhere to strict financial standards and practices. In the case of Fomoso, it is important to note that the broker claims to be regulated by the National Futures Association (NFA) and the Financial Crimes Enforcement Network (FinCEN). However, upon closer examination, it becomes evident that Fomoso does not hold valid regulatory licenses from these bodies.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0511076 | United States | Unverified |

| FinCEN | 31000212133824 | United States | Not applicable |

The absence of proper regulation raises significant concerns regarding the safety of funds and the overall legitimacy of Fomoso. Without oversight from recognized regulatory authorities, traders are left vulnerable to potential fraud and malpractice. Furthermore, there have been numerous complaints and negative reviews from users regarding withdrawal issues and poor customer service, further substantiating the concerns surrounding Fomoso's regulatory status. Therefore, it is crucial to approach this broker with caution.

Company Background Investigation

Fomoso, officially known as Fomoso Global Holdings Co., Ltd., was established in 2017. The broker markets itself as a comprehensive platform for forex and CFD trading. However, the lack of transparency regarding its ownership structure and operational history is concerning. There is limited information available about the management team and their professional backgrounds, which raises questions about the broker's credibility.

The company's website does not provide adequate details about its physical location or contact information, making it difficult for potential clients to verify its legitimacy. The absence of clear company registration details and the lack of a verifiable address further contribute to the perception that Fomoso may not be a trustworthy broker. Traders should be wary of engaging with companies that lack transparency and fail to disclose essential information about their operations.

Trading Conditions Analysis

Fomoso offers various trading conditions, including multiple account types and leverage options. However, a thorough examination of its fee structure reveals potential red flags. The broker imposes high minimum deposit requirements, with the pro account demanding a staggering $50,000 to open. Additionally, the spreads on major currency pairs are reportedly high, which can significantly impact trading profitability.

| Fee Type | Fomoso | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Moderate |

| Commission Structure | Variable | Standard |

| Overnight Interest Range | High | Low to Moderate |

The high fees associated with trading on Fomoso's platform may deter potential traders, particularly those looking for cost-effective trading options. Furthermore, the lack of clarity regarding commission structures and overnight interest rates raises concerns about the broker's overall transparency. Traders are advised to carefully consider these factors before deciding to trade with Fomoso.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Fomoso claims to implement measures to protect client funds; however, the absence of regulatory oversight raises questions about the effectiveness of these measures. The broker does not appear to offer segregated accounts, which are essential for ensuring that client funds are kept separate from the broker's operational funds. This lack of segregation can expose traders to significant risks in the event of the broker's insolvency.

Additionally, Fomoso does not provide information regarding investor protection schemes or negative balance protection policies, which are typically offered by regulated brokers to safeguard clients from excessive losses. The historical complaints related to fund withdrawals and slow processing times further highlight the potential risks associated with trading on this platform. Therefore, traders must exercise extreme caution when considering Fomoso as their broker.

Customer Experience and Complaints

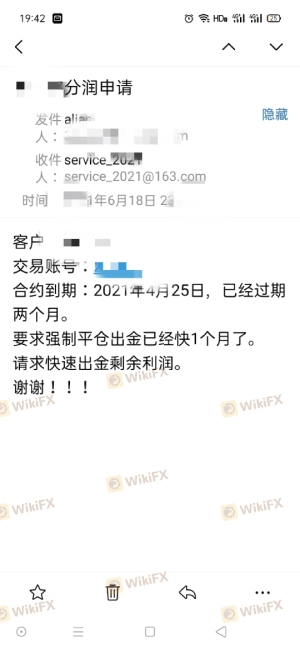

Customer feedback is a critical indicator of a broker's reliability. In the case of Fomoso, numerous complaints have surfaced regarding withdrawal issues, poor customer service, and high spreads. Users have reported significant delays in processing withdrawal requests, with some clients stating that their requests remained unaddressed for weeks. This pattern of negative feedback raises serious concerns about the broker's commitment to customer satisfaction.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| High Spreads | Moderate | Average |

| Customer Service Issues | High | Poor |

For instance, one user reported being unable to withdraw their funds for over two months, citing a lack of communication from customer support. Such experiences indicate a troubling trend that potential clients should be aware of before opening an account with Fomoso. The overall customer experience appears to be lacking, with many users expressing frustration over the broker's responsiveness and reliability.

Platform and Execution

Fomoso utilizes the widely recognized MetaTrader 4 (MT4) platform for trading. While MT4 is known for its user-friendly interface and comprehensive trading tools, the execution quality and reliability of the platform depend heavily on the broker's infrastructure. Reports of slippage, order rejections, and other execution issues have been noted by users, suggesting that Fomoso may not provide the level of service expected from a reputable broker.

The platform's stability and performance are crucial for traders, particularly during volatile market conditions. Any signs of manipulation or unfair practices can severely impact a trader's experience and profitability. Therefore, it is essential for traders to evaluate the execution quality and reliability of Fomoso's platform before committing their funds.

Risk Assessment

Trading with Fomoso presents several risks that traders should consider. The absence of regulatory oversight, high fees, and poor customer service contribute to a heightened risk profile for this broker. Additionally, the lack of transparency regarding the company's operations and ownership raises further concerns about its legitimacy.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Financial Risk | High | High fees and spreads |

| Operational Risk | Medium | Withdrawal issues |

To mitigate these risks, traders should conduct thorough research, consider using smaller amounts for initial trading, and remain vigilant regarding their funds. It is advisable to explore alternative brokers that are properly regulated and offer better transparency and customer service.

Conclusion and Recommendations

In conclusion, the evidence suggests that Fomoso presents several red flags that warrant caution. The lack of proper regulation, high fees, and numerous customer complaints indicate that Fomoso may not be a safe option for traders. While the broker offers a wide range of trading instruments and utilizes a popular trading platform, the associated risks and concerns overshadow these benefits.

Traders are advised to consider reputable and regulated alternatives that prioritize customer safety and transparency. Brokers that are overseen by recognized regulatory authorities provide a greater level of protection for traders' funds and ensure compliance with industry standards. In light of the findings, it is prudent for potential clients to approach Fomoso with skepticism and to prioritize their financial safety by opting for established, trustworthy brokers.

Is FOMOSO a scam, or is it legit?

The latest exposure and evaluation content of FOMOSO brokers.

FOMOSO Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FOMOSO latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.