Is AM Broker safe?

Pros

Cons

Is Am Broker A Scam?

Introduction

Am Broker is a relatively new entrant in the forex trading arena, established in 2018 and registered in Saint Vincent and the Grenadines. As with any brokerage, it is crucial for traders to evaluate its legitimacy and trustworthiness before committing their funds. This is particularly true in the forex market, where scams and unregulated brokers abound. Traders must exercise caution and conduct thorough due diligence to protect their investments. In this article, we will investigate Am Broker's regulatory status, company background, trading conditions, customer experience, and overall safety to determine if Am Broker is safe or a potential scam.

Regulation and Legitimacy

The regulatory environment of a brokerage is a crucial factor in assessing its legitimacy. Am Broker claims to be registered with the Financial Services Authority (FSA) of Saint Vincent and the Grenadines. However, it is important to note that this registration does not equate to regulation in the traditional sense, as the FSA does not oversee or regulate financial services providers operating in this jurisdiction.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SVG FSA | N/A | Saint Vincent and the Grenadines | Unverified |

The lack of robust regulatory oversight raises significant concerns regarding the safety of funds and the operational integrity of Am Broker. Without a reputable regulatory body monitoring its activities, traders may find themselves vulnerable to potential fraud or mismanagement of their funds. The absence of regulation is a common red flag for many traders, making it essential to question whether Am Broker is indeed a safe option.

Company Background Investigation

Am Broker is operated by Am Globe Services Ltd., which is based in Kingstown, Saint Vincent and the Grenadines. The company has been in operation for a relatively short period, which may raise concerns regarding its stability and reliability. The ownership structure is not clearly disclosed on its website, leading to questions about transparency and accountability.

The management team's background and expertise are also critical factors in evaluating the broker's credibility. However, there is limited information available regarding the qualifications and experience of the individuals behind Am Broker. This lack of transparency can be disconcerting for potential clients, as it is often indicative of a company's willingness to uphold high standards of professionalism and ethical conduct.

Trading Conditions Analysis

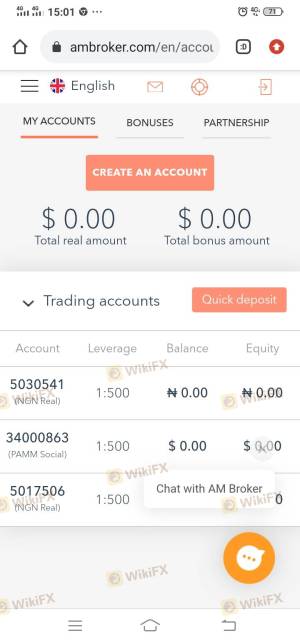

When evaluating whether Am Broker is safe, it is essential to examine its trading conditions, including fees, spreads, and commissions. The broker offers a minimum deposit requirement of $1,000, which is significantly higher than the industry average of around $250. This high barrier to entry may deter many potential traders from engaging with the platform.

| Fee Type | Am Broker | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.6 pips | 1.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While Am Broker advertises competitive spreads starting from 0.6 pips, the lack of clarity regarding commission structures and overnight interest rates raises concerns. The absence of detailed information could indicate a less-than-transparent fee structure, which is a common tactic used by unscrupulous brokers to obscure hidden costs.

Client Funds Security

The security of client funds is paramount when evaluating any broker. Am Broker claims to implement certain measures to ensure the safety of client funds. However, the lack of regulatory oversight means that there are no guarantees regarding the segregation of client funds or investor protection measures. Traders should be wary of the potential risks involved when dealing with an unregulated broker.

The absence of negative balance protection is another cause for concern, as this could lead to traders losing more than their initial investment. Furthermore, historical data on Am Broker's fund security practices is scarce, leaving potential clients in the dark about any past issues or disputes regarding fund safety.

Customer Experience and Complaints

Customer feedback is a vital component in assessing whether Am Broker is safe. Reviews from users indicate a mixed experience, with some praising the broker's customer service while others report significant issues. Common complaints include delays in withdrawals, poor customer support, and a lack of transparency regarding fees.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Fair |

For instance, one user reported having to wait several days for a withdrawal to be processed, while another cited unresponsive customer support when seeking assistance. These patterns of complaints raise questions about the broker's reliability and responsiveness to client concerns.

Platform and Trade Execution

The trading platform offered by Am Broker is MetaTrader 5 (MT5), a widely used platform known for its advanced features and user-friendly interface. However, the performance of the platform, including execution quality and slippage rates, is critical to the overall trading experience.

Users have reported inconsistent execution speeds and instances of slippage, which may indicate potential manipulation or issues with the broker's order execution process. Such factors can significantly impact traders' performance and raise further concerns about whether Am Broker is safe.

Risk Assessment

In summary, the overall risk of trading with Am Broker can be categorized as high due to several factors, including lack of regulation, high minimum deposit requirements, and reported issues with withdrawals and customer support.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker operating in a high-risk jurisdiction. |

| Financial Risk | High | High minimum deposit with potential hidden fees. |

| Operational Risk | Medium | Reports of withdrawal delays and execution issues. |

To mitigate these risks, traders should consider starting with a demo account, conducting thorough research, and only investing funds they can afford to lose.

Conclusion and Recommendations

Based on the evidence presented, it is clear that Am Broker raises several red flags that warrant caution. The lack of regulatory oversight, high minimum deposit requirements, and numerous customer complaints suggest that traders should carefully consider their options before engaging with this broker.

If you are a trader seeking a reliable and trustworthy forex broker, it may be prudent to explore alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers such as XM or eToro may provide safer trading environments with better customer support and more transparent fee structures.

In conclusion, while Am Broker may offer attractive trading conditions, the potential risks and concerns surrounding its legitimacy and safety cannot be overlooked. Always prioritize due diligence when choosing a broker, and consider whether you are comfortable with the inherent risks associated with trading through Am Broker.

Is AM Broker a scam, or is it legit?

The latest exposure and evaluation content of AM Broker brokers.

AM Broker Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

AM Broker latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.