BX 2025 Review: Everything You Need to Know

Summary: The BX forex broker has garnered significant attention, primarily for its unregulated status and numerous negative user experiences. While some users praise the speed of deposits and withdrawals, there are serious concerns regarding the brokers reliability and the safety of funds.

Note: It is crucial to recognize that BX operates under various entities across different regions, which adds complexity to its regulatory status and user experiences. This review aims to present a balanced view based on multiple sources for fairness and accuracy.

Rating Overview

How We Rated the Broker: Our ratings are based on the analysis of user feedback, expert opinions, and factual data regarding the broker's operations.

Broker Overview

BX, operated by 8 Bit Nex Limited, is a forex broker established within the last 2-5 years, primarily based in Saint Lucia. The broker offers a variety of trading instruments, including forex, precious metals, commodities, and stock indices. However, it is important to note that BX is currently unregulated, raising significant concerns about the safety of client funds. The platform supports the widely used MetaTrader 4 (MT4) for trading, which is favored by many traders for its robust features.

Detailed Section

Regulatory Status

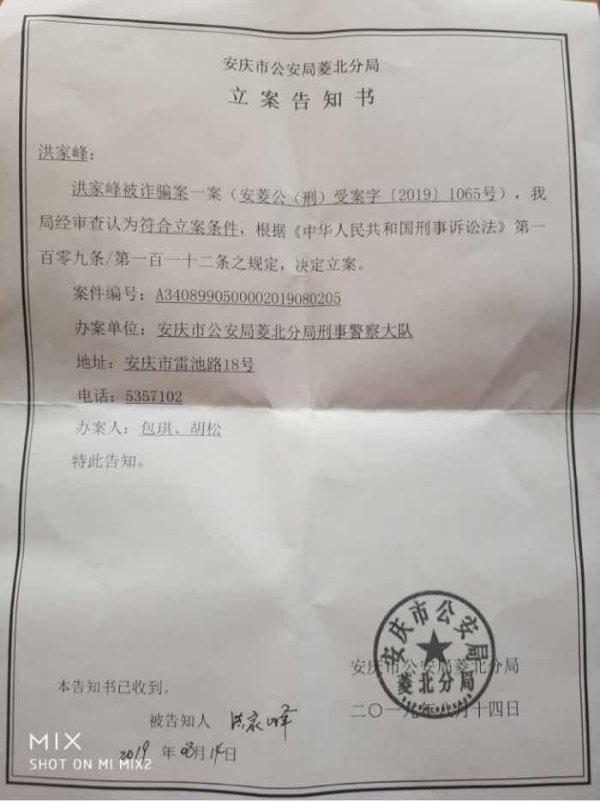

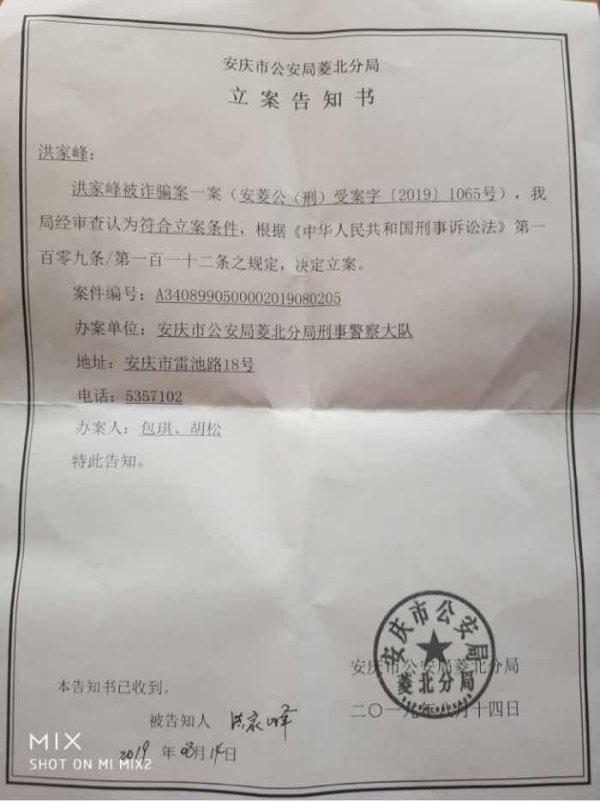

BX does not hold a valid regulatory license from any recognized authority, which poses a significant risk to traders. The lack of regulation means that there is little to no oversight of the brokers activities, making it difficult for clients to seek recourse in case of disputes. According to WikiBit, the broker has been flagged as a suspicious clone of other regulated entities, further eroding its credibility.

Deposit/Withdrawal Options

BX supports various deposit methods, including bank transfers and credit cards. However, it imposes a 1% fee on all deposits and withdrawals. Users have reported that deposits are typically processed within one business day, but withdrawals can take up to three days, leading to frustration among clients. This has been echoed in user reviews, where many have expressed dissatisfaction with the withdrawal process, often citing delays and difficulties in accessing their funds.

Minimum Deposit

The minimum deposit requirements vary by account type. For the standard account, the minimum deposit is set at $100, while professional accounts require a deposit of $5,000, and premium accounts necessitate a $20,000 deposit. This tiered structure may appeal to various trader levels, but the higher thresholds may deter novice traders.

There are no specific bonuses or promotional offers highlighted in the available reviews, indicating that BX may not engage in incentivizing trading through such methods. This could be a disadvantage for traders looking for added value through bonuses.

Tradable Asset Classes

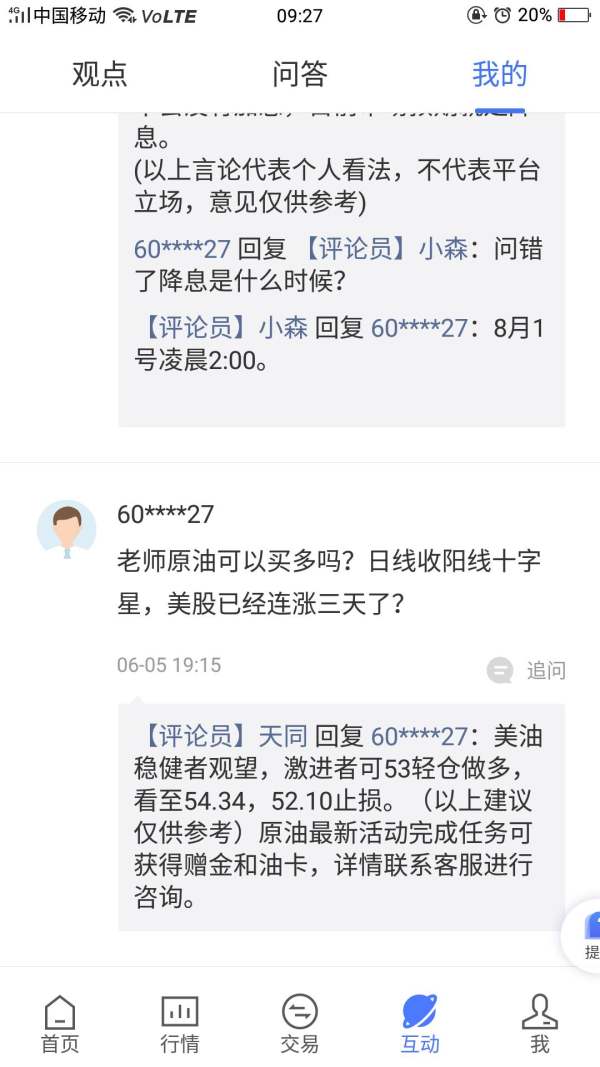

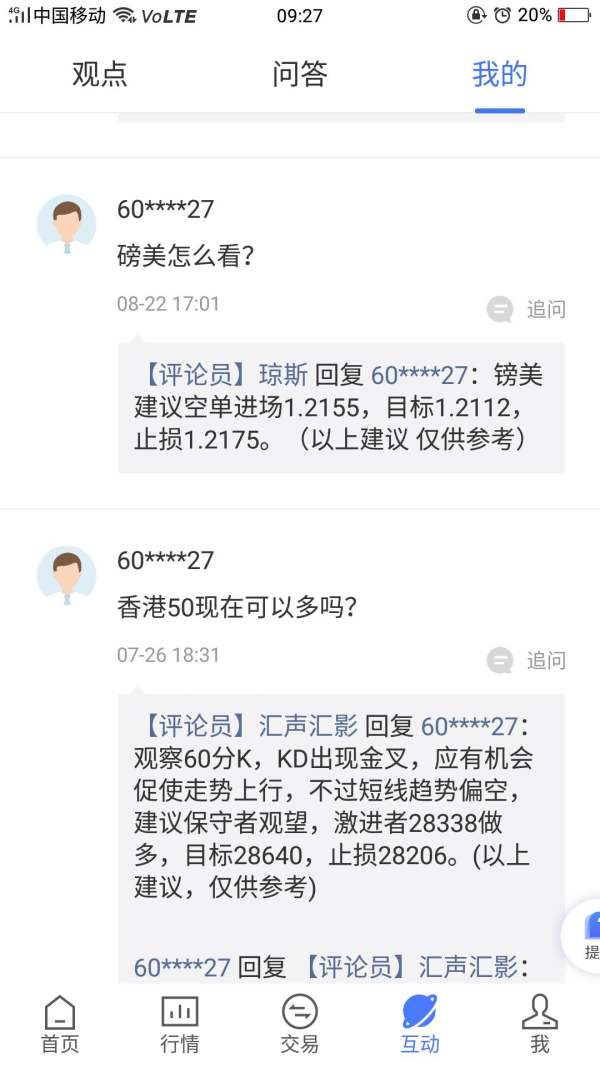

BX offers a diverse range of tradable assets, including forex, precious metals (like gold and silver), commodities (such as crude oil and natural gas), and stock indices. This variety allows traders to diversify their portfolios, although the lack of regulation raises concerns about the execution and reliability of trades.

Costs (Spreads, Fees, Commissions)

Spreads at BX reportedly start from as low as 0.1 pips, which is competitive in the market. However, the absence of detailed information regarding commission structures creates uncertainty for potential traders. Many users have expressed concerns about hidden fees, which could significantly impact trading profitability.

Leverage

BX offers leverage of up to 500:1, allowing traders to amplify their positions significantly. While this high leverage can increase potential gains, it also amplifies risk, particularly for inexperienced traders who may not fully understand the implications of trading with such high leverage.

BX primarily operates on the MetaTrader 4 platform, a popular choice among traders for its user-friendly interface and extensive features. The broker also offers a web-based platform and mobile trading applications for iOS and Android, providing flexibility for traders to manage their investments on the go.

Restricted Regions

While specific information on restricted regions is not readily available, it is advisable for potential clients to verify their local regulations regarding trading with unregulated brokers before proceeding.

Available Customer Service Languages

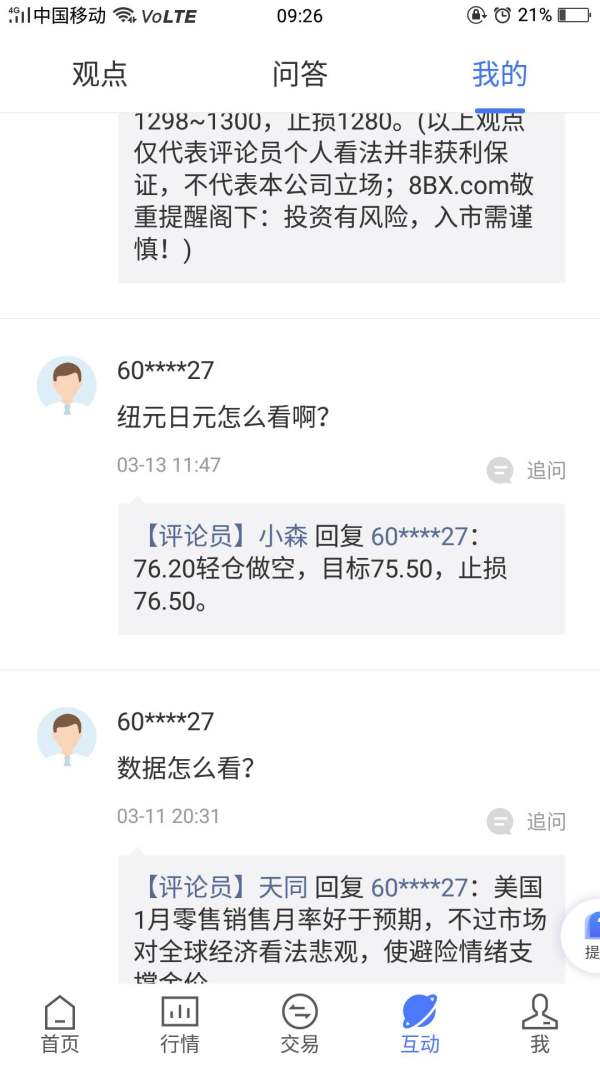

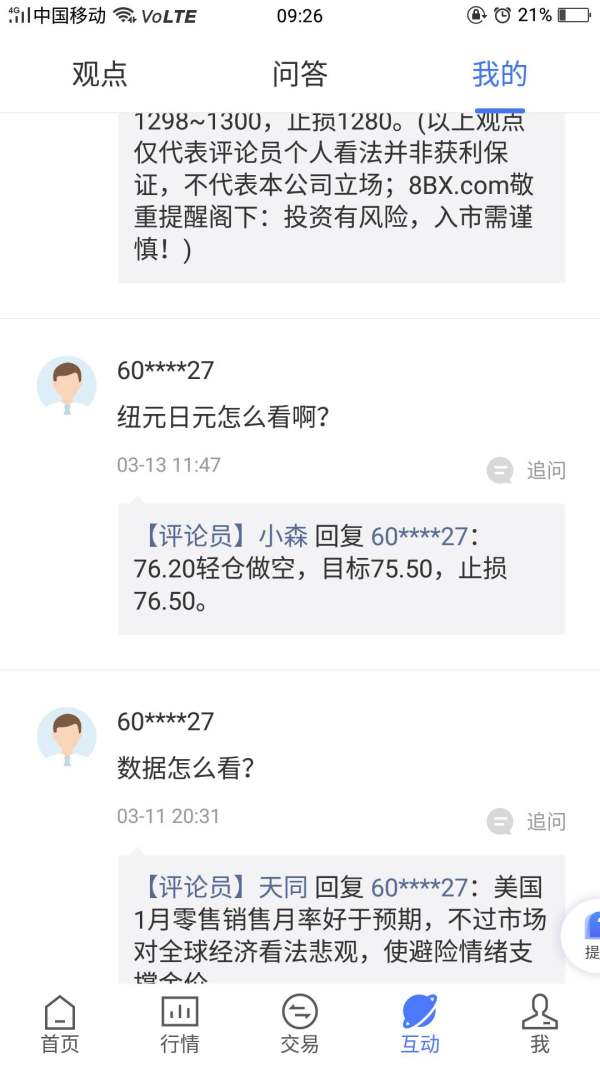

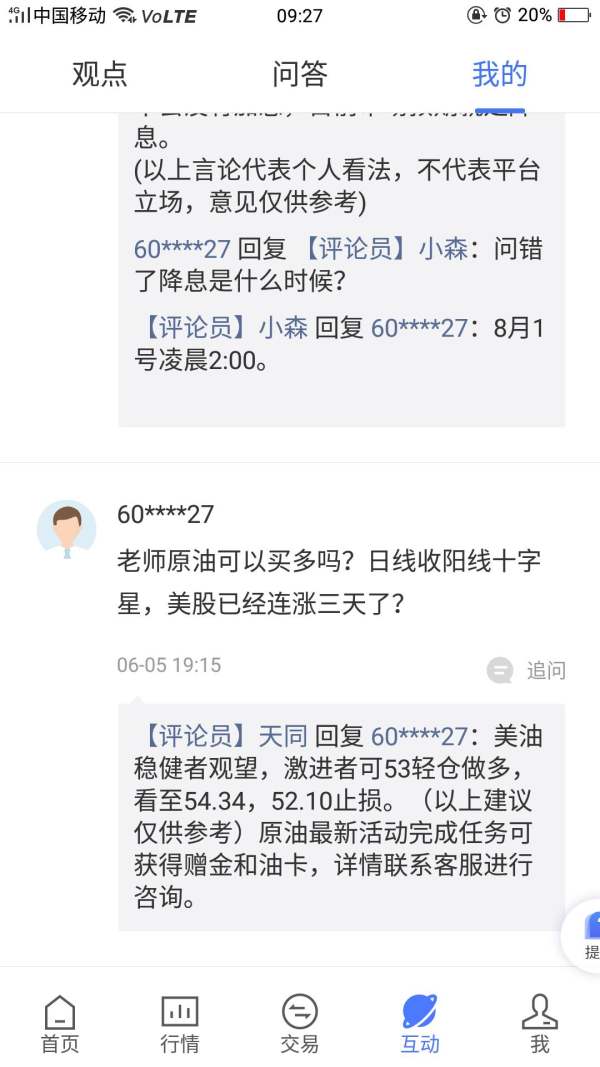

Customer service at BX is primarily conducted in Chinese, which may limit accessibility for non-Chinese speaking clients. Users have reported difficulties in reaching customer support, with many citing poor response times and unhelpfulness when issues arise.

Repeated Rating Overview

Detailed Breakdown

- Account Conditions: The tiered minimum deposit structure may appeal to some traders, but the overall lack of transparency and high minimums for professional accounts are concerning.

- Tools and Resources: BX offers a standard trading platform (MT4) and some educational tools, but the lack of comprehensive resources limits traders' ability to make informed decisions.

- Customer Service and Support: Numerous user complaints highlight significant deficiencies in customer support, including slow response times and unavailability.

- Trading Setup (Experience): While the platform is user-friendly, many users report issues with slippage and order execution, raising concerns about the trading experience.

- Trustworthiness: The unregulated status and numerous negative reviews regarding fund withdrawal and customer service create a low trust score.

- User Experience: Mixed reviews indicate that while some users have had positive experiences with deposits, the overwhelming sentiment is negative, particularly concerning withdrawals.

In conclusion, while BX offers a range of trading instruments and a popular trading platform, the significant risks associated with its unregulated status and negative user experiences warrant caution. Potential traders should consider these factors seriously before deciding to engage with this broker.