Bainbridge Review 2

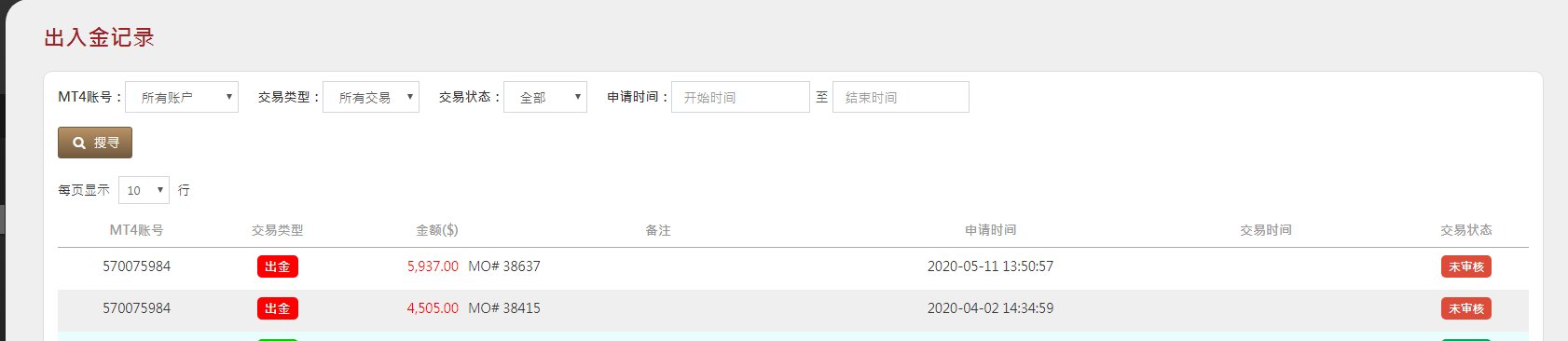

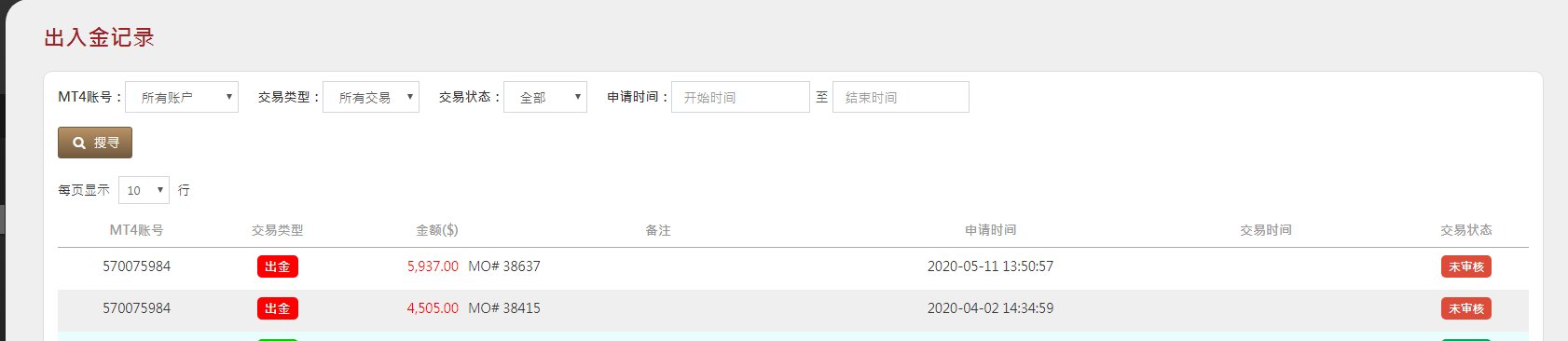

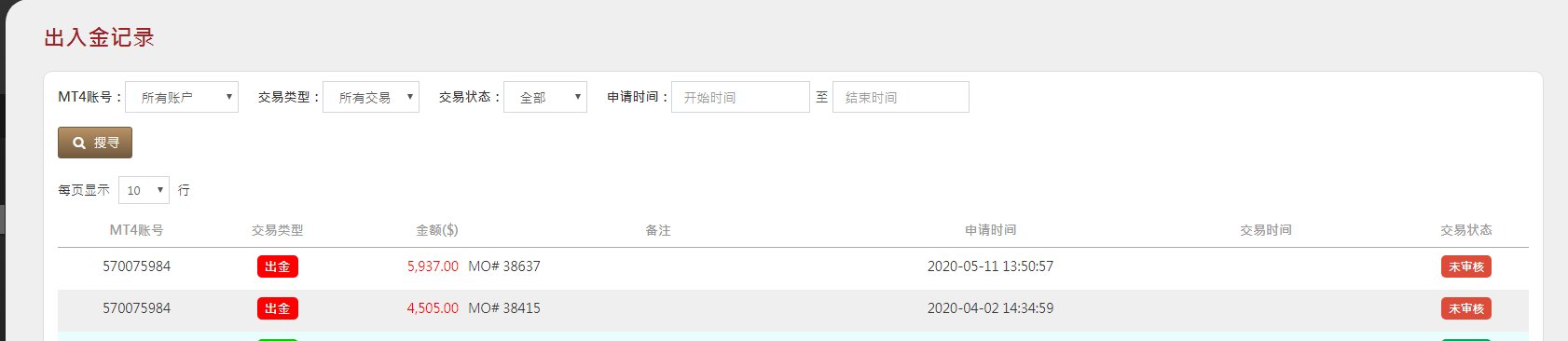

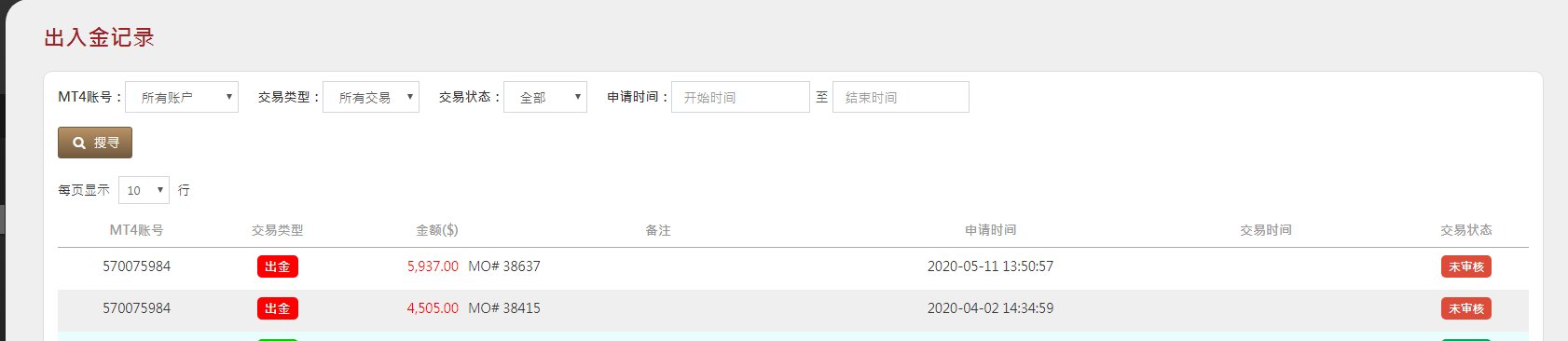

The withdrawal is unavailable for 2 months. Stay away.

The platform is disappeared. Agent and clients couldn’t make withdrawal. It is a rip-off. Stay away.

Bainbridge Forex Broker provides real users with * positive reviews, * neutral reviews and 2 exposure review!

Business

License

The withdrawal is unavailable for 2 months. Stay away.

The platform is disappeared. Agent and clients couldn’t make withdrawal. It is a rip-off. Stay away.

This bainbridge review provides a complete analysis of Bainbridge Brokerage. The company started in 2025 and focuses mainly on freight and cargo services. While the company calls itself a brokerage, our investigation shows big gaps in traditional forex trading services and regulatory transparency.

Based on available information, Bainbridge Brokerage appears to work primarily with freight brokerage rather than financial instrument trading. This raises important questions for potential forex traders. The company's main operations center around freight services, offering technology solutions to reduce empty miles and maximize earnings for freight operators.

However, critical information about forex trading conditions, regulatory oversight, and traditional brokerage services is missing from available sources. This lack of transparency in core trading services creates problems for traders seeking reliable financial market access. Our analysis targets forex traders and individuals seeking complete brokerage services, though the current service offering appears limited to freight operations.

The evaluation shows a need for caution among traditional forex market participants considering this platform.

Regional Entity Differences: Available information does not specify regulatory jurisdictions or regional operational differences. Potential clients should know that regulatory requirements and service availability may vary significantly across different regions. However, specific regulatory information for Bainbridge Brokerage remains undisclosed in accessible materials.

Review Methodology: This assessment is based on publicly available information and company materials. The evaluation methodology incorporates analysis of official company communications and available user feedback. However, comprehensive trading data and regulatory documentation were not accessible during the review period.

| Criteria | Score | Justification |

|---|---|---|

| Account Conditions | 3/10 | No specific account information available for forex trading |

| Tools and Resources | 4/10 | Limited to freight-focused technology solutions |

| Customer Service | 5/10 | Basic contact information provided, service quality unverified |

| Trading Experience | 2/10 | No evidence of traditional forex trading platform |

| Trust and Regulation | 2/10 | No regulatory information or transparency measures identified |

| User Experience | 3/10 | Limited user feedback available, primarily freight-focused |

Company Foundation and Background

Bainbridge Brokerage established operations in 2025. The company positions itself within the brokerage industry with a specialized focus on freight and cargo services. According to company materials, the organization emphasizes "dedicated freight" solutions, suggesting a business model centered on logistics rather than traditional financial instrument trading.

The company's emergence in 2025 places it among newer market entrants, though its operational focus differs significantly from conventional forex brokerages. The company's business model appears to prioritize freight brokerage services, offering solutions for load optimization and carrier efficiency. This operational focus includes technology platforms designed to reduce empty miles for freight operators and maximize earnings through optimized routing systems.

However, traditional forex trading services, which would typically be expected from a financial brokerage, are notably absent from available company descriptions.

Service Portfolio and Platform Information

Available information indicates that Bainbridge Brokerage operates primarily through freight-focused technology solutions rather than traditional trading platforms. The company promotes a Transportation Management System application designed for load tracking and payment management. This differs substantially from the MetaTrader or proprietary platforms typically associated with forex brokerages.

This bainbridge review finds no evidence of conventional currency trading capabilities or multi-asset trading platforms. The asset classes available through Bainbridge Brokerage appear limited to freight and logistics services rather than financial instruments such as forex pairs, CFDs, or commodities. This service limitation represents a significant departure from traditional brokerage expectations and may not meet the requirements of forex traders seeking currency market access.

Regulatory Jurisdiction: Available materials do not specify regulatory oversight or licensing jurisdictions for financial services. The absence of regulatory information raises concerns about compliance with forex trading regulations.

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal methods for trading accounts was not identified in available sources. Traditional payment processing information remains undisclosed.

Minimum Deposit Requirements: No minimum deposit information for trading accounts is available in accessible company materials.

Promotional Offers: Current promotional offerings or bonus structures for trading accounts are not detailed in available sources.

Tradeable Assets: Based on available information, the company focuses on freight brokerage services rather than traditional financial instruments such as forex pairs, indices, or commodities.

Cost Structure: Specific information regarding spreads, commissions, or trading costs is not provided in available materials. The company mentions earning 1.25% of each freight load, indicating a freight-focused fee structure.

Leverage Options: Leverage ratios for trading positions are not specified in available company information.

Platform Selection: The company promotes a TMS application for freight management rather than traditional trading platforms like MetaTrader 4 or 5.

Geographic Restrictions: Specific geographic limitations for services are not detailed in available materials.

Customer Support Languages: Available customer service language options are not specified in accessible sources.

This bainbridge review reveals significant information gaps regarding traditional brokerage services. The findings suggest the company's primary focus remains on freight operations rather than forex trading.

The evaluation of account conditions for Bainbridge Brokerage reveals substantial limitations in traditional trading account offerings. Available information does not specify account types typically associated with forex trading, such as standard, premium, or professional trading accounts. The absence of detailed account structure information suggests that the company may not offer conventional trading accounts designed for currency market participation.

Minimum deposit requirements, which are fundamental considerations for forex traders, remain unspecified in available company materials. This lack of transparency regarding financial requirements makes it difficult for potential clients to assess accessibility and plan their trading capital allocation. Traditional brokerages typically provide clear deposit tiers corresponding to different account types and service levels.

The account opening process is not detailed in accessible sources. This raises questions about verification procedures, documentation requirements, and time frames for account activation. Professional forex brokerages typically maintain streamlined onboarding processes with clear timelines and requirements, information that appears absent from Bainbridge Brokerage materials.

Special account features, such as Islamic accounts, managed accounts, or institutional services, are not mentioned in available information. This bainbridge review finds that the company's account offerings appear primarily focused on freight brokerage services rather than financial trading accounts. This significantly limits its appeal to forex market participants.

The analysis of trading tools and resources reveals a significant disconnect between Bainbridge Brokerage's offerings and traditional forex trading requirements. The company promotes a Transportation Management System application designed for freight operations. This does not align with the analytical tools typically required for currency trading.

Standard forex trading tools such as economic calendars, technical analysis indicators, and charting packages are not mentioned in available materials. Research and analysis resources, which are essential for informed forex trading decisions, appear to be absent from the company's service portfolio. Traditional brokerages provide market analysis, economic research, and trading signals to support client decision-making, services that are not evident in Bainbridge Brokerage's current offerings.

Educational resources, including webinars, trading guides, and market tutorials, are not detailed in available company information. The absence of educational support limits the platform's suitability for both novice and experienced traders seeking to enhance their market knowledge and trading skills. Automated trading support, including Expert Advisor compatibility and algorithmic trading capabilities, is not addressed in available materials.

The company's focus on freight management technology rather than trading automation tools further emphasizes its departure from traditional forex brokerage services.

Customer service evaluation for Bainbridge Brokerage is limited by the scarcity of detailed support information in available sources. The company provides basic contact information but does not specify the range of customer service channels typically expected from professional forex brokerages. These typically include live chat, phone support, or dedicated account management services.

Response time commitments, which are crucial for trading support where market conditions can change rapidly, are not specified in available materials. Professional forex brokerages typically guarantee response times for different inquiry types and maintain 24/7 support during market hours. These standards cannot be verified for Bainbridge Brokerage.

Service quality assessments are hampered by the limited availability of user feedback specifically related to customer support experiences. The company's primary focus on freight services may result in support staff being more familiar with logistics issues rather than trading-related inquiries. This could potentially impact service quality for forex traders.

Multilingual support capabilities are not detailed in accessible sources, which may limit accessibility for international clients. Professional forex brokerages typically offer support in multiple languages to serve diverse client bases. This service standard remains unverified for Bainbridge Brokerage.

The trading experience evaluation reveals fundamental limitations in Bainbridge Brokerage's platform capabilities for forex trading. Available information does not indicate the presence of traditional trading platforms such as MetaTrader 4, MetaTrader 5, or proprietary trading interfaces designed for financial instrument trading. Instead, the company focuses on freight management applications that do not support currency trading activities.

Platform stability and execution speed, critical factors for successful forex trading, cannot be assessed due to the apparent absence of trading platform offerings. The company's TMS application serves freight operations rather than financial trading. This makes traditional performance metrics irrelevant to the current service portfolio.

Order execution quality, including fill rates, slippage control, and execution speed, cannot be evaluated as the company does not appear to offer forex trading services. These fundamental trading capabilities are essential for professional forex operations but are not addressed in available company materials. Mobile trading experience, increasingly important for modern forex traders, is not detailed in available sources.

While the company mentions a mobile application, it appears designed for freight tracking rather than financial trading. This limits its utility for currency market participants. This bainbridge review finds significant gaps in trading experience offerings compared to industry standards.

Trust and regulatory analysis reveals concerning gaps in transparency and oversight information for Bainbridge Brokerage. No regulatory licenses or oversight bodies are identified in available materials. This represents a significant concern for potential forex trading clients who require regulatory protection for their investments.

Established forex brokerages typically maintain licenses from recognized financial authorities such as the FCA, ASIC, or CySEC. Fund security measures, including segregated client accounts, investor compensation schemes, and audit procedures, are not detailed in accessible sources. These protections are fundamental requirements for legitimate forex brokerages and their absence raises significant trust concerns for potential clients considering fund deposits.

Company transparency regarding ownership, financial statements, and operational procedures is limited in available information. Professional forex brokerages typically provide detailed company information, regulatory filings, and transparency reports to build client confidence. These standards are not met in current Bainbridge Brokerage materials.

Industry reputation and recognition by professional organizations or rating agencies are not evident in available sources. The company's recent establishment in 2025 may contribute to limited industry recognition. However, the absence of any regulatory oversight or industry acknowledgment compounds trust concerns for potential forex trading clients.

User experience evaluation is constrained by limited available feedback specifically related to trading services. The company's focus on freight brokerage services means that existing user experiences may not be relevant to forex trading requirements. This limits the applicability of available feedback for potential trading clients.

Interface design and usability cannot be properly assessed for trading purposes as the company's applications appear designed for freight management rather than financial trading. User interface standards for forex trading, including chart functionality, order placement efficiency, and account management features, are not addressed in available materials. Registration and verification processes for trading accounts are not detailed in accessible sources.

This makes it impossible to assess the user experience for account opening procedures. Professional forex brokerages typically maintain streamlined KYC processes with clear documentation requirements and processing timelines. Fund operation experiences, including deposit and withdrawal procedures, processing times, and fee structures, are not specified in available company information.

These operational aspects significantly impact user satisfaction and are essential considerations for forex traders. However, they remain unaddressed in current materials available for this bainbridge review.

This comprehensive bainbridge review reveals that Bainbridge Brokerage operates primarily as a freight and logistics service provider rather than a traditional forex brokerage. The company's 2025 establishment and focus on cargo services, including TMS applications and freight optimization tools, positions it outside the conventional forex trading industry. The absence of regulatory information, trading platforms, and financial instrument offerings presents significant limitations for forex market participants.

The evaluation suggests that Bainbridge Brokerage may be suitable for freight operators and logistics professionals seeking cargo management solutions. However, it does not meet the requirements of forex traders seeking currency market access. The lack of trading platforms, regulatory oversight, and financial services transparency makes it unsuitable for serious forex trading activities.

Primary advantages include recent establishment with modern freight technology solutions. Significant disadvantages encompass the absence of forex trading capabilities, lack of regulatory transparency, and limited financial service offerings. Forex traders should exercise extreme caution and consider established, regulated alternatives for currency trading requirements.

FX Broker Capital Trading Markets Review