Is BX safe?

Pros

Cons

Is BX a Scam? A Comprehensive Analysis

Introduction

BX is a relatively new player in the forex trading market, operating as an online brokerage that offers trading services primarily in cryptocurrencies and binary options. Founded in 2019 and based in Saint Lucia, BX aims to attract both novice and experienced traders with its low minimum deposit requirements and a user-friendly trading platform. However, as with any financial service, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with scams and unregulated brokers, making it imperative for traders to assess the legitimacy and safety of their chosen brokerage. This article aims to provide an objective evaluation of BX by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and associated risks. The analysis is based on a review of available online resources, user feedback, and expert opinions.

Regulation and Legitimacy

Regulation is one of the most critical aspects of assessing a brokerage's legitimacy. Regulated brokers are required to adhere to strict guidelines that protect traders' interests and ensure fair trading practices. Unfortunately, BX operates without any valid regulatory oversight, which raises significant concerns about its reliability and the safety of client funds.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that traders have limited recourse in case of disputes or issues with fund withdrawals. This lack of oversight is particularly alarming given the historical issues associated with unregulated brokers, including fraudulent practices and the inability to guarantee the safety of client funds. While BX may present itself as a legitimate broker, the absence of a regulatory framework should serve as a significant red flag for potential clients.

Company Background Investigation

BX was established in 2019 and is registered in Saint Lucia. The company claims to provide a range of trading services; however, detailed information about its ownership structure and management team is scarce. This lack of transparency complicates the ability to assess the credibility of the individuals behind the brokerage.

The management team's background and expertise are crucial indicators of a brokerage's reliability. Unfortunately, BX has not provided sufficient information regarding its leadership, making it difficult for potential clients to evaluate their qualifications and experience in the financial sector. The firm's single-page website lacks comprehensive disclosures, further diminishing trust and transparency.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its competitiveness and overall value. BX markets itself as having low barriers to entry, with a minimum deposit requirement of just $1. However, the lack of detailed information on spreads, commissions, and other trading costs raises questions about the overall cost structure.

| Fee Type | BX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1-2 pips |

| Commission Model | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | 0.5%-2.5% |

The absence of clear fee structures can lead to unexpected costs for traders. Moreover, the lack of transparency regarding commissions and spreads is a common tactic employed by less reputable brokers to obscure their true costs. As a result, traders may find themselves facing higher expenses than anticipated, significantly impacting their profitability.

Customer Fund Safety

The safety of customer funds is paramount in any trading environment. BX has not provided adequate information regarding its fund safety measures. Typically, regulated brokers are required to keep client funds in segregated accounts, ensuring that they are not used for operational expenses. However, without regulatory oversight, it is unclear whether BX follows such practices.

The lack of investor protection measures, such as negative balance protection, raises further concerns. Traders should be aware that in the event of significant market fluctuations, they could potentially lose more than their initial investment. Historical issues with similar unregulated brokers demonstrate that clients may struggle to recover their funds in case of disputes or insolvency.

Customer Experience and Complaints

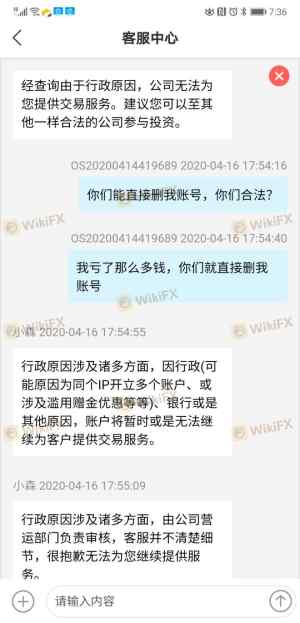

User feedback is a valuable resource for assessing the quality of service provided by a brokerage. Reviews of BX reveal a mix of experiences, with several users reporting difficulties in withdrawing funds and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Account Manipulation | High | Unresponsive |

Common complaints include forced liquidations, manipulated orders, and difficulties accessing accounts. These issues reflect a troubling pattern often associated with fraudulent brokers. For instance, one user reported losing significant funds due to alleged manipulation of their trades, highlighting the risks involved in trading with an unregulated entity.

Platform and Trade Execution

A reliable trading platform is essential for effective trading. BX offers an electronic trading platform, but user reviews indicate that it may suffer from performance issues, including slow execution times and high slippage.

Traders have reported instances of order rejections and delays in trade execution, which can significantly impact trading outcomes. The quality of order execution is a critical factor, as poor execution can lead to losses, especially in volatile markets. Additionally, any signs of platform manipulation should be scrutinized, as they can indicate deeper issues within the brokerage's operations.

Risk Assessment

Trading with BX presents several risks, primarily due to its unregulated status and the associated lack of transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Safety | High | No investor protection |

| Execution Risk | Medium | Poor order execution |

| Transparency Risk | High | Lack of information |

Traders should exercise extreme caution when considering BX as their trading platform. The absence of regulatory oversight, coupled with a lack of transparency regarding fees and fund safety, creates an environment ripe for potential fraud. To mitigate risks, traders are advised to seek well-regulated brokers that prioritize transparency and client protection.

Conclusion and Recommendations

In conclusion, BX raises significant concerns regarding its legitimacy and safety as a trading platform. The absence of regulation, coupled with numerous user complaints and a lack of transparency, suggests that potential traders should approach this broker with caution. While BX may offer enticing features, the risks associated with trading through an unregulated broker far outweigh the potential benefits.

For traders seeking a reliable and secure trading experience, it is advisable to consider alternative brokers that are regulated by reputable financial authorities. These brokers typically offer greater transparency, better customer support, and more robust fund safety measures. By prioritizing safety and due diligence, traders can better protect their investments and achieve their trading goals.

Is BX a scam, or is it legit?

The latest exposure and evaluation content of BX brokers.

BX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.