FXMarket 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive fxmarket review reveals significant concerns about the broker's reliability and trustworthiness in 2025. Our research comes from multiple sources including Scamadviser and WikiFX, showing that FXMarket presents substantial red flags that potential traders should carefully consider before investing their money. The platform shows poor trust scores. It also receives negative user feedback across various review platforms, which raises serious questions about its operations. While some trading services may be available, the overall assessment indicates serious credibility issues. These problems make this broker unsuitable for most retail traders who value safety and reliability. The limited positive feedback creates additional concerns. The concerning trust indicators suggest that FXMarket primarily attracts traders with extremely high risk tolerance who may not prioritize regulatory compliance and platform security as much as they should. Our analysis strongly recommends caution when considering this broker for forex trading activities.

Important Notice

This fxmarket review is based on publicly available information from various sources including user reviews, trust scoring platforms, and industry databases. The fragmented nature of available information about FXMarket means that some specific details regarding trading conditions, regulatory status, and operational procedures may not be fully documented in accessible sources that we could verify. Our evaluation methodology relies primarily on trust scores from Scamadviser, user feedback from WikiFX, and general industry standards for broker assessment. Traders should conduct additional due diligence and verify all information independently before making any trading decisions that could affect their financial well-being.

Rating Overview

Broker Overview

FXMarket operates in the competitive forex trading space. Specific information about its establishment date and company background remains unclear in available documentation, which immediately raises red flags for potential users. The broker appears to target retail forex traders through its online platform. The lack of transparent company information raises immediate concerns about its legitimacy and operational history that cannot be ignored by serious traders. Without clear founding details or comprehensive company background information, potential clients face significant uncertainty. They must question the broker's track record and business stability before investing any money.

The platform's business model appears to focus on forex trading services. Specific details about its trading infrastructure, technology partnerships, and operational framework are not well-documented in accessible sources, making it difficult to verify their claims. This fxmarket review must note that the absence of detailed company information is itself a significant red flag. The forex industry is heavily regulated, and transparency and disclosure are fundamental requirements for legitimate operations that protect traders from fraud. The limited available information suggests a broker that may not meet standard industry disclosure practices. This creates additional risks for anyone considering using their services.

Regulatory Status: Specific regulatory information for FXMarket is not clearly documented in available sources. This represents a major concern for potential traders seeking regulated trading environments that provide legal protections.

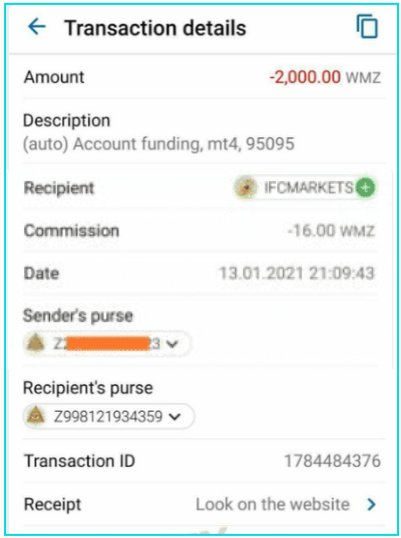

Deposit and Withdrawal Methods: Available sources do not provide detailed information about accepted payment methods, processing times, or associated fees for funding operations. This lack of transparency makes it difficult for traders to plan their financial transactions effectively.

Minimum Deposit Requirements: Specific minimum deposit amounts are not clearly stated in accessible documentation. This makes it difficult for traders to assess accessibility and plan their initial investments properly.

Promotional Offers: Current bonus structures and promotional campaigns are not detailed in available sources. Traders should exercise caution with any unregulated promotional offers that may seem too good to be true.

Available Trading Instruments: The range of tradeable assets and instruments offered by FXMarket is not comprehensively documented in accessible sources. This limits traders' ability to evaluate whether the platform meets their specific trading needs.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available in current documentation. This makes it impossible to calculate the true cost of trading with this broker.

Leverage Options: Specific leverage ratios and margin requirements are not clearly outlined in available sources. This information is crucial for risk management and trading strategy development.

Trading Platforms: Information about supported trading platforms and their features is not detailed in accessible documentation. Modern traders need reliable and feature-rich platforms to execute their strategies effectively.

Geographic Restrictions: Specific country restrictions and availability are not clearly documented in available sources. This creates uncertainty for international traders about whether they can legally use the platform.

Customer Support Languages: Available support languages and communication channels are not detailed in current documentation. This fxmarket review must emphasize that the lack of detailed information across these critical areas represents a significant concern for potential traders who need transparency to make informed decisions.

Account Conditions Analysis

The evaluation of FXMarket's account conditions proves challenging due to the limited information available in accessible sources. Standard industry practices would expect clear documentation of account types, minimum deposit requirements, account features, and opening procedures that help traders understand what they're signing up for. However, specific details about FXMarket's account structure are not comprehensively outlined in available documentation. This lack of transparency regarding fundamental account information raises serious questions about the broker's operational standards and commitment to client disclosure that legitimate brokers typically provide.

Without clear information about account types, traders cannot properly assess whether the broker offers suitable options for different trading styles and capital levels. The absence of documented minimum deposit requirements makes it impossible for potential clients to plan their initial investment appropriately and budget for their trading activities. Additionally, the lack of detailed account opening procedures suggests potential complications in the onboarding process. New traders may face unexpected hurdles or requirements that weren't disclosed upfront.

The limited available information does not indicate the presence of specialized account features such as Islamic accounts, professional trading accounts, or institutional services. This fxmarket review must note that reputable brokers typically provide comprehensive account information as part of their transparency obligations to clients and regulators. The significant information gaps in this area contribute to the overall poor rating for account conditions. These gaps suggest that traders should seek more transparent alternatives that clearly explain their account structures and requirements.

FXMarket's trading tools and educational resources cannot be properly evaluated due to insufficient information in available sources. Professional forex brokers typically provide comprehensive suites of trading tools including technical analysis software, economic calendars, market research, and educational materials that help traders make informed decisions. However, specific details about FXMarket's tool offerings are not documented in accessible sources. This makes it impossible to assess the quality and comprehensiveness of their trading resources.

The absence of information about analytical tools, research capabilities, and educational content represents a significant gap in the broker's transparency. Modern forex trading requires access to sophisticated analytical tools, real-time market data, and ongoing educational support to succeed in competitive markets. Without documented evidence of these resources, traders cannot determine whether FXMarket provides the necessary infrastructure for informed trading decisions. This creates uncertainty about whether the platform can support serious trading activities.

Additionally, information about automated trading support, API access, and third-party tool integration is not available in current documentation. The lack of detailed tool and resource information contributes to the poor rating in this category and suggests that FXMarket may not meet the technological standards expected by serious forex traders who rely on advanced tools. This fxmarket review recommends that traders prioritize brokers with clearly documented and comprehensive tool offerings. Such transparency helps traders understand exactly what resources they'll have access to before committing their money.

Customer Service and Support Analysis

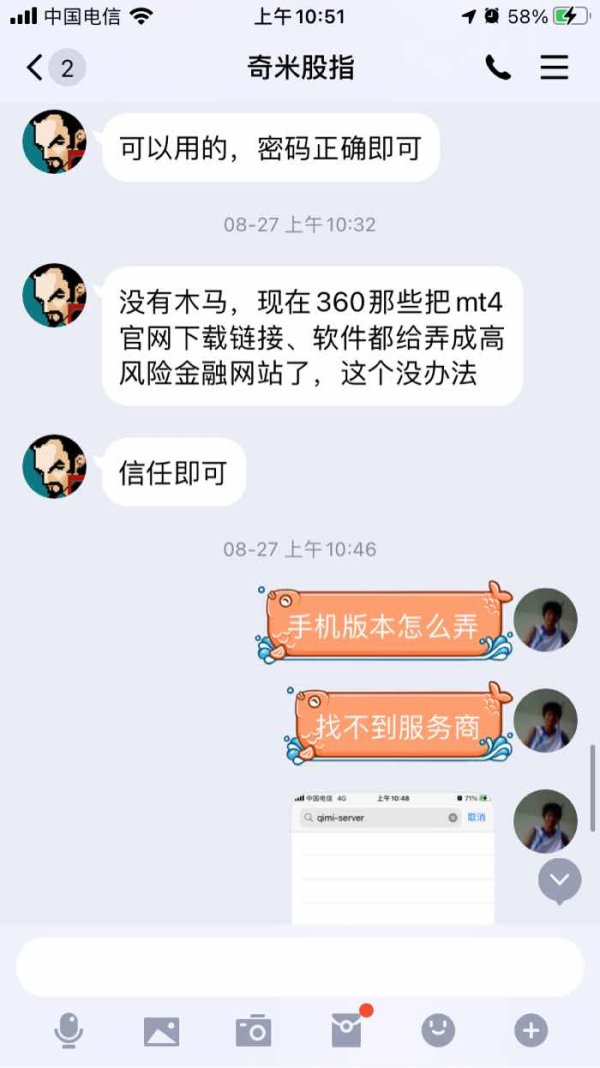

The evaluation of FXMarket's customer service capabilities is severely limited by the lack of detailed information in available sources. Industry-standard customer support typically includes multiple communication channels, extended service hours, multilingual support, and rapid response times that help traders resolve issues quickly. However, specific details about FXMarket's customer service infrastructure are not comprehensively documented. This makes it difficult to assess their support quality and availability when traders need help.

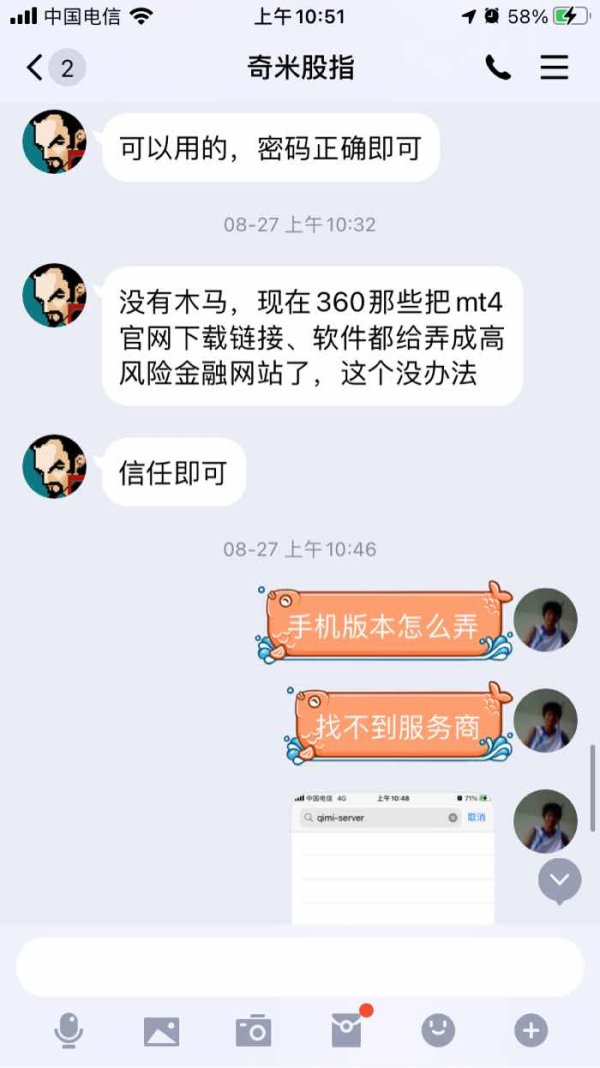

Available user feedback suggests poor customer service experiences. Specific details about response times, service quality, and problem resolution are not well-documented, which prevents potential users from understanding what to expect. The absence of clear information about support channels, operating hours, and available languages raises concerns about the broker's commitment to client service. Professional forex brokers typically provide 24/5 support during market hours with multiple communication options including live chat, phone, and email support that traders can rely on.

The limited documentation of customer service capabilities, combined with negative user feedback indicators, contributes to the poor rating in this category. Without adequate customer support, traders may face significant challenges in resolving account issues, technical problems, or trading disputes that could cost them money. This fxmarket review strongly emphasizes the importance of robust customer support in forex trading. FXMarket's apparent deficiencies in this area represent a major concern for potential clients who need reliable support when problems arise.

Trading Experience Analysis

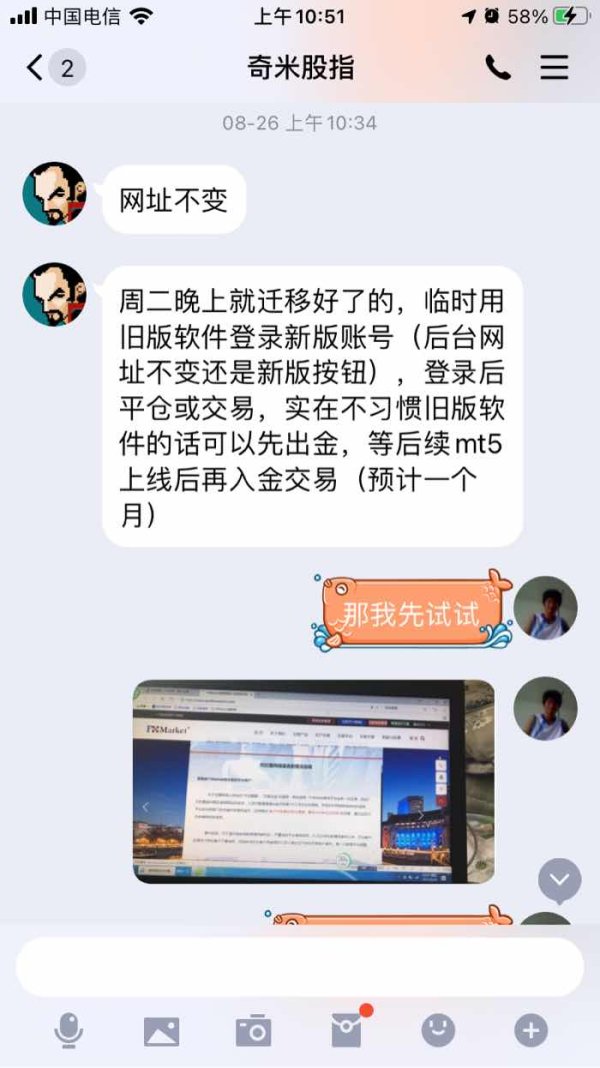

Assessing FXMarket's trading experience proves challenging due to limited technical information in available sources. Critical factors such as platform stability, execution speed, order processing quality, and overall trading environment are not well-documented, making it impossible to verify their trading capabilities. Professional forex trading requires reliable platform performance, fast order execution, and stable trading conditions. Specific data about FXMarket's technical capabilities is not readily available to confirm these essential requirements.

User feedback suggests potential issues with trading experience. Detailed accounts of platform performance, execution quality, and technical reliability are not comprehensively documented, which prevents traders from understanding what they might encounter. The absence of specific information about trading platform features, mobile accessibility, and system uptime raises concerns about the broker's technical infrastructure. It also questions their commitment to providing professional trading conditions that serious traders require.

Without documented evidence of platform testing results, execution statistics, or technical performance metrics, traders cannot properly evaluate whether FXMarket provides suitable trading conditions for their needs. The limited available information and negative user feedback indicators contribute to the poor rating in this category and suggest significant problems with the trading experience. This fxmarket review emphasizes that reliable trading experience is fundamental to forex success. FXMarket's apparent deficiencies represent a significant concern for serious traders who need dependable platform performance.

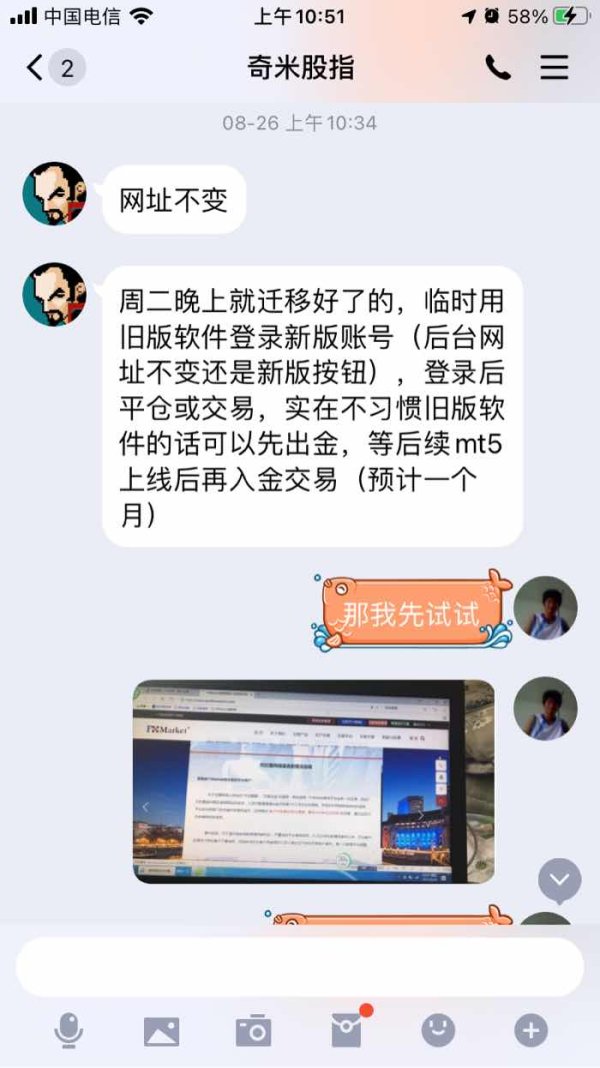

Trust and Security Analysis

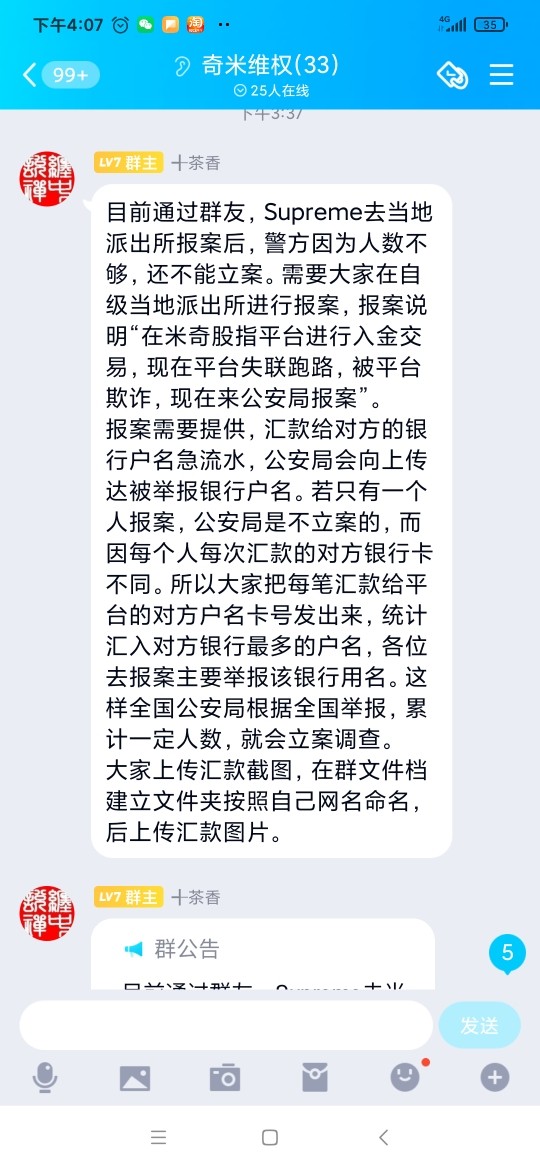

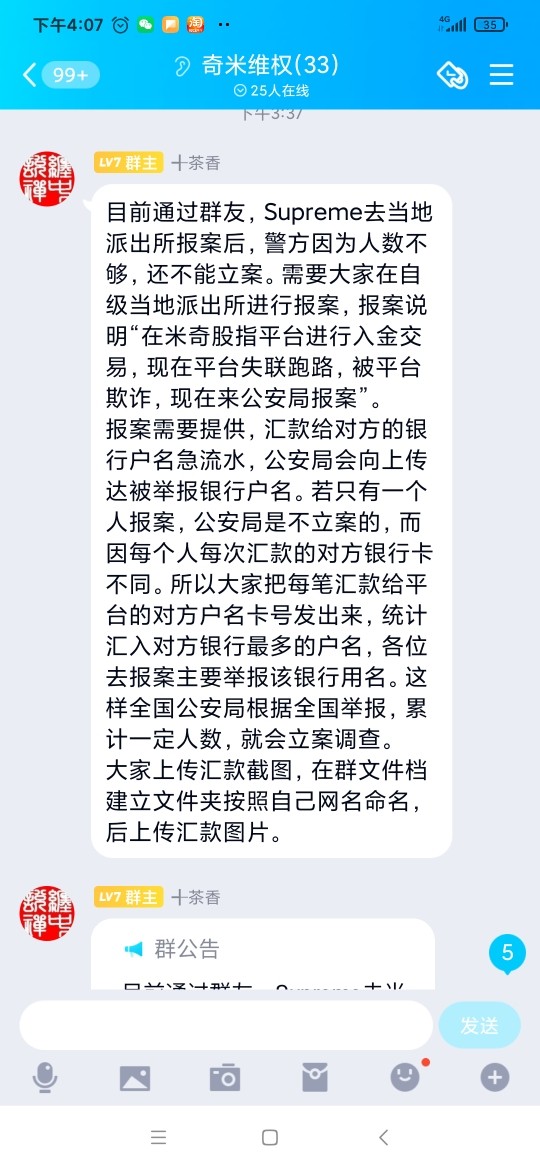

The trust and security assessment of FXMarket reveals the most significant concerns in this comprehensive review. According to Scamadviser, fxmarket-trading.com receives low trust scores and has been flagged as a potentially suspicious website with possible fraud risks that should immediately alarm any potential trader. This represents a critical red flag that should immediately concern any potential trader considering this platform. Such warnings from independent security assessment platforms cannot be ignored when choosing a forex broker.

The absence of clear regulatory information compounds these trust concerns significantly. Legitimate forex brokers typically operate under strict regulatory oversight from recognized financial authorities, providing client fund protection, operational transparency, and regulatory compliance that protects traders from fraud and abuse. However, FXMarket's regulatory status is not clearly documented in available sources. This suggests potential operation outside established regulatory frameworks that normally protect traders.

The combination of low trust scores and unclear regulatory status creates a high-risk environment for traders. Without proper regulatory oversight, client funds may lack adequate protection, and dispute resolution mechanisms may be limited or non-existent when problems arise. The negative trust indicators from independent assessment platforms provide strong evidence that FXMarket may not meet basic security and reliability standards. These standards are expected in the forex industry to protect traders from fraud and ensure fair trading conditions. This fxmarket review strongly advises extreme caution regarding trust and security concerns. The evidence suggests significant risks that most traders should avoid.

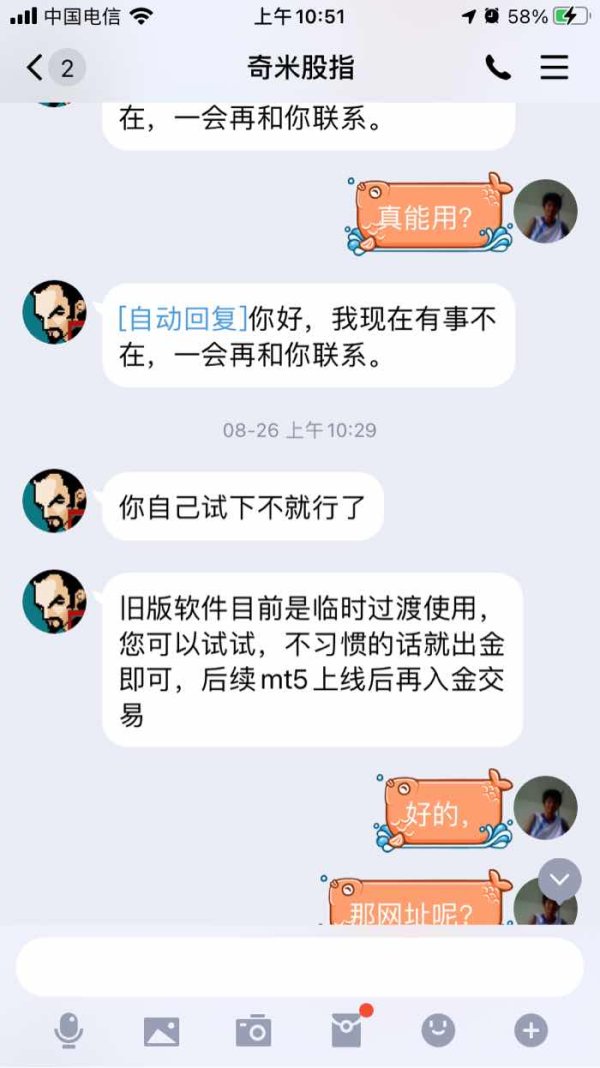

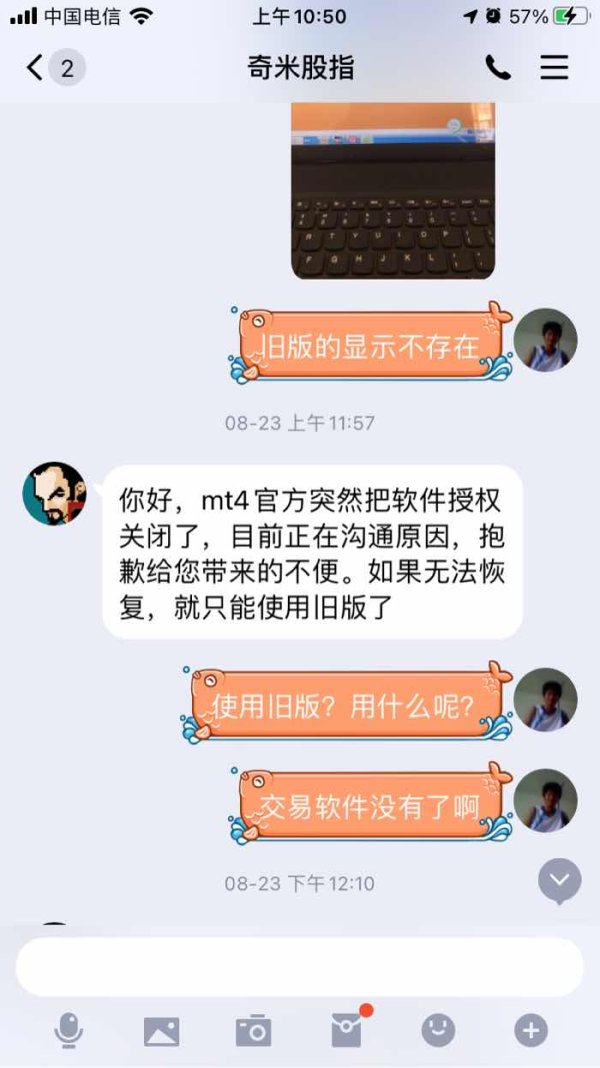

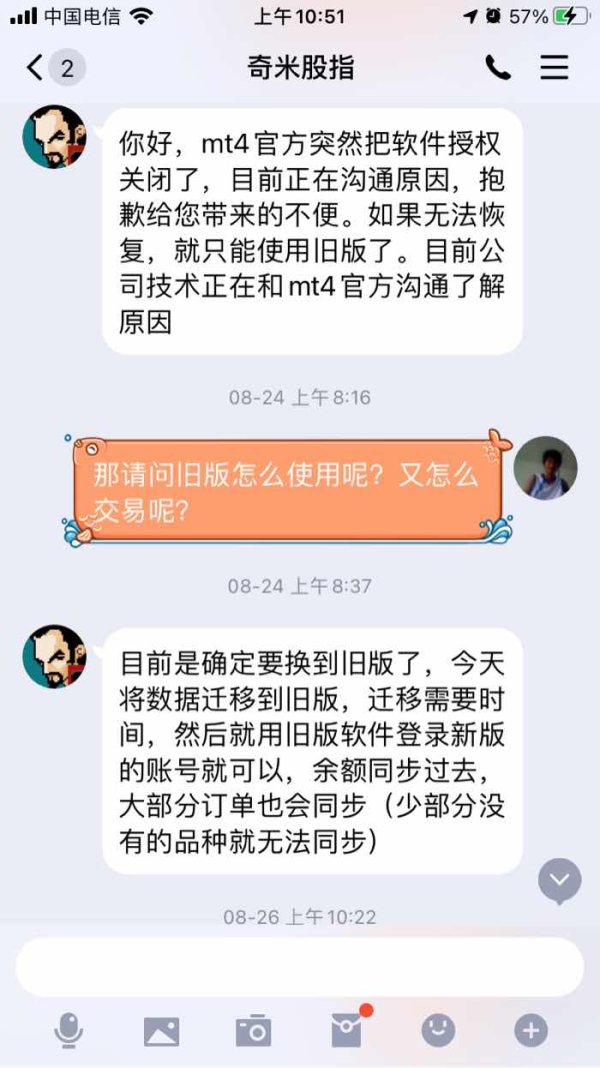

User Experience Analysis

User experience evaluation for FXMarket is significantly hampered by poor user feedback and limited detailed information about platform usability. Available sources indicate that user reviews are predominantly negative, suggesting widespread dissatisfaction with the broker's services across multiple areas of operation. However, specific details about interface design, registration processes, and overall platform usability are not comprehensively documented. This makes it difficult to identify exactly what problems users encounter.

The negative user feedback patterns suggest potential issues with platform functionality, account management processes, and overall service delivery. Without positive user testimonials or detailed experience reports, it appears that FXMarket struggles to meet basic user expectations for forex trading platforms that should be intuitive and reliable. The lack of documented user satisfaction metrics or positive feedback creates concerns about the broker's ability to provide satisfactory trading experiences. Most successful brokers have at least some positive reviews from satisfied customers.

Common user complaints appear to center around reliability and service quality issues. Specific details are not well-documented in available sources, but the pattern of negative feedback is concerning for potential new users. The predominance of negative feedback, combined with limited positive reviews, suggests that FXMarket may not be suitable for traders seeking reliable and user-friendly trading platforms. This fxmarket review notes that poor user experience significantly impacts trading success and can lead to financial losses. We recommend considering brokers with documented positive user feedback and comprehensive platform features that support successful trading.

Conclusion

This comprehensive fxmarket review reveals significant concerns that make FXMarket unsuitable for most forex traders in 2025. The combination of low trust scores, poor user feedback, limited transparency, and unclear regulatory status creates a high-risk environment that contradicts fundamental requirements for safe forex trading and puts trader funds at unnecessary risk. The broker's apparent deficiencies across multiple evaluation categories suggest systemic issues. These problems extend beyond minor operational concerns and indicate fundamental problems with the broker's business model.

FXMarket may only be suitable for traders with extremely high risk tolerance who understand and accept the potential for significant losses beyond normal trading risks. However, even risk-seeking traders should carefully consider whether the apparent lack of regulatory protection and transparency issues align with their risk management strategies and financial goals. The overwhelming evidence suggests that most traders would benefit from choosing more established and transparent brokers. Such brokers typically offer clear regulatory oversight and positive user feedback that indicates reliable service and fair trading conditions.