Regarding the legitimacy of FTMarkets forex brokers, it provides FSA and WikiBit, (also has a graphic survey regarding security).

Is FTMarkets safe?

Business

License

Is FTMarkets markets regulated?

The regulatory license is the strongest proof.

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

FT Worldwide Holdings Ltd

Effective Date:

--Email Address of Licensed Institution:

cs@ftmarkets.comSharing Status:

No SharingWebsite of Licensed Institution:

www.ftmarkets.comExpiration Time:

--Address of Licensed Institution:

Office 4, Unit 2, 2nd Floor, Dekk Complex, Plaisance, Mahe, SeychellesPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is FTMarkets A Scam?

Introduction

FTMarkets is a forex brokerage that claims to provide a range of trading services to both novice and experienced traders. Operating under the name FT Worldwide Holdings Limited, it positions itself as a global trading platform offering access to various financial instruments. However, in the fast-paced world of forex trading, it is crucial for traders to conduct thorough due diligence before entrusting their money to any broker. The potential risks associated with unregulated or poorly regulated brokers can lead to significant financial losses. In this article, we will investigate whether FTMarkets is safe or a scam, using a comprehensive evaluation framework that includes regulatory status, company background, trading conditions, client safety measures, and customer feedback.

Regulatory and Legality

The regulatory status of any forex broker is a critical factor in determining its legitimacy. A well-regulated broker is typically required to adhere to strict guidelines that protect clients' funds and ensure transparent operations. FTMarkets has been flagged as an unregulated entity, which raises significant concerns about its reliability and safety for traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

FTMarkets claims to be registered in the British Virgin Islands but lacks any verifiable regulatory license. The absence of regulation means that there are no safeguards for client funds, and traders have no recourse in case of disputes or malpractices. Furthermore, FTMarkets has been reported to have previously claimed regulation from the Seychelles Financial Services Authority, but this license has since been revoked. This unregulated status is a significant red flag, indicating that FTMarkets operates outside the bounds of established financial oversight.

Company Background Investigation

FTMarkets was established in 2005, but its claims of a long-standing operational history are questionable. The company's ownership structure is unclear, with little information available about its management team or their qualifications. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their leadership and operational history.

Additionally, there are no clear indicators of FTMarkets' physical presence, as it does not disclose a legitimate business address. This anonymity is a common characteristic of fraudulent brokers, who often aim to evade scrutiny. The lack of transparency and information disclosure raises significant doubts about the integrity and reliability of FTMarkets, leading many to question: Is FTMarkets safe?

Trading Conditions Analysis

Understanding a broker's trading conditions is essential for evaluating its overall value proposition. FTMarkets claims to offer competitive trading fees and various account types; however, there is a lack of clarity regarding its fee structure.

| Fee Type | FTMarkets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unclear | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Unclear | 1.0 - 3.0% |

The absence of clearly defined costs and the presence of potentially hidden fees can be indicative of a scam. Moreover, FTMarkets promotes a 200% deposit bonus, which is often a tactic used by unscrupulous brokers to entice clients while imposing stringent withdrawal conditions. Traders may find themselves unable to access their funds due to excessive trading volume requirements tied to these bonuses, further raising the question: Is FTMarkets safe?

Client Fund Safety

The safety of client funds is paramount when choosing a forex broker. FTMarkets does not appear to have any clear safety measures in place to protect client deposits. There is no mention of segregated accounts, which are crucial for ensuring that client funds are kept separate from the broker's operational funds. Additionally, the absence of investor protection schemes means that traders have no safety net in case of broker insolvency.

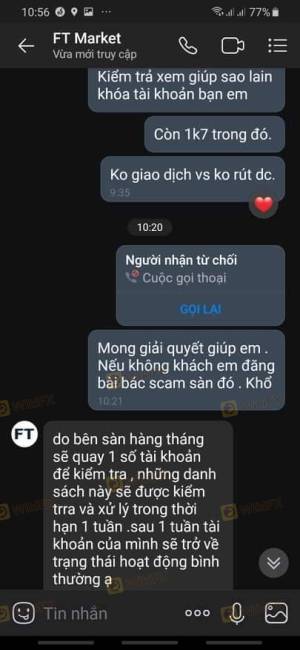

Furthermore, historical complaints and reports indicate that FTMarkets has faced issues related to fund withdrawals, with clients often citing difficulties in accessing their money. This lack of transparency and security raises significant concerns about the safety of funds held with FTMarkets. Thus, the question remains: Is FTMarkets safe?

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. A review of various user experiences with FTMarkets reveals a pattern of negative feedback, with many clients reporting issues related to fund withdrawals and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Poor |

| Misleading Promotions | High | Inadequate |

Common complaints include delays in processing withdrawal requests, unresponsive customer support, and misleading promotional offers. Clients have reported that once they deposit funds, communication with the broker becomes increasingly difficult, leading to feelings of frustration and distrust. These patterns of behavior are often indicative of a scam, prompting many to question: Is FTMarkets safe?

Platform and Trade Execution

The performance and reliability of a trading platform are vital for a successful trading experience. FTMarkets claims to offer a proprietary trading platform; however, users have reported difficulties in accessing it and have raised concerns about its functionality.

Issues such as slippage, order rejections, and the absence of a demo account further complicate the trading experience. Traders have expressed concerns about the possibility of platform manipulation, which is a significant risk factor associated with unregulated brokers. Given these factors, the integrity of FTMarkets' trading platform is questionable, leading to further doubts about its safety.

Risk Assessment

When evaluating the risks associated with FTMarkets, it is essential to consider various factors that could impact a trader's experience.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Fund Safety Risk | High | Lack of segregation and investor protection. |

| Trading Conditions Risk | Medium | Unclear fee structure and withdrawal issues. |

| Customer Service Risk | High | Poor response to client complaints. |

Given these risks, it is advisable for traders to exercise caution when considering FTMarkets as their broker. Potential clients should be aware of the high stakes involved and take proactive steps to mitigate these risks.

Conclusion and Recommendations

In conclusion, the evidence suggests that FTMarkets exhibits several characteristics commonly associated with scam brokers. Its lack of regulation, unclear trading conditions, and poor customer feedback raise serious concerns about its legitimacy. Therefore, traders should be extremely cautious and consider alternative options.

For those seeking reliable trading platforms, it is advisable to explore brokers with strong regulatory oversight, transparent fee structures, and positive customer reviews. Some reputable alternatives include brokers regulated by the FCA, ASIC, or CySEC, which provide a safer trading environment. Ultimately, the question remains: Is FTMarkets safe? Based on the available evidence, it is prudent to approach this broker with skepticism and consider safer alternatives for your trading activities.

Is FTMarkets a scam, or is it legit?

The latest exposure and evaluation content of FTMarkets brokers.

FTMarkets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FTMarkets latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.