Am Broker 2025 Review: Everything You Need to Know

Summary: Am Broker has garnered mixed reviews from users and industry experts alike, with notable strengths in trading conditions and a diverse range of tradable assets. However, concerns regarding its regulatory status and high minimum deposit requirements have raised red flags for potential traders.

Note: Its important to recognize that Am Broker operates under different entities across regions, which may affect its regulatory compliance and user experience. This review aims to provide a fair and accurate assessment based on available information.

Rating Overview

How We Rate Brokers: Our ratings are based on a comprehensive analysis of user reviews, expert opinions, and factual data regarding the brokers offerings.

Broker Overview

Founded in 2018, Am Broker is operated by AM Globe Services Ltd and is based in Kingstown, Saint Vincent and the Grenadines. The broker primarily offers trading on the MetaTrader 5 platform, a popular choice among forex traders due to its advanced features and user-friendly interface. Traders can access a wide range of assets, including forex pairs, CFDs on stocks, indices, commodities, and cryptocurrencies. However, Am Broker's regulatory oversight is limited to the Financial Services Authority of Saint Vincent and the Grenadines, which has raised concerns about its credibility in the market.

Detailed Breakdown

Regulated Geographical Areas:

Am Broker is registered in Saint Vincent and the Grenadines, which is known for its lenient regulatory environment. The broker does not provide services to clients in the United States, Canada, Japan, the EU, and New Zealand, which limits its reach to less regulated markets.

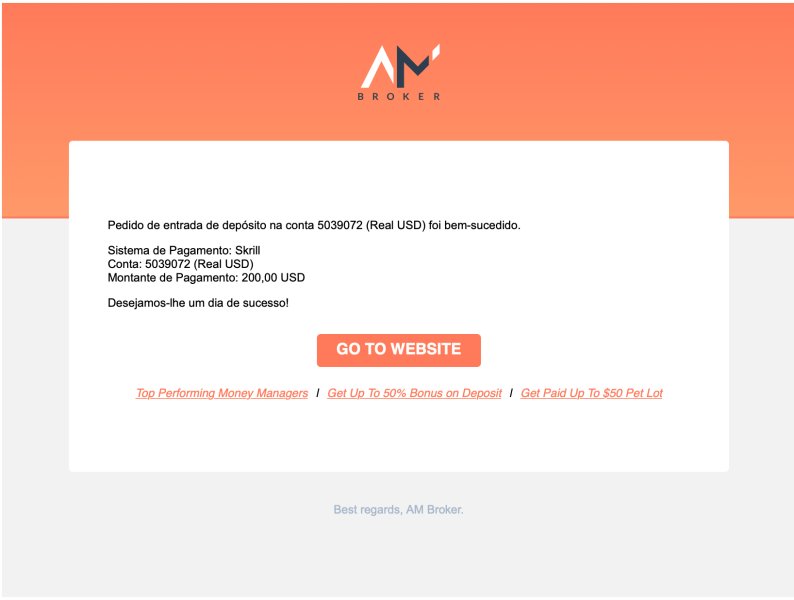

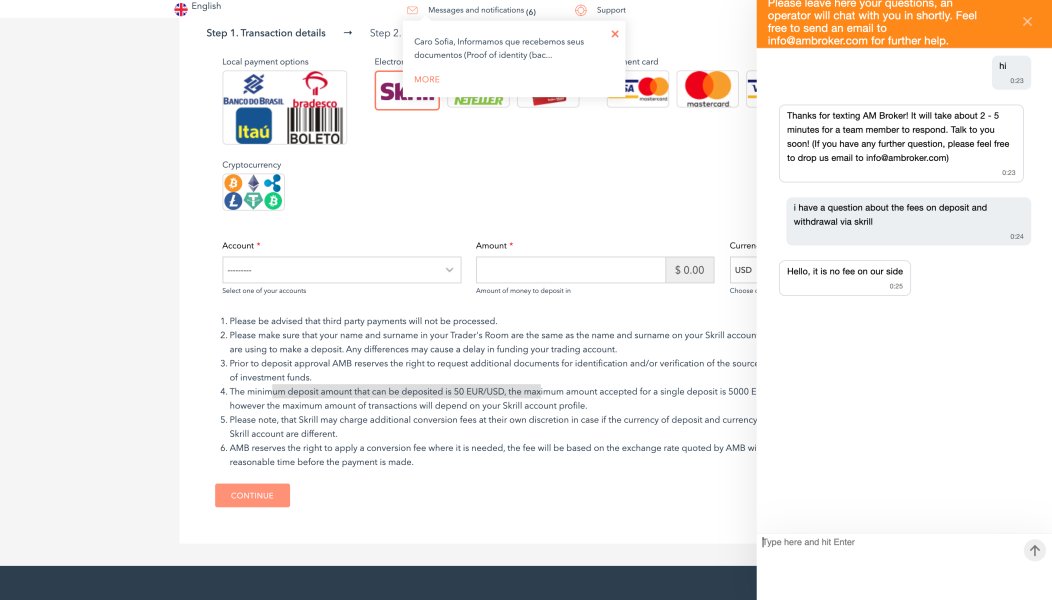

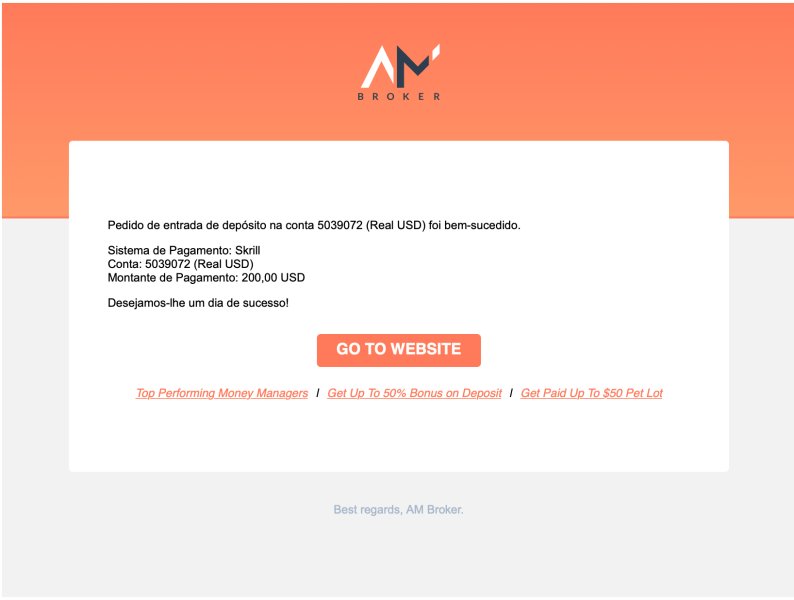

Deposit/Withdrawal Currency/Cryptocurrency:

Traders can deposit funds using credit/debit cards (Visa and MasterCard) and electronic payment methods like Neteller, FastPay, and Skrill. However, withdrawals are restricted to Visa and MasterCard, potentially causing delays of up to a week.

Minimum Deposit:

The minimum deposit requirement for opening a retail account with Am Broker is $1,000, which is significantly higher than the industry average of around $200. This high barrier to entry may deter beginner traders.

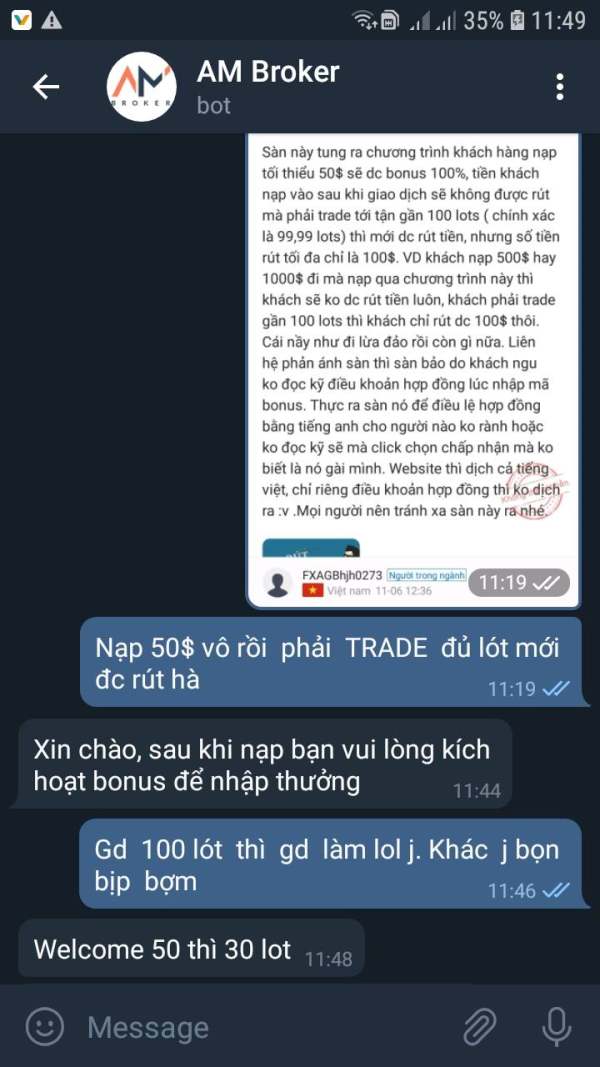

Bonuses/Promotions:

Am Broker offers a 25% bonus on initial deposits, which can be appealing to new traders. However, the terms for withdrawing bonus funds can be complex and may require trading a certain volume before withdrawal.

Tradable Asset Classes:

Am Broker allows trading in over 100 currency pairs, 3,000 CFDs on stocks, 20 indices, and a selection of commodities and cryptocurrencies. This diverse offering can help traders build a varied portfolio.

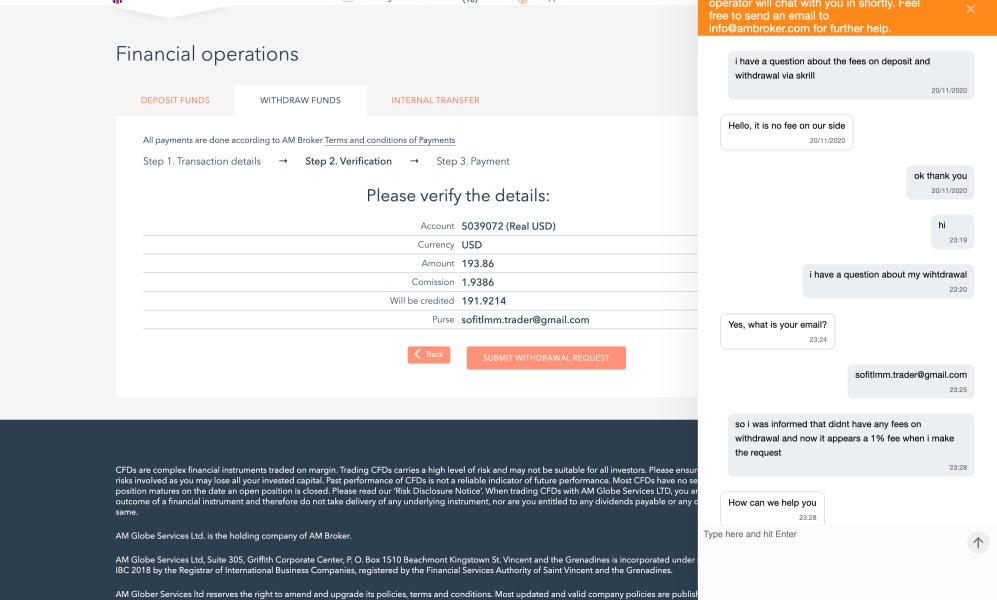

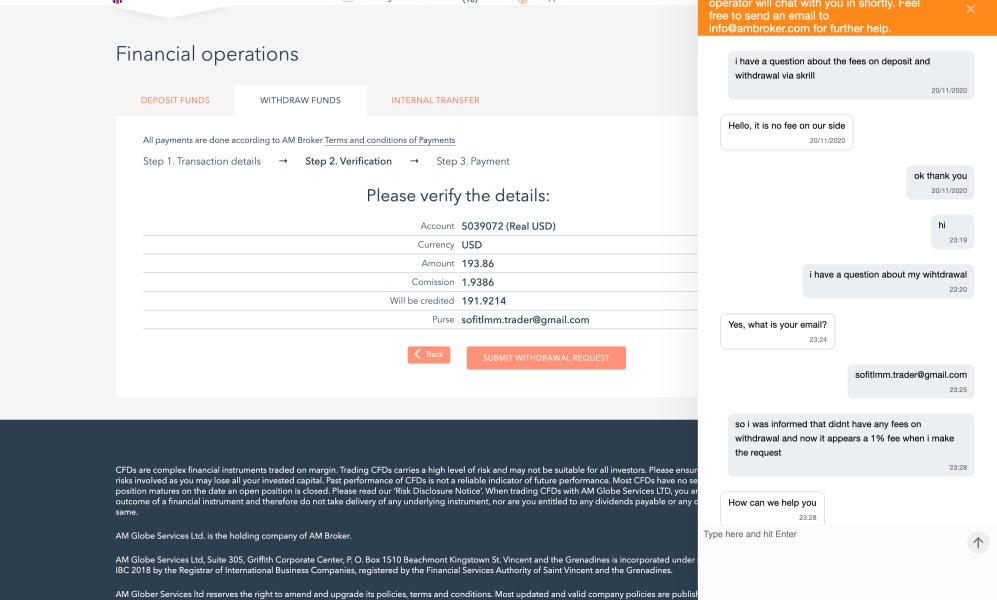

Costs (Spreads, Fees, Commissions):

Spreads for the retail account start from 0.6 pips, with no commissions on forex trades. Professional accounts may feature spreads from 0.0 pips but incur commissions on certain trades. While these costs are competitive, the overall lack of transparency regarding fees has raised concerns.

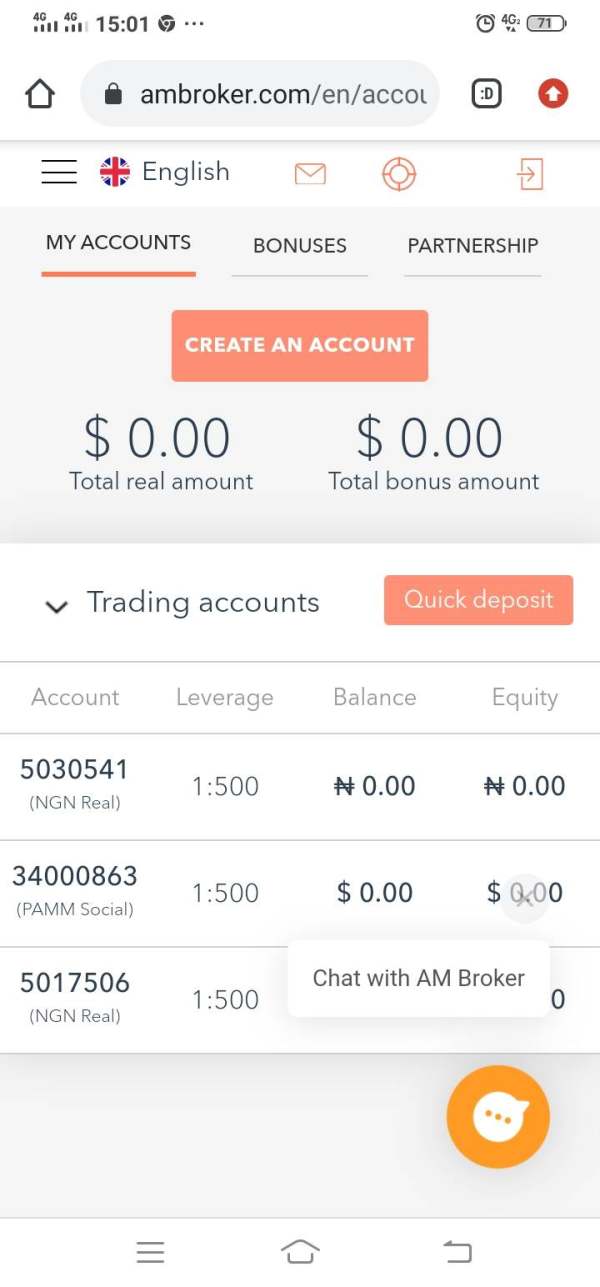

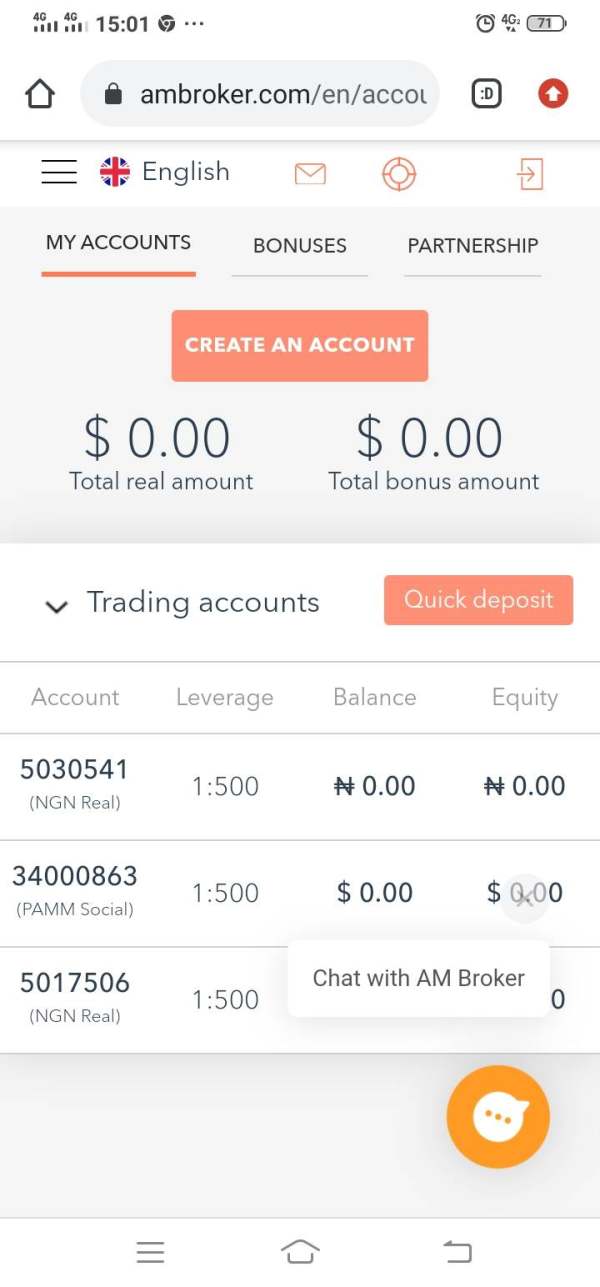

Leverage:

Am Broker offers a maximum leverage of up to 1:500, which can be attractive for experienced traders looking to maximize their potential returns. However, high leverage also increases the risk of significant losses, particularly for inexperienced traders.

Allowed Trading Platforms:

Traders can utilize the MetaTrader 5 platform, which is available on desktop, web, and mobile devices. This flexibility allows traders to manage their accounts from anywhere, enhancing the overall trading experience.

Restricted Regions:

As mentioned, Am Broker does not accept clients from several major markets, including the U.S., Canada, EU, and Japan. This restriction is primarily due to regulatory issues and the broker's offshore status.

Available Customer Service Languages:

Customer support is available in English, with contact options including email and phone support. However, user reviews indicate that customer service may be slow to respond and not always helpful, leading to dissatisfaction among clients.

Revised Rating Overview

Detailed Analysis

Account Conditions:

The account conditions at Am Broker are somewhat favorable, with a variety of account types available. However, the high minimum deposit requirement and limited withdrawal methods diminish the overall appeal. User reviews indicate that the account opening process is straightforward, but the high initial investment is a deterrent for many.

Tools and Resources:

While Am Broker provides access to the MetaTrader 5 platform, the educational resources available to traders are limited. Users have expressed a desire for more comprehensive training materials and market analysis tools. The broker does offer some technical analysis signals and an economic calendar, but these resources could be enhanced.

Customer Service & Support:

Customer support has received mixed feedback, with users reporting delays in response times and unhelpful interactions. The lack of a dedicated support channel for non-English speakers has also been noted as a drawback.

Trading Setup (Experience):

The trading experience on the MetaTrader 5 platform is generally well-received, with users appreciating its functionality and ease of use. However, the trading conditions are affected by the broker's offshore status, which raises concerns about the safety of funds and the reliability of execution.

Trustworthiness:

Am Broker's lack of robust regulatory oversight is a significant concern. The Financial Services Authority of Saint Vincent and the Grenadines does not provide the same level of protection as more established regulators. This absence of regulation, combined with high minimum deposits and limited withdrawal options, has led to skepticism about the broker's trustworthiness.

User Experience:

Overall, the user experience with Am Broker is mixed. While some traders appreciate the range of assets and competitive spreads, others have expressed frustrations with customer service and the broker's regulatory status. The high minimum deposit requirement is a common point of contention among potential clients.

In conclusion, while Am Broker offers a variety of trading options and competitive conditions, potential traders should weigh the risks associated with its unregulated status and high entry requirements. As always, thorough research and consideration of individual trading needs are essential before engaging with any broker.