Is FXMarket safe?

Pros

Cons

Is FXMarket Safe or a Scam?

Introduction

FXMarket is a foreign exchange broker that has emerged in the trading landscape since its establishment in 2019. This broker operates primarily in the United Kingdom and offers a variety of trading services, including Forex, commodities, and indices. However, the rapid growth of online trading platforms has also led to an increase in scams, making it crucial for traders to carefully assess the legitimacy and safety of brokers before investing their funds. This article aims to evaluate whether FXMarket is a trustworthy trading platform or a potential scam.

To conduct this investigation, we utilized various online resources, including user reviews, regulatory information, and expert analyses. Our evaluation framework focuses on critical aspects such as regulatory compliance, company background, trading conditions, customer experiences, and the overall safety of client funds. By systematically analyzing these areas, we aim to provide a comprehensive overview of FXMarket's safety profile.

Regulation and Legitimacy

Regulatory oversight is a fundamental aspect of a broker's credibility. A regulated broker is generally considered safer as they must adhere to strict guidelines set by financial authorities. In the case of FXMarket, it claims to be regulated by the Australian Securities and Investments Commission (ASIC). However, it is essential to verify the legitimacy of this claim.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001282243 | Australia | Unsubscribed |

The information indicates that FXMarket is not currently subscribed to ASIC, which raises concerns about its regulatory status. The absence of a robust regulatory framework can expose traders to significant risks, including potential fraud and mismanagement of funds. Moreover, the lack of a credible regulatory body overseeing FXMarket could make it challenging for clients to seek recourse in case of disputes.

In summary, the regulatory quality of FXMarket is questionable, and traders should exercise caution. The lack of proper oversight from a reputable authority like ASIC is a red flag that warrants further investigation into whether FXMarket is safe or a potential scam.

Company Background Investigation

Understanding the company behind a trading platform is crucial for assessing its reliability. FXMarket, officially known as Qimi FX Market Ltd., was founded in 2019. The company claims to have a presence in various regions, including the UK, Canada, and Hong Kong. However, the transparency of its ownership structure and management team is limited.

The management team of FXMarket has not been extensively documented, making it difficult to ascertain their professional backgrounds and expertise in the financial sector. A lack of transparency in ownership and management can lead to concerns about the company's accountability and operational practices. Furthermore, the absence of clear information regarding the company's history may deter potential investors who prioritize trustworthiness.

In conclusion, while FXMarket presents itself as a legitimate broker, the limited information available regarding its background and management raises questions about its credibility. This lack of transparency could be a potential indicator that FXMarket is not as safe as it claims to be.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, play a significant role in determining its overall attractiveness to traders. FXMarket offers various account types, including standard, VIP, and ECN accounts, each with different minimum deposit requirements and leverage options. However, a closer examination of its fee structure reveals some concerning aspects.

| Fee Type | FXMarket | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 0.5 - 1 pip |

| Commission Model | Unclear | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The spread on major currency pairs at FXMarket is reportedly around 1 pip, which is on par with industry standards. However, the lack of clarity regarding commissions and overnight interest raises concerns about hidden fees that could affect traders' profitability. Furthermore, the absence of detailed information regarding these costs may suggest a lack of transparency in FXMarket's pricing model.

Overall, while FXMarket may offer competitive spreads, the uncertainty surrounding its commission structure and potential hidden fees warrants caution. Traders should be aware of these factors when considering whether FXMarket is safe for trading.

Client Fund Safety

The safety of client funds is paramount when evaluating a broker's reliability. FXMarket claims to implement several measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures needs to be scrutinized.

Segregated accounts are essential for ensuring that client funds are kept separate from the broker's operational funds. This practice helps protect traders in the event of the broker's insolvency. Additionally, investor protection schemes can provide further assurance to clients. However, the specifics of FXMarket's fund safety measures remain unclear, and there have been no documented cases of significant fund safety issues.

Given the importance of fund security, potential investors should be cautious. The lack of detailed information regarding FXMarket's fund protection measures raises concerns about whether it is indeed safe for trading. Traders must consider these factors before deciding to invest their hard-earned money with FXMarket.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Reviews and testimonials from existing clients can provide valuable insights into the overall trading experience. Unfortunately, FXMarket has received a considerable number of complaints from users, raising red flags regarding its service quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

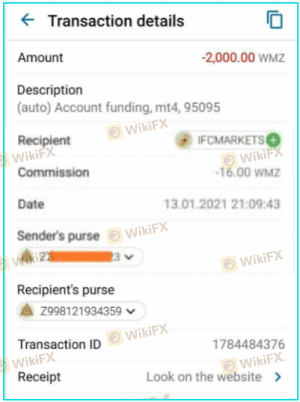

| Withdrawal Issues | High | Poor |

| Account Blocking | Medium | Slow |

| Hidden Fees | High | Unresponsive |

Common complaints include difficulties in withdrawing funds, account blocking without prior notice, and allegations of hidden fees. Many users have reported feeling frustrated and dissatisfied with the company's response to their concerns. In some cases, traders have faced challenges in accessing their funds, leading to suspicions about the broker's legitimacy.

One notable case involved a trader who reported being unable to withdraw their profits despite fulfilling all necessary requirements. This pattern of complaints suggests a troubling trend that potential investors should consider when evaluating whether FXMarket is safe or a scam.

Platform and Execution

The trading platform and execution quality are crucial factors influencing a trader's experience. FXMarket claims to offer a user-friendly trading platform with various features. However, the performance and reliability of this platform require careful assessment.

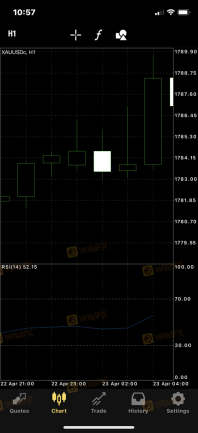

Users have reported mixed experiences regarding the platform's stability and execution speed. Some traders have experienced slippage during high volatility, while others have faced issues with order rejections. These performance inconsistencies can significantly impact trading outcomes and raise concerns about whether FXMarket is operating with integrity.

In summary, while FXMarket may present itself as a reliable broker, the mixed reviews regarding its platform performance and execution quality suggest that traders should approach with caution. The potential for execution issues could pose significant risks for traders, making it essential to consider whether FXMarket is truly safe for trading.

Risk Assessment

Evaluating the overall risk associated with a broker is vital for informed trading decisions. FXMarket presents several risk factors that potential investors should consider before engaging with the platform.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unsubscribed from ASIC |

| Fund Safety | Medium | Lack of transparency in fund protection |

| Customer Service | High | Numerous complaints and poor response |

| Platform Reliability | Medium | Mixed reviews on execution quality |

The high-risk level associated with FXMarket's regulatory compliance is particularly concerning. The lack of proper oversight can expose traders to potential fraud and mismanagement of funds. Additionally, the mixed reviews regarding customer service and platform reliability further contribute to the overall risk profile.

To mitigate these risks, traders should conduct thorough research before investing and consider using alternative, well-regulated brokers. Seeking guidance from experienced traders and financial advisors can also help navigate the complexities of the forex market.

Conclusion and Recommendations

In conclusion, FXMarket presents several warning signs that suggest it may not be a safe trading option. The lack of robust regulatory oversight, coupled with numerous customer complaints and concerns about fund safety, raises significant doubts about the broker's legitimacy. While some aspects of its trading conditions may appear competitive, the overall risk profile indicates that potential investors should exercise caution.

For traders seeking a reliable and trustworthy forex broker, it is advisable to consider alternatives that are well-regulated and have a proven track record of customer satisfaction. Brokers regulated by reputable authorities such as the FCA or ASIC may offer a safer trading environment. Ultimately, the decision to trade with FXMarket should be approached with careful consideration of the associated risks and potential red flags.

Is FXMarket a scam, or is it legit?

The latest exposure and evaluation content of FXMarket brokers.

FXMarket Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXMarket latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.