Is Aibascny safe?

Business

License

Is Aibascny Safe or Scam?

Introduction

Aibascny is a forex broker that positions itself within the competitive landscape of online trading platforms. As the forex market continues to expand, traders are increasingly presented with a myriad of options, making it crucial for them to evaluate brokers carefully. The importance of thorough assessments cannot be overstated, as the forex industry is fraught with both reputable and potentially fraudulent entities. This article aims to provide an objective analysis of Aibascny, investigating its credibility, regulatory status, trading conditions, and overall safety for traders. Our investigation is based on a comprehensive review of online sources, user testimonials, and regulatory information, structured to offer a clear picture of whether Aibascny is safe or a scam.

Regulation and Legitimacy

The regulatory status of a broker is a fundamental aspect that determines its legitimacy and reliability. Aibascny has raised significant concerns regarding its regulatory compliance, as it currently operates without any valid licenses. The absence of regulation is a major red flag, as it implies that the broker is not subject to oversight by any recognized financial authority. This lack of regulation can expose traders to various risks, including the potential for fraud and the absence of investor protection mechanisms.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The lack of a license means that Aibascny does not adhere to the stringent guidelines set by reputable regulatory bodies, which are designed to protect traders from unethical practices. Regulatory authorities such as the Financial Conduct Authority (FCA) in the UK and the Commodity Futures Trading Commission (CFTC) in the US impose strict standards on licensed brokers, including capital requirements, regular audits, and transparency in operations. Aibascny's absence from such oversight raises serious questions about its operational integrity and the safety of funds deposited by traders.

Company Background Investigation

A thorough investigation into Aibascnys company background reveals a concerning lack of transparency. The broker's history, ownership structure, and management team are not well-documented, making it difficult for potential clients to ascertain its credibility. A reputable broker typically provides detailed information about its establishment, ownership, and the professional backgrounds of its management team. This transparency helps build trust and allows traders to make informed decisions.

Unfortunately, Aibascny appears to lack this level of transparency, which is essential for establishing credibility in the financial services industry. Without clear information about its founders, management, and operational history, traders are left in the dark regarding who is managing their funds and the broker's overall stability. This opacity is a significant factor when assessing whether Aibascny is safe or a scam.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial. Aibascnys fee structure and trading conditions have come under scrutiny, particularly regarding its spreads, commissions, and other trading costs. While competitive trading costs are essential for traders, any unusual or hidden fees can signal potential issues.

| Fee Type | Aibascny | Industry Average |

|---|---|---|

| Spread on Major Pairs | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 0.5-1.5% |

The lack of clear information regarding Aibascny's trading costs is alarming. Traders rely on transparent fee structures to gauge the overall cost of trading, and the absence of such information can lead to unexpected charges that diminish trading profitability. Furthermore, if a broker does not disclose its fees upfront, it may indicate a lack of integrity, increasing the likelihood that Aibascny is not safe for traders.

Customer Funds Security

The security of customer funds is a primary concern for any trader. A reputable broker should implement robust measures to safeguard client deposits, including the segregation of funds, investor protection schemes, and negative balance protection policies. Unfortunately, Aibascny's lack of regulatory oversight raises significant concerns about the safety of client funds.

Aibascny has not provided adequate information regarding its fund security measures. Without clear policies on fund segregation and protection, traders may be at risk of losing their investments in the event of the broker's insolvency. The absence of a safety net for investor funds is a critical factor that potential clients should consider when determining if Aibascny is safe or a scam.

Customer Experience and Complaints

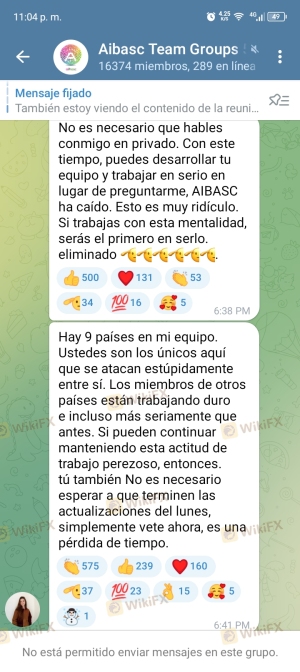

The experiences of existing customers can provide valuable insights into a broker's reliability. Aibascny has received numerous complaints from users regarding withdrawal issues, lack of communication, and unresponsive customer service. These complaints are common indicators of a broker's operational shortcomings and can significantly impact traders' experiences.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Issues | Medium | Poor |

Several users have reported difficulties in withdrawing their funds, with some claiming that their requests went unanswered for extended periods. This pattern of complaints raises serious concerns about Aibascny's commitment to customer service and its ability to provide a secure trading environment. If traders encounter persistent issues with withdrawals, it may indicate that Aibascny is not safe for trading.

Platform and Execution

A broker's trading platform and execution quality are vital for a positive trading experience. Aibascny's platform performance, stability, and user experience have been criticized, with reports of slow execution and high slippage rates. These issues can hinder traders' ability to execute trades effectively, potentially leading to losses.

The lack of detailed information regarding Aibascny's platform capabilities further complicates the assessment of its safety. Traders should be cautious if a broker does not provide a reliable and efficient trading environment, as this can be a sign of underlying operational problems.

Risk Assessment

Using Aibascny presents several risks that potential traders should be aware of. The absence of regulation, coupled with customer complaints and unclear trading conditions, indicates a higher risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Security Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Numerous complaints about withdrawal issues. |

To mitigate these risks, traders should conduct thorough research before engaging with Aibascny. Seeking alternative regulated brokers with transparent practices and positive user experiences is advisable.

Conclusion and Recommendations

In conclusion, the evidence suggests that Aibascny raises several red flags that warrant caution. The absence of regulation, combined with numerous customer complaints and a lack of transparency, indicates that Aibascny may not be a safe choice for traders.

For those considering trading in the forex market, it is advisable to opt for well-regulated brokers that provide clear information about their services and trading conditions. Alternatives like IC Markets, Exness, or Forex.com offer robust regulatory oversight and a commitment to customer service. Always prioritize safety and due diligence when selecting a broker to ensure a secure trading experience.

Is Aibascny a scam, or is it legit?

The latest exposure and evaluation content of Aibascny brokers.

Aibascny Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Aibascny latest industry rating score is 1.32, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.32 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.