Regarding the legitimacy of ACFX forex brokers, it provides CYSEC and WikiBit, .

Is ACFX safe?

Pros

Cons

Is ACFX markets regulated?

The regulatory license is the strongest proof.

CYSEC Market Making License (MM)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Atlas Capital Financial Services Ltd

Effective Date:

2007-10-31Email Address of Licensed Institution:

legal@acfs.euSharing Status:

No SharingWebsite of Licensed Institution:

www.acfx.com, www.acfs.euExpiration Time:

--Address of Licensed Institution:

19, Promahon Eleftherias Str, Agios Athanasios, CY-4103 LimassolPhone Number of Licensed Institution:

35725501000Licensed Institution Certified Documents:

Is ACFX Safe or Scam?

Introduction

ACFX, a trading name for Atlas Capital Financial Services Ltd., has been part of the forex trading landscape since its inception in 2007. Based in Cyprus, ACFX positions itself as a broker offering a diverse range of financial instruments, including forex, commodities, and indices. However, in a market rife with both legitimate brokers and scams, it is crucial for traders to conduct thorough due diligence before engaging with any trading platform. The forex market is particularly vulnerable to fraudulent activities, making it essential for traders to assess the credibility and reliability of brokers like ACFX. This article aims to evaluate whether ACFX is a safe trading option or a scam by examining its regulatory status, company history, trading conditions, and customer experiences.

To conduct this investigation, we analyzed various online sources, including user reviews, regulatory announcements, and expert assessments. Our evaluation framework focuses on key areas such as regulatory compliance, company background, trading conditions, customer fund safety, and overall user experience.

Regulation and Legitimacy

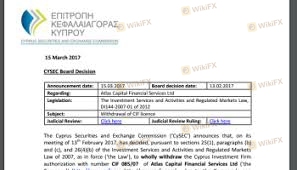

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. ACFX claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC) and the Financial Conduct Authority (FCA) in the UK. However, the broker has faced significant scrutiny regarding its regulatory compliance.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 085/07 | Cyprus | Suspended |

| FCA | 480859 | United Kingdom | Suspicious Clone |

The CySEC suspended ACFX's license back in April 2016 due to concerns about the safeguarding of client funds and compliance with regulatory standards. This suspension raises serious questions about the broker's operational integrity. Furthermore, reports indicate that ACFX has been operating without valid regulatory oversight since its license was revoked, making it a potential scam. The FCA has also categorized ACFX as a suspicious clone, which further diminishes its credibility.

The absence of active regulatory oversight means that traders may not have the same protections they would expect from a fully licensed broker. Given these circumstances, it is imperative for potential clients to approach ACFX with caution and consider the risks associated with trading through an unregulated broker.

Company Background Investigation

ACFX operates under the umbrella of Atlas Capital Financial Services Ltd., a company that has been in the financial sector for over two decades. The company claims to be part of the Atlas Group, a conglomerate involved in various financial services. However, the transparency of ACFX's operations raises concerns about its legitimacy.

The management team of ACFX is not well-publicized, and there is a lack of information regarding their qualifications and experience in the financial industry. This lack of transparency can be a red flag, as it makes it difficult for potential clients to gauge the competence and reliability of the individuals managing their funds. Moreover, ACFX has faced numerous complaints from clients regarding withdrawal issues and account management, which adds to the skepticism surrounding its operations.

While the company presents itself as a reputable entity, the historical context of its regulatory issues and the opaque nature of its management structure suggest that ACFX may not be a safe trading option. The lack of clear and accessible information about its ownership and management further complicates the assessment of its credibility.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is essential. ACFX offers various account types, including classic, VIP, and Islamic accounts, with a minimum deposit requirement of $50. The broker claims to provide competitive spreads and leverage of up to 1:500. However, the actual trading costs can often differ from what is advertised.

| Cost Type | ACFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2-3 pips | 1-2 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

The spread on major currency pairs is reported to be higher than the industry average, which can significantly impact trading profitability. Additionally, while ACFX advertises no commissions, the overall cost structure may include hidden fees or unfavorable trading conditions that are not immediately apparent to clients.

Furthermore, the high leverage offered by ACFX, while appealing to some traders, also increases the risk of substantial losses. The combination of high spreads and potential hidden costs raises concerns about the overall trading environment provided by ACFX, making it essential for traders to carefully consider their options before committing funds.

Customer Fund Safety

The safety of customer funds is paramount when selecting a broker. ACFX claims to implement measures for fund security, such as segregated accounts and investor protection. However, the broker's history of regulatory issues casts doubt on the effectiveness of these measures.

ACFX has been criticized for its lack of transparency regarding fund segregation and the absence of a clear investor compensation scheme. The suspension of its CySEC license indicates that the broker may not adhere to the stringent regulations designed to protect client funds. Additionally, there have been reports of clients experiencing difficulties when attempting to withdraw their funds, further highlighting potential risks associated with trading through ACFX.

In light of these issues, it is reasonable to conclude that ACFX may not provide a safe environment for client funds. Traders should exercise extreme caution and consider the risks involved in trading with a broker that has a questionable track record in fund management.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. ACFX has garnered a range of reviews, with many users expressing dissatisfaction with the broker's services. Common complaints include withdrawal delays, account blockages, and poor customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or No Response |

| Account Management | Moderate | Inconsistent Support |

| Customer Service | High | Poor Communication |

Many users have reported that their withdrawal requests were either delayed for extended periods or outright denied, with some clients claiming that their accounts were unjustly blocked. These patterns of complaints suggest a troubling trend that may indicate ACFX's operations are not aligned with best practices in customer service.

For instance, one user reported being unable to access their funds for months, despite repeated attempts to contact customer support. Such experiences raise significant concerns about the broker's commitment to client satisfaction and its ability to manage accounts responsibly.

Platform and Trade Execution

The trading platform is a critical component of any trading experience. ACFX offers the widely used MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, the performance of the platform has come under scrutiny.

Users have reported issues with order execution quality, including slippage and re-quotes, particularly during volatile market conditions. These execution problems can severely impact trading outcomes and lead to frustration among traders. Additionally, there are allegations of platform manipulation, which further complicates the assessment of ACFX's reliability.

Overall, while ACFX provides a familiar trading platform, the execution quality and potential manipulation raise questions about whether ACFX is a safe choice for traders.

Risk Assessment

Engaging with ACFX carries several risks that potential clients should be aware of. The combination of regulatory issues, customer complaints, and platform performance concerns creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | License revoked; unregulated operations |

| Fund Safety | High | Concerns about fund segregation and withdrawals |

| Customer Support | Medium | Poor response to complaints and issues |

| Execution Quality | High | Reports of slippage and manipulation |

To mitigate these risks, traders should conduct thorough research, consider using alternative brokers with better regulatory oversight, and be cautious about the amount of capital they invest with ACFX.

Conclusion and Recommendations

In conclusion, ACFX presents several red flags that suggest it may not be a safe trading option. The broker's history of regulatory issues, combined with numerous customer complaints about withdrawal problems and poor service, raises serious concerns about its legitimacy.

For traders seeking a reliable forex broker, it is advisable to consider alternatives that prioritize regulatory compliance and customer service. Brokers that are well-regulated, transparent, and have positive user experiences should be the preferred choice. In light of the findings, it is clear that ACFX may pose significant risks, and potential clients should proceed with caution or seek more reputable options in the market.

Is ACFX a scam, or is it legit?

The latest exposure and evaluation content of ACFX brokers.

ACFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ACFX latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.