Brisk Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive brisk markets review reveals major concerns about Brisk Markets LLC. The company is an offshore forex broker that operates without proper regulatory oversight in its registered area. Brisk Markets was established in 2022 and has its headquarters in Saint Vincent and the Grenadines, but the company has received mostly negative feedback from users across multiple review platforms.

The broker claims to offer forex trading services. However, our analysis shows substantial risks with this platform. The broker lacks authorization from reputable regulatory authorities in its operating region, which raises immediate red flags for potential investors.

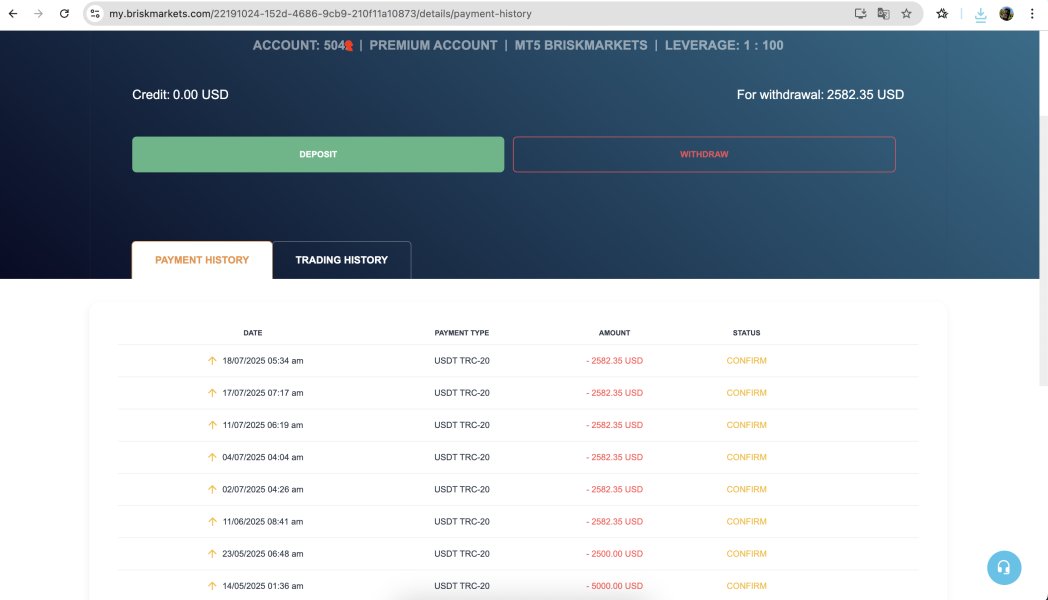

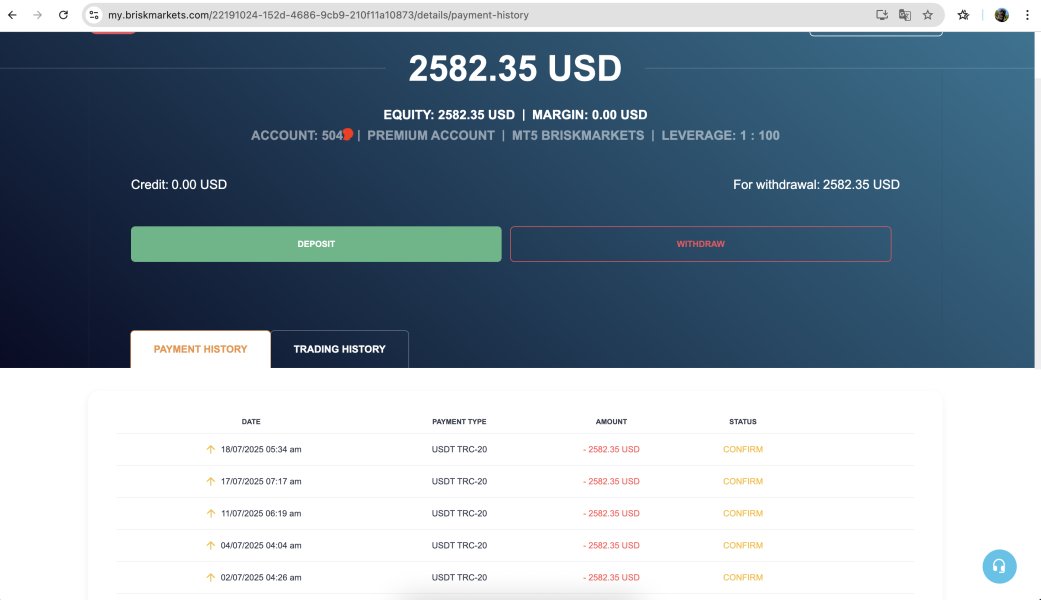

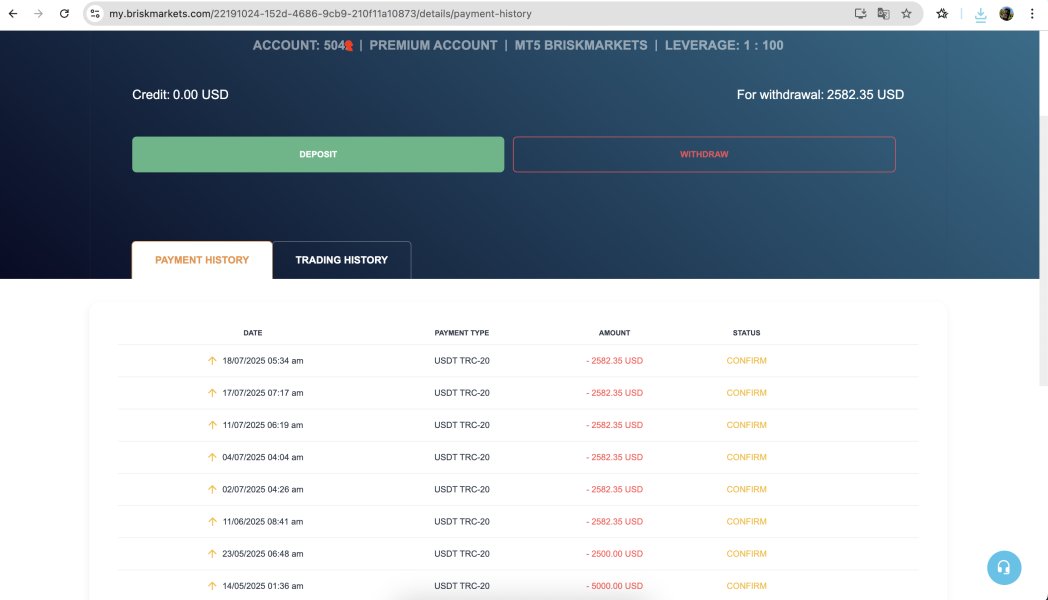

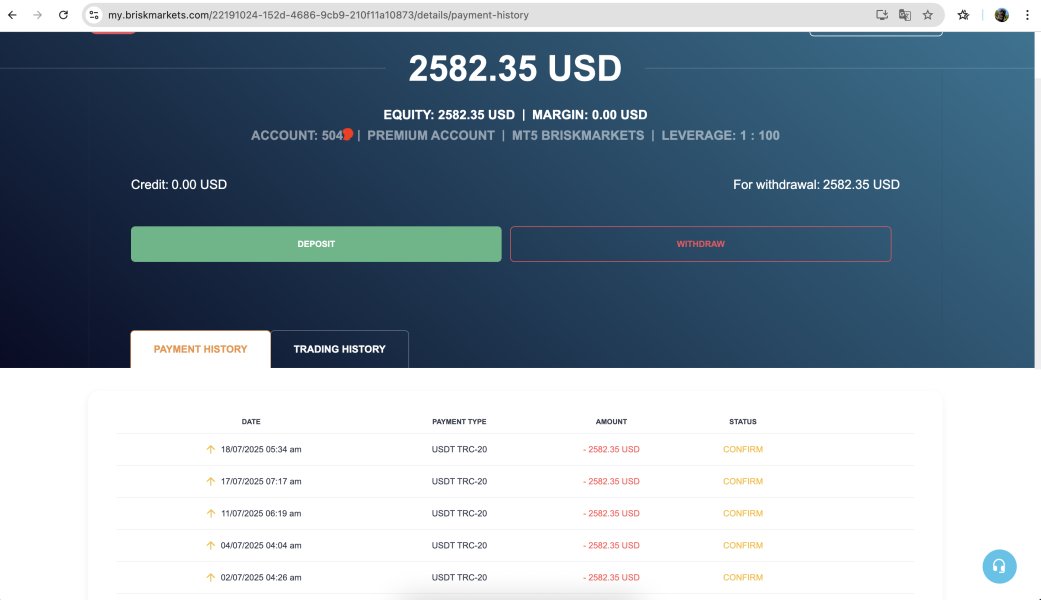

User testimonials consistently highlight issues ranging from poor customer service to concerns about fund security. According to various review platforms, traders have reported difficulties with withdrawals and questionable business practices. These reports suggest this broker may not operate with the transparency and reliability expected in the forex industry.

Our evaluation positions Brisk Markets as unsuitable for average retail traders. This is particularly true for those seeking regulated and secure trading environments. The broker might only appeal to extremely high-risk tolerance traders, though even this group should exercise extreme caution given the numerous warning signs identified in our research.

Important Disclaimers

Regional Entity Differences: Brisk Markets LLC operates from Saint Vincent and the Grenadines but lacks valid forex or brokerage licenses in its registered area. While some sources indicate potential oversight from the Seychelles Financial Services Authority, this regulatory status remains unclear and unverified across multiple review platforms.

Review Methodology: This analysis is based on publicly available information, user feedback from established review platforms, and regulatory database searches. No direct testing or on-site evaluation was conducted for this assessment.

Rating Framework

Broker Overview

Brisk Markets LLC emerged in the forex brokerage landscape in 2022. The company positions itself as an offshore trading platform based in Saint Vincent and the Grenadines. However, this brisk markets review uncovers troubling aspects of the company's operational framework that potential clients must understand.

The broker's business model remains largely unclear. There is limited publicly available information about its corporate structure, management team, or operational procedures. The company's offshore jurisdiction choice is particularly concerning, as Saint Vincent and the Grenadines is known for its lenient regulatory environment.

This regulatory environment often attracts brokers seeking to avoid strict oversight. This regulatory strategy typically benefits brokers rather than traders, as it reduces compliance costs while potentially compromising client protection measures. According to available information, Brisk Markets focuses primarily on forex trading services.

However, specific details about their trading platform technology, liquidity providers, or execution model remain undisclosed. The broker's website and marketing materials lack the comprehensive disclosure typically expected from legitimate financial service providers. This further contributes to transparency concerns highlighted in multiple user reviews.

Regulatory Status: Brisk Markets operates under questionable regulatory oversight. Some sources mention potential supervision by the Seychelles Financial Services Authority. However, the broker lacks valid licensing in its registered jurisdiction of Saint Vincent and the Grenadines, creating significant regulatory gaps that expose clients to unnecessary risks.

Deposit and Withdrawal Methods: Specific information about available funding methods was not detailed in available sources. This represents a significant transparency issue for potential clients seeking to understand their financial transaction options.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit thresholds. This makes it impossible for potential traders to assess account accessibility or plan their initial investment strategies effectively.

Promotional Offers: No specific bonus or promotional programs were identified in available materials. However, this lack of information may simply reflect the broker's limited marketing transparency rather than absence of such offerings.

Available Trading Assets: The platform primarily focuses on forex instruments. However, the specific currency pairs, exotic options, or additional asset classes remain unspecified in publicly available documentation.

Cost Structure: Critical information about spreads, commission rates, overnight financing charges, and other trading costs was not available in reviewed sources. This represents a major transparency deficit that should concern potential clients.

Leverage Options: Maximum leverage ratios and margin requirements were not disclosed in available materials. This prevents traders from assessing risk management parameters before account opening.

Platform Technology: The specific trading platform software was not clearly identified in available sources. It remains unclear whether they use proprietary or third-party solutions like MetaTrader.

Geographic Restrictions: The broker explicitly excludes US residents from its services. However, additional jurisdictional limitations may apply without clear disclosure.

Customer Support Languages: Specific language support options were not detailed in available materials. This potentially limits accessibility for international clients.

This brisk markets review identifies numerous information gaps that legitimate brokers typically address through comprehensive disclosure documentation.

Detailed Rating Analysis

Account Conditions Analysis (Score: 1/10)

Our evaluation of Brisk Markets' account conditions reveals severe deficiencies in transparency and client communication. The broker fails to provide essential information about account types, minimum deposit requirements, or specific features that would help potential clients make informed decisions.

This lack of basic disclosure represents a fundamental failure in meeting industry standards for client communication. User feedback consistently indicates confusion about account opening procedures, with multiple reports suggesting that the broker's onboarding process lacks clarity and professional structure. The absence of detailed account specifications on the broker's website and marketing materials suggests either poor business practices or intentional opacity designed to obscure unfavorable terms.

Compared to regulated brokers that typically offer multiple account tiers with clear specifications, Brisk Markets' approach appears unprofessional and potentially problematic. Legitimate brokers usually provide comprehensive account comparison charts, detailed fee schedules, and clear eligibility criteria to help clients choose appropriate services.

The scoring reflects the broker's failure to meet basic transparency standards expected in modern forex brokerage. Account conditions should be clearly communicated before client engagement. This brisk markets review cannot recommend the broker based on such fundamental disclosure failures.

The assessment of Brisk Markets' trading tools and educational resources reveals significant shortcomings that impact trader success potential. Available sources provide no specific information about analytical tools, charting capabilities, or research resources that would support informed trading decisions.

Educational materials appear to be absent or inadequately promoted. Legitimate brokers typically offer these materials to help clients develop trading skills. This absence is particularly concerning for novice traders who rely on broker-provided education to understand market dynamics and risk management principles.

User feedback suggests disappointment with the platform's analytical capabilities, though specific tool deficiencies were not detailed in available reviews. The lack of information about automated trading support, expert advisors, or algorithmic trading capabilities further limits the platform's appeal to sophisticated traders.

Professional forex brokers typically provide comprehensive market analysis, economic calendars, trading signals, and educational webinars as standard offerings. Brisk Markets' apparent lack of such resources suggests either inadequate investment in client success tools or poor marketing of available features.

Customer Service and Support Analysis (Score: 2/10)

Customer service evaluation reveals concerning patterns in Brisk Markets' client support capabilities. User feedback consistently reports extended response times and inadequate resolution of client inquiries, suggesting systemic issues in the broker's support infrastructure.

The specific communication channels available to clients remain unclear from available sources. However, user reports suggest limited accessibility and professional competency. Response quality appears to be a particular concern, with multiple users indicating that support interactions failed to resolve their issues satisfactorily.

Multilingual support capabilities were not specified in available materials. These capabilities are essential for international brokers serving diverse client bases. This lack of information suggests potential communication barriers for non-English speaking clients seeking assistance with account or trading issues.

The absence of detailed support hours, escalation procedures, or specialized support teams for different client needs indicates a potentially underdeveloped customer service infrastructure. Legitimate brokers typically provide 24/5 support during market hours, multiple communication channels, and specialized assistance for technical or account-related issues.

Trading Experience Analysis (Score: 2/10)

User feedback regarding trading experience with Brisk Markets reveals significant concerns about platform stability and execution quality. Reports of trading difficulties include platform interruptions and poor order execution, suggesting technical infrastructure limitations that can negatively impact trader performance.

Slippage and requote issues appear to be common complaints among users. These issues indicate potential problems with the broker's liquidity provision or execution algorithms. These technical issues can result in increased trading costs and reduced profitability for clients, particularly during volatile market conditions.

Platform functionality completeness remains unclear from available sources, though user feedback suggests limitations in advanced trading features that experienced traders typically expect. The absence of detailed platform specifications makes it difficult for potential clients to assess whether the technology meets their trading requirements.

Mobile trading capabilities were not specifically addressed in available materials. These capabilities are increasingly important for modern forex traders. This information gap prevents assessment of the broker's commitment to providing comprehensive trading access across multiple devices and operating systems.

This brisk markets review indicates that the trading experience falls well below industry standards for reliability and functionality.

Trust and Safety Analysis (Score: 1/10)

The trust and safety evaluation of Brisk Markets reveals fundamental concerns that should alarm potential clients. The broker's unregulated status in its registered jurisdiction creates significant risks for client fund protection and dispute resolution.

Fund security measures were not identified in available sources. These measures include segregated client accounts, deposit insurance, or third-party fund administration. This absence of clear fund protection protocols represents a major risk factor for potential clients considering account opening.

Company transparency issues extend beyond regulatory concerns to include limited disclosure about corporate ownership, management team, and operational procedures. Legitimate brokers typically provide comprehensive company information to build client confidence and meet regulatory transparency requirements.

Industry reputation analysis reveals predominantly negative sentiment from users and review platforms. Multiple sources categorize the broker as potentially fraudulent or high-risk. This reputation assessment is particularly concerning given the importance of trust in financial services relationships.

The broker's handling of negative events or client complaints appears inadequate based on available user feedback. This suggests limited commitment to maintaining client satisfaction or addressing operational issues professionally.

User Experience Analysis (Score: 2/10)

Overall user satisfaction with Brisk Markets appears to be extremely low based on available feedback from multiple review platforms. Users consistently report negative experiences across various aspects of the broker's services, from account opening to ongoing trading support.

Interface design and usability information was not specifically detailed in available sources. However, user complaints suggest that platform navigation and functionality may be suboptimal. Modern traders expect intuitive, responsive trading interfaces that support efficient decision-making and order management.

Registration and verification processes appear to be problematic based on user reports. Users complain about complex procedures and unclear requirements. Legitimate brokers typically streamline these processes while maintaining necessary compliance standards.

The user demographic analysis suggests that even high-risk tolerance traders should exercise extreme caution when considering this broker. Average retail traders should avoid the platform entirely. The concentration of negative feedback around fraud concerns represents a significant warning signal.

Common user complaints focus primarily on withdrawal difficulties and concerns about fund security. These are among the most serious issues that can affect forex traders. These complaints suggest systemic problems rather than isolated incidents.

Conclusion

This comprehensive brisk markets review concludes that the broker demonstrates poor performance across multiple critical evaluation dimensions. The company particularly fails in regulatory compliance and user trust. The combination of unclear licensing status, limited transparency, and predominantly negative user feedback creates a risk profile that is unacceptable for most forex traders.

The broker is not recommended for ordinary retail investors seeking reliable, regulated trading environments. Even traders with high risk tolerance should exercise extreme caution and consider the numerous warning signs identified throughout this analysis.

The lack of proper regulatory oversight and transparent business practices represents fundamental deficiencies. Legitimate brokers typically address these issues through proper licensing and compliance procedures. Primary disadvantages include the absence of credible regulatory oversight, numerous user complaints about service quality, and significant information gaps regarding essential trading conditions and corporate transparency that potential clients require for informed decision-making.