OMC 2025 Review: Everything You Need to Know

Executive Summary

OMC has made its mark in the foreign exchange market. However, we still don't have enough details about their trading services to make a complete judgment. This omc review shows both good and bad sides of how the broker performs and how reliable they are. The OMC Group has earned a strong 4.8 rating on Trustpilot, which means customers are happy with some parts of what they do. But employee feedback tells a different story, with workers giving average ratings of 3.5 out of 5 based on 21 reviews, showing that the company needs to improve how it treats its staff and makes the workplace better.

The broker seems to focus on traders who care about safety and good user experience. Still, the lack of clear regulatory information makes us question how open they are about their business. The high Trustpilot rating suggests customers have good experiences, but without detailed information about trading conditions, it's hard to give a full review. People thinking about using this platform should be careful and get more information before they commit, especially about regulatory compliance and trading terms.

Important Notice

This review is based on limited information about OMC's forex trading operations. The lack of detailed regulatory information suggests that services might vary depending on where you live. Traders should know that rules and regulations can be very different from one region to another, which might affect how safe and legal trading operations are.

Our review method relies mostly on user feedback and public ratings. Since we don't have much information available, this review might not cover everything about OMC's trading environment. People considering opening accounts should do their own research and check regulatory status before they start trading.

Rating Framework

Broker Overview

OMC works in the foreign exchange market. However, we don't have clear details about when the company started or what its background is. The broker seems to operate under the OMC Group name, which has gotten a lot of positive attention from users based on their strong Trustpilot performance. But the lack of detailed company history and operational background makes us uncertain about how experienced the broker is and where it stands in the market.

We don't know much about OMC's business model and how they operate. This omc review must point out that without clear information about their trading approach or whether they work as a market maker or ECN broker, potential clients can't fully judge if their services are right for them. The missing basic business information is a big gap that future traders should fill by asking the company directly.

Trading platform details, available types of assets, and regulatory oversight information are not fully covered in the materials we can access. This lack of openness about essential trading infrastructure raises concerns about whether the broker is committed to full disclosure. We can't identify which major regulatory authorities might oversee OMC's operations from current documentation, which is especially concerning for traders who want regulatory protection.

Regulatory Status: Available sources don't say which regulatory bodies oversee OMC's operations, creating uncertainty about legal compliance and trader protection measures.

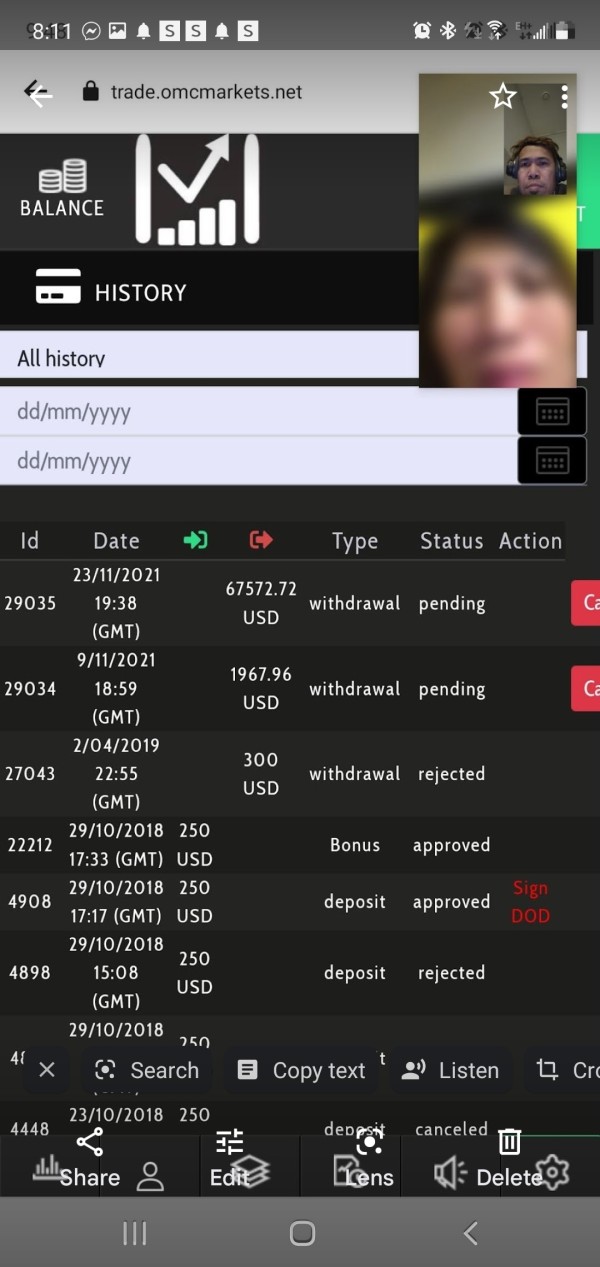

Deposit and Withdrawal Methods: We don't have specific information about funding options, processing times, and fees in current documentation.

Minimum Deposit Requirements: Entry-level funding requirements for opening accounts are not specified in available materials.

Promotional Offers: Current bonus structures, welcome offers, or ongoing promotions are not outlined in accessible sources.

Available Assets: The range of tradeable instruments, including currency pairs, commodities, indices, or other financial products, is not fully detailed.

Cost Structure: Important pricing information including spreads, commissions, overnight fees, and other trading costs remains unspecified in available documentation. This is a big information gap for traders who care about costs.

Leverage Options: Maximum leverage ratios and margin requirements are not detailed in current sources.

Platform Selection: We can't identify specific trading platforms offered, whether they're proprietary or third-party solutions like MetaTrader, in available materials.

Geographic Restrictions: Information about restricted countries or regional limitations is not provided in accessible sources.

Customer Support Languages: Available support languages beyond English are not specified in current documentation.

This omc review must stress that the lack of detailed operational information is a concerning transparency gap that potential clients should address before moving forward.

Detailed Rating Analysis

Account Conditions Analysis

Evaluating OMC's account conditions faces big limitations because we don't have detailed information in available sources. We don't know about account type varieties, their specific features, and benefits, making it impossible to judge how competitive the broker is in this important area. Future traders usually expect clear information about different account levels, minimum balance requirements, and special features that make each option different.

We don't have details about minimum deposit requirements, which are a key barrier for new traders, in current documentation. This lack of openness prevents potential clients from planning their initial investment properly and comparing how accessible OMC is against industry standards. The account opening process, including required paperwork, verification procedures, and timeline expectations, also lacks detailed explanation.

Special account features like Islamic accounts for Sharia-compliant trading, demo account availability, or professional trader classifications are not addressed in available materials. This omc review can't provide meaningful analysis of account conditions without access to basic operational details. We don't have user feedback specifically about account setup experiences, condition satisfaction, or related concerns in current sources.

Assessing OMC's trading tools and educational resources is challenging because we have limited available information. We don't know about the variety and quality of analytical tools, which are essential for making informed trading decisions, in current documentation. Modern traders expect access to technical analysis software, economic calendars, market news feeds, and research reports, but OMC's offerings in these areas are not detailed.

Educational resources, including webinars, tutorials, market analysis, and trading guides, are not outlined in available sources. For many traders, especially beginners, comprehensive educational support is a crucial factor in choosing a broker. The missing information about OMC's commitment to trader education creates uncertainty about their support for client development and success.

We don't have information about automated trading support, including Expert Advisor compatibility, algorithm trading capabilities, and API access, in current materials. Professional traders increasingly rely on automated strategies, making this information gap especially significant for advanced users. User feedback about tool effectiveness, educational content quality, or resource accessibility is not available in accessible sources.

Customer Service and Support Analysis

OMC's customer service evaluation benefits from some available data, though comprehensive details remain limited. The employee rating of 3.5 out of 5, based on 21 reviews, suggests moderate satisfaction levels among staff members, which often relates to service quality delivered to clients. However, this internal perspective may not fully reflect the customer experience from an outside viewpoint.

We don't have details about available customer service channels, including live chat, email support, phone assistance, and social media responsiveness, in current sources. Response time expectations, service availability hours, and escalation procedures for complex issues also lack documentation. These operational details are crucial for traders who may need immediate help during volatile market conditions.

Multi-language support capabilities, which are essential for international brokers, are not specified in available materials. We don't know about the quality of support across different languages, cultural sensitivity in customer interactions, and regional expertise availability. Problem resolution case studies and customer satisfaction metrics specific to support experiences are not provided in accessible documentation.

Trading Experience Analysis

We can't adequately assess platform stability and execution speed, which are fundamental to successful trading operations, because we have limited available information. Order execution quality, including slippage rates, requote frequency, and fill accuracy, lacks detailed documentation in current sources. These technical performance metrics are crucial for evaluating a broker's operational competence and reliability.

Platform functionality completeness, including charting capabilities, order types availability, and analytical tools integration, is not comprehensively covered in available materials. Mobile trading experience, which has become increasingly important for modern traders, also lacks detailed evaluation in accessible sources. The absence of specific platform information prevents meaningful assessment of OMC's technological capabilities.

This omc review can't provide substantial analysis of trading experience without access to user feedback about platform performance, execution quality, or overall satisfaction with trading conditions. We don't have technical performance data, including server uptime statistics, execution speed benchmarks, and system reliability metrics, in current documentation.

Trust and Safety Analysis

Regulatory compliance, which forms the foundation of broker trustworthiness, faces significant evaluation challenges because regulatory information is absent in available sources. We can't establish the identification of supervising authorities, license numbers, and compliance frameworks from current documentation. This regulatory uncertainty is a major concern for safety-conscious traders seeking protected trading environments.

Fund safety measures, including segregated account policies, deposit insurance coverage, and client money protection protocols, are not detailed in available sources. Company transparency about ownership structure, financial reporting, and operational disclosure also lacks comprehensive coverage. These elements are essential for establishing institutional credibility and trader confidence.

The OMC Group's strong 4.8 Trustpilot rating suggests positive customer experiences and potentially good industry reputation, though we don't have specific feedback content and verification details. Third-party evaluations, industry recognition, and negative event handling procedures are not addressed in current materials. User trust feedback and safety-related testimonials are not available in accessible sources.

User Experience Analysis

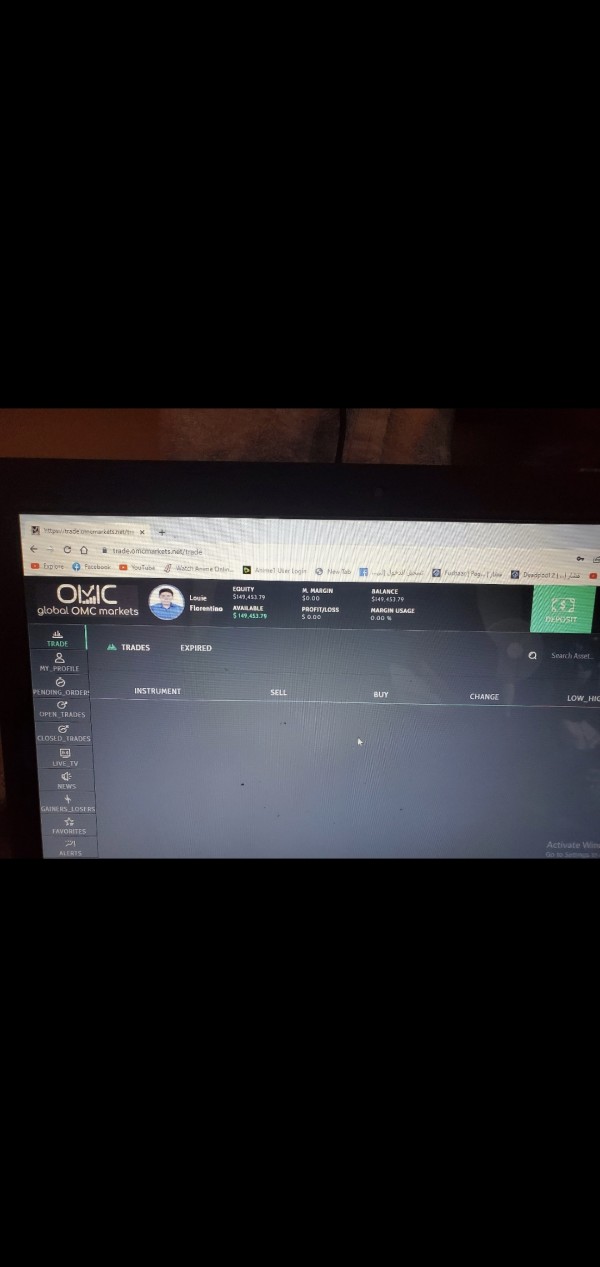

Overall user satisfaction assessment is challenging because we have limited feedback availability in current sources. The high Trustpilot rating of 4.8 suggests positive user experiences, though we don't have specific satisfaction elements and detailed feedback content. We can't evaluate interface design quality, navigation ease, and platform usability without access to detailed user testimonials and experience reports.

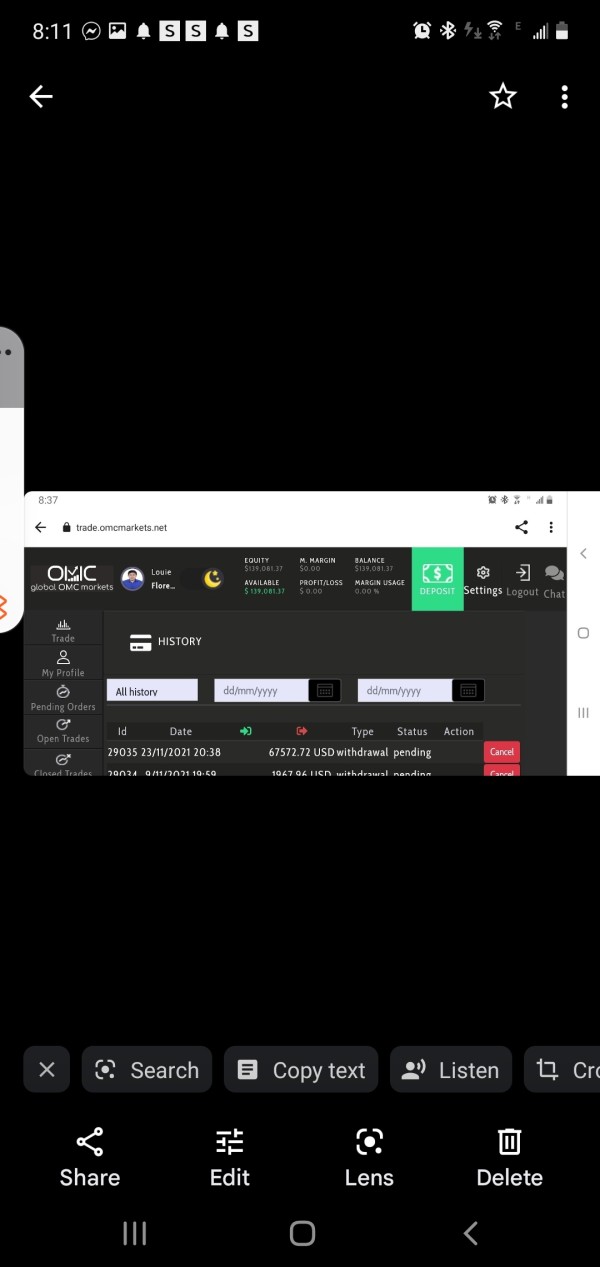

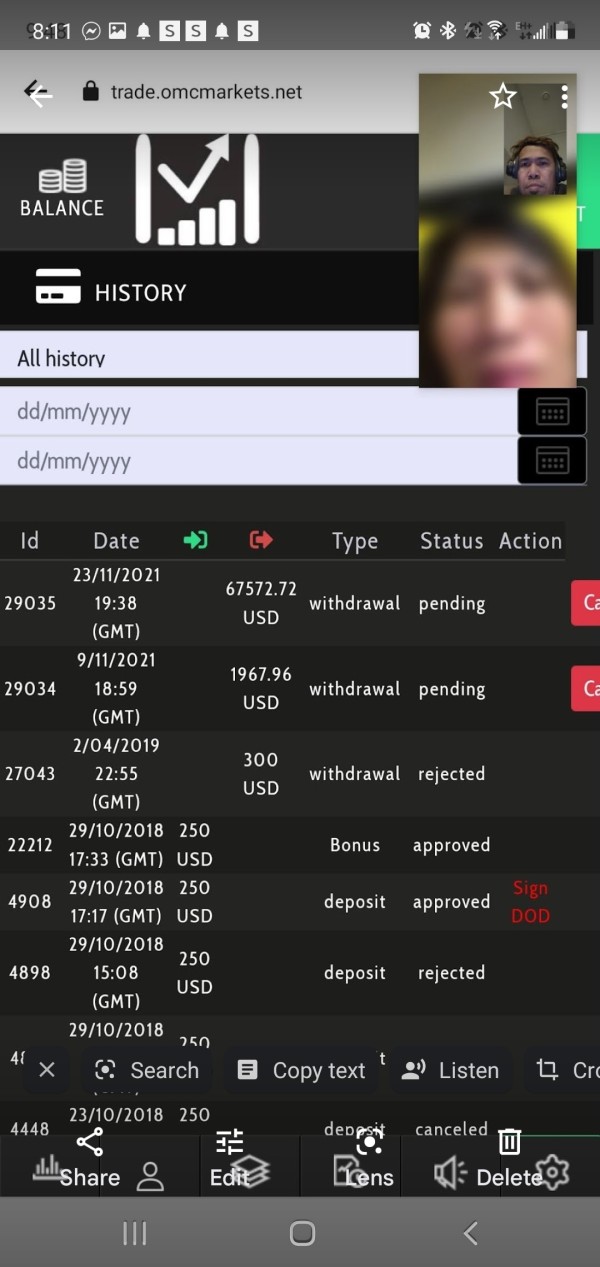

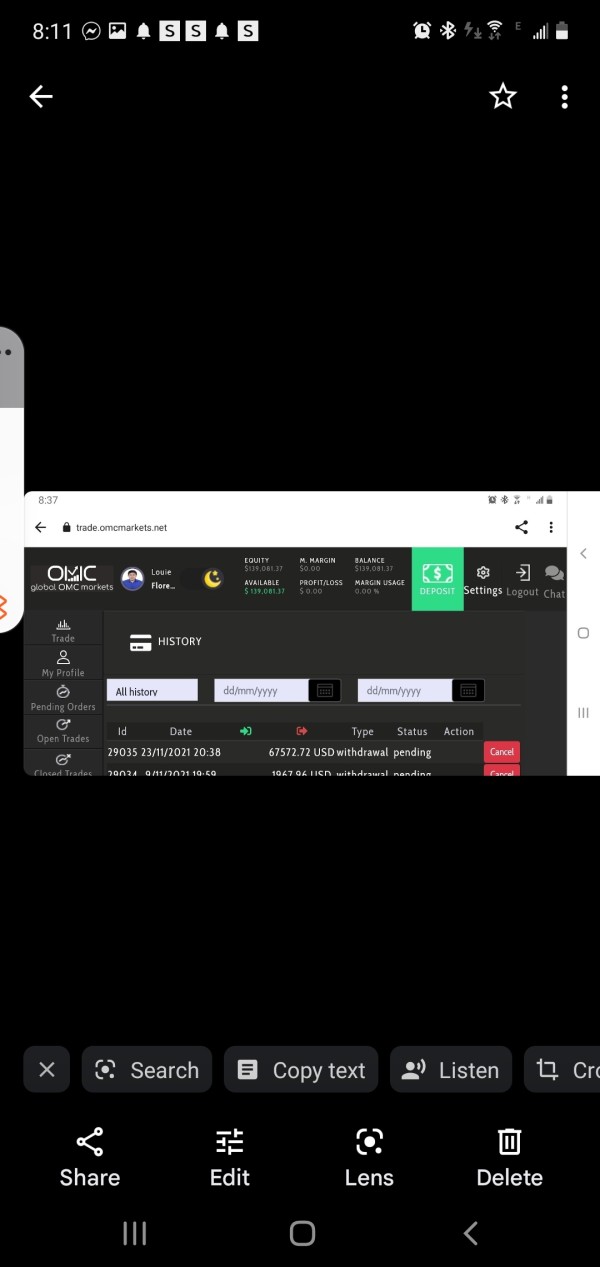

Registration and verification process efficiency, including account opening speed, documentation requirements, and approval timelines, lack detailed coverage in available materials. Fund operation experiences, including deposit processing, withdrawal efficiency, and payment method satisfaction, also remain unspecified. We can't identify common user complaints and recurring issues in accessible sources.

We can't establish user demographic analysis and trader type suitability from current documentation. The balance between positive and negative user feedback, improvement suggestions from the community, and overall satisfaction trends are not detailed in available sources. This omc review can't provide comprehensive user experience evaluation without access to substantial user feedback data.

Conclusion

This comprehensive omc review reveals a broker with limited publicly available information, creating challenges for thorough evaluation. While the OMC Group's strong 4.8 Trustpilot rating suggests positive customer experiences, the absence of detailed operational information, regulatory clarity, and trading conditions represents significant transparency concerns. The moderate employee satisfaction rating of 3.5 out of 5 indicates potential internal operational challenges that may impact service delivery.

OMC may be suitable for traders who prioritize customer service quality and are comfortable with limited transparency about operational details. However, the lack of comprehensive regulatory information, trading conditions, and platform specifications makes it difficult to recommend this broker for safety-conscious traders or those requiring detailed operational transparency. Prospective clients should conduct thorough independent research and direct communication with OMC before making any trading commitments.