FXCloudmarket 2025 Review: Everything You Need to Know

Executive Summary

FXCloudmarket is a newly established online forex broker that launched in 2024. It positions itself as a platform offering diverse financial instruments and advanced trading technology. While the broker provides competitive brokerage fees and promises fast trade execution, this fxcloudmarket review reveals significant concerns regarding its regulatory status and overall trustworthiness.

The platform caters primarily to traders interested in forex, stocks, and commodities. It particularly appeals to cost-sensitive investors seeking competitive trading conditions. However, the broker's lack of regulatory oversight presents substantial risks that potential clients must carefully consider. According to available information, FXCloudmarket operates without proper regulatory authorization, resulting in an extremely low trust rating of just 2% among users and industry observers.

The broker's trading platform utilizes proprietary technology branded as FXCLOUDMARKET. Users have reported that it offers satisfactory execution speeds and functionality. Despite these technical advantages, the absence of regulatory protection and mixed user feedback regarding overall service quality raises serious questions about the platform's reliability and long-term viability for serious traders.

Important Notice

Cross-Regional Entity Differences: FXCloudmarket operates without regulatory supervision from any recognized financial authority. Users considering trading with this broker must carefully assess the associated risks. They should particularly consider the legal and financial vulnerabilities that arise from engaging with unregulated entities. Cross-border trading through unregulated platforms may expose clients to additional legal complications and limited recourse options in case of disputes.

Review Methodology: This assessment is compiled based on available user feedback, platform information, and industry standards. Given the limited regulatory disclosure and company transparency, this review aims to provide a comprehensive perspective while highlighting areas where information remains incomplete or unverified.

Rating Framework

Broker Overview

FXCloudmarket emerged in the online trading landscape in 2024 as a new entrant targeting retail traders seeking access to multiple asset classes. The company positions itself as a technology-focused broker headquartered in the United States. However, specific details about its corporate structure and ownership remain limited in publicly available information. The broker's business model centers on providing internet-based trading services across forex, equity, and commodity markets.

The platform distinguishes itself through its proprietary trading technology and emphasis on competitive fee structures. FXCloudmarket operates primarily through its web-based platform, offering traders access to various financial instruments through a single interface. This fxcloudmarket review finds that while the broker presents itself as a modern trading solution, the lack of established track record and regulatory backing creates uncertainty about its operational standards and client protection measures.

The broker's target demographic appears to focus on traders who prioritize cost-effectiveness and platform functionality over regulatory assurance. However, the absence of proper licensing raises fundamental questions about the broker's ability to provide the security and reliability that experienced traders typically expect from their chosen platforms.

Regulatory Status: Available information does not indicate any regulatory authorization from recognized financial supervisory bodies. This represents a significant red flag for potential clients considering this platform.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods, processing times, and associated fees is not detailed in available sources. This requires direct inquiry with the broker.

Minimum Deposit Requirements: The broker has not disclosed specific minimum deposit amounts in publicly available information. This suggests potential clients should verify these details directly.

Bonus and Promotional Offers: Current promotional structures and bonus programs are not specified in available documentation. This indicates either absence of such offers or limited marketing disclosure.

Tradeable Assets: The platform provides access to forex pairs, stock instruments, and commodity markets. However, the exact number of available instruments and market coverage depth requires further verification.

Cost Structure: While FXCloudmarket advertises competitive brokerage fees, specific spread ranges, commission structures, and overnight financing rates are not transparently disclosed. This fxcloudmarket review is based on available information.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in accessible broker information.

Platform Options: The broker operates primarily through its proprietary FXCLOUDMARKET platform. Limited information exists about additional platform availability or third-party integrations.

Geographic Restrictions: Specific country limitations and regulatory compliance requirements are not clearly outlined in available sources.

Customer Support Languages: Multi-language support capabilities and available communication channels require direct verification with the broker.

Account Conditions Analysis

The account structure and conditions offered by FXCloudmarket present several areas of concern due to limited transparency and disclosure. Available information does not provide clear details about different account types, their respective features, or the specific requirements for account opening. This lack of clarity represents a significant disadvantage for potential clients who need to understand exactly what services and conditions they can expect.

The absence of detailed minimum deposit information makes it difficult for traders to plan their initial investment. It also makes it hard to assess whether the broker's requirements align with their budget constraints. Industry standards typically require brokers to clearly communicate these fundamental account parameters. The lack of such disclosure raises questions about FXCloudmarket's adherence to best practices.

Account opening procedures and verification requirements are not detailed in available sources. This leaves potential clients uncertain about the onboarding process timeline and documentation needs. Additionally, the availability of specialized account features, such as Islamic accounts for Sharia-compliant trading, remains unspecified.

This fxcloudmarket review identifies the limited account information as a significant weakness that potential clients should address through direct communication with the broker before making any commitment. The lack of transparency in account conditions contributes to the overall uncertainty surrounding this platform's reliability and professional standards.

FXCloudmarket's trading tools and resources present a mixed picture of capabilities and limitations. The broker offers access to multiple financial instruments across forex, stocks, and commodities, suggesting a reasonable breadth of trading opportunities. However, the quality and depth of these offerings require careful evaluation due to limited detailed information about specific features and functionalities.

The platform's proprietary trading technology appears to be the broker's primary strength. Users report satisfactory performance in terms of execution speed and basic functionality. However, the absence of detailed information about advanced analytical tools, charting capabilities, and technical indicators limits the ability to fully assess the platform's suitability for different trading strategies.

Research and market analysis resources are not prominently featured in available information. This could disadvantage traders who rely on fundamental analysis and market insights for their trading decisions. Educational resources, webinars, and training materials also appear to be limited or not well-publicized, potentially impacting newer traders who require guidance and learning support.

The availability of automated trading support, expert advisors, and algorithmic trading capabilities remains unclear from available sources. This information gap represents a significant limitation for traders who employ sophisticated trading strategies or require advanced platform features for their operations.

Customer Service and Support Analysis

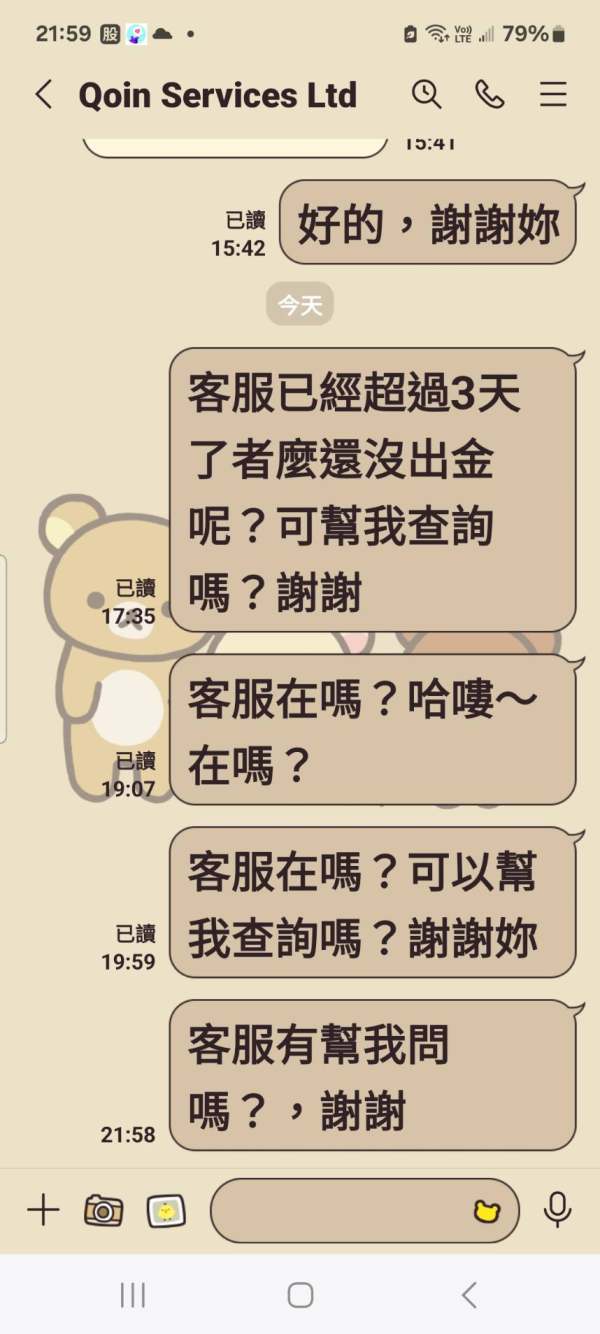

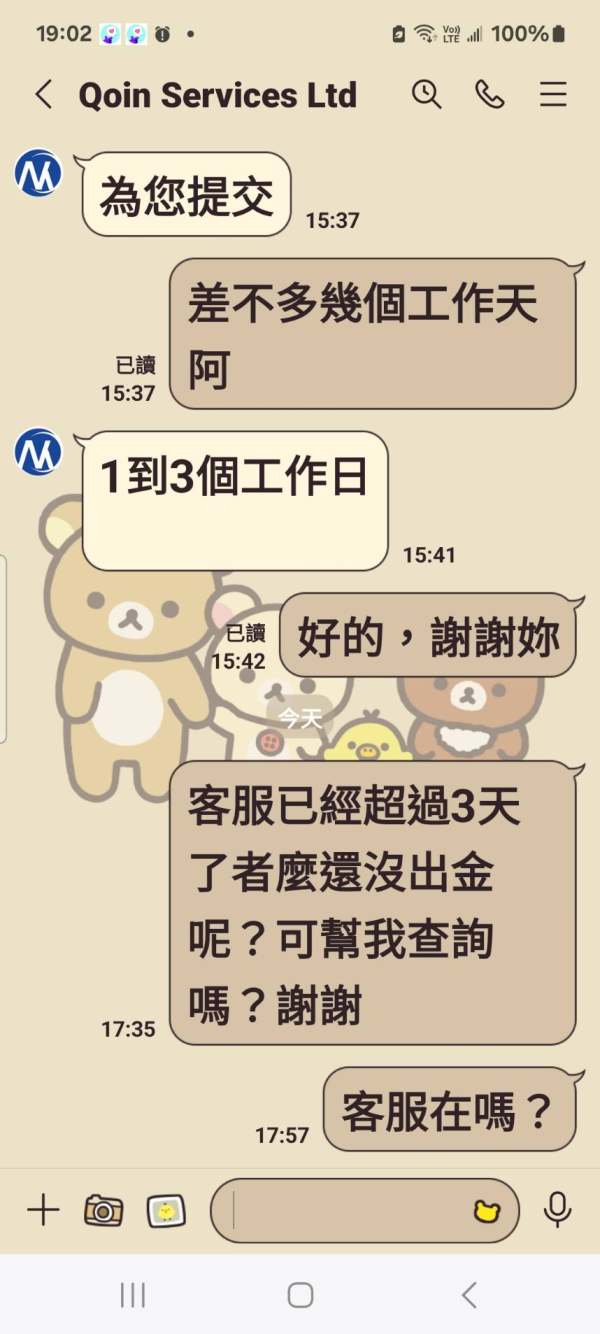

Customer service quality represents one of the more concerning aspects highlighted in this evaluation. While specific details about support channels and availability are not comprehensively documented, user feedback suggests inconsistent service experiences. These range from satisfactory to problematic interactions.

The broker's customer support infrastructure appears to lack the comprehensive coverage and professional standards typically expected from established trading platforms. Response times, service quality, and problem resolution effectiveness have not been clearly demonstrated through available user testimonials or company documentation.

Multi-language support capabilities and the availability of various communication channels are not well-documented. This potentially creates barriers for international clients or those preferring specific communication methods. The absence of clear customer service policies and service level commitments raises concerns about the broker's dedication to client satisfaction.

Support availability hours and geographic coverage are not specified in available information. This could be particularly problematic for traders in different time zones who require assistance during their active trading hours. The mixed user feedback regarding customer service suggests that while some clients may receive adequate support, others experience significant difficulties in obtaining timely and effective assistance.

Trading Experience Analysis

The trading experience offered by FXCloudmarket shows both promising elements and areas requiring improvement. Users have reported positive experiences with the platform's execution speed. This indicates that the proprietary FXCLOUDMARKET system delivers on its promise of fast trade processing. This represents a significant advantage for traders who require quick order execution, particularly in volatile market conditions.

Platform stability appears to meet basic operational requirements. However, comprehensive stress testing results and performance metrics during high-volume trading periods are not publicly available. The functionality of the trading interface has received generally positive feedback from users, suggesting that the platform provides essential trading capabilities without major technical obstacles.

However, detailed information about order execution quality is not transparently disclosed. This includes slippage rates, requote frequency, and price accuracy. These factors are crucial for traders to evaluate the true cost and reliability of their trading environment, and the lack of such data represents a significant information gap.

Mobile trading capabilities and cross-device synchronization features are not well-documented. This potentially limits traders who require flexible access to their accounts across different devices. The overall trading environment's competitiveness in terms of spread stability and liquidity provision also requires further verification through direct experience or more comprehensive user feedback analysis.

This fxcloudmarket review suggests that while the basic trading functionality appears adequate, the lack of comprehensive performance data and limited user feedback make it difficult to confidently assess the platform's suitability for serious trading activities.

Trust and Reliability Analysis

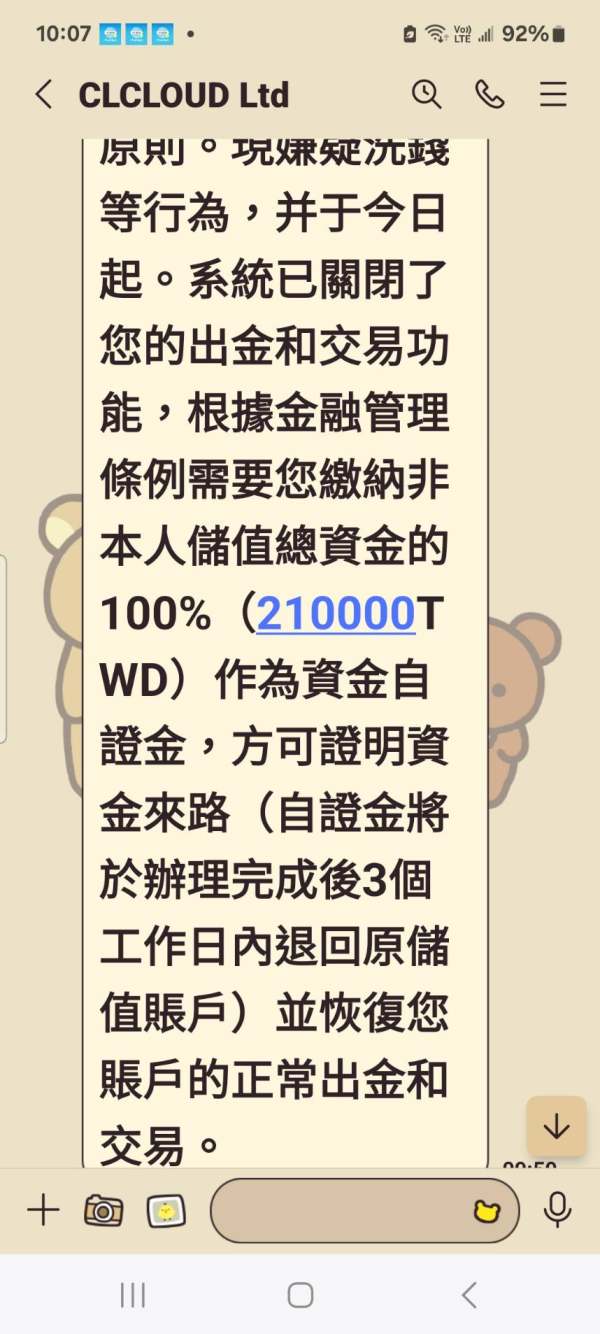

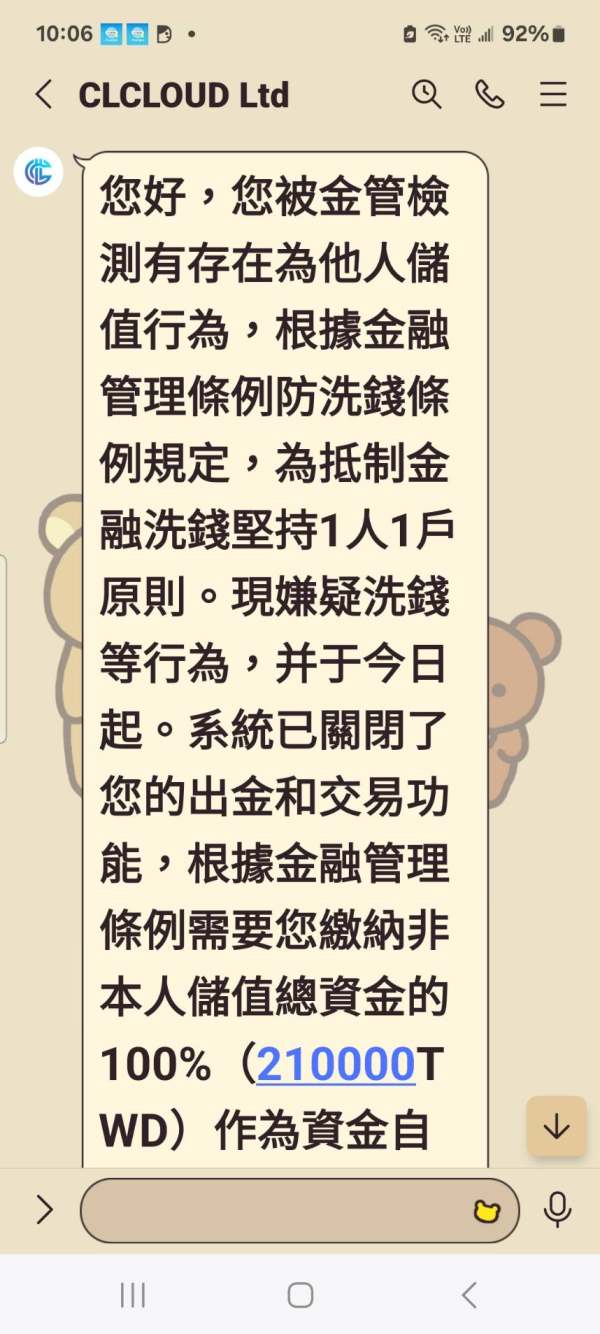

Trust and reliability represent the most significant concerns identified in this evaluation of FXCloudmarket. The broker's complete absence of regulatory authorization from any recognized financial supervisory authority creates fundamental questions about client protection, fund security, and operational oversight. These concerns cannot be overlooked.

The extremely low trust rating of 2% reflects serious industry and user concerns about the platform's credibility and long-term viability. This rating suggests widespread skepticism about the broker's ability to provide secure and reliable services. It should serve as a major warning signal for potential clients.

Fund security measures, segregation of client funds, and investor protection protocols are not transparently disclosed. This leaves clients uncertain about the safety of their deposits and trading capital. The absence of regulatory oversight means that standard industry protections, such as compensation schemes and dispute resolution mechanisms, may not be available to clients.

Company transparency regarding ownership structure, financial backing, and operational procedures is notably limited. This makes it difficult for potential clients to conduct proper due diligence. The lack of verifiable company information and regulatory compliance documentation raises serious questions about the broker's legitimacy and professional standards.

The handling of negative events and client complaints is not well-documented. Without regulatory oversight, clients may have limited recourse options in case of disputes or operational problems. This combination of factors creates a high-risk environment that experienced traders would typically avoid.

User Experience Analysis

User experience with FXCloudmarket presents a complex picture of mixed satisfaction levels and varying service quality. Available feedback suggests that while some users appreciate certain aspects of the platform, overall satisfaction remains inconsistent. This contributes to concerns about service reliability and consistency.

The user interface design and platform usability have received moderate feedback. Some users find the system functional for basic trading needs while others report limitations in advanced features and customization options. The learning curve for new users and the availability of guidance materials appear to be areas requiring improvement.

Registration and account verification processes are not well-documented in terms of user experience, timeline expectations, and required documentation. This lack of clarity can create frustration for new clients who are uncertain about onboarding procedures and approval timeframes.

Fund management operations have not been comprehensively reported by users. This includes deposit and withdrawal experiences, making it difficult to assess the efficiency and reliability of financial transactions. Common user complaints appear to focus on platform functionality limitations and service consistency issues.

The typical user profile for FXCloudmarket appears to be cost-sensitive traders willing to accept higher risks in exchange for potentially lower fees. However, the mixed feedback suggests that even price-focused users may find the overall experience lacking in important areas such as reliability and support quality.

Conclusion

FXCloudmarket presents itself as a new-generation trading platform with competitive features and modern technology. However, this comprehensive evaluation reveals significant concerns that potential clients must carefully consider. While the broker offers fast execution speeds and competitive fee structures that may appeal to cost-conscious traders, the fundamental lack of regulatory oversight creates unacceptable risks for most serious investors.

The platform may be suitable for highly experienced traders who fully understand the risks associated with unregulated brokers. These traders must be willing to accept these risks in exchange for potentially lower costs. However, the majority of traders, particularly those new to forex markets or seeking reliable long-term trading relationships, would be better served by choosing regulated alternatives with established track records.

The primary advantages of competitive fees and fast execution are significantly outweighed by the disadvantages of regulatory absence, limited transparency, and inconsistent user feedback. Until FXCloudmarket addresses these fundamental issues through proper regulatory authorization and improved service standards, potential clients should exercise extreme caution when considering this platform for their trading activities.