Top Trading 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

Top Trading positions itself as a budget-friendly broker within the ever-competitive landscape of financial trading. By focusing on low trading costs and a diverse range of platforms, it attracts beginner to intermediate traders who are eager to navigate their risks for potentially high rewards. However, this enticing proposal is countered by serious concerns regarding regulatory oversight and mixed user reviews that highlight alarming issues of fund safety and customer service. As such, potential investors must weigh the low costs against the substantial risks implied by the broker's operations.

⚠️ Important Risk Advisory & Verification Steps

Before venturing into the world of trading with any broker, particularly one that lacks robust regulatory scrutiny, it is crucial to proceed with caution. The potential for scams or untrustworthy practices is heightened when trading with unregulated entities. To verify a broker's legitimacy, follow these steps:

- Check Regulatory Status: Visit official regulatory websites (e.g., SEC, FCA, ASIC) to confirm if the broker is authorized to operate.

- Read Reviews: Look for user experiences on various financial forums and review sites.

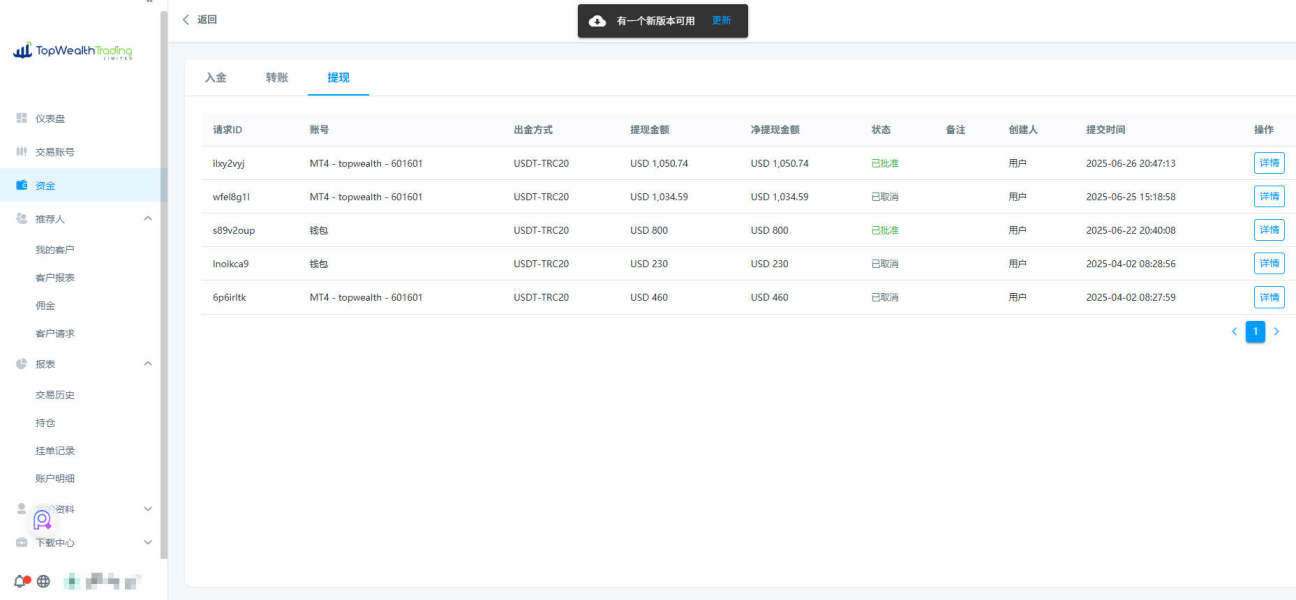

- Assess Withdrawal Policies: Be cautious of brokers with complaints regarding difficulties in fund withdrawals.

- Engage with Customer Support: Reach out to support to gauge their responsiveness and reliability.

- Investigate Company Background: Conduct a thorough search of the broker's history and ownership.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2010, Top Trading claims to operate under a unique umbrella of global trading practices. Although registered in the Commonwealth of Dominica, concerns about its legitimate standing persist, especially given the absence of strong regulatory affiliations. This positioning potentially limits customer trust, particularly for risk-averse investors seeking a secure financial environment.

Core Business Overview

Top Trading primarily focuses on offering a range of contract for difference (CFD) trading options across various asset classes including forex, commodities, and indices. The broker provides access to several trading platforms, prominently featuring MetaTrader 4, which is favored among many traders for its user-friendly interface. However, the regulatory claims made by Top Trading regarding oversight from reputable financial authorities remain ambiguous, a fact that potential traders must consider carefully when choosing whether to engage with them.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Teaching users to manage uncertainty.

There is significant concern surrounding Top Trading's lack of regulation from top-tier financial authorities such as SEC and FCA. Many trading experts highlight that only brokerage firms regulated by such entities can provide a certain level of safety and investor protection. Without this regulatory backing, traders are placed at risk, with limited recourse in the event of trading disputes or issues like fund withdrawal.

To verify the broker's legitimacy, follow this self-verification guide:

- Visit the official website of the broker.

- Search for any registration numbers or details linked to known regulatory bodies.

- Cross-reference these details with the relevant authoritys lists of licensed brokers.

User feedback consistently emphasizes that the broker falls short concerning fund safety, with several users reporting difficulties in retrieving their investments or dissatisfaction with customer service.

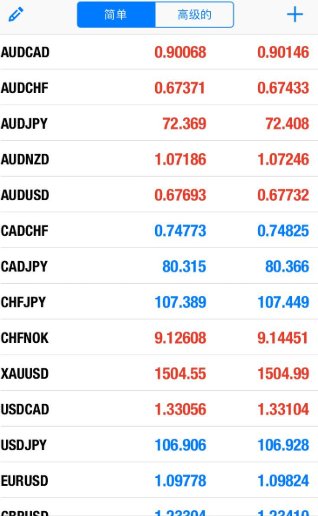

Trading Costs Analysis

The double-edged sword effect.

Top Trading promotes a low-cost trading structure, which is attractive to new traders. For example, they advertise trading without commissions on specific actions and competitive spreads. However, it's essential to remain vigilant concerning possible non-trading fees. Users have highlighted withdrawal fees and a lack of transparency surrounding other potential charges, summarizing that the apparent cost savings may be offset by these unexpected costs.

In summary, while the commission structures might appeal to beginner traders, those planning to engage in significant trading operations should critically analyze the fees involved.

Professional depth vs. beginner-friendliness.

Top Trading provides access to platforms like MetaTrader 4, suitable for both new traders and experienced ones due to its wide array of trading tools. Nevertheless, the absence of support for advanced trading options or tools can be a disadvantage for seasoned traders who seek more sophisticated analytical resources.

User experiences reflect a sense of discontent regarding the platforms usability, mainly when faced with technical issues or slow system responses during peak trading hours.

User Experience Analysis

Navigating mixed perceptions.

User experiences reveal a department of dissatisfaction, particularly around customer service. Many traders report long response times and difficulties when attempting to withdraw funds. These experiences indicate a gap between the company's promises and the delivery of actual services, prompting a need for improvement.

Those requiring dedicated support may find the absence of reliable guidance a significant drawback.

Customer Support Analysis

Increasing apprehensions on responsiveness.

High user complaints about customer support are common, focusing on slow response times and inadequate support for withdrawal issues. The inconsistency in service quality diminishes trust among potential traders, particularly risk-averse individuals who prefer brokers with proactive customer assistance.

Account Conditions Analysis

Balancing accessibility and security.

Top Trading provides various account types that allow beginners to start trading with a low minimum investment. However, users must remain aware of the limitations imposed on smaller accounts and the complications surrounding withdrawal conditions. The mixed reputation regarding fund safety means that potential users must weigh the advantages of accessible entry against the risks associated with engaging in trading with an unregulated broker.

Conclusion

Top Trading offers an accessible entry point for novice traders through competitive costs and immediate access to trading platforms like MetaTrader 4. However, the significant red flags concerning its lack of regulation, mixed user experiences, and poor customer service suggest that it may not be a suitable option for investors prioritizing safety and reliability. Thus, prospective users should approach with caution, ensuring they conduct thorough verification before committing their funds.