Oxtrade Review 1

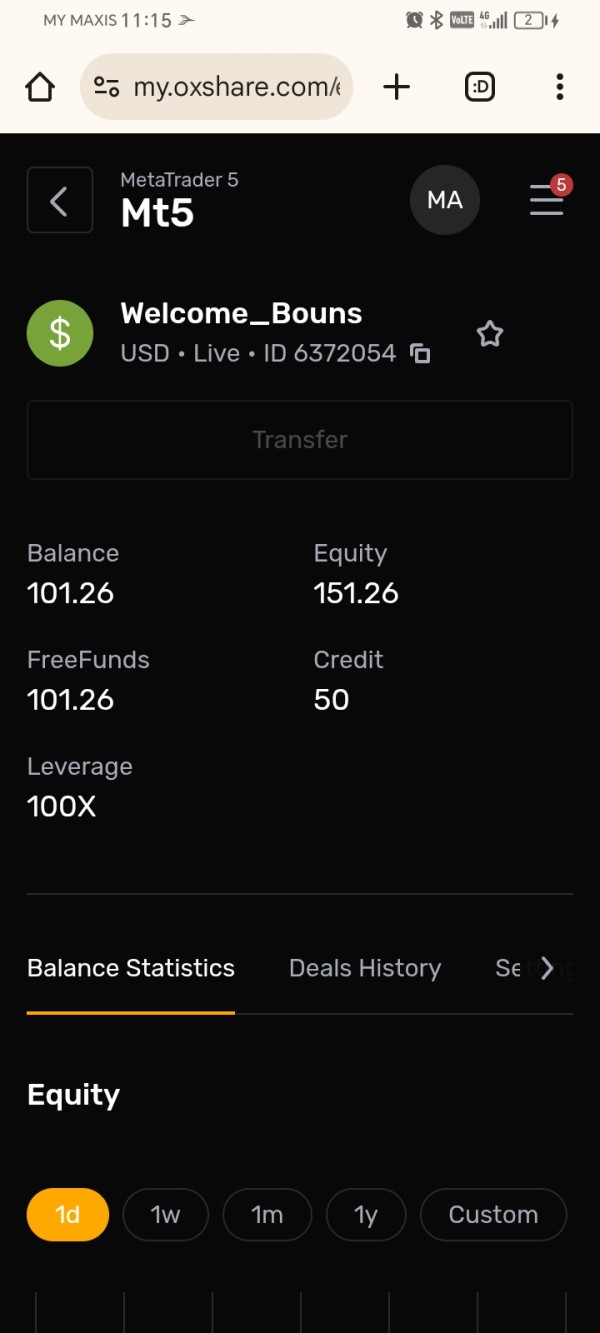

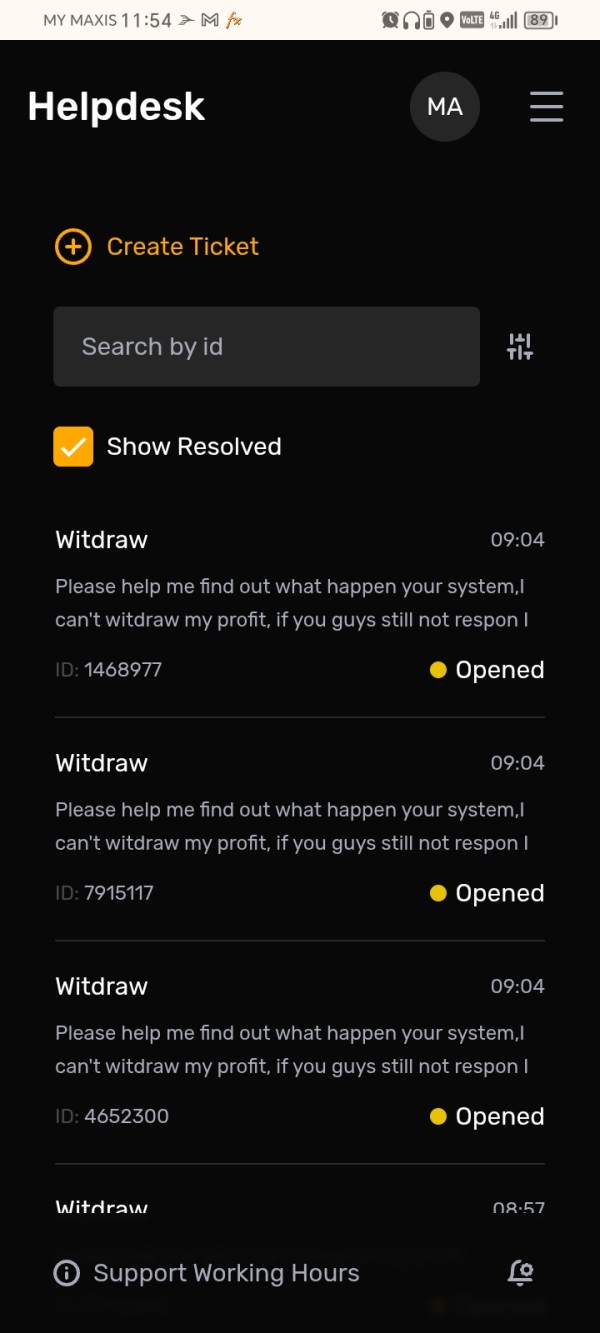

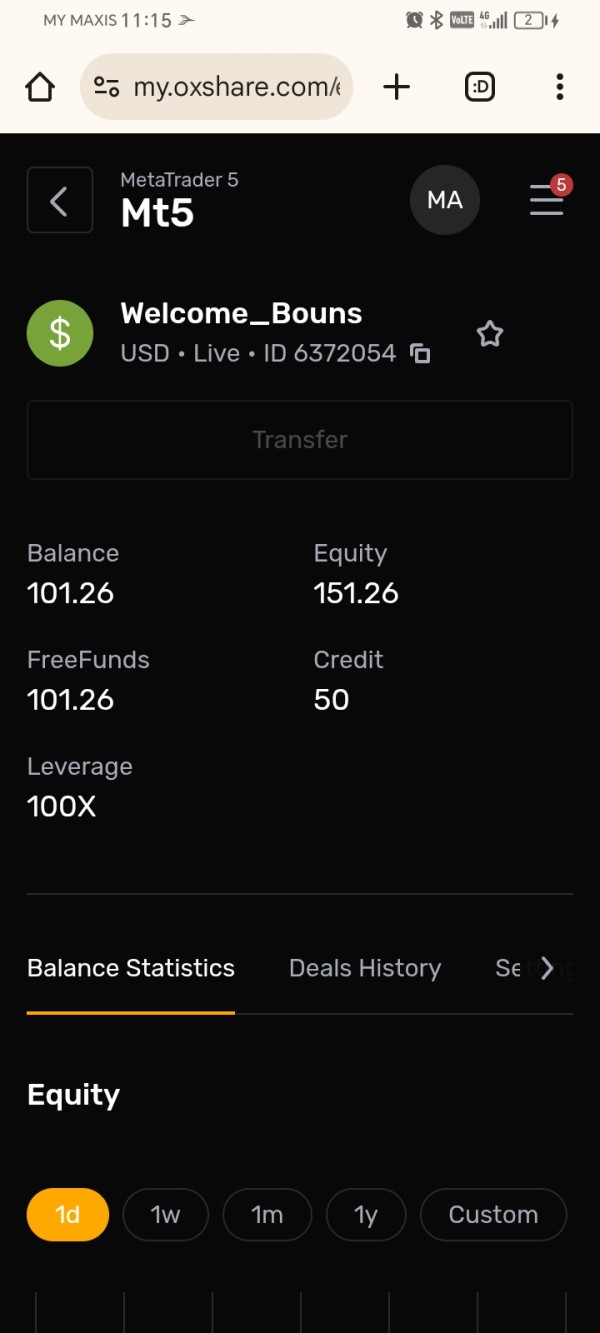

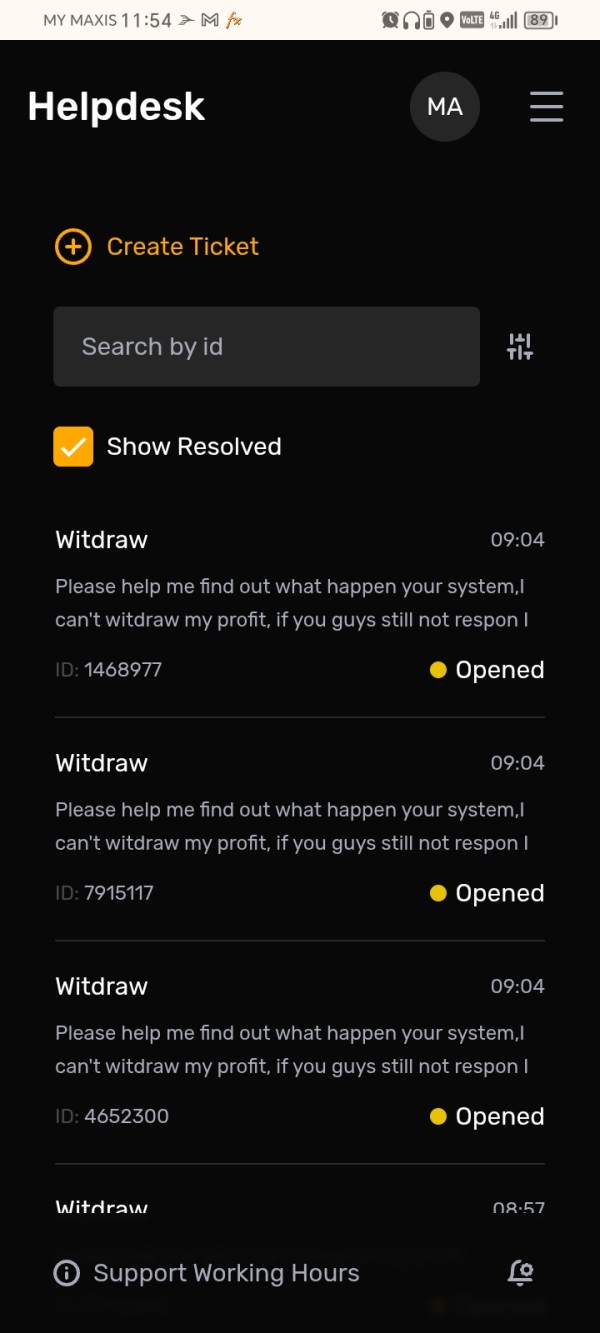

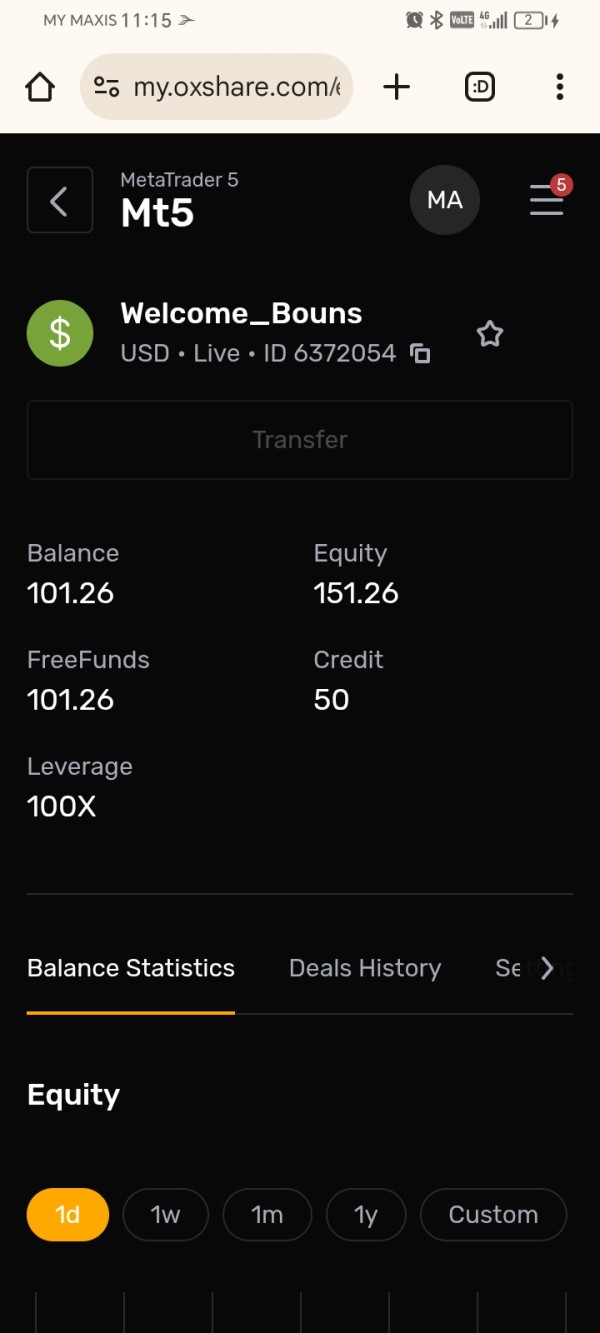

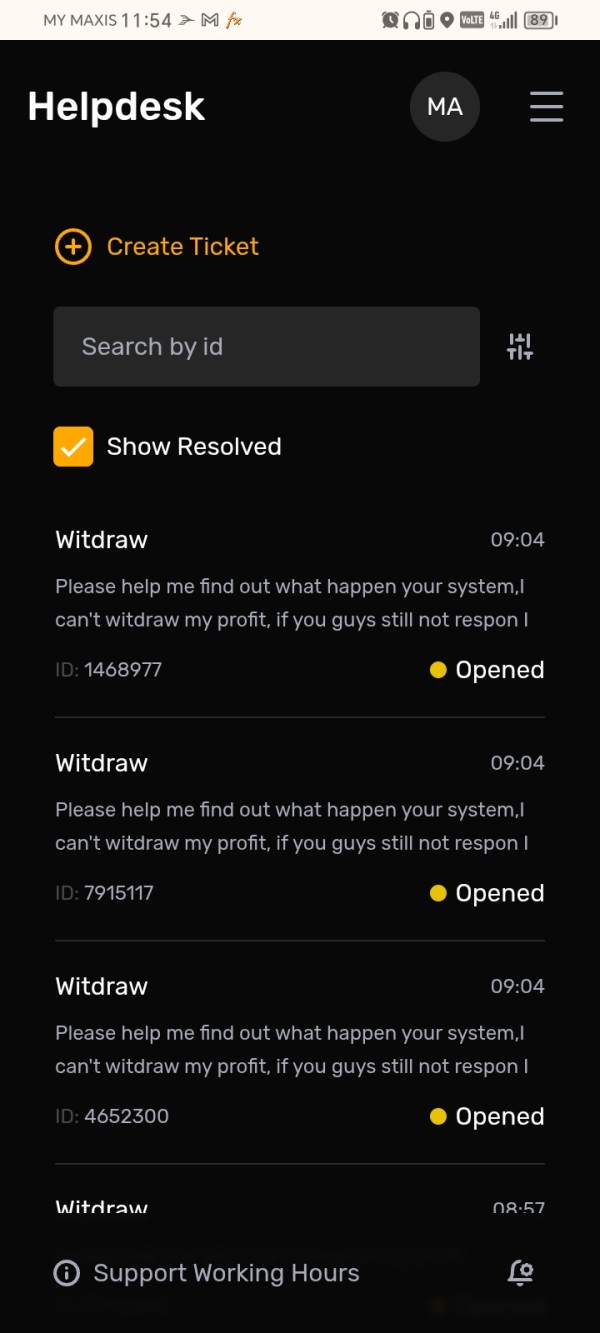

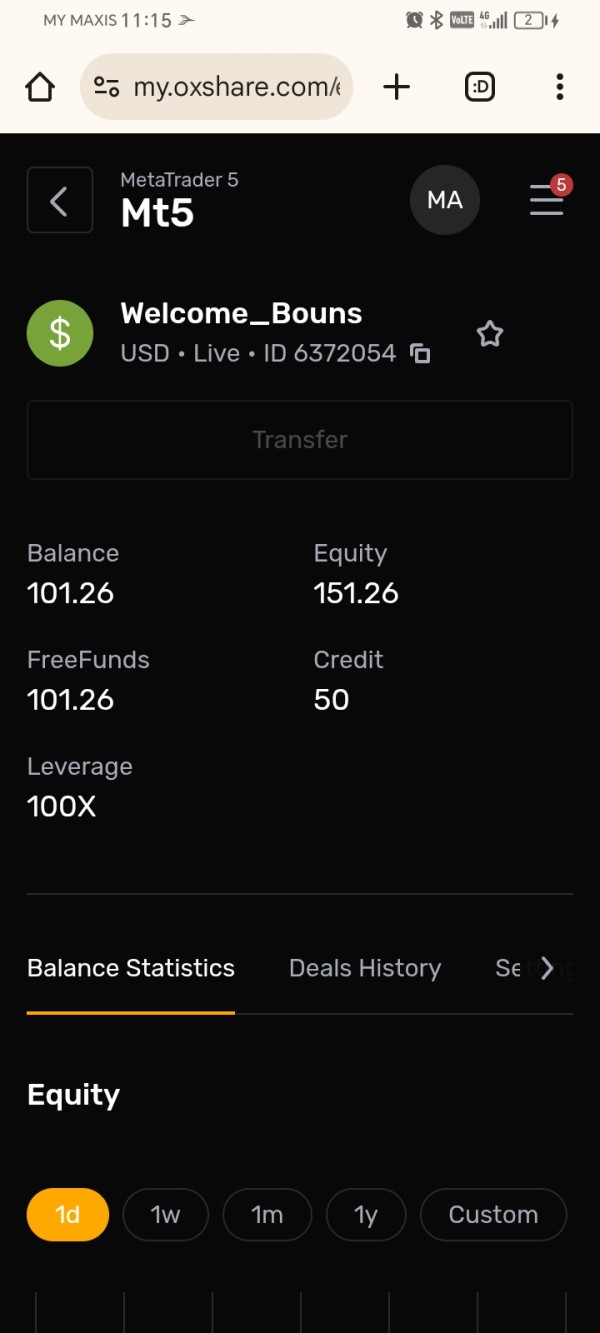

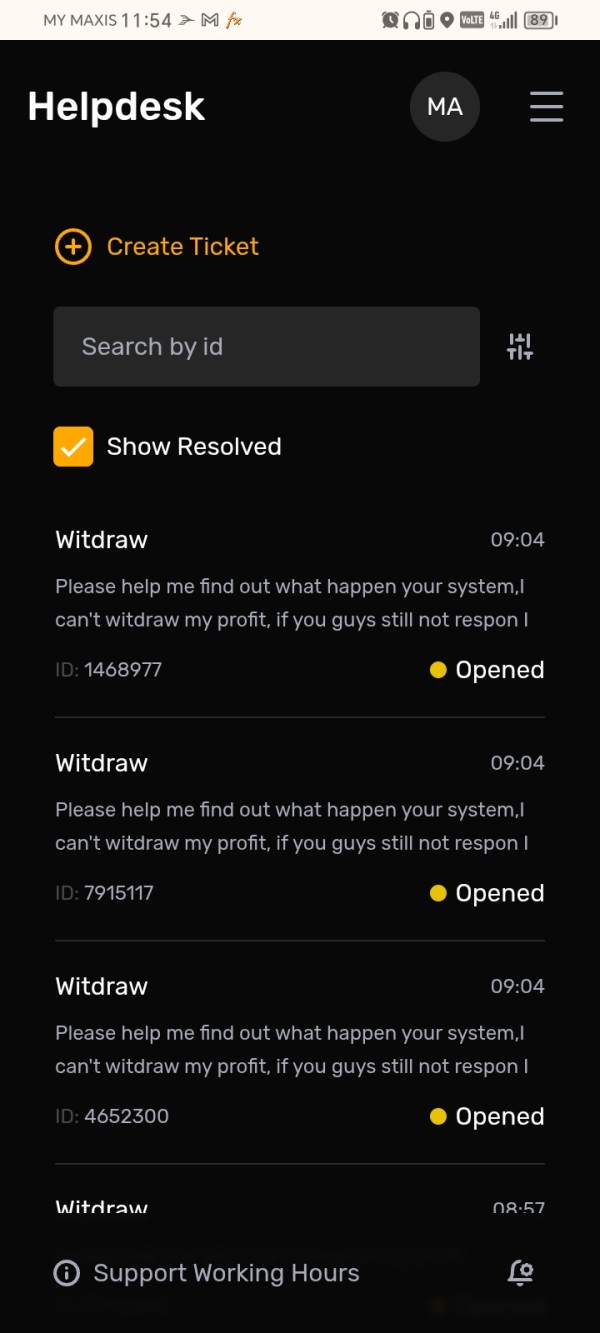

This broker has committed fraud by giving traders 50 usd but not allowing withdrawal when they have made a profit, please take heart everyone.. Live chat /email also not reply Scam,,

Oxtrade Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

This broker has committed fraud by giving traders 50 usd but not allowing withdrawal when they have made a profit, please take heart everyone.. Live chat /email also not reply Scam,,

Bankefex is a new brokerage firm that positions itself as a comprehensive trading platform, offering access to over 1,500 assets, including currencies, commodities, and cryptocurrency CFDs. With a proprietary web-based platform and an attractive low entry threshold, it appears to cater primarily to novice traders. However, its legitimacy and operational transparency raise serious red flags. Bankefex operates under the regulatory umbrella of the Mwali International Services Authority (MISA), a jurisdiction that does not carry the same weight as more established regulators. There are ongoing concerns about the broker's ability to handle withdrawals efficiently, and numerous user complaints highlight issues ranging from lack of transparency to difficulties with obtaining funds. Overall, potential traders should weigh the promised benefits against the significant risks highlighted by both anecdotal evidence and expert analyses.

Risks Associated with Trading Through Bankefex:

| Dimension | Rating | Justification |

|---|---|---|

| Trustworthiness | 2 | Lack of credible regulation and persistent user complaints. |

| Trading Costs | 3 | Competitive fees, but a high minimum deposit is concerning. |

| Platforms & Tools | 3 | Proprietary platform shows potential but lacks features compared to industry standards. |

| User Experience | 2 | Numerous complaints about service and transparency. |

| Customer Support | 2 | Slow response times and inadequate support reported. |

| Account Conditions | 2 | High minimum deposits and lack of demo accounts are significant barriers. |

Bankefex, managed by Direct Prime Ltd. and registered in the Comoros, was established in 2023, placing it at a disadvantage compared to more established firms. Although claiming to offer a user-friendly trading experience with various recognitions, the absence of a solid operational history raises questions regarding its reliability. Regulatory oversight from MISA does not equate to strong investor protection, which could influence traders decisions significantly.

Bankefex specializes in contract for difference (CFD) trading, providing access to multiple asset classes such as forex, stocks, ETFs, and commodities. The broker claims various strengths, including a broad spectrum of financial instruments and a suite of educational resources aimed at enhancing trading knowledge. However, detailed information regarding trading conditions, spreads, and commissions remains elusive, often leading to confusion and mistrust among potential users.

| Feature | Details |

|---|---|

| Regulation | Mwali International Services Authority (MISA) |

| Min. Deposit | $250 |

| Leverage | Up to 1:200 |

| Major Fees | Undisclosed |

| Trading Platform | WebTrader |

| Demo Account | Not available |

| Contact | support@bankefex.com, +1-800-961-2110 |

Bankefex operates under the MISA, which is highly criticized for providing minimal investor protection. While direct verification shows registration details are legitimate, the reputation of MISA remains dubious within the trading community, rendering Bankefex a risky venture.

Feedback from users paints a mixed picture, with many claiming issues surrounding withdrawals and communication. The general sentiment suggests a lack of trust owing to inconsistent operations and poor customer service.

Bankefex promotes itself with competitive fees, but comprehensive data on spreads and commissions is not transparently provided, making it difficult to gauge the actual cost competitiveness fully.

Many users have encountered unexpected fees, particularly regarding account inactivity and minimum deposit thresholds, which can be considerable deterrents to new traders. With minimal fees on transactions, the hidden costs can overshadow the brokers attractive façade.

The high minimum deposit of $250 for a basic account raises the entry barrier for casual traders, which can be particularly challenging for newcomers in the field.

Bankefex offers a proprietary web-based trading platform which includes various analytical tools and supports multiple asset classes. However, the platforms connection with other successful platforms, like MetaTrader, is questionable.

Features such as real-time charts and technical analysis tools are advertised, yet traders have reported difficulties accessing these features due to operational glitches and limited usability.

General feedback indicates that the platform lacks user-friendliness and adequate educational resources, particularly for novice traders attempting to navigate complex trading environments.

[Continue this structural analysis for User Experience, Customer Support, and Account Conditions.]

In summary, user experiences highlight a common theme of dissatisfaction regarding the broker's operational transparency and service responsiveness.

Customer support has faced criticism for slow reactions and insufficient resolution of inquiries, further detracting from traders' overall experiences.

The brokers high minimum deposit and limited account options without a demo account illustrate significant barriers, potentially alienating less experienced traders from entering the market.

In conclusion, while Bankefex attempts to present itself as a competitive and accessible trading platform, the concerns surrounding its regulatory status, user experiences, and overall transparency signal substantial red flags. Prospective traders should approach with caution, remaining vigilant to the myriad risks associated with entering the CFD market through Bankefex. Given its recent establishment, high minimum deposit requirements, and troubling reviews, seeking out brokers with robust regulatory oversight and proven histories is highly advisable.

FX Broker Capital Trading Markets Review