Lego Market 2025 Review: Everything You Need to Know

Executive Summary

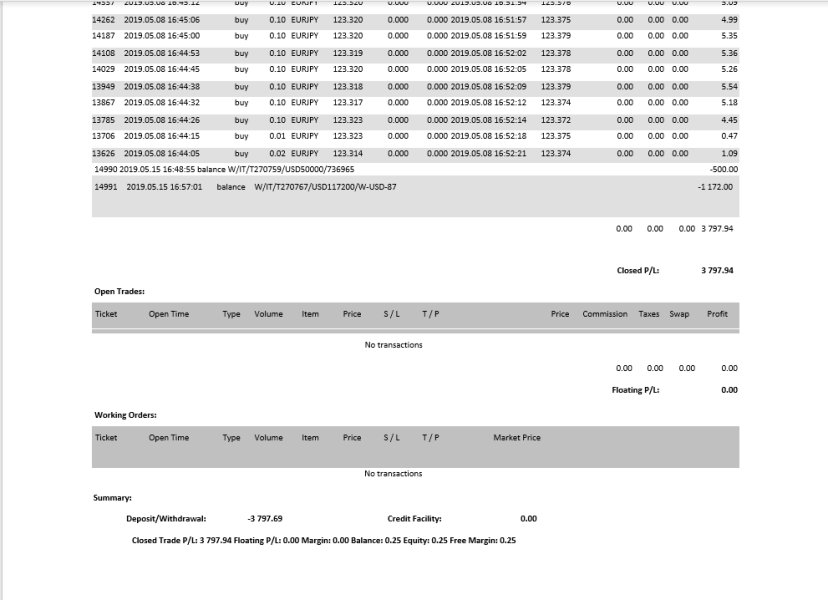

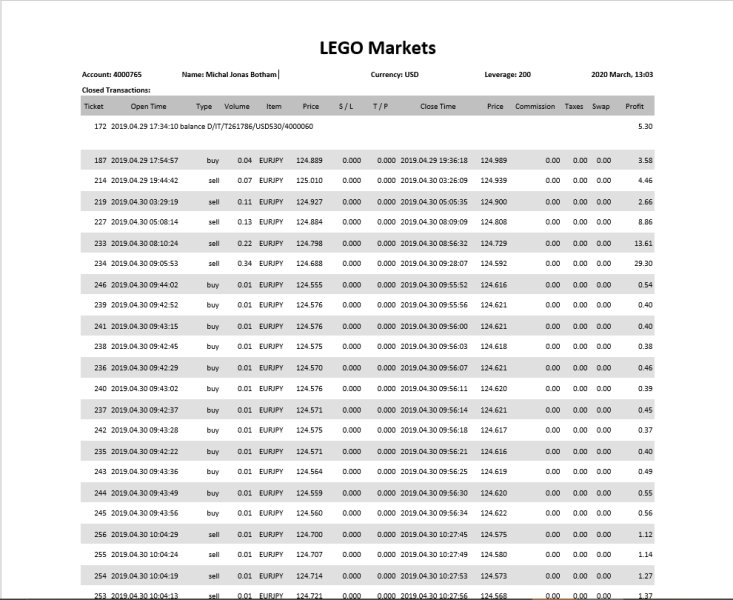

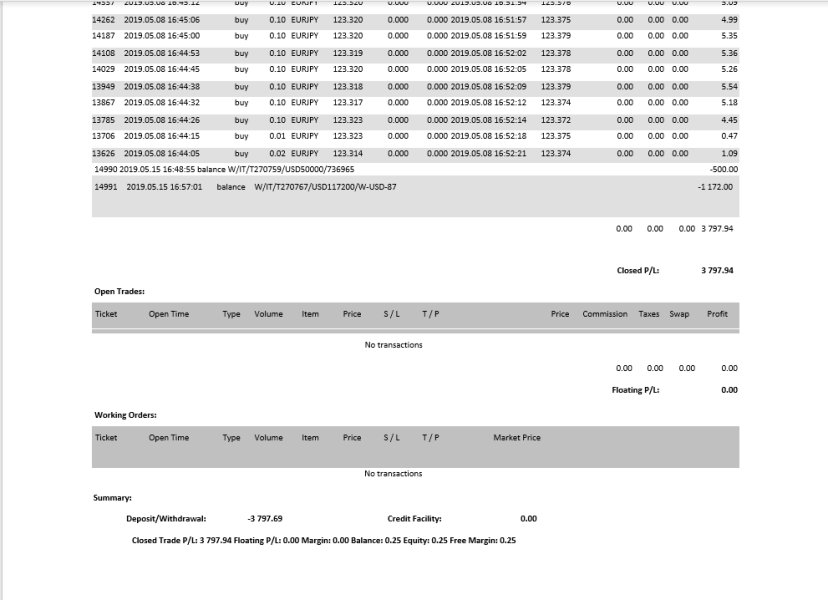

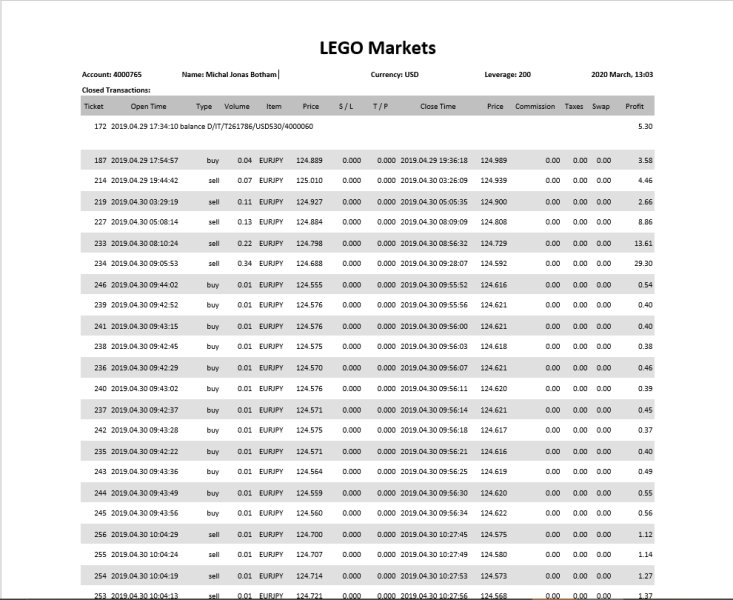

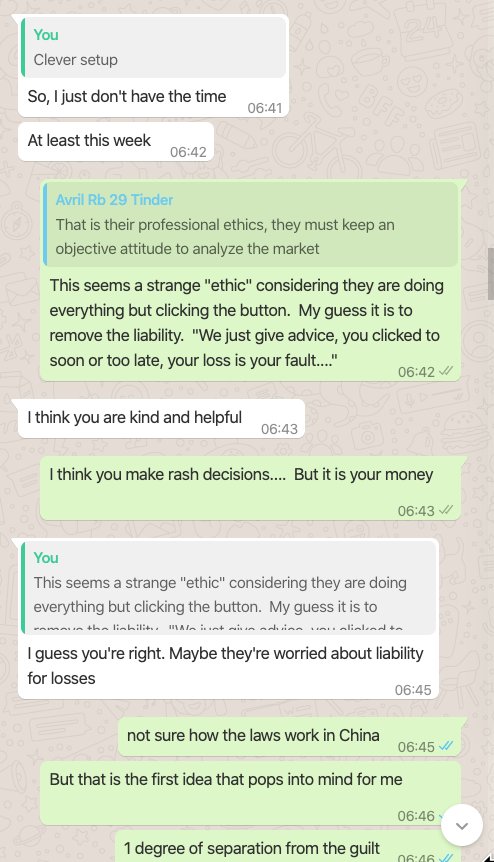

This Lego Market review reveals a controversial forex broker that has garnered significant negative attention in the trading community. Lego Market LLC was established in 2017 and is headquartered in Saint Vincent and the Grenadines. It operates as an unregulated forex and CFD broker, which immediately raises red flags for potential traders. The broker has a concerning user rating of 2.3 stars from 53 reviews. Most clients express dissatisfaction with their trading experience.

Despite offering a relatively low minimum deposit requirement of just $10 and providing access to the popular MT4 trading platform, Lego Market's unregulated status and numerous user complaints overshadow these potentially attractive features. The broker offers trading in forex, indices, and soft commodities such as coffee and sugar. It primarily targets small-scale investors who may be drawn to the low entry barrier, but the high volume of negative feedback and lack of regulatory oversight make this broker unsuitable for most traders seeking a reliable trading environment.

Important Notice

This review is based on publicly available information and user feedback collected from various sources. Readers should be aware that regulatory status and operational conditions may vary across different jurisdictions. Lego Market's regulatory framework may differ depending on your geographical location. Traders are strongly advised to verify the applicable laws and regulations in their respective countries before engaging with this broker.

The analysis presented in this review reflects information available at the time of writing and should be considered alongside current market conditions and regulatory updates. Due to the dynamic nature of the forex industry, some details may have changed since publication.

Rating Framework

Broker Overview

Lego Market LLC emerged in the forex trading landscape in 2017. It positioned itself as a provider of forex and CFD trading services, establishing operations from Saint Vincent and the Grenadines. The company has attempted to establish a presence in the competitive online trading market by offering access to popular financial instruments. However, according to Forex Peace Army and other review platforms, the broker has struggled to maintain a positive reputation among traders.

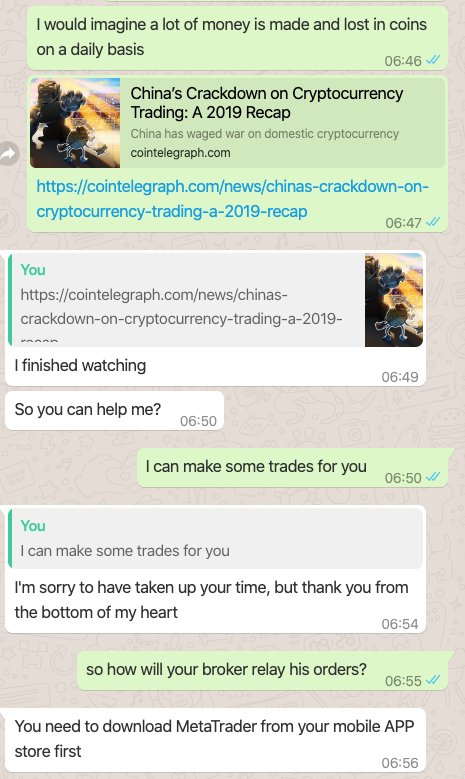

The company's business model centers around providing retail forex and CFD trading services through the widely recognized MetaTrader 4 platform. Lego Market targets primarily small-scale investors by maintaining a low minimum deposit requirement. This makes it theoretically accessible to beginners and those with limited capital, but the broker's operational approach has attracted significant criticism from the trading community.

Lego Market offers trading access to multiple asset classes including major and minor forex pairs, various stock indices, and soft commodities such as coffee and sugar futures. The broker provides both desktop and mobile trading solutions through MT4 and MT4 Mobile platforms. Despite these offerings, the lack of regulatory oversight and numerous user complaints have significantly impacted the broker's standing in the industry. Many review platforms categorize it among "Closed Brokers" or problematic service providers.

Regulatory Status: Available information indicates that Lego Market operates without proper regulatory oversight from recognized financial authorities. This poses significant risks for trader fund security and dispute resolution.

Minimum Deposit: The broker maintains a minimum deposit requirement of $10. This makes it one of the more accessible options for small-scale investors seeking to enter the forex market.

Trading Assets: Lego Market provides access to forex currency pairs, stock indices, and soft commodities including coffee and sugar contracts. The exact number of available instruments remains unclear from available sources.

Cost Structure: Specific information regarding spreads, commissions, and other trading costs is not detailed in available documentation. This itself raises transparency concerns for potential traders.

Trading Platforms: The broker offers MT4 and MT4 Mobile platforms. These provide traders with access to standard charting tools, technical indicators, and automated trading capabilities.

Leverage Ratios: Specific leverage information is not clearly disclosed in available materials. This represents another transparency issue for traders seeking to understand their potential exposure.

Promotional Offers: Information regarding bonus programs or promotional offers is not available in the reviewed sources.

Payment Methods: Specific details about deposit and withdrawal methods are not provided in the available documentation.

Geographic Restrictions: Information about regional trading restrictions or service availability limitations is not specified in the reviewed materials.

Customer Support Languages: Available sources indicate English language support. Additional language options are not confirmed.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

Lego Market's account conditions present a mixed picture that ultimately falls short of industry standards. The broker's primary attraction lies in its exceptionally low minimum deposit requirement of $10. This theoretically makes forex trading accessible to virtually anyone interested in entering the market, appealing to complete beginners or those looking to test trading strategies with minimal financial commitment.

However, the lack of detailed information about account types, features, and specific terms represents a significant transparency issue. Available sources do not provide clear details about different account tiers, their respective benefits, or any premium features that might be available to higher-deposit clients. The minimum trade size of 0.01 lots suggests micro-lot trading capability. This aligns with the low deposit requirement and small-scale trader focus.

According to user feedback compiled from various review platforms, the account opening process lacks clarity, and many traders report confusion about terms and conditions. The absence of detailed account specifications in promotional materials raises concerns about the broker's commitment to transparency. When compared to regulated competitors, Lego Market's account conditions appear underdeveloped and potentially problematic for serious traders seeking comprehensive trading solutions.

Lego Market's trading tools and resources offering centers primarily around the MetaTrader 4 platform. This provides a standard set of trading functionalities including basic charting capabilities, technical indicators, and automated trading support through Expert Advisors. The inclusion of MT4 Mobile extends trading accessibility to smartphones and tablets, allowing traders to monitor positions and execute trades on the go.

However, the broker's tool offering appears limited when compared to more comprehensive competitors. Available information does not indicate the presence of additional research tools, market analysis resources, or educational materials that could enhance the trading experience. The absence of proprietary trading tools or advanced analytical resources suggests a basic service offering. This may not meet the needs of more sophisticated traders.

User feedback regarding platform performance and tool effectiveness is generally mixed, with some traders noting basic functionality while others report technical issues. The lack of detailed information about additional tools, research capabilities, or educational resources in available documentation suggests that Lego Market's offering in this area is minimal. This is potentially inadequate for traders seeking comprehensive support.

Customer Service and Support Analysis (Score: 3/10)

Customer service represents one of Lego Market's most significant weaknesses, as evidenced by numerous negative user reviews and complaints. The high volume of user complaints documented across multiple review platforms indicates systemic issues with customer support responsiveness and effectiveness. Many traders report difficulties in reaching customer service representatives and unsatisfactory resolution of their concerns.

Available information does not provide specific details about customer service channels, operating hours, or response time commitments. This itself represents a service quality issue, as the lack of transparency regarding support availability and contact methods creates additional frustration for traders seeking assistance. User reviews frequently mention slow response times and unhelpful support interactions. This suggests inadequate staffing or training in the customer service department.

The broker's customer service challenges appear to be compounded by its unregulated status, which limits traders' recourse options when disputes arise. Without regulatory oversight, dissatisfied customers have fewer avenues for complaint resolution, making quality customer service even more critical. Unfortunately, based on available user feedback, Lego Market appears to fall significantly short in this crucial area.

Trading Experience Analysis (Score: 4/10)

The trading experience with Lego Market appears to be hampered by several significant issues, despite the provision of the familiar MT4 platform. User feedback suggests that platform stability may be inconsistent, with some traders reporting technical difficulties and connection issues that can impact trading effectiveness. The absence of detailed information about order execution quality, slippage rates, and fill rates makes it difficult to assess the technical trading environment.

The lack of transparency regarding spreads and commission structures creates uncertainty for traders trying to calculate their trading costs accurately. This information gap makes it challenging for traders to develop effective trading strategies or compare Lego Market's offering with competitors. The broker's unregulated status also raises questions about trade execution integrity and fair pricing practices.

Mobile trading through MT4 Mobile provides basic functionality, though specific user feedback about mobile platform performance is limited in available sources. The overall trading experience appears to be negatively impacted by the broker's operational issues and lack of regulatory oversight. This can create uncertainty and stress for active traders, and this Lego Market review indicates that while the platform infrastructure exists, the overall execution and reliability fall short of professional standards.

Trust and Safety Analysis (Score: 2/10)

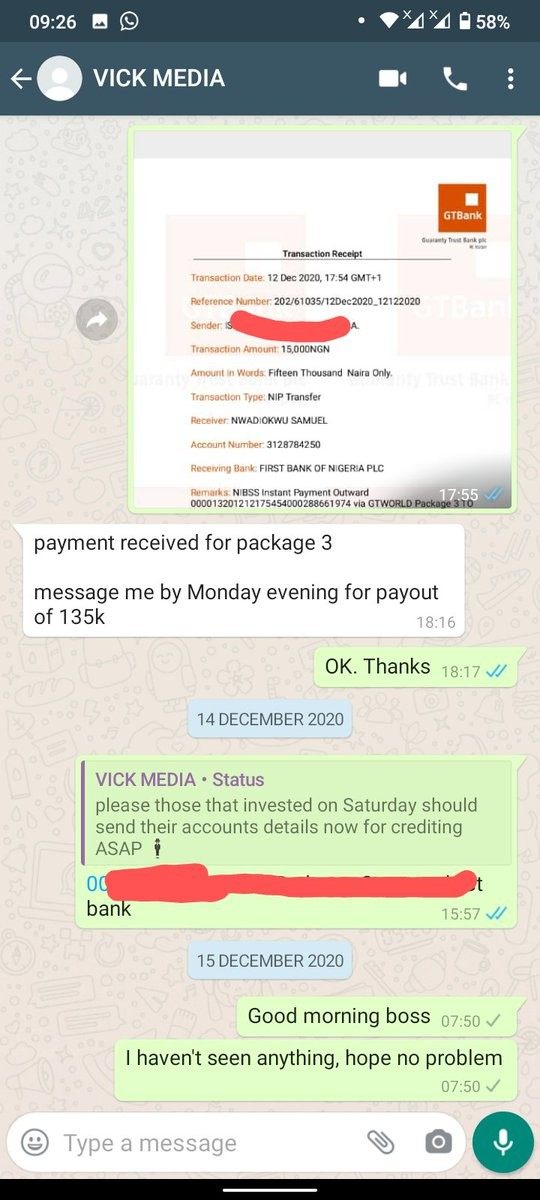

Trust and safety represent Lego Market's most critical weakness, with the broker's unregulated status serving as the primary concern for potential traders. Operating without oversight from recognized financial regulators means that client funds lack the protection typically provided by regulatory frameworks such as segregated accounts, compensation schemes, or dispute resolution mechanisms.

The broker's registration in Saint Vincent and the Grenadines, a jurisdiction known for minimal financial regulation, further compounds trust concerns. This regulatory environment provides limited protection for traders and minimal oversight of business practices. The absence of regulatory compliance requirements also means that standard industry practices for client fund protection may not be implemented or enforced.

User reviews consistently highlight trust issues, with many traders expressing concerns about fund security and withdrawal processes. The high number of negative reviews and complaints documented across multiple platforms suggests systemic operational problems that impact trader confidence. The lack of published financial statements, audit reports, or transparency regarding company operations further undermines trust in the broker's stability and integrity.

User Experience Analysis (Score: 3/10)

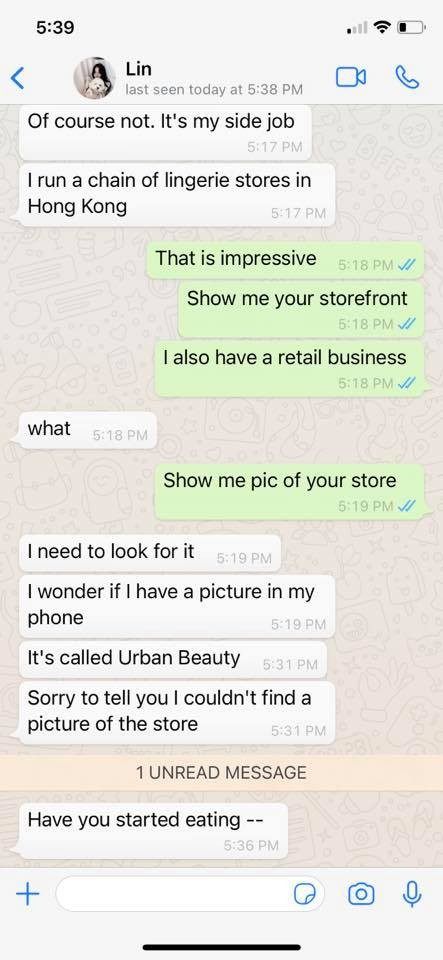

The overall user experience with Lego Market is predominantly negative, as reflected in the broker's 2.3-star rating from 53 reviews. User feedback consistently points to various operational issues that detract from a positive trading experience. Common complaints include difficulties with customer service, platform reliability issues, and concerns about fund security and withdrawal processes.

The broker's target demographic appears to be small-scale investors attracted by the low minimum deposit requirement. However, even traders with modest expectations report disappointment with the service quality and operational reliability. The lack of educational resources and comprehensive support materials also limits the experience for beginning traders who might benefit from additional guidance.

Interface design and platform usability appear to be standard MT4 implementations, though specific feedback about customization options or user interface enhancements is limited. The registration and account verification processes reportedly lack clarity, contributing to user frustration from the initial stages of the relationship. Overall user sentiment suggests that while the low entry barrier may attract initial interest, the subsequent experience fails to meet basic expectations for reliability and professionalism.

Conclusion

This comprehensive Lego Market review reveals a forex broker that fails to meet industry standards for safety, reliability, and customer service. While the broker's $10 minimum deposit requirement may initially attract small-scale investors, the significant risks associated with its unregulated status and poor user satisfaction ratings far outweigh this single advantage.

The broker may theoretically suit traders with very limited capital who are willing to accept substantial risks. Even this narrow demographic would be better served by regulated alternatives, as the combination of operational issues, poor customer service, and lack of regulatory protection makes Lego Market unsuitable for serious traders seeking a reliable trading environment.

The primary advantages include low minimum deposits and MT4 platform access, while the disadvantages encompass unregulated status, poor customer service, limited transparency, and consistently negative user feedback. Traders are strongly advised to consider regulated alternatives that provide better protection, transparency, and service quality for their trading activities.