YDFX 2025 Review: Everything You Need to Know

Executive Summary

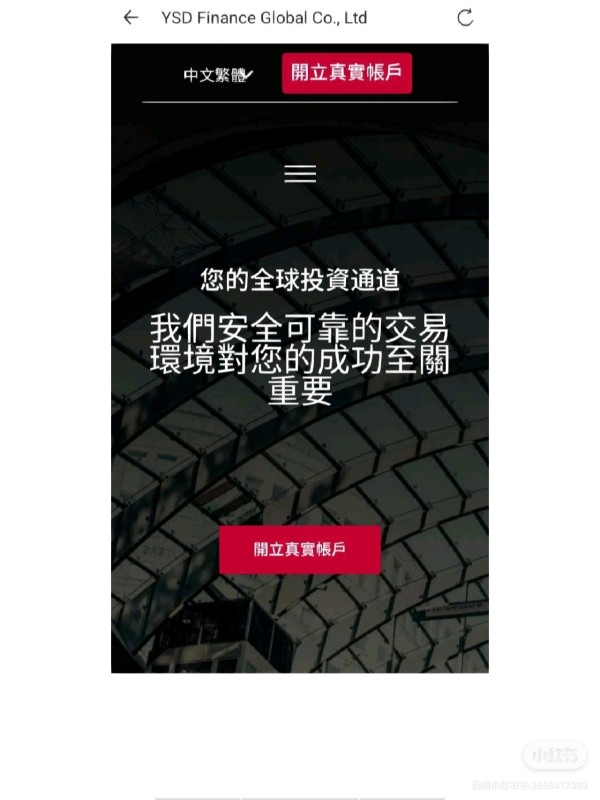

YDFX is a CFD broker that started in 2018. It offers different trading options across many types of investments. This ydfx review looks at a broker that gives access to over 160 trading products, including cryptocurrencies, forex, indices, stocks, and commodities. The platform uses the well-known MetaTrader 4 and MetaTrader 5 trading platforms. It positions itself as a complete solution for traders who want variety in their investment portfolios.

YDFX is a UK-based forex prime broker. It markets itself as providing multiple trading options spanning crypto, currencies, spot metals, and various other financial instruments. The broker highlights its cryptocurrency trading capabilities against USD on the MT4 platform and spot metals trading against major currencies. However, user feedback about the company's legitimacy shows mixed signals, with some concerns raised about regulatory transparency and overall trustworthiness.

The platform targets experienced traders who value product diversity. These traders are comfortable with the MT4/MT5 ecosystem. While YDFX offers an extensive range of trading instruments, potential users should carefully evaluate the regulatory framework and conduct thorough due diligence before committing funds.

Important Notice

YDFX has limited publicly available regulatory information. Trading experiences may vary significantly across different regions. Users should know that the broker's operational standards and legal compliance may differ depending on their geographical location and local financial regulations.

This review is based on available public information and user feedback. The evaluation does not include verification of regulatory documentation or independent testing of trading conditions. Prospective traders are strongly advised to conduct their own research and verify all claims independently before opening an account.

Rating Framework

Broker Overview

YDFX emerged in the forex trading landscape in 2018 as a UK-based CFD broker. It positions itself as a comprehensive trading solutions provider. The company operates as a forex prime broker, focusing on delivering multiple trading options across various asset classes including cryptocurrencies, traditional currencies, commodities, and financial derivatives. Since its establishment, YDFX has built its business model around providing traders with access to diverse markets through established trading platforms.

The broker's operational framework centers on CFD trading. It offers clients exposure to forex markets, cryptocurrency trading, precious metals, stocks, indices, and commodities. YDFX emphasizes its role as an intermediary that connects traders to global financial markets, leveraging technology to provide real-time access to over 160 different trading products. The company's business approach targets traders who value product diversity and seek a single platform for multiple asset class exposure.

YDFX uses the industry-standard MetaTrader 4 and MetaTrader 5 platforms as its primary trading infrastructure. These platforms provide traders with access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features. The broker offers trading across major asset categories including foreign exchange pairs, cryptocurrency against USD, spot metals trading against major currencies, equity indices, individual stocks, and various commodity markets. However, specific regulatory oversight details remain unclear in available public information, which represents a significant consideration for this ydfx review.

Regulatory Status: Available information does not specify particular regulatory authorities overseeing YDFX operations. This raises questions about compliance frameworks and investor protection measures.

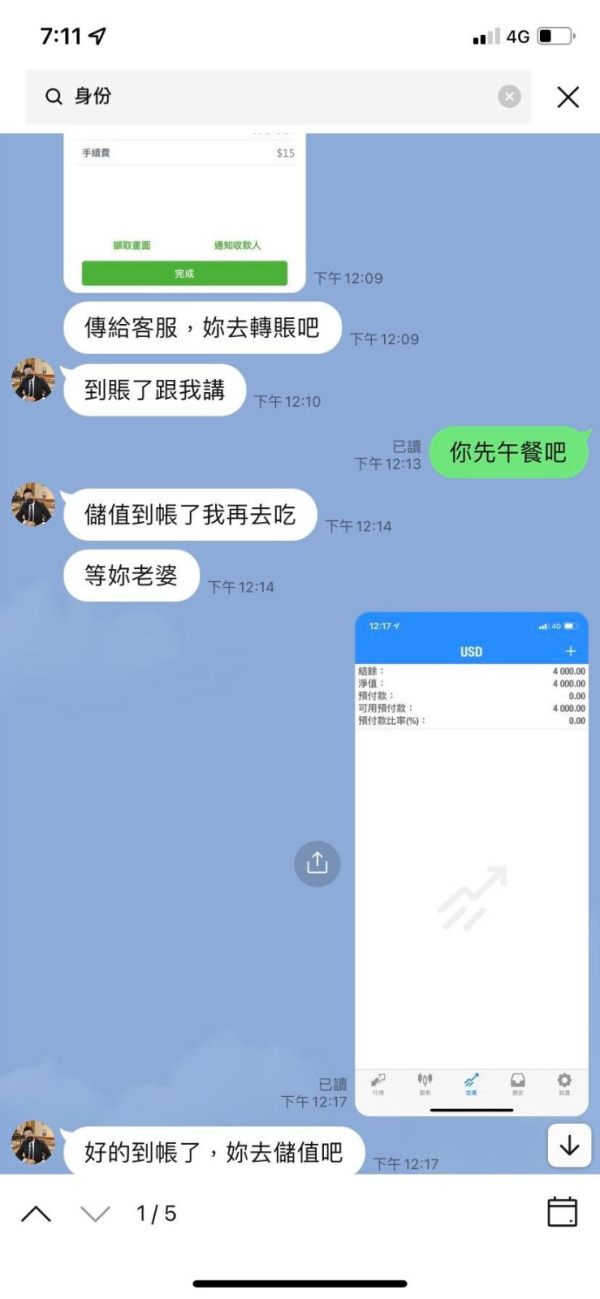

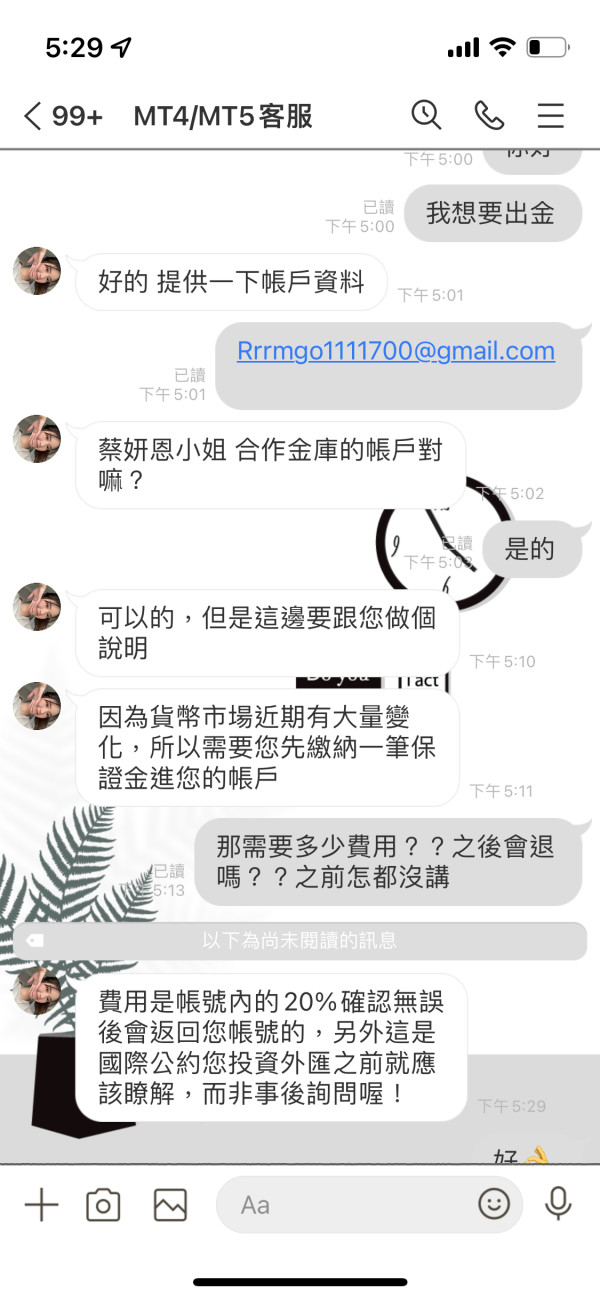

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not detailed in current available information. This requires direct inquiry with the broker for clarification.

Minimum Deposit Requirements: The broker has not publicly disclosed minimum deposit thresholds for account opening. This makes it difficult to assess accessibility for different trader segments.

Bonus and Promotional Offers: Current promotional activities, welcome bonuses, or ongoing incentive programs are not specified in available materials.

Tradeable Assets: YDFX provides access to foreign exchange pairs, cryptocurrency trading, CFDs on various instruments, precious metals, equity indices, individual stocks, and commodity markets. This totals over 160 different trading products.

Cost Structure: Detailed information about spreads, commission structures, overnight financing costs, and other trading fees is not readily available in public materials. This requires direct communication with the broker for specifics.

Leverage Ratios: Maximum leverage offerings and margin requirements across different asset classes are not specified in available information.

Platform Options: The broker exclusively offers MetaTrader 4 and MetaTrader 5 platforms. This provides traders with familiar and widely-used trading environments.

Geographic Restrictions: Specific countries or regions where services are restricted or unavailable are not clearly outlined in available materials.

Customer Support Languages: The range of languages supported for customer service is not specified in current information sources.

This ydfx review highlights the need for prospective traders to conduct direct inquiries to obtain comprehensive details about trading conditions and operational specifics.

Detailed Rating Analysis

Account Conditions Analysis

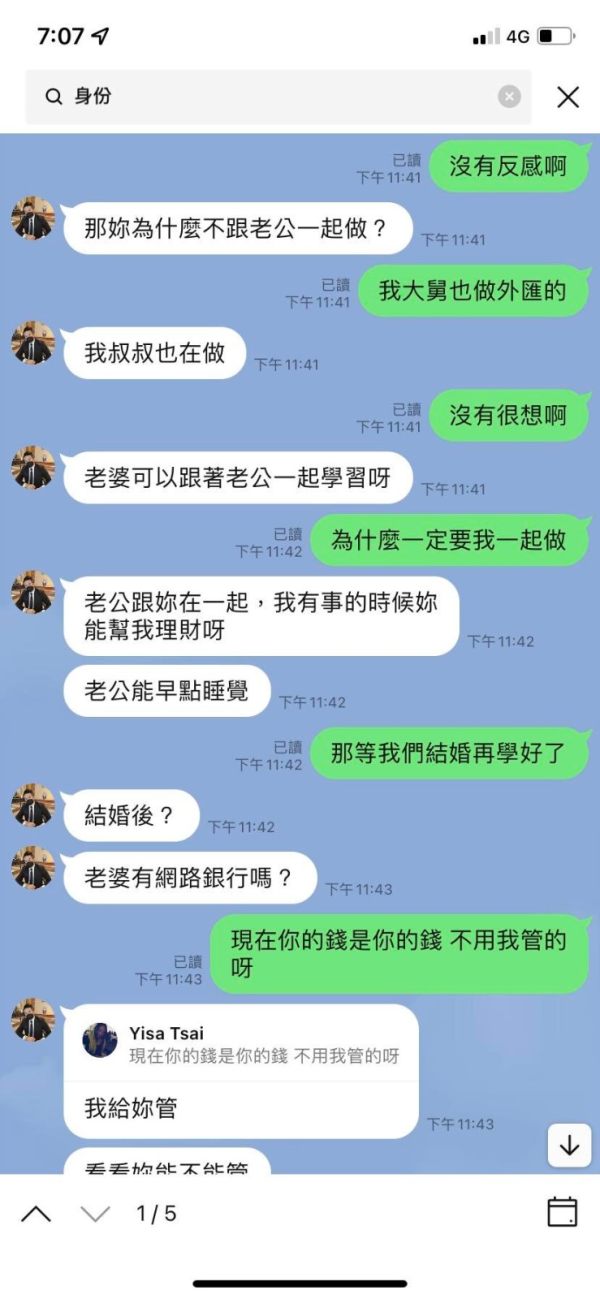

The evaluation of YDFX's account conditions faces significant limitations due to the absence of detailed information about account types, structures, and specific terms in available materials. Traditional forex brokers typically offer multiple account tiers designed for different trader segments, ranging from basic accounts for beginners to premium accounts for high-volume traders. However, YDFX has not publicly detailed its account classification system, making it impossible to assess the variety and appropriateness of available options.

Minimum deposit requirements represent a crucial factor for trader accessibility. This is particularly important for newcomers to forex trading. Unfortunately, specific deposit thresholds for account opening are not disclosed in available information, preventing potential users from understanding the financial commitment required to begin trading. Similarly, the account opening process, required documentation, verification timeframes, and any special account features such as Islamic accounts for Muslim traders are not specified in current materials.

The absence of clear account condition information raises concerns about transparency. It makes it difficult for traders to make informed decisions. Professional traders typically require detailed information about account specifications, including leverage options, margin requirements, and any account-specific benefits or restrictions. Without this fundamental information, prospective users cannot adequately compare YDFX's offerings with other brokers in the market.

This ydfx review emphasizes that potential traders should directly contact the broker to obtain comprehensive account condition details before making any commitment. The lack of readily available account information may indicate limited marketing transparency or suggest that the broker operates with less standardized account structures than typically expected in the retail forex industry.

YDFX demonstrates strength in its platform and tool offerings by providing access to both MetaTrader 4 and MetaTrader 5. These are two of the most widely recognized and respected trading platforms in the forex industry. These platforms offer comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and extensive customization options that cater to both novice and experienced traders.

The broker's commitment to offering over 160 different trading products across multiple asset classes represents a significant strength in terms of trading diversity. This extensive product range includes traditional forex pairs, cryptocurrency trading against USD, spot metals, indices, stocks, and commodities, providing traders with substantial opportunities for portfolio diversification and risk management across different market sectors.

MT4 and MT5 platforms come equipped with built-in technical indicators, drawing tools, multiple timeframe analysis capabilities, and support for custom indicators and automated trading strategies. The platforms also offer mobile trading applications, enabling traders to monitor positions and execute trades from anywhere with internet connectivity. However, specific information about additional research resources, market analysis tools, economic calendars, or educational materials provided by YDFX is not detailed in available information.

The absence of information about proprietary trading tools, research departments, daily market analysis, educational webinars, or trading tutorials represents a potential limitation. Modern traders often expect brokers to provide comprehensive educational resources and market insights to support their trading decisions. Without clear details about these supplementary resources, it's difficult to assess the full value proposition of YDFX's tool and resource offering beyond the standard MT4/MT5 functionality.

Customer Service and Support Analysis

The evaluation of YDFX's customer service and support capabilities is significantly hampered by the lack of specific information about support channels, availability, and service quality in available materials. Effective customer support represents a critical component of any forex broker's service offering, particularly for traders who may need assistance with technical issues, account management, or trading-related inquiries at various times throughout global trading sessions.

Professional forex brokers typically provide multiple contact methods including live chat, telephone support, email assistance, and sometimes dedicated account managers for high-volume traders. The availability of 24/5 or 24/7 support during market hours is often considered essential, given the global nature of forex trading and the need for immediate assistance during volatile market conditions. Unfortunately, YDFX has not publicly detailed its customer support infrastructure or availability schedules.

Response times for different inquiry types, the technical expertise of support staff, and the ability to resolve complex trading or platform-related issues are crucial factors that determine customer satisfaction. Additionally, multilingual support capabilities are important for international brokers serving diverse client bases. The absence of information about supported languages or regional support offices makes it difficult to assess YDFX's ability to serve traders from different geographic regions effectively.

The quality of customer service often reflects a broker's overall professionalism and commitment to client satisfaction. Without specific user testimonials, response time metrics, or detailed support channel information, potential traders cannot adequately evaluate whether YDFX provides the level of customer service support necessary for their trading activities. This information gap represents a significant consideration for traders who prioritize reliable customer support in their broker selection process.

Trading Experience Analysis

Assessing the trading experience provided by YDFX presents challenges due to limited specific user feedback and detailed performance metrics in available information sources. The trading experience encompasses multiple factors including platform stability, order execution speed, slippage frequency, requote occurrences, and overall system reliability during different market conditions, particularly during high-volatility periods when these factors become most critical.

Platform stability represents a fundamental requirement for successful forex trading. System downtime or connectivity issues can result in missed opportunities or unexpected losses. While YDFX utilizes the established MT4 and MT5 platforms, which generally offer reliable performance, the broker's server infrastructure, data feed quality, and technical maintenance standards directly impact the actual trading experience delivered to users.

Order execution quality, including the speed of trade processing and the accuracy of fill prices, significantly affects trading outcomes. This is especially true for scalpers and high-frequency traders. Factors such as slippage during news events, the occurrence of requotes, and the consistency of spread pricing during different market sessions are crucial performance indicators. Unfortunately, specific user feedback about these execution characteristics is not detailed in available information.

The mobile trading experience, including app functionality, synchronization with desktop platforms, and the reliability of mobile order execution, has become increasingly important as traders seek flexibility in their trading activities. Additionally, the availability of advanced order types, partial fill capabilities, and sophisticated risk management tools affects the overall trading experience quality.

This ydfx review notes that without comprehensive user testimonials or independent testing data about trading conditions, potential users cannot adequately assess whether YDFX provides the execution quality and platform reliability necessary for their specific trading strategies and requirements.

Trust and Reliability Analysis

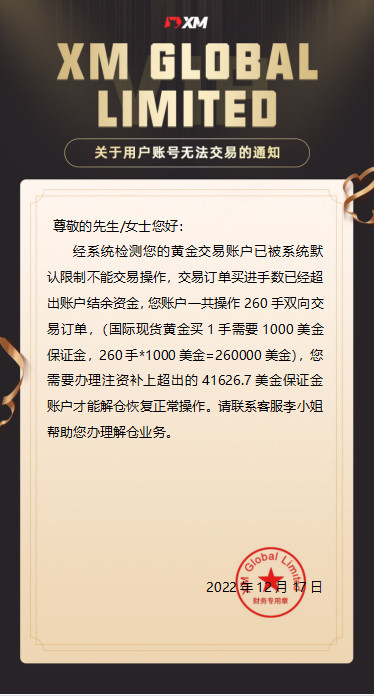

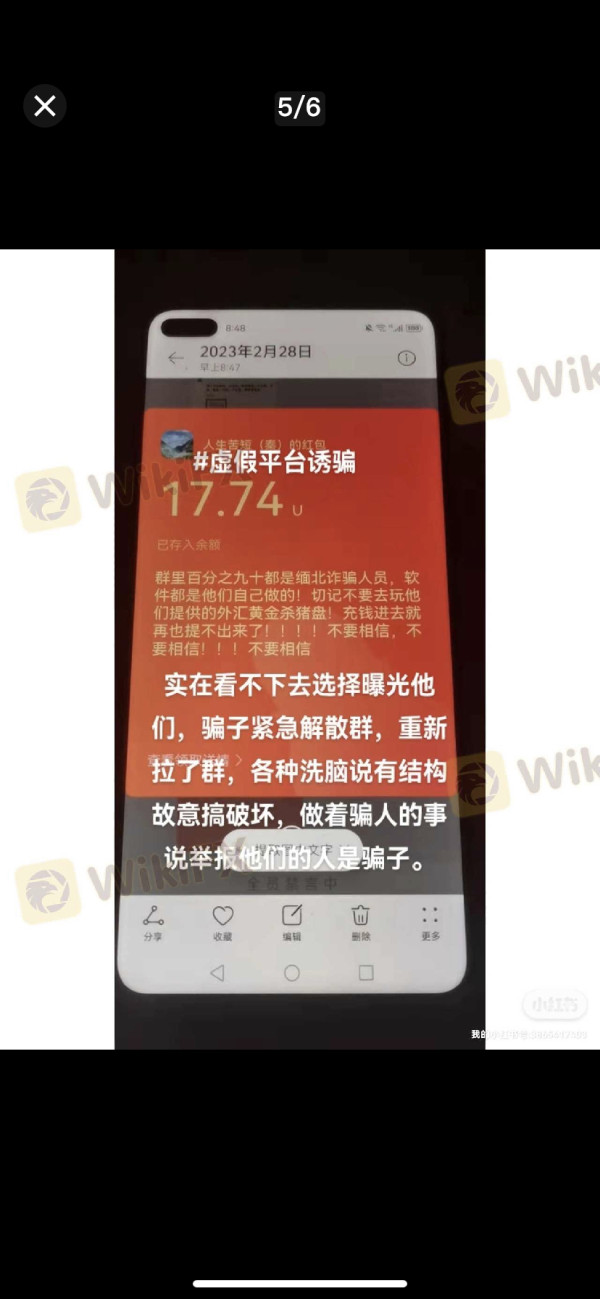

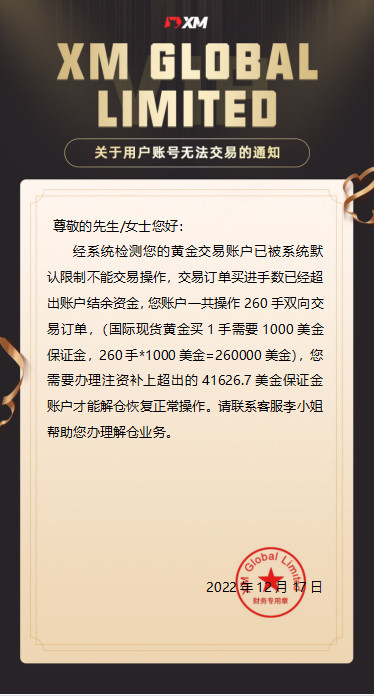

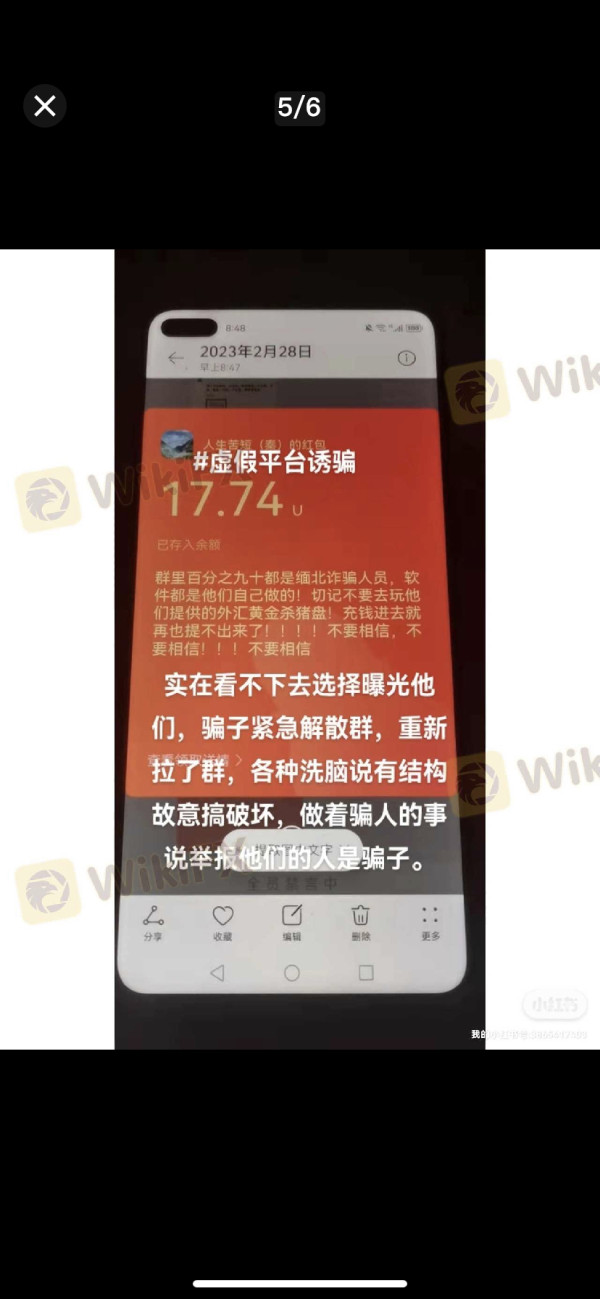

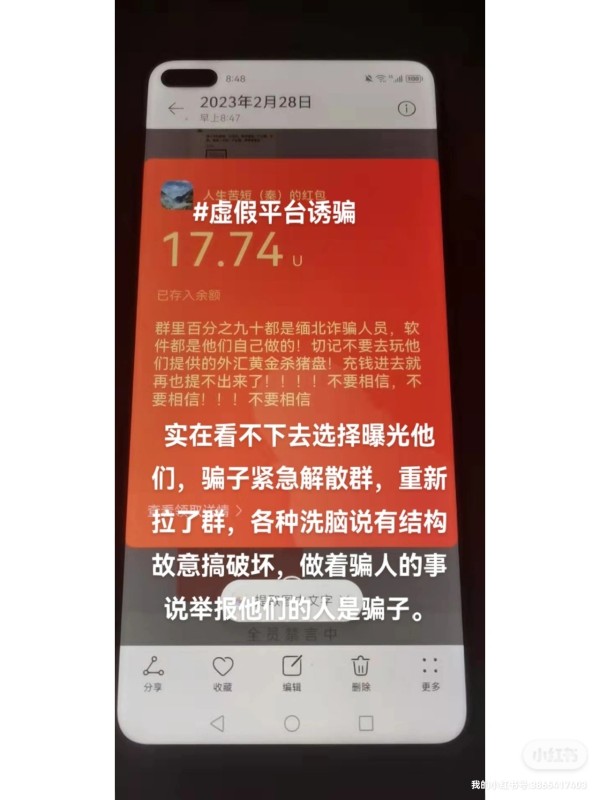

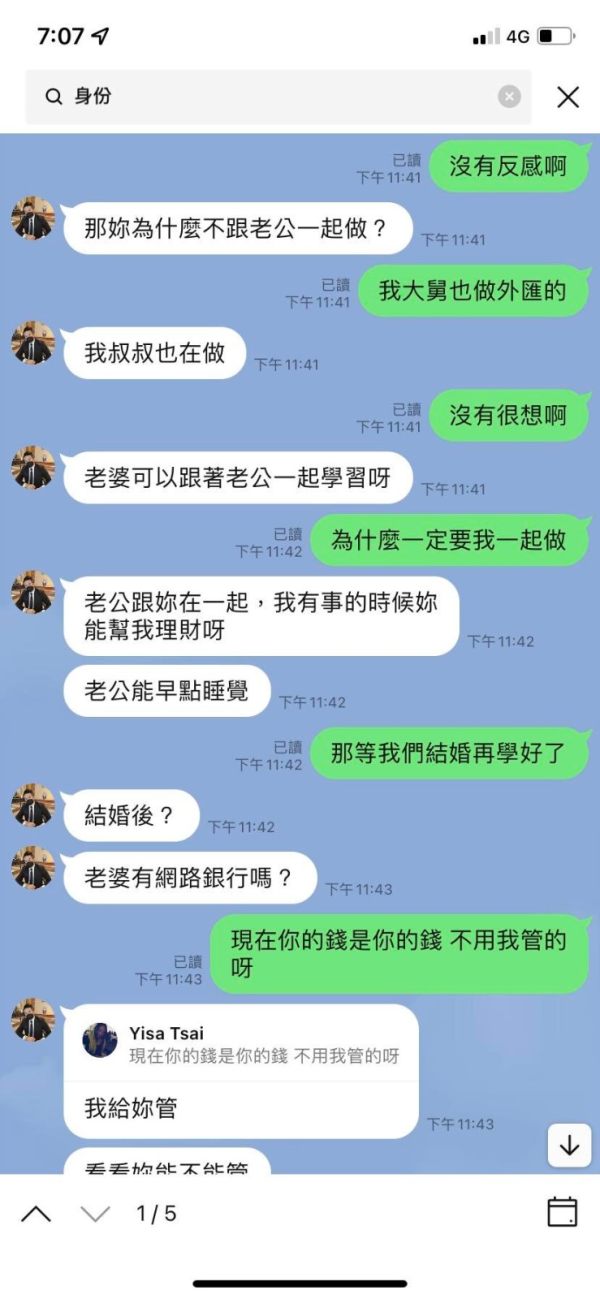

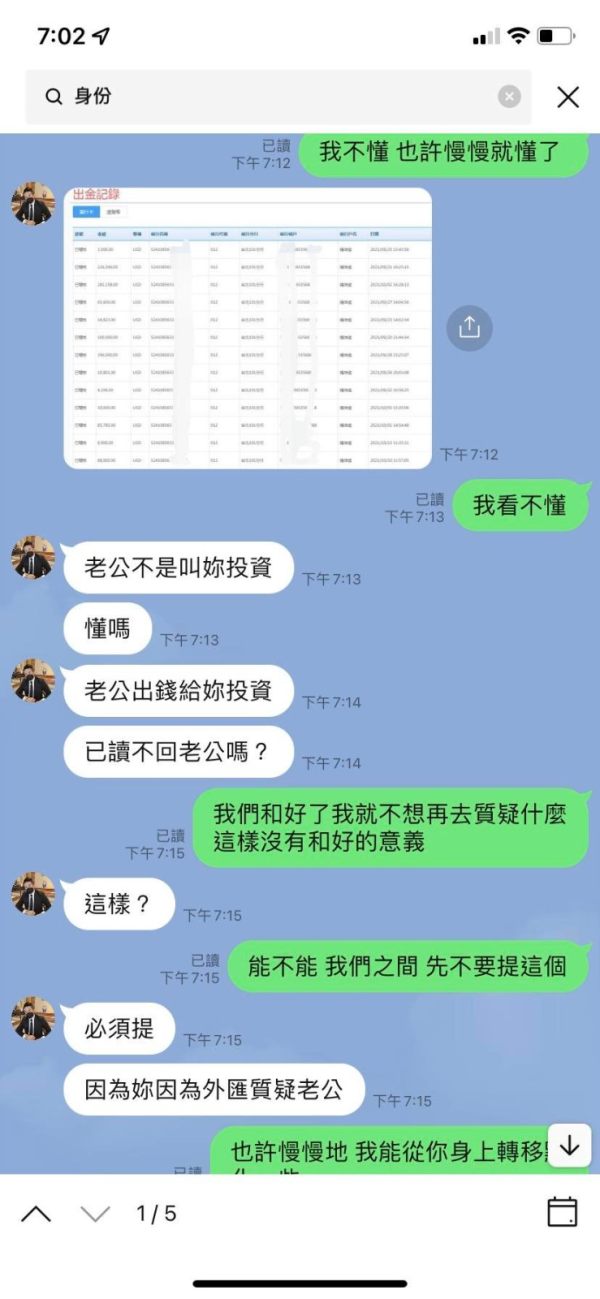

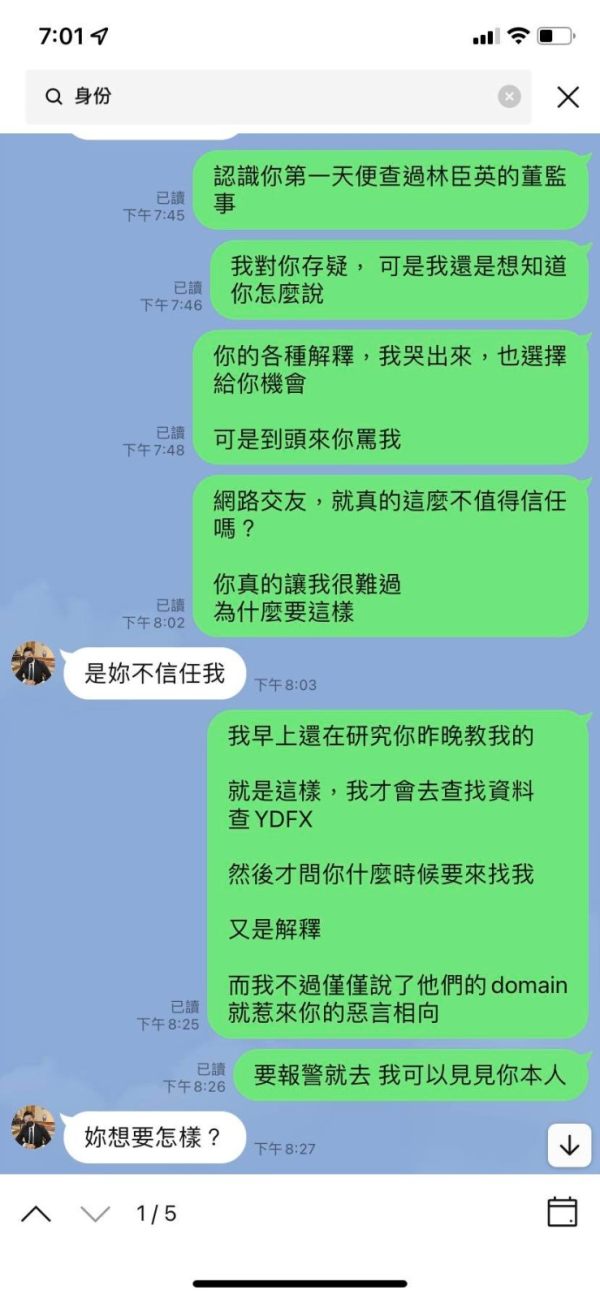

The trust and reliability assessment of YDFX reveals significant concerns that potential traders must carefully consider before engaging with the broker. The most prominent issue identified is the absence of clear regulatory information and oversight details, which represents a fundamental red flag in the forex industry where regulatory compliance serves as the primary protection mechanism for trader funds and interests.

Legitimate forex brokers typically operate under the supervision of recognized financial regulatory authorities such as the FCA, CySEC, ASIC, or other established regulatory bodies. These regulators impose strict capital requirements, operational standards, and client fund protection measures including segregated account requirements and compensation schemes. The lack of specific regulatory information about YDFX raises questions about investor protection and compliance with international financial standards.

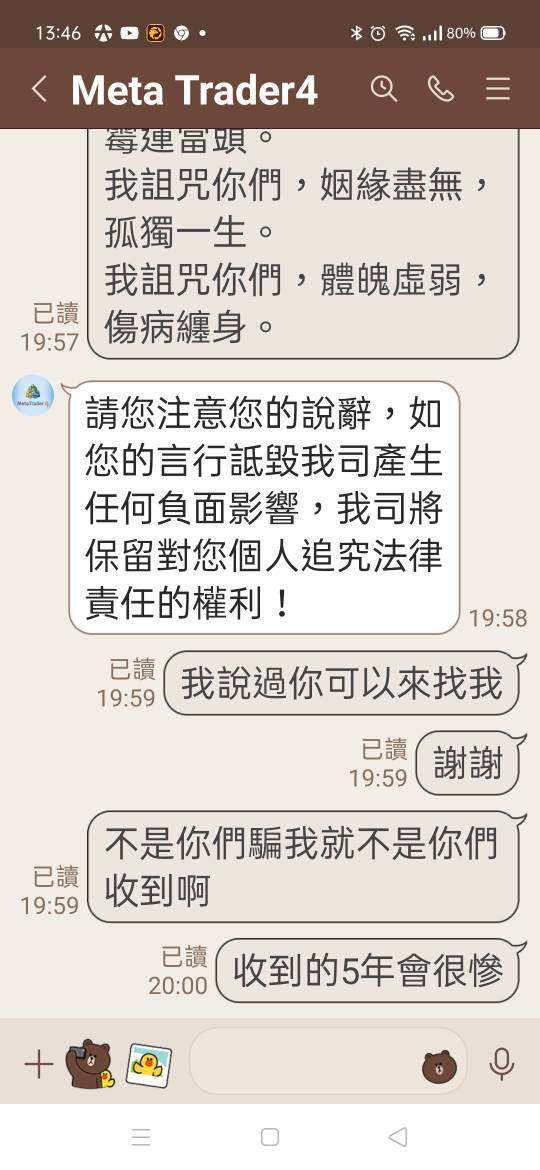

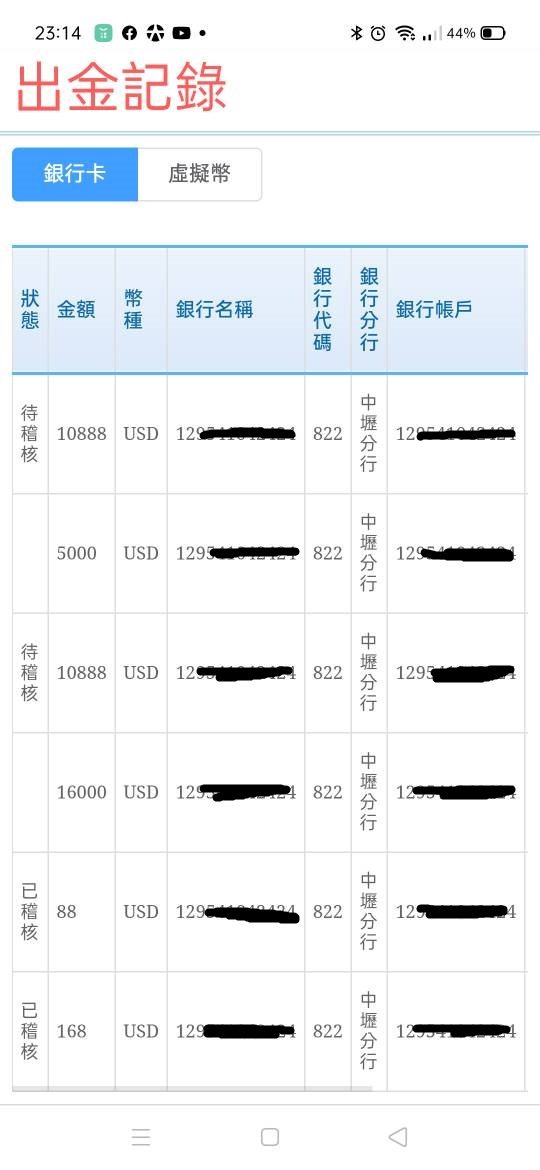

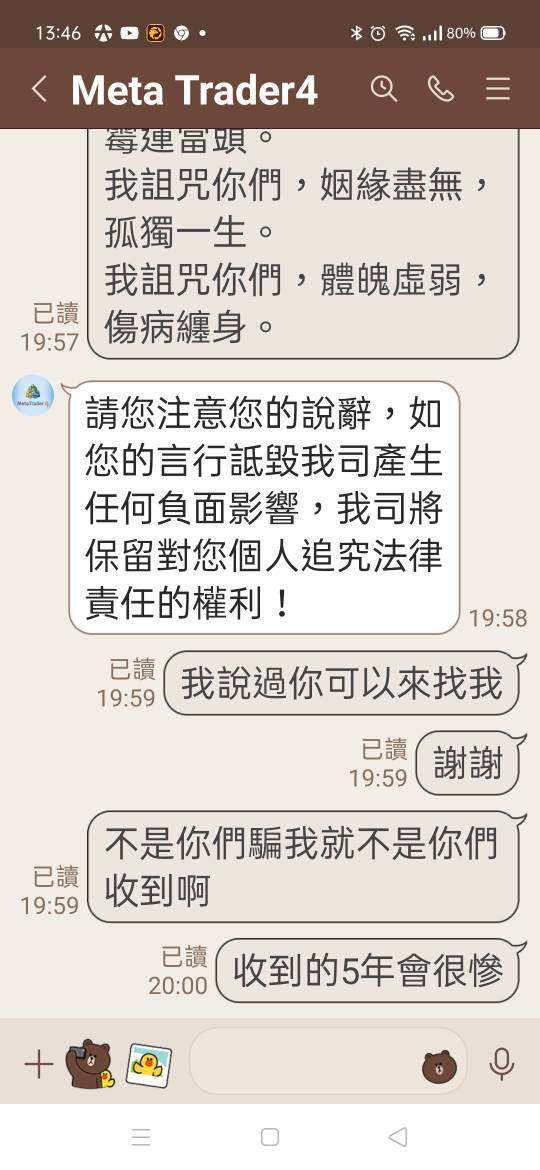

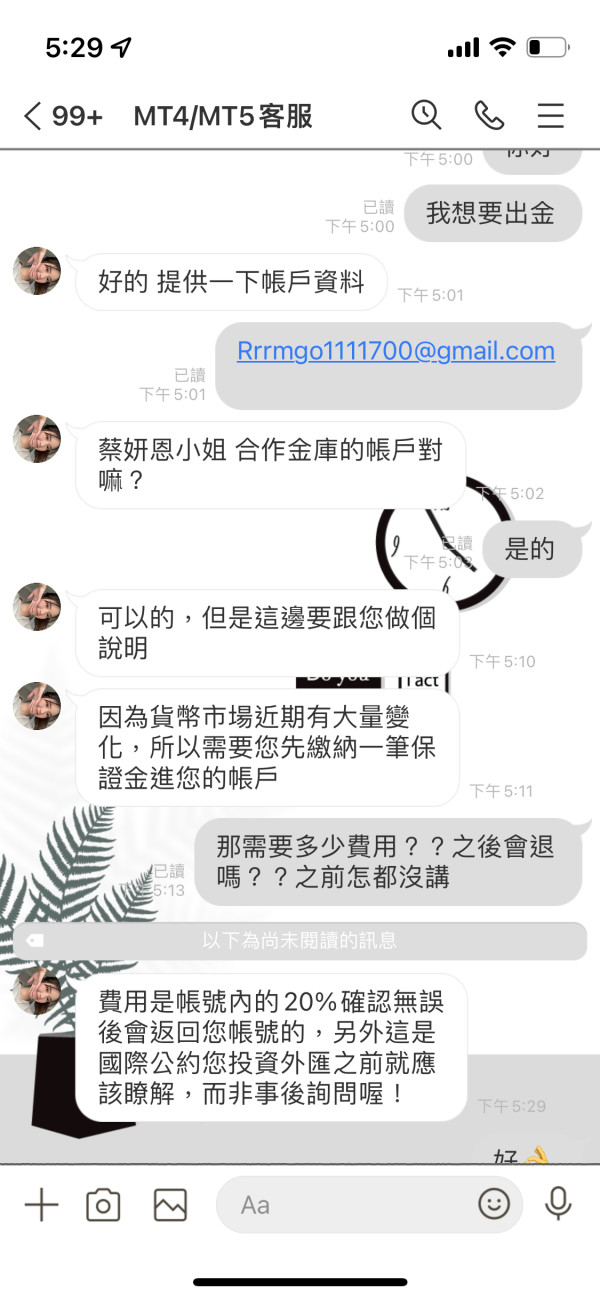

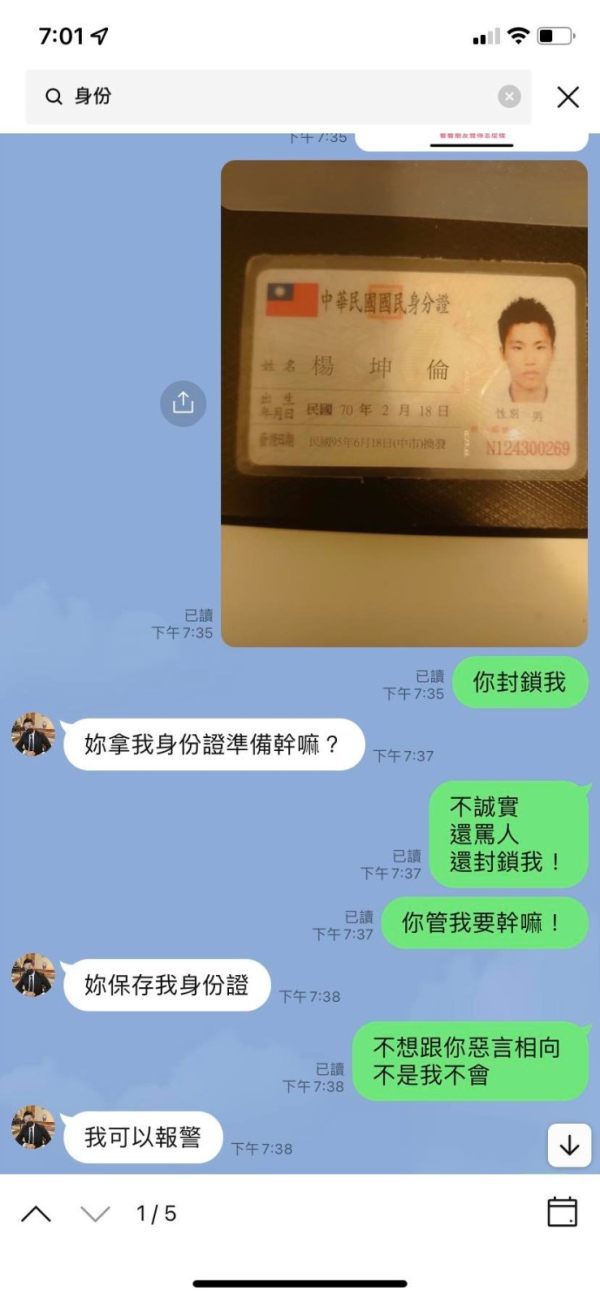

User concerns about the company's legitimacy, as noted in available information, further compound trust-related issues. In the forex industry, where broker reliability directly impacts trader fund security, any questions about legitimacy represent serious considerations that require thorough investigation. The absence of transparent company information, regulatory licensing details, and clear operational frameworks contributes to uncertainty about the broker's credibility.

Additional trust factors typically include company financial statements, audit reports, regulatory compliance history, and industry recognition or awards. Professional forex brokers often provide detailed company information, regulatory licensing numbers, and clear terms of service that outline client protections and dispute resolution procedures. The limited availability of such information about YDFX suggests potential transparency issues that could affect long-term reliability and trustworthiness for serious traders seeking secure trading environments.

User Experience Analysis

The comprehensive evaluation of YDFX's user experience faces significant limitations due to the absence of detailed user feedback, satisfaction surveys, and specific usability assessments in available information sources. User experience in forex trading encompasses multiple touchpoints including account registration processes, platform navigation, educational resources, customer service interactions, and fund management procedures, all of which contribute to overall trader satisfaction and retention.

The registration and account verification process represents the first significant user interaction with any forex broker. Efficient, secure, and user-friendly onboarding procedures set expectations for the overall service quality. Modern traders expect streamlined digital processes with clear documentation requirements, reasonable verification timeframes, and transparent communication throughout the account opening process. Unfortunately, specific details about YDFX's registration procedures and user experience are not available in current information sources.

Platform usability, including interface design, navigation logic, and feature accessibility, significantly impacts daily trading activities. While YDFX offers MT4 and MT5 platforms, which generally provide familiar interfaces for experienced traders, the broker's implementation, customization options, and any proprietary enhancements affect the actual user experience. Additionally, the quality of platform tutorials, user guides, and technical support for platform-related issues influences user satisfaction.

Based on available information, YDFX appears to target experienced traders seeking diverse trading products. This suggests that the platform may be optimized for users familiar with CFD trading and multiple asset classes. However, without specific user testimonials, satisfaction ratings, or detailed feedback about common user challenges, it's impossible to assess whether the actual user experience aligns with the needs and expectations of this target demographic.

The absence of comprehensive user experience data represents a significant information gap that potential traders should address through direct platform testing or trial accounts before committing significant funds to trading activities.

Conclusion

YDFX presents itself as a CFD broker offering diverse trading opportunities across multiple asset classes through established MT4 and MT5 platforms. While the broker provides access to over 160 trading products including cryptocurrencies, forex, and commodities, significant concerns about regulatory transparency and legitimacy overshadow these potential benefits.

The broker appears most suitable for experienced traders who value product diversity. These traders are comfortable with the inherent risks associated with less transparent operational frameworks. However, the absence of clear regulatory oversight, limited publicly available information about trading conditions, and user concerns about legitimacy make YDFX a questionable choice for traders prioritizing security and regulatory protection.

The main advantages include extensive product offerings and utilization of industry-standard trading platforms. The primary disadvantages center on regulatory uncertainty, limited transparency, and questions about overall trustworthiness. Potential users should exercise extreme caution and conduct thorough due diligence before considering YDFX for their trading activities.