Is YDFX safe?

Business

License

Is YDFX A Scam?

Introduction

YDFX is a forex broker that has emerged in the trading landscape, offering various financial instruments including forex pairs, commodities, and CFDs. As the forex market continues to grow, traders are increasingly cautious about selecting brokers that are not only reliable but also regulated. The importance of assessing a broker's legitimacy cannot be overstated, as traders risk their capital when engaging with unregulated entities. This article aims to provide a thorough evaluation of YDFX, focusing on its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our analysis is based on a comprehensive review of available online resources, including user feedback and regulatory reports.

Regulation and Legitimacy

The regulatory environment is crucial for any forex broker, as it signifies the level of oversight and protection provided to traders. YDFX has been flagged by the National Futures Association (NFA) as "unauthorized," which raises significant concerns regarding its legitimacy. Below is a summary of YDFX's regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| National Futures Association (NFA) | N/A | United States | Unauthorized |

The absence of a valid regulatory license is a red flag for potential investors. Regulatory bodies are essential for maintaining market integrity, ensuring that brokers adhere to strict operational standards. The NFA's classification of YDFX as unauthorized suggests that traders may not receive the protections typically afforded by regulated brokers, such as segregated accounts or investor compensation schemes. Furthermore, the lack of transparency regarding YDFX's regulatory compliance raises questions about its operational practices and accountability.

Company Background Investigation

YDFX operates under the name YDFX Global Limited, with reported offices in various locations, including the United States and Canada. However, the company's ownership structure and history remain somewhat opaque. There is limited information available regarding the management team and their professional backgrounds, which further complicates the assessment of the broker's reliability. Transparency is a vital aspect of a trustworthy brokerage; the lack of publicly available information about YDFX's leadership and corporate governance raises concerns about its credibility. Investors should be wary of companies that do not disclose essential operational details, as this can indicate a lack of accountability.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is paramount. YDFX offers various trading instruments, but the associated costs and fees are critical factors to consider. The broker supports the widely-used MetaTrader 4 platform, which is known for its user-friendly interface. However, traders should be aware of the following costs associated with YDFX:

| Fee Type | YDFX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Varies (not disclosed) | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Varies | Varies |

The lack of transparency regarding spreads and commissions can be concerning for traders. While many reputable brokers provide a clear breakdown of their fees, YDFX's vague cost structure may lead to unexpected expenses. Traders should exercise caution and conduct thorough research before engaging with YDFX to ensure they fully understand the potential costs involved.

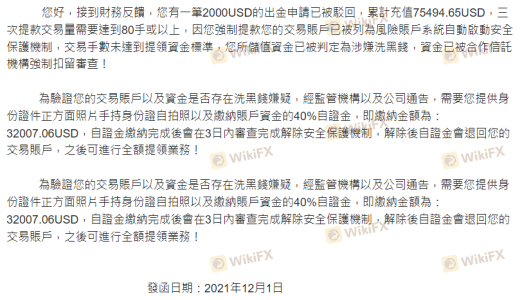

Client Fund Safety

The safety of client funds is a critical aspect of any trading platform. YDFX's approach to fund security is questionable, particularly given its unauthorized status with the NFA. The lack of information regarding fund segregation and investor protection measures raises significant concerns. Without proper safeguards, clients may be at risk of losing their funds in the event of financial instability or operational issues within the brokerage. Historical incidents of fund mismanagement or disputes can further exacerbate these risks, making it crucial for traders to thoroughly assess the safety measures in place before depositing their capital.

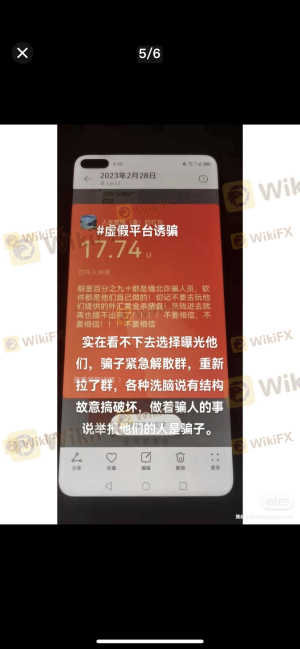

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's operational integrity. Reports indicate that YDFX has received a number of complaints regarding withdrawal issues and overall customer service. Below is a summary of common complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

| Transparency Issues | High | Poor |

Many users have reported difficulties in withdrawing their funds, which is a significant red flag for any trading platform. The quality of customer support has also been criticized, with many clients expressing frustration over response times and the effectiveness of the assistance provided. Such complaints can indicate systemic issues within the brokerage and should be taken seriously by potential investors.

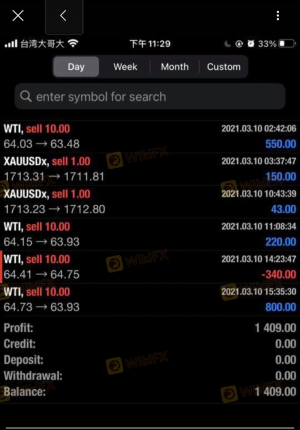

Platform and Execution

The performance of a trading platform is essential for a seamless trading experience. YDFX claims to offer a stable trading environment via the MetaTrader 4 platform. However, users have reported issues related to order execution, including slippage and order rejections. These problems can significantly impact trading outcomes, particularly for those employing high-frequency trading strategies. Signs of potential platform manipulation or instability should be carefully monitored, as they can compromise the integrity of the trading experience.

Risk Assessment

Engaging with YDFX presents several risks that potential investors should consider. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unauthorized status with NFA |

| Fund Safety Risk | High | Lack of transparency in fund management |

| Customer Service Risk | Medium | Reports of poor support and unresolved complaints |

| Execution Risk | Medium | Issues with order execution and potential slippage |

To mitigate these risks, traders should conduct thorough due diligence, consider using smaller amounts for initial deposits, and be prepared for the possibility of encountering operational issues. Engaging with regulated brokers may provide a safer alternative for those looking to invest in the forex market.

Conclusion and Recommendations

In conclusion, the evidence suggests that YDFX presents a range of risks that potential investors should carefully consider. The broker's unauthorized status, coupled with reports of withdrawal issues and poor customer service, raises significant concerns about its legitimacy. While YDFX may offer attractive trading conditions, the potential for fraud and operational instability cannot be overlooked.

For traders seeking a reliable and secure trading environment, it is advisable to explore alternative options with established regulatory oversight. Brokers such as [insert reputable broker names] offer a more transparent and secure trading experience, ensuring that investors can trade with confidence. As always, traders should remain vigilant and conduct thorough research before committing their funds to any broker, especially when assessing whether YDFX is safe or potentially a scam.

Is YDFX a scam, or is it legit?

The latest exposure and evaluation content of YDFX brokers.

YDFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

YDFX latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.