Richness 2025 Review: Everything You Need to Know

Executive Summary

This richness review looks at a broker that lacks clear public information about its rules, trading terms, and how it works. Our review stays neutral because we don't have enough clear facts about key areas of operation. The broker seems to focus on retail investors and new forex traders, but we can't tell what specific services they offer or what makes them better than others. The name "richness" might make people think of money and growth, but we can't find solid proof of regulatory compliance, trading infrastructure, or client protection measures in available documents.

This richness review tries to give traders an honest look based on what information we can find right now. We want to show both the possible opportunities and the big information gaps that potential clients should think about before choosing this broker. Without more transparency, traders face significant uncertainty about the broker's reliability and safety standards.

Important Notice

Our way of evaluating this richness review uses public information, industry standards, and comparisons with established forex brokers. Because the broker provides limited regulatory information and operational transparency, readers should be extra careful when thinking about this platform.

The assessment here shows the current state of available information and may not represent the complete picture of how the broker operates. We strongly recommend that potential clients do their own checking of regulatory status and trading conditions before opening any trading accounts. This review does not give investment advice, and traders should consider their risk tolerance and regulatory preferences when picking a forex broker.

Rating Framework

Broker Overview

Richness works in the competitive forex and CFD trading space, but specific details about when it started, its corporate structure, and founding principles are not disclosed in available public documents. The broker's business model and operational approach are not clearly defined in materials we can access.

This makes it hard to assess its market position and strategic focus. Without clear information about the company's history, management team, or corporate governance structure, potential clients face significant uncertainty about the broker's stability and long-term viability. The trading infrastructure and platform offerings of Richness are not well documented in available sources.

Information about supported asset classes, trading instruments, and platform technology stays limited. This raises questions about the broker's commitment to transparency and client education. The absence of detailed regulatory information makes concerns about the broker's compliance framework and client protection measures even worse.

This richness review emphasizes the importance of comprehensive research given these information gaps.

Regulatory Status: Available documents do not provide clear information about specific regulatory authorities overseeing Richness operations. This represents a significant concern for trader safety and compliance.

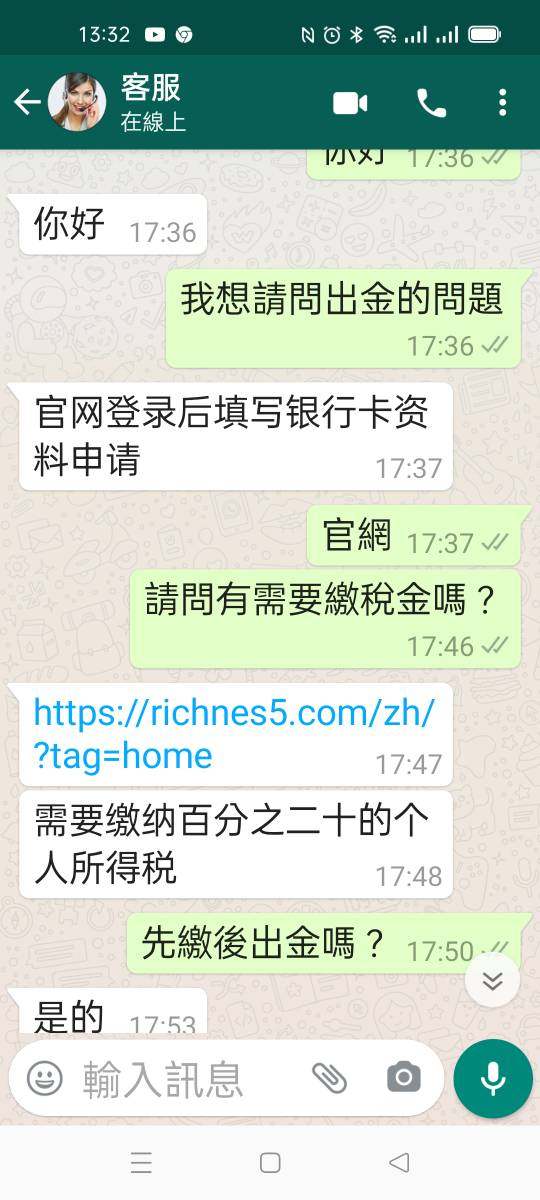

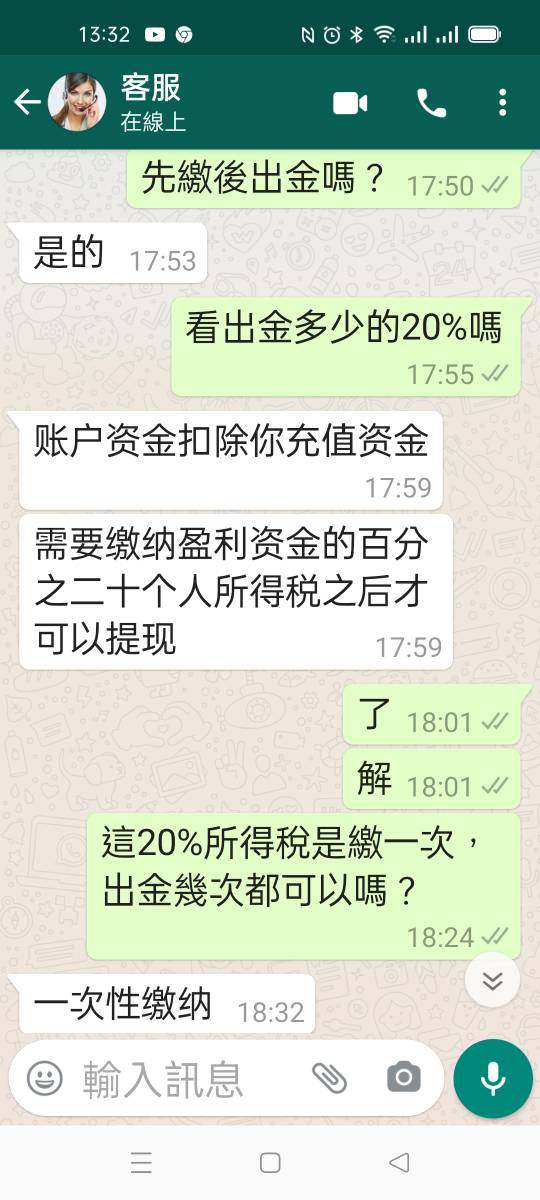

Deposit and Withdrawal Methods: Specific payment processing options, supported currencies, and transaction timeframes are not detailed in accessible broker information.

Minimum Deposit Requirements: Concrete minimum deposit amounts for different account types are not specified in available materials.

Promotions and Bonuses: Current promotional offerings, welcome bonuses, or loyalty programs are not documented in publicly available sources.

Trading Assets: The range of available trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, is not outlined in accessible information.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs is not readily available for analysis in this richness review.

Leverage Options: Maximum leverage ratios and margin requirements for different asset classes are not specified in available documents.

Platform Selection: Information about trading platform options, whether proprietary or third-party solutions like MetaTrader, is not clearly documented.

Geographic Restrictions: Specific countries or regions where services are restricted or unavailable are not clearly outlined.

Customer Support Languages: Available customer service languages and support channels are not detailed in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions offered by Richness remain largely undocumented in publicly available sources. This leads to a neutral rating in this critical area. Without specific information about account types, minimum deposit requirements, or account features, potential traders cannot make informed decisions about whether the broker's offerings align with their trading needs and capital requirements.

The absence of detailed account specifications suggests either limited transparency or inadequate marketing communication from the broker. Standard industry practice involves clearly outlining different account tiers, each with specific benefits, trading conditions, and minimum funding requirements. The lack of such information in this richness review reflects poorly on the broker's commitment to client transparency.

Professional traders typically require detailed account information to evaluate execution quality, cost structures, and available features before committing capital. Without comprehensive account documentation, Richness fails to meet basic industry transparency standards that clients rightfully expect from legitimate forex brokers. This creates unnecessary uncertainty for potential clients who need clear information to make informed decisions.

The trading tools and educational resources provided by Richness are not adequately documented in available materials. This results in a below-average rating for this essential category. Modern forex trading requires sophisticated analytical tools, real-time market data, and comprehensive educational materials to support trader development and decision-making processes.

The absence of detailed information about available tools suggests either limited offerings or poor communication of available resources. Professional trading platforms typically include advanced charting capabilities, technical analysis indicators, economic calendars, and market research reports. Educational resources should include beginner tutorials, advanced trading strategies, webinars, and market analysis content.

This richness review cannot identify specific tools or resources offered by the broker. This represents a significant disadvantage compared to established competitors who provide comprehensive trading support ecosystems. The lack of documented research capabilities and educational content particularly impacts newer traders who rely on broker-provided resources for skill development.

Customer Service and Support Analysis (5/10)

Customer service quality and availability represent crucial factors in forex broker selection. Yet Richness provides limited publicly available information about support channels, response times, or service quality standards. The neutral rating reflects the absence of concrete data about customer support capabilities rather than documented service problems.

Professional forex brokers typically offer multiple contact methods, including live chat, phone support, and email assistance. They also provide clearly stated availability hours and response time commitments. Effective customer support requires multilingual capabilities, especially for international brokers serving diverse client bases.

Technical support for trading platform issues, account management assistance, and general inquiry handling are fundamental service expectations. Without documented customer service protocols or client feedback about support quality, this richness review cannot provide meaningful assessment of the broker's commitment to client assistance. The lack of transparency regarding support capabilities raises concerns about problem resolution efficiency and overall client care standards.

Trading Experience Analysis (5/10)

The trading experience offered by Richness cannot be evaluated due to insufficient information about platform stability, execution quality, and overall trading environment. This neutral rating reflects the absence of documented performance metrics, user testimonials, or technical specifications rather than confirmed trading problems.

Professional trading experiences require reliable platform performance, fast order execution, minimal slippage, and comprehensive market access. Modern traders expect sophisticated platform functionality, including advanced order types, risk management tools, and seamless mobile trading capabilities. Platform stability during high-volatility periods and consistent execution quality are fundamental requirements for serious trading activities.

This richness review cannot assess these critical factors due to limited available documentation about the broker's trading infrastructure and performance standards. The absence of detailed platform information and performance data represents a significant disadvantage for traders seeking reliable execution environments. Without concrete performance metrics, traders cannot evaluate whether the platform meets their execution requirements.

Trust and Regulation Analysis (4/10)

Trust and regulatory compliance represent perhaps the most critical factors in forex broker evaluation. Richness receives a below-average rating due to limited transparency regarding regulatory oversight and compliance measures. The absence of clearly documented regulatory authorization from recognized financial authorities raises significant concerns about client protection, fund segregation, and operational oversight.

Legitimate forex brokers typically maintain authorization from multiple regulatory bodies and provide detailed compliance information. Regulatory oversight ensures brokers adhere to strict operational standards, maintain adequate capital reserves, and implement client fund protection measures. The lack of specific regulatory information in this richness review prevents assessment of the broker's compliance framework and client protection protocols.

Professional traders typically prioritize regulatory transparency and choose brokers with clear authorization from reputable financial authorities. Without documented regulatory status, Richness fails to meet fundamental trust requirements expected by informed traders. This creates significant risk for potential clients who need assurance about fund safety and regulatory protection.

User Experience Analysis (5/10)

User experience evaluation for Richness remains limited due to insufficient publicly available feedback, interface documentation, and usability information. The neutral rating reflects the absence of comprehensive user testimonials, platform screenshots, or detailed workflow descriptions rather than confirmed usability problems.

Modern forex trading platforms require intuitive interfaces, efficient navigation, and seamless user workflows to support effective trading activities. Positive user experiences include easy account registration, straightforward verification processes, intuitive platform navigation, and efficient fund management capabilities. Mobile trading functionality and cross-device synchronization are increasingly important for active traders.

This richness review cannot assess these user experience factors due to limited available documentation and user feedback. The absence of detailed interface information and client testimonials prevents meaningful evaluation of the broker's commitment to user-centered design and functionality optimization. Without user feedback and interface documentation, potential clients cannot assess whether the platform meets their usability expectations.

Conclusion

This comprehensive richness review reveals significant information gaps that prevent a positive overall assessment of the broker's offerings and capabilities. The neutral-to-negative evaluation reflects insufficient transparency regarding regulatory compliance, trading conditions, and operational standards rather than documented service failures.

Prospective clients should exercise considerable caution given the limited available information about fundamental broker characteristics including regulatory oversight, platform capabilities, and client protection measures. The broker may be suitable for traders willing to accept higher uncertainty levels, but professional traders typically prefer brokers with comprehensive transparency and documented regulatory compliance. Without more detailed information about operations and regulatory status, traders face unnecessary risks that could be avoided by choosing more transparent alternatives.