Is Tesco safe?

Business

License

Is Tesco Safe or a Scam?

Introduction

Tesco PLC Trade is a broker that has gained attention in the forex market, primarily due to its claims of offering a diverse range of trading instruments and competitive trading conditions. However, as with any online trading platform, it is crucial for traders to perform diligent assessments before committing their funds. The forex market is rife with both reputable and dubious brokers, making it imperative for potential investors to evaluate the legitimacy and safety of their chosen trading platform. This article will investigate whether Tesco is safe or a scam by examining its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and associated risks.

Regulation and Legitimacy

Regulatory oversight is a cornerstone of a safe trading environment. It ensures that brokers adhere to strict guidelines designed to protect investors. Unfortunately, Tesco PLC Trade has been flagged for operating without proper regulation.

| Regulator | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Blacklisted |

The Financial Conduct Authority (FCA) in the UK has issued warnings against Tesco, stating that it operates without authorization. This lack of regulation is a significant red flag for traders. Legitimate brokers typically have to comply with stringent regulations, including maintaining segregated accounts for client funds and participating in compensation schemes. The absence of such protections raises concerns about the safety of funds deposited with Tesco. Historically, unregulated brokers have been known to engage in fraudulent activities, making it essential for traders to be cautious.

Company Background Investigation

Tesco PLC Trade claims to be based in the UK, but further investigation reveals a lack of credible information regarding its ownership structure and operational history. The company appears to have been established recently, with no substantial track record in the forex industry. This raises questions about its reliability and transparency.

The management team behind Tesco also lacks publicly available information, which is critical for assessing a broker's credibility. A transparent broker typically provides details about its founders, executive team, and their professional experiences. The absence of such information can indicate a lack of accountability, which is a serious concern for potential investors. Moreover, the company's reluctance to disclose vital information can be interpreted as an attempt to obscure its true operational practices, further feeding into the narrative that Tesco is not safe.

Trading Conditions Analysis

The trading conditions offered by Tesco PLC Trade may initially seem appealing, but a closer examination reveals potential pitfalls. The broker offers several account types, each with varying minimum deposit requirements and spreads. However, the overall fee structure is not clearly laid out, which can lead to unexpected charges for traders.

| Fee Type | Tesco PLC Trade | Industry Average |

|---|---|---|

| Spread for Major Pairs | 2 pips | 1-1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest | N/A | Varies |

The spread for major currency pairs at Tesco is notably higher than the industry average, which can significantly impact trading profitability. Additionally, the lack of a transparent commission model raises concerns about hidden fees that may be levied on traders. Such practices are often indicative of brokers that prioritize profit over client welfare, leading to the conclusion that Tesco is not safe for traders seeking fair trading conditions.

Customer Fund Safety

The safety of customer funds is paramount in forex trading. Tesco PLC Trade has been criticized for its inadequate measures to protect client funds. The broker does not offer segregated accounts, which means that client funds could be at risk in the event of the broker's insolvency. Furthermore, there is no evidence of participation in any investor compensation schemes, which would typically provide a safety net for traders in case of broker failure.

Historically, unregulated brokers like Tesco have faced serious allegations regarding the mishandling of client funds, leading to significant financial losses for traders. The absence of negative balance protection is another alarming factor, as it exposes traders to the risk of losing more than their initial investment. Given these issues, it is evident that Tesco is not safe for traders concerned about the security of their funds.

Customer Experience and Complaints

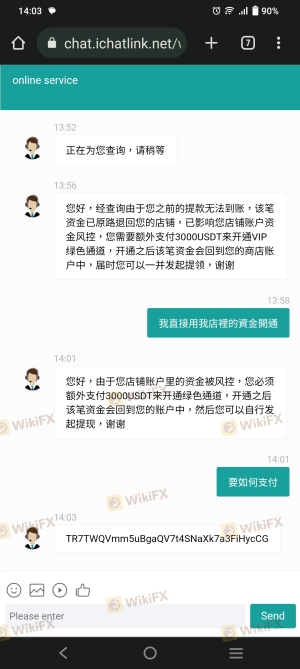

Customer feedback is a crucial aspect of evaluating a broker's reputation. Numerous reviews indicate a pattern of complaints regarding Tesco PLC Trade, particularly concerning withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Support | Medium | Poor |

| Misleading Information | High | Poor |

Many users report difficulties in withdrawing their funds, with some claiming that their requests were ignored or delayed indefinitely. Additionally, the quality of customer support has been described as lacking, with traders often left without adequate assistance. Such complaints not only highlight the broker's inefficiencies but also suggest a potential risk of Tesco being a scam, as these are common tactics used by fraudulent brokers to retain client funds.

Platform and Execution

The trading platform provided by Tesco PLC Trade has received mixed reviews. While it claims to offer a user-friendly interface, many users have reported issues with stability and execution quality. The absence of support for popular platforms like MetaTrader 4 raises further concerns about the broker's reliability.

Traders have noted instances of slippage and rejected orders, which can severely impact trading outcomes. Additionally, there are allegations of potential platform manipulation, which is a significant concern for any trader. Given these issues, it is critical to approach trading with Tesco with caution, as the performance of the trading platform is a key factor in determining whether Tesco is safe.

Risk Assessment

Using Tesco PLC Trade presents several risks that potential traders should consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid regulation, high potential for fraud. |

| Fund Safety Risk | High | Lack of segregated accounts and investor protection. |

| Operational Risk | Medium | Issues with platform stability and execution. |

| Customer Service Risk | High | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders should consider using only regulated brokers that offer transparent trading conditions and robust customer support. Conducting thorough research before investing is crucial to ensure that funds are not placed in jeopardy.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Tesco is not safe for forex traders. The broker's lack of regulation, questionable trading conditions, and numerous customer complaints indicate a high risk of fraudulent practices. Traders are advised to exercise extreme caution and consider alternative options that are regulated and have a proven track record of reliability.

For those seeking trustworthy trading platforms, consider regulated brokers that have established reputations in the industry. Always prioritize safety and transparency when choosing a broker to ensure a secure trading experience.

Is Tesco a scam, or is it legit?

The latest exposure and evaluation content of Tesco brokers.

Tesco Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tesco latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.