Is Richness safe?

Pros

Cons

Is Richness Safe or Scam?

Introduction

Richness, a relatively new player in the forex market, has garnered attention for its trading platform and offerings. Established in recent years, it positions itself as a broker for forex, CFDs, and cryptocurrencies. However, the volatility and potential risks in the forex market necessitate that traders conduct thorough evaluations of any broker before committing their funds. Given the prevalence of scams and fraudulent activities in the online trading space, it's crucial for traders to assess the legitimacy and safety of brokers like Richness. This article utilizes a comprehensive investigative framework, drawing from various sources, to evaluate whether Richness is a safe trading option or a potential scam.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its credibility and safety for traders. Richness operates without any recognized regulatory oversight, which raises significant concerns. The absence of regulation means that traders have little recourse in the event of disputes or issues with the broker. Below is a summary of Richness's regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The lack of regulation is a major red flag. Regulatory bodies are essential as they enforce compliance with strict financial standards, ensuring that traders' interests are protected. In the case of Richness, the absence of any regulatory framework indicates a higher risk for traders, as they are not afforded the protections that regulated brokers must adhere to. Historically, unregulated brokers have been associated with numerous complaints and scams, further solidifying the need for caution when considering Richness.

Company Background Investigation

Richness's company background reveals a lack of transparency that is concerning for potential clients. Established in recent years, the details surrounding its ownership and management team are vague. There are no clear records indicating the individuals behind the company or their professional qualifications. This opacity can be alarming, as a reputable broker typically provides detailed information about its management team and corporate structure.

Furthermore, the absence of a physical address or contact information raises questions about the broker's legitimacy. Effective communication channels are vital for addressing trader concerns, and Richness's lack of transparency in this regard is troubling. Traders are advised to be wary of companies that do not disclose essential information about their operations, as this can often indicate underlying issues.

Trading Conditions Analysis

Understanding the trading conditions offered by Richness is crucial for evaluating its safety. The broker's fee structure appears to be less favorable compared to industry standards, which can be indicative of potential hidden costs. Below is a comparison of core trading costs associated with Richness:

| Fee Type | Richness | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 2.0 pips | 1.0-1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Richness are significantly higher than the industry average, which can erode traders' profits. Additionally, the lack of transparency regarding commission structures and overnight interest rates is concerning. Traders should be cautious of brokers that do not clearly disclose their fee structures, as this can lead to unexpected costs and diminished returns.

Client Funds Security

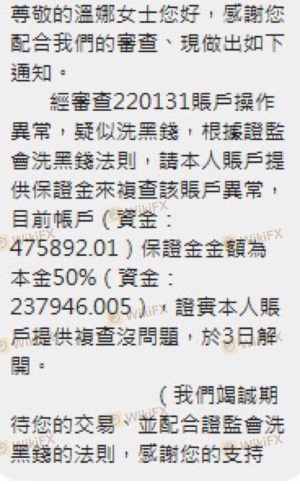

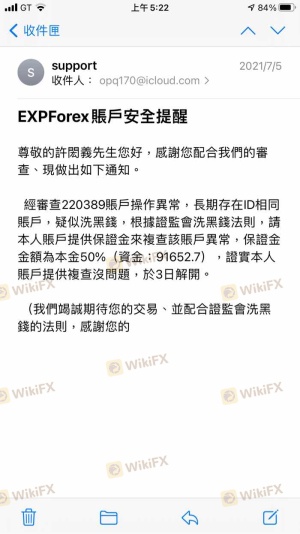

The safety of client funds should be a primary concern for any trader. Richness has not provided sufficient information regarding its fund security measures. Details about whether client funds are held in segregated accounts, investor protection schemes, or negative balance protection policies are notably absent. The lack of these safety measures can expose traders to significant risks, especially in volatile market conditions.

Historically, unregulated brokers like Richness have faced issues related to fund security, with reports of clients being unable to withdraw their funds. This lack of assurance regarding fund safety is a critical factor that traders must consider when evaluating the legitimacy of Richness. Without clear policies in place to protect client funds, the risk of financial loss increases substantially.

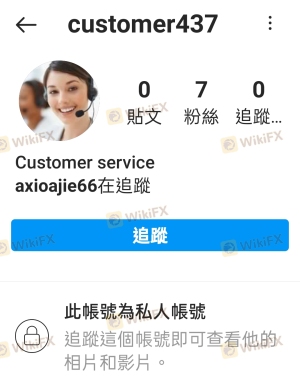

Customer Experience and Complaints

Analyzing customer feedback is essential for assessing the overall experience with Richness. Numerous complaints have surfaced regarding withdrawal issues, poor customer service, and lack of responsiveness. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service | Medium | Inadequate |

| Transparency Issues | High | Lacking |

Many users have reported difficulties in accessing their funds, with some claiming that their accounts were frozen without clear explanations. The slow response from customer service further exacerbates these issues, leaving traders feeling frustrated and vulnerable. These patterns of complaints suggest a lack of professionalism and accountability from Richness, raising further doubts about its safety and reliability.

Platform and Trade Execution

The trading platform provided by Richness is another critical aspect to evaluate. While it claims to offer a stable and user-friendly experience, there are concerns regarding order execution quality, slippage, and potential rejections of orders. Traders have reported instances of delayed executions and unfavorable slippage, which can significantly impact trading outcomes.

Additionally, the absence of robust performance metrics raises questions about the platform's reliability. Traders should be cautious of platforms that do not provide transparent data on execution speeds and order fulfillment rates, as these factors are crucial for successful trading.

Risk Assessment

Using Richness as a trading broker presents several risks that traders must carefully consider. Below is a summary of the key risk areas associated with trading with Richness:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Unclear fund protection measures |

| Customer Service Risk | Medium | Poor responsiveness to complaints |

| Trading Condition Risk | High | High spreads and hidden fees |

Given these risks, potential traders should take proactive measures to mitigate exposure. It is advisable to conduct thorough research, utilize demo accounts if available, and remain vigilant about the broker's practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that Richness poses significant risks for traders. The lack of regulation, transparency issues, and numerous customer complaints indicate that it may not be a safe trading option. Traders should exercise extreme caution when dealing with Richness and consider alternative brokers that are regulated and have a proven track record of reliability.

For those seeking safer trading options, it is recommended to explore well-regulated brokers with transparent fee structures and strong customer support systems. Ultimately, the decision to trade with Richness should be made with careful consideration of the associated risks and potential consequences. It is essential to prioritize safety and due diligence in the forex market, particularly in light of the findings regarding Richness.

Is Richness a scam, or is it legit?

The latest exposure and evaluation content of Richness brokers.

Richness Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Richness latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.