SynergyFX was established in 2011 and is headquartered in Australia. Initially marketed as a reputable broker, the company quickly gained traction in the forex trading community due to its innovative trading capabilities and competitive conditions. In September 2018, SynergyFX was acquired by ACY Capital, an established player in the Australian forex market, which purportedly enhanced its technology and trading prowess. The organization claims to maintain strict operational protocols in line with ASIC regulations, positioning itself as a trustworthy option in a complicated regulatory landscape.

Focusing on forex, commodities, and indices, SynergyFX services are structured through a no-dealing-desk (NDD) environment, offering direct market access for trading. The broker supports two popular platforms, MetaTrader 4 and MetaTrader 5, known for their advanced charting capabilities and automated trading options. Despite its appealing offerings, users have expressed concerns about the broker's claims of robust regulatory oversight, given mixed reviews about their experiences.

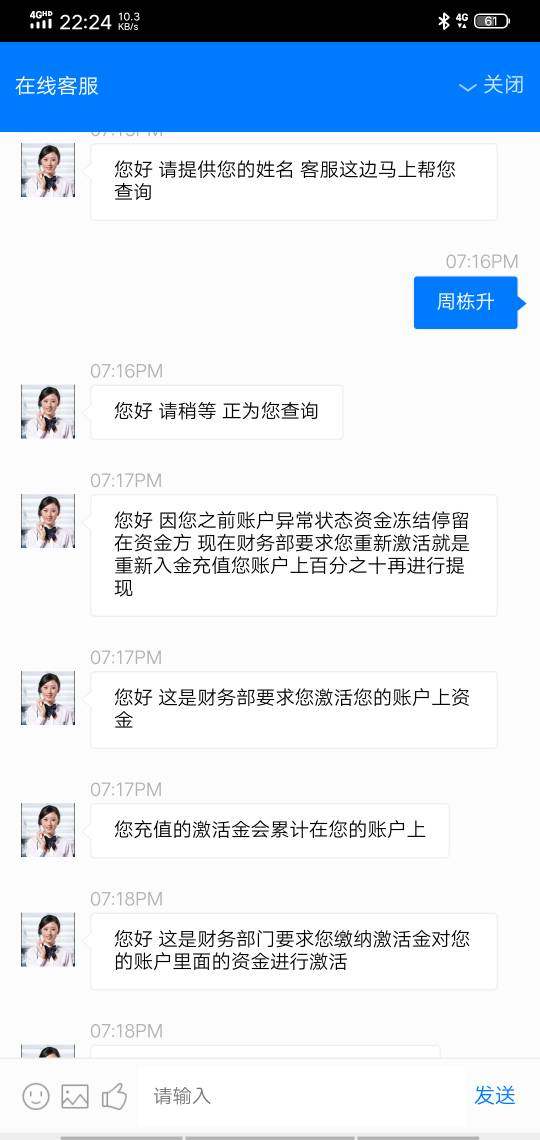

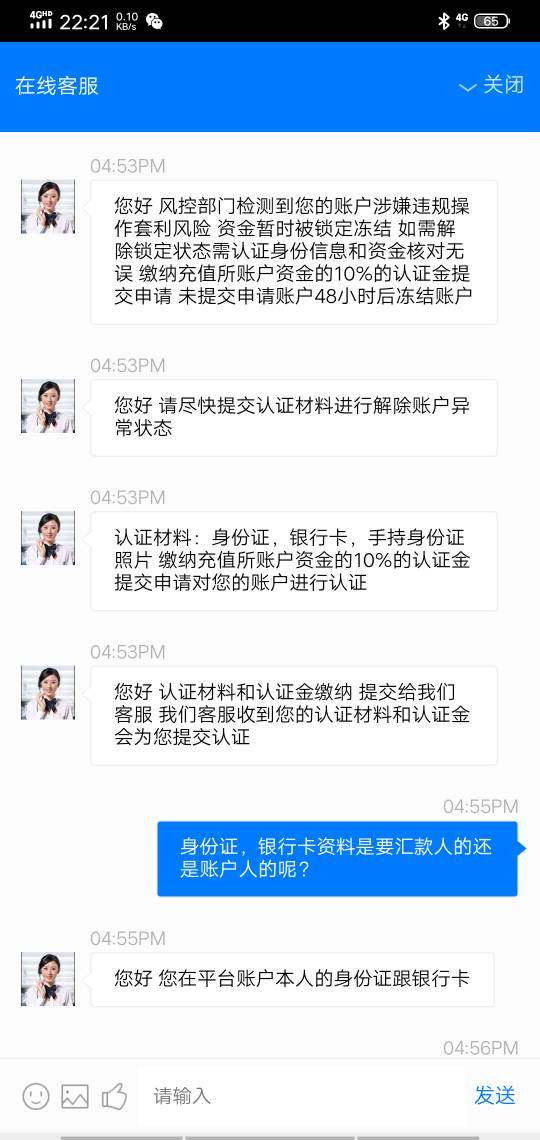

Despite the claim of ASIC regulation, user feedback casts doubt on SynergyFXs credibility. Reports indicate potential discrepancies regarding the registrations and complaints that have arisen surrounding withdrawal issues. Understanding the regulatory framework in which a broker operates is crucial, given the implications for fund security and operational legitimacy.

- Visit the ASIC website to check the broker's licensing status.

- Review third-party websites for user experiences.

- Contact SynergyFX to directly assess customer service response times.

- Analyze the fee structures to gauge transparency in costs.

3. Industry Reputation Summary

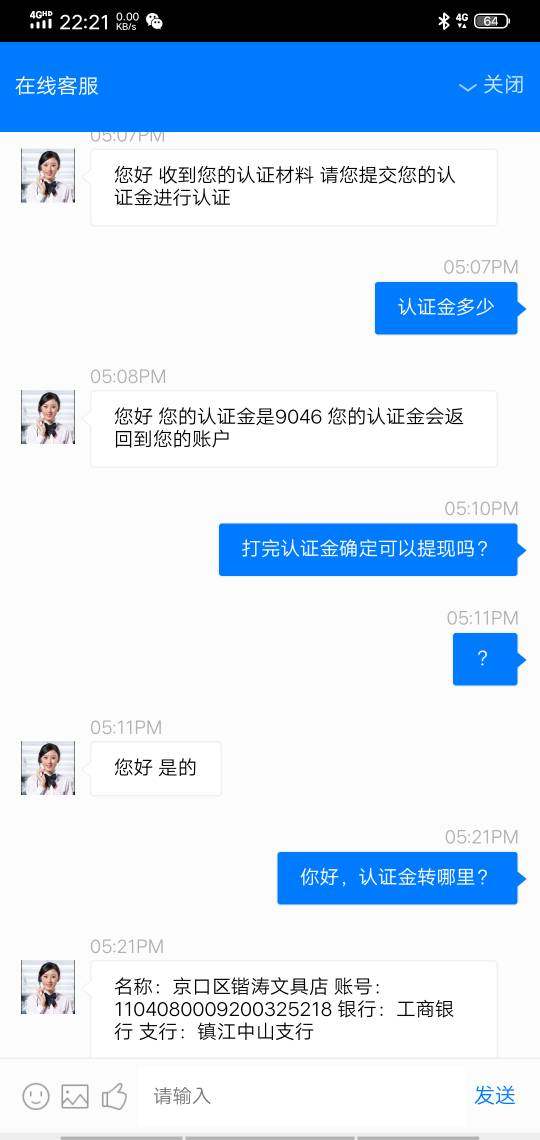

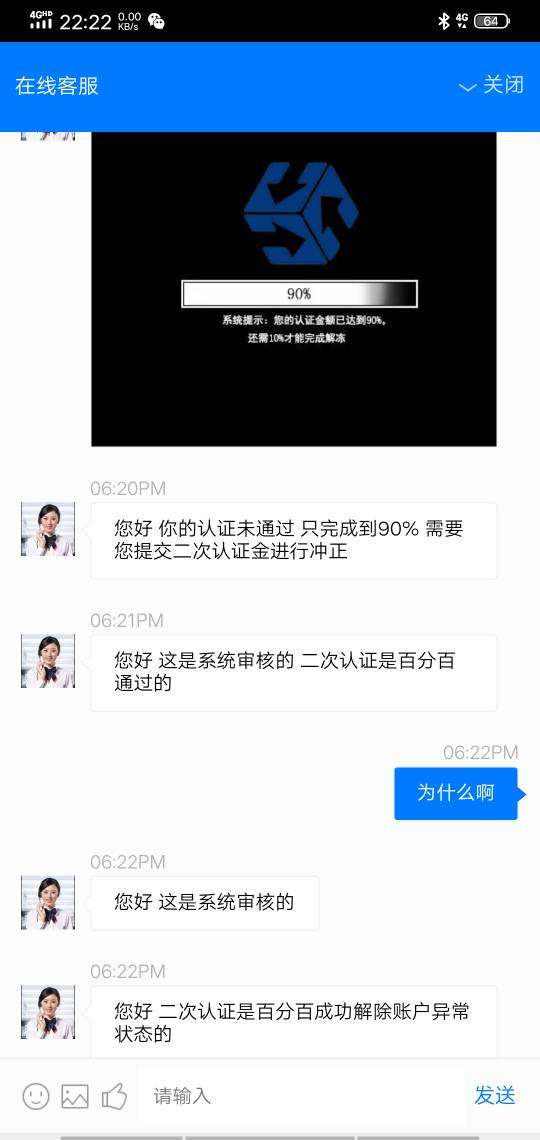

User reviews of SynergyFX highlight significant concerns, with elements like fund withdrawal difficulties being recurring themes. As stated by one user:

“I made a profit of $90,000, but when it came time to withdraw, I faced numerous obstacles and fees.”

Trading Costs Analysis

1. Advantages in Commissions

SynergyFX markets itself with a competitive commission structure, particularly for professional accounts that can start with zero pip spreads. Traders can enjoy meaningful savings through low-cost commissions when executing trades, making it an appealing option for high-volume traders.

2. The "Traps" of Non-Trading Fees

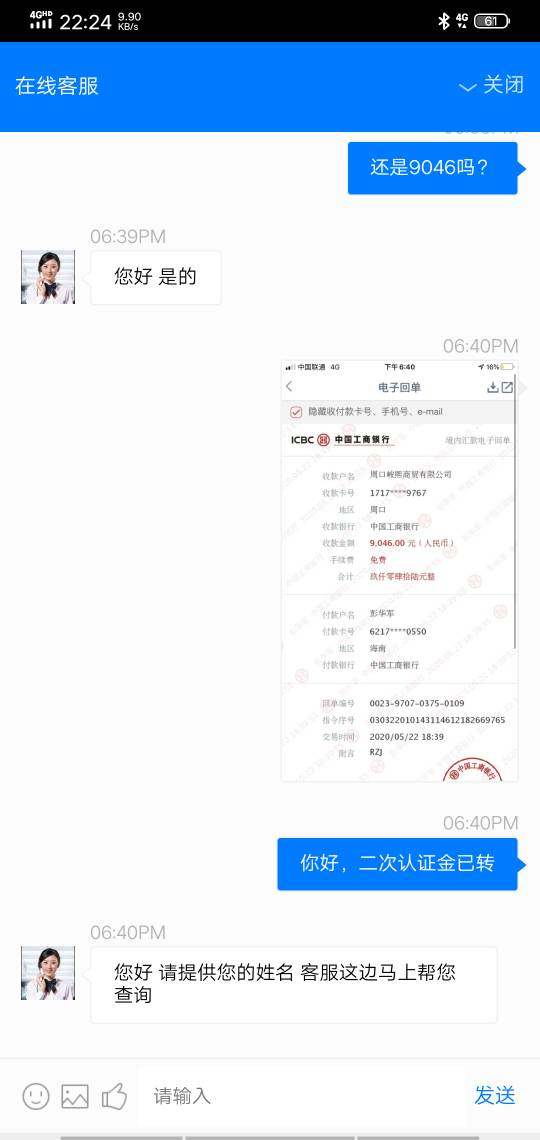

Several user complaints emphasize surprising withdrawal fees, particularly international transfer charges of $25 that can derail anticipated profits. For instance, as noted by a trader:

“I withdrew $10,000 only to find I was charged a $25 fee, depleting my expectations.”

3. Cost Structure Summary

Though some traders laud the commission model, the presence of hidden costs in the form of withdrawal fees needs careful consideration. New traders should particularly be mindful of understanding the overall cost structure that may affect their bottom line.

SynergyFX employs popular trading platforms, notably MT4 and MT5, which allow traders to benefit from advanced tools and resources for both manual and algorithmic trading. The technology utilized by SynergyFX is competent, yet some features remain outdated compared to newer brokers.

The MT4 platform supports an array of charting tools and market indicators, but some users have reported that certain sought-after features lack visibility or accessibility. This can frustrate traders who rely on quick, actionable insights while trading.

Users have shared their experiences, stating:

“The MT4 platform is easy to use, but at times navigating it feels cumbersome.”

User Experience Analysis

1. Account Opening Procedure

The account opening process is straightforward but may require multiple document verifications before being fully operational.

2. Deposit and Withdrawal Experience

While many users relish the low minimum deposit which starts at $100, significant concerns loom over withdrawal processes marked by delays or complications, particularly for first-time users.

Customer Support Analysis

1. Availability and Responsiveness

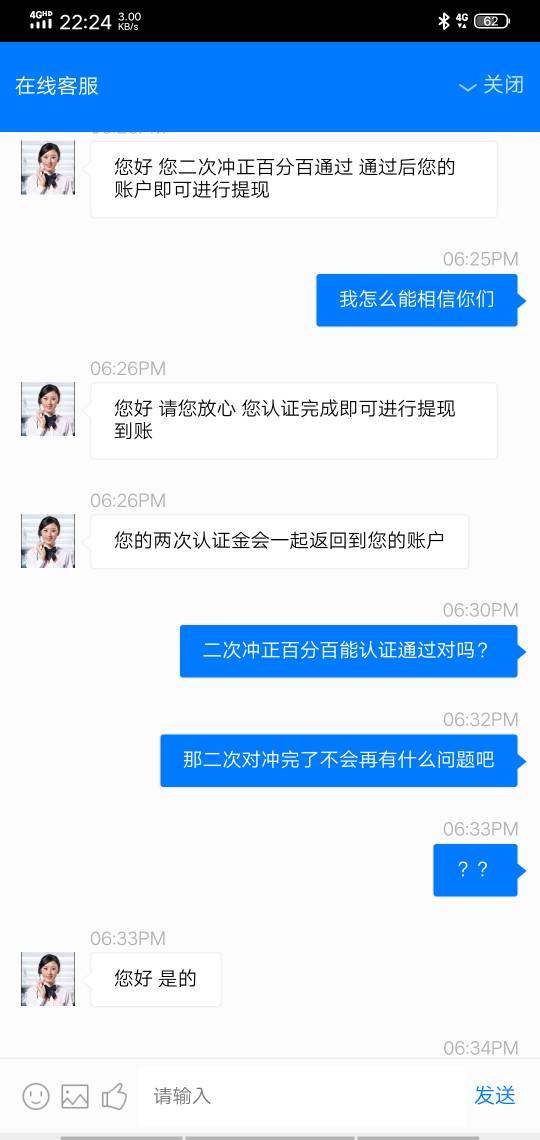

Numerous users of SynergyFX have reported fluctuating support responsiveness. The support is available across different languages, yet delays in email responses average between 3 hours to sometimes even 6 days.

2. Effectiveness of Support Solutions

When reaching out via live chat or phone, some users report quick response times, yet others faced long waiting periods. As one trader emphasized:

“When I called customer support, it took less than 5 minutes. But sending an email felt like sending a letter into the void.”

Account Conditions Analysis

1. Types of Accounts Offered

SynergyFX offers three different account types tailored for varying trader requirements, including a standard account, a zero-commission ECN account, and a pure ECN account, providing flexibility and adaptability based on trading style.

2. Minimum Deposits and Leverage

The associated minimum deposit requirements and scope for leverage up to 1:500 may attract certain trader demographics, specifically seasoned traders familiar with high-risk scenarios.

Conclusion

In summary, while SynergyFX promotes favorable trading conditions and competitive features, responsibility and thorough research are critical before committing funds. Regulatory compliance provides a layer of investor protection, but reported difficulties related to withdrawals and customer experiences may warrant caution. As such, understanding both the opportunities and risks involved is essential for making informed trading decisions.

For retail traders seeking a platform that promises robust trading tools and competitive pricing, it is prudent to weigh the positive trading conditions against the concerns rooted in user experiences. While SynergyFX holds potential, ensuring it aligns with personal trading strategies and risk appetite is paramount.