Regarding the legitimacy of CAPITAL INDEX forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is CAPITAL INDEX safe?

Software Index

Risk Control

Is CAPITAL INDEX markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

VANTOS MARKETS (UK) LIMITED

Effective Date:

2015-12-04Email Address of Licensed Institution:

compliance@capitalindex.com, complaints@capitalindex.comSharing Status:

No SharingWebsite of Licensed Institution:

www.capitalindex.comExpiration Time:

--Address of Licensed Institution:

75 King William Street London City Of London EC4N 7BE UNITED KINGDOMPhone Number of Licensed Institution:

+442070605120Licensed Institution Certified Documents:

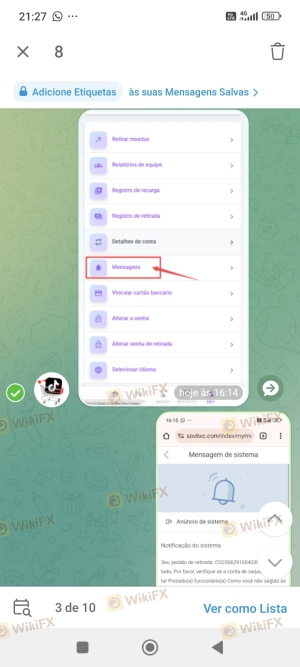

Is Capital Index A Scam?

Introduction

Capital Index is an online brokerage firm that has positioned itself in the forex and CFD trading market since its establishment in 2014. Based in the United Kingdom, it offers services such as forex trading, spread betting, and contracts for difference (CFDs) across various financial instruments. As the forex market continues to grow, traders must exercise caution when selecting a broker, as the industry is rife with both reputable firms and potential scams. This article aims to provide a thorough evaluation of Capital Index, focusing on its regulatory standing, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment. Our investigation draws from a range of credible sources, including regulatory filings, user reviews, and expert analyses, to deliver a balanced perspective on whether Capital Index is safe or a potential scam.

Regulation and Legitimacy

The regulatory environment in which a broker operates is critical to its credibility and the safety of client funds. Capital Index is regulated by several reputable authorities, which adds a layer of trustworthiness to its operations. Below is a summary of the key regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA (UK) | 709693 | United Kingdom | Verified |

| SCB (Bahamas) | SIA-F 199 | Bahamas | Verified |

| ASIC (Australia) | 439907 | Australia | Verified |

The Financial Conduct Authority (FCA) in the UK is known for its stringent regulatory standards, which require brokers to maintain high levels of transparency and client fund protection. As part of its regulatory obligations, Capital Index is mandated to keep client funds in segregated accounts, ensuring that these funds are not used for operational purposes. Additionally, the broker is part of the Financial Services Compensation Scheme (FSCS), which provides compensation to clients in the event of insolvency, up to £85,000 per eligible client.

While the regulatory oversight by the FCA is strong, it's important to note that the regulation from the Securities Commission of the Bahamas (SCB) is less stringent. This dual-regulatory structure means that traders should be cautious, as protections may vary based on the entity with which they are trading. Overall, the regulatory framework suggests that Capital Index is safe, but traders should remain aware of the varying levels of protection depending on jurisdiction.

Company Background Investigation

Capital Index was founded in 2014 and has since expanded its operations to serve clients in multiple jurisdictions, including the UK, Australia, and the Bahamas. The company is structured as a private limited company, with its headquarters located in London. The management team consists of experienced professionals from the finance and trading sectors, which enhances the company's credibility.

The broker has made significant investments in technology and infrastructure to provide a seamless trading experience for its clients. However, transparency regarding the ownership structure and specific team members is somewhat limited, as the company does not publicly disclose detailed information about its management team. This lack of transparency might raise concerns for some traders who prioritize knowing the individuals behind the brokerage.

Capital Index has received various accolades for its services, reflecting its commitment to maintaining high standards in customer service and trading conditions. However, the absence of comprehensive information about its management and operational history could be viewed as a drawback. Despite this, the overall impression is that Capital Index is safe for traders looking for a regulated environment, provided they understand the company's operational framework.

Trading Conditions Analysis

The trading conditions offered by Capital Index play a crucial role in determining its attractiveness to potential clients. The broker provides a straightforward fee structure, primarily based on spreads, which vary depending on the account type. The following table illustrates the core trading costs associated with Capital Index:

| Fee Type | Capital Index | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.4 pips | 1.0 - 1.5 pips |

| Commission Model | None (for most accounts) | Varies widely |

| Overnight Interest Range | -2% to +2% | Varies widely |

Capital Index offers two primary account types: the Advanced Account and the Pro Account. The Advanced Account requires a minimum deposit of $100 and offers spreads starting from 1.4 pips, while the Pro Account requires a minimum deposit of $10,000 and provides tighter spreads from 1.0 pips. The absence of commissions on most trades is an attractive feature, but traders should be aware that spreads may be higher than those offered by some competitors.

While the trading conditions may seem favorable, the spreads, particularly on the Advanced Account, are on the higher side compared to industry averages. This could be a potential drawback for traders who rely on tight spreads for profitability. Overall, while the trading conditions are competitive, they may not be the best in the market. Thus, traders should carefully consider their trading strategies and requirements before choosing Capital Index.

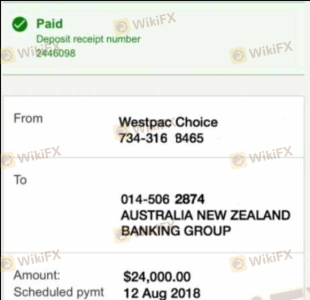

Customer Fund Safety

The safety of customer funds is paramount in the forex trading industry. Capital Index employs several measures to ensure the security of its clients' funds. The broker keeps client funds segregated from its operational funds, meaning that in the event of insolvency, client funds are protected. Additionally, the broker adheres to strict regulatory requirements set by the FCA, which includes regular audits and compliance checks.

Moreover, Capital Index offers negative balance protection, ensuring that traders cannot lose more than their account balance during volatile market conditions. This feature provides an added layer of security, particularly for traders using leverage. However, it is worth noting that the protections may vary depending on the regulatory entity under which the trader operates.

Historically, there have been no significant reports of fund security issues or disputes involving Capital Index. The broker's commitment to regulatory compliance and fund safety measures indicates that Capital Index is safe for traders concerned about the security of their investments.

Customer Experience and Complaints

User feedback plays a significant role in assessing the reliability of any broker. Capital Index has received mixed reviews from its clients, reflecting both positive and negative experiences. Common themes in customer feedback include the quality of customer support, withdrawal processing times, and overall trading experience.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response times |

| Customer Support | Medium | Mixed responses |

| Account Verification | Medium | Delays reported |

Many users have praised Capital Index for its competitive trading conditions and user-friendly platform. However, complaints often revolve around delays in processing withdrawals and difficulties in account verification. Some users have reported long wait times when seeking assistance from customer support, which can be frustrating for traders needing immediate help.

For instance, one user reported a positive experience with the trading platform but faced challenges when attempting to withdraw funds, highlighting the slow response from customer support. Conversely, another user expressed dissatisfaction with the trading conditions and the inability to withdraw funds promptly. These mixed reviews suggest that while some traders find success with Capital Index, others experience significant frustrations.

Platform and Execution

The performance and reliability of a trading platform are critical to a trader's success. Capital Index primarily uses the popular MetaTrader 4 (MT4) platform, known for its robust features and user-friendly interface. Traders can access a range of analytical tools, customize their trading environment, and utilize automated trading strategies through Expert Advisors (EAs).

However, some users have reported issues with order execution, including slippage and rejections during high volatility periods. While the platform generally performs well, any signs of manipulation or execution issues could raise concerns among traders. Overall, the platform offers a solid trading experience, but traders should remain vigilant regarding execution quality, particularly during volatile market conditions.

Risk Assessment

Using Capital Index comes with inherent risks that traders should be aware of. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Varies by jurisdiction; offshore entity may have less protection. |

| Trading Risk | High | Trading forex and CFDs involves significant risk, especially with leverage. |

| Customer Support Risk | Medium | Mixed reviews on support responsiveness may affect trading experience. |

To mitigate these risks, traders should conduct thorough research, understand the broker's terms and conditions, and consider starting with a demo account to familiarize themselves with the platform. Additionally, implementing sound risk management strategies when trading can help protect capital.

Conclusion and Recommendations

Based on the comprehensive evaluation of Capital Index, it is evident that the broker is regulated and offers a range of trading services. While there are some concerns regarding customer support and withdrawal processing times, the overall regulatory framework and safety measures suggest that Capital Index is safe for traders.

However, potential clients should be cautious of the higher spreads and consider their trading strategies before committing funds. For traders seeking alternatives, reputable brokers such as IG, CMC Markets, and Saxo Bank may offer more competitive trading conditions and a broader range of services.

In summary, while Capital Index is not a scam and operates under regulatory oversight, traders should weigh the pros and cons carefully and remain vigilant about their trading experiences.

Is CAPITAL INDEX a scam, or is it legit?

The latest exposure and evaluation content of CAPITAL INDEX brokers.

CAPITAL INDEX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

CAPITAL INDEX latest industry rating score is 7.25, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 7.25 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.