Regarding the legitimacy of GUOSEN SECURITIES (HK) forex brokers, it provides SFC and WikiBit, (also has a graphic survey regarding security).

Is GUOSEN SECURITIES (HK) safe?

Business

Risk Control

Is GUOSEN SECURITIES (HK) markets regulated?

The regulatory license is the strongest proof.

SFC Derivatives Trading License (AGN)

Securities and Futures Commission of Hong Kong

Securities and Futures Commission of Hong Kong

Current Status:

RegulatedLicense Type:

Derivatives Trading License (AGN)

Licensed Entity:

Guosen Securities (HK) Brokerage Company, Limited

Effective Date:

2010-02-26Email Address of Licensed Institution:

lcd@guosen.com.hkSharing Status:

No SharingWebsite of Licensed Institution:

www.guosen.com.hkExpiration Time:

--Address of Licensed Institution:

香港金鐘道88號太古廣場1座32樓3207-3212室Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Guosen Securities HK Safe or Scam?

Introduction

Guosen Securities HK, a subsidiary of the larger Guosen Securities Co., Ltd., has carved a niche for itself in the forex market, offering a range of financial services including securities brokerage, corporate finance, and asset management. Established in 2009, the firm operates under the regulatory framework of Hong Kong, aiming to provide a secure trading environment for its clients. However, the importance of conducting thorough due diligence cannot be overstated in the ever-evolving landscape of forex trading, where the proliferation of scams has made traders increasingly wary.

In this article, we will delve into the various aspects of Guosen Securities HK to determine if it is a safe trading platform or a potential scam. Our investigation will utilize a comprehensive assessment framework, focusing on regulatory compliance, company background, trading conditions, client safety, user experiences, and risk factors. By synthesizing qualitative insights and quantitative data, we aim to provide a balanced and objective analysis of Guosen Securities HK.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its legitimacy. Guosen Securities HK operates under the oversight of the Securities and Futures Commission (SFC) of Hong Kong, a reputable regulatory body known for enforcing strict compliance standards. This regulation is essential as it signifies that the broker adheres to specific operational guidelines, which include maintaining client funds in segregated accounts and ensuring transparent reporting practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| SFC | AUI 491 | Hong Kong | Verified |

The SFC's oversight adds a layer of credibility to Guosen Securities HK. However, it is crucial to note that regulatory compliance does not guarantee absolute safety. The firm has faced scrutiny in the past for compliance failures, including a significant fine for anti-money laundering (AML) violations in 2019, where it failed to report suspicious transactions adequately. While these incidents raise concerns, they also indicate that the regulatory framework is functioning as intended, holding brokers accountable for their actions.

Company Background Investigation

Guosen Securities HK has a rich history that traces back to its parent company, Guosen Securities Co., Ltd., which was founded in 1994. The firm has grown significantly, establishing a strong presence in the financial services sector. The ownership structure is primarily state-owned, which can lend an additional layer of stability. The management team comprises seasoned professionals with extensive experience in finance and investment, contributing to the firm's operational expertise.

Transparency is a key factor in evaluating a brokerage's trustworthiness. Guosen Securities HK provides access to information about its services, regulatory status, and company history on its website. However, some user reviews indicate that there may be gaps in communication regarding client concerns, which could affect overall transparency. It is essential for potential clients to consider these factors when assessing whether Guosen Securities HK is safe for trading.

Trading Conditions Analysis

When evaluating the trading conditions at Guosen Securities HK, it is vital to consider the fee structure and any potential hidden costs. The broker offers competitive spreads and commission rates, but traders should be aware of any unusual policies that may apply.

| Fee Type | Guosen Securities HK | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Structure | 0.25% of traded value | 0.20% |

| Overnight Interest Range | 1.5% - 2.5% | 1.0% - 2.0% |

While the spreads at Guosen Securities HK are relatively competitive, the commission structure may be slightly higher than the industry average. Traders should carefully review the terms and conditions associated with their accounts to avoid any unexpected fees. Overall, while the trading conditions appear reasonable, potential clients should ensure they fully understand the cost implications of trading with Guosen Securities HK.

Client Fund Safety

The safety of client funds is paramount when assessing a broker's reliability. Guosen Securities HK employs several measures to protect client assets, including segregated accounts that ensure client funds are kept separate from the company's operational funds. This practice is essential for safeguarding investors' capital in the event of financial difficulties faced by the brokerage.

Additionally, Guosen Securities HK is subject to the investor protection schemes mandated by the SFC, which further enhances the security of client deposits. However, it is crucial to note that the firm has faced scrutiny in the past regarding its compliance with AML regulations, which raises questions about its internal controls. The historical issues related to fund safety and compliance should be carefully considered by potential clients when evaluating whether Guosen Securities HK is safe.

Customer Experience and Complaints

Customer feedback plays a significant role in assessing the reliability of a brokerage. Reviews of Guosen Securities HK reveal a mixed bag of experiences. While some clients praise the range of services and customer support, others have reported issues related to withdrawal processes and communication.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Communication | Medium | Moderate response |

| High Fees | Low | Acknowledged |

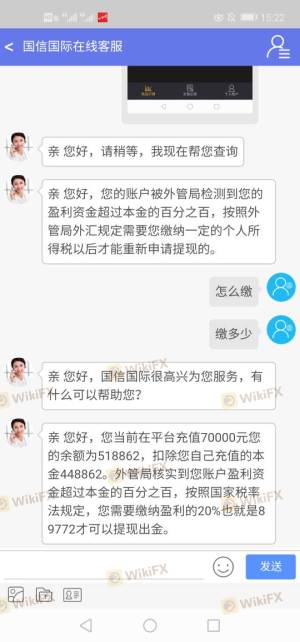

The most common complaints revolve around withdrawal difficulties, which have been reported on various platforms. Clients have expressed frustration with the time taken to process withdrawals, leading to concerns about the firm's operational efficiency. While Guosen Securities HK has made efforts to address these issues, the recurring nature of these complaints serves as a red flag for potential investors considering whether Guosen Securities HK is safe.

Platform and Trade Execution

The trading platform offered by Guosen Securities HK is critical for the overall user experience. The firm provides a proprietary trading platform that supports various financial instruments, including forex, stocks, and commodities. User feedback indicates that the platform is generally stable, though some traders have reported instances of slippage and order rejections during high volatility periods.

The execution quality is essential for traders, especially in the fast-paced forex market. While Guosen Securities HK aims to deliver quick order execution, any signs of manipulation or inefficiencies could compromise the trading experience. Traders should conduct thorough testing of the platform before committing significant capital, as the performance of the trading platform directly impacts the overall safety and reliability of the trading experience.

Risk Assessment

Engaging with any forex broker comes with inherent risks. When evaluating Guosen Securities HK, several risk factors must be considered, particularly regarding regulatory compliance, customer service responsiveness, and financial stability.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Past compliance issues |

| Customer Service | High | Frequent withdrawal complaints |

| Financial Stability | Medium | State-owned, but historical issues |

To mitigate these risks, potential clients should ensure they conduct thorough due diligence, including reading user reviews, understanding the fee structure, and testing the trading platform. It is advisable to start with a smaller investment to gauge the broker's reliability before committing larger sums of capital.

Conclusion and Recommendations

In conclusion, while Guosen Securities HK operates under the regulation of the SFC and offers a wide range of financial services, there are significant concerns regarding its past compliance issues and customer service responsiveness. The historical incidents related to withdrawal difficulties and regulatory breaches raise red flags about the firm's reliability. Therefore, potential traders should exercise caution and conduct thorough research before engaging with Guosen Securities HK.

For traders seeking a safer alternative, consider brokers with a proven track record of reliability and positive user experiences. Always remember to assess your risk tolerance and trading goals before making any decisions. Ultimately, while Guosen Securities HK has its merits, the potential risks associated with its past performance warrant careful consideration when evaluating whether Guosen Securities HK is safe.

Is GUOSEN SECURITIES (HK) a scam, or is it legit?

The latest exposure and evaluation content of GUOSEN SECURITIES (HK) brokers.

GUOSEN SECURITIES (HK) Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GUOSEN SECURITIES (HK) latest industry rating score is 5.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 5.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.