Regarding the legitimacy of synergyfx forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is synergyfx safe?

Pros

Cons

Is synergyfx markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

ACY Securities Pty Ltd

Effective Date: Change Record

2011-07-11Email Address of Licensed Institution:

compliance@acy.comSharing Status:

No SharingWebsite of Licensed Institution:

www.acy.com.auExpiration Time:

--Address of Licensed Institution:

'LEVEL 18 TOWER' B 799 PACIFIC HWY CHATSWOOD NSW 2067Phone Number of Licensed Institution:

0291882999Licensed Institution Certified Documents:

Is Synergy FX A Scam?

Introduction

Synergy FX is an Australian forex broker that has positioned itself as a provider of competitive trading conditions, offering access to a variety of financial instruments including forex, commodities, and indices. Established in 2011 and acquired by ACY Securities in 2018, Synergy FX claims to provide a robust trading environment with tight spreads and fast execution. However, as with any financial service provider, it is crucial for traders to carefully evaluate the legitimacy and reliability of the broker before committing their funds. This article aims to assess whether Synergy FX is a safe trading option or a potential scam. Our investigation is based on a comprehensive review of available data, including regulatory status, company background, trading conditions, customer experiences, and safety measures in place to protect client funds.

Regulation and Legitimacy

The regulatory status of a broker is one of the most important factors to consider when evaluating its legitimacy. Synergy FX is regulated by the Australian Securities and Investments Commission (ASIC), which is known for its stringent regulatory framework designed to protect traders. ASIC requires brokers to adhere to strict operational guidelines, including maintaining segregated accounts for client funds and ensuring transparency in their operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 403863 | Australia | Verified |

ASIC's oversight is significant as it provides a level of assurance that the broker operates within a regulated environment. However, it is essential to note that some reports have emerged questioning the legitimacy of Synergy FX's licensing, labeling it as a "clone firm." This term refers to brokers that falsely claim to be regulated by reputable authorities, potentially putting clients at risk. Therefore, while Synergy FX does have a regulatory license, the quality of the regulation and the broker's historical compliance should be critically assessed.

Company Background Investigation

Synergy FX was founded in 2011 and has since evolved under the ownership of ACY Securities, which has a solid reputation in the forex industry. The management team of Synergy FX comprises individuals with extensive experience in financial markets, enhancing the broker's credibility. However, transparency about the company's ownership structure and operational practices is limited, leading to questions about its overall governance.

The broker's website provides basic information about its services, but it lacks detailed disclosures regarding its management team and their qualifications. A transparent broker typically offers comprehensive information about its leadership, which can help build trust among potential clients. A lack of transparency in this area raises concerns about the broker's commitment to ethical practices and investor protection.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions they offer is essential. Synergy FX presents a competitive fee structure, with variable spreads and no inactivity fees. However, some users have reported unexpected charges, which can be a red flag for potential clients.

| Fee Type | Synergy FX | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.2 pips | 1.0 - 1.5 pips |

| Commission Model | $6 per lot | $5 per lot |

| Overnight Interest Range | Varies | Varies |

The spread on major currency pairs is slightly higher than the industry average, which may deter some traders. Additionally, the commission structure for certain account types raises questions about potential hidden fees, which can significantly impact trading profitability. It is crucial for traders to fully understand the cost structure before opening an account with Synergy FX.

Client Funds Security

The safety of client funds is paramount in the forex trading industry. Synergy FX claims to implement several measures to protect client funds, including segregated accounts held in tier-1 banks. This practice ensures that client funds are kept separate from the broker's operational funds, providing a layer of security in case the broker faces financial difficulties.

Furthermore, ASIC regulations require brokers to maintain strict capital standards and implement internal procedures to ensure accountability. However, there have been instances where clients reported difficulties in withdrawing their funds, raising concerns about the broker's reliability in handling client withdrawals.

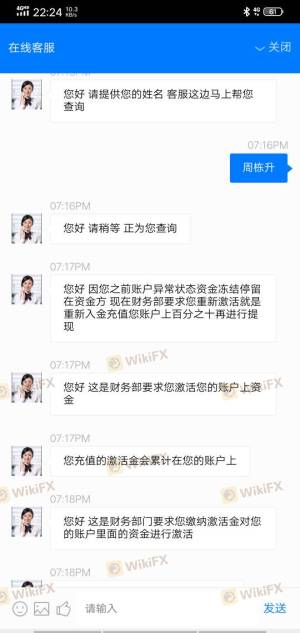

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's credibility. Reviews of Synergy FX reveal a mixed bag of experiences. While some clients praise the broker for its competitive spreads and responsive customer service, others have reported significant issues with fund withdrawals and lack of communication.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or Non-Responsive |

| Lack of Communication | Medium | Average |

| Account Management | Low | Generally Positive |

One common complaint involves clients experiencing delays in processing withdrawals, which can lead to frustration and distrust. For example, a user reported that after making a profit, their account was frozen, and they were unable to access their funds, which raises serious concerns about the broker's operational integrity.

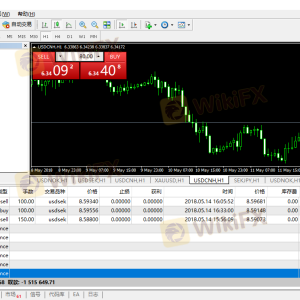

Platform and Trade Execution

The trading platform offered by Synergy FX is primarily MetaTrader 4 (MT4), which is widely recognized for its user-friendly interface and robust trading capabilities. However, users have reported issues with order execution quality, including slippage and rejections, which can be detrimental to a trader's performance.

The execution speed and reliability of the trading platform are critical for traders, especially in a volatile market. If a broker frequently experiences issues with order execution, it can lead to significant financial losses for traders.

Risk Assessment

Using Synergy FX comes with various risks that traders should be aware of. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Potential issues with regulatory legitimacy. |

| Fund Withdrawal Issues | Medium | Reports of difficulties in accessing funds. |

| Execution Quality | High | Concerns about slippage and order rejections. |

To mitigate these risks, traders should conduct thorough research and consider starting with a demo account to familiarize themselves with the platform before committing real funds. Additionally, maintaining a solid understanding of risk management strategies is crucial when trading with any broker.

Conclusion and Recommendations

In conclusion, while Synergy FX presents itself as a legitimate broker regulated by ASIC, there are several red flags that potential clients should consider. The mixed reviews regarding customer experiences, concerns about withdrawal issues, and questions surrounding the broker's regulatory legitimacy warrant caution.

For traders seeking a reliable forex broker, it may be prudent to explore alternative options with a proven track record and more transparent operational practices. Brokers with a strong reputation for customer service, clear fee structures, and robust regulatory oversight may provide a safer trading environment.

In summary, is Synergy FX safe? While it operates under the oversight of ASIC, the potential risks associated with its operations suggest that traders should proceed with caution.

Is synergyfx a scam, or is it legit?

The latest exposure and evaluation content of synergyfx brokers.

synergyfx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

synergyfx latest industry rating score is 1.60, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.60 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.