Is TwiceFX safe?

Business

License

Is TwiceFX Safe or a Scam?

Introduction

TwiceFX is an online forex broker that has recently garnered attention among traders seeking new platforms for currency trading. Positioned as a global trading entity, it claims to offer a variety of trading instruments, including forex pairs, commodities, stocks, and cryptocurrencies. However, the influx of unregulated brokers in the forex market necessitates a cautious approach from traders. Evaluating the credibility of a broker like TwiceFX is crucial to ensure the safety of investments and the integrity of trading practices. In this article, we will systematically analyze TwiceFX's regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, and overall risks associated with trading on this platform.

Regulation and Legitimacy

Understanding the regulatory framework under which a broker operates is paramount in assessing its legitimacy. TwiceFX operates without a valid license from any recognized regulatory authority, which raises significant red flags. The broker claims to be registered in Saint Vincent and the Grenadines, a jurisdiction known for its lenient regulatory environment. However, registration does not equate to regulation, and many brokers exploit this loophole to operate without oversight.

Heres a summary of the regulatory status of TwiceFX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Saint Vincent and the Grenadines | Unverified |

The absence of a regulatory license means that traders have limited recourse in case of disputes or fraudulent activities. Reputable regulatory bodies, such as the FCA or CySEC, enforce strict compliance measures to protect investors, including fund segregation and negative balance protection. In contrast, TwiceFX lacks these essential safeguards, making it a risky option for traders.

Company Background Investigation

TwiceFX is owned by Si Kiang Ltd, which operates from Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont, Kingstown, Saint Vincent and the Grenadines. The company's history is relatively obscure, with limited information available regarding its establishment and operational practices. The management team behind TwiceFX is not well-documented, which raises concerns about their qualifications and experience in the financial sector.

Transparency is a vital factor for any broker, and TwiceFX falls short in this regard. The lack of publicly available information about its management and operational history makes it difficult for potential clients to gauge the broker's reliability. Moreover, the absence of clear communication regarding its business practices further diminishes trust.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is crucial for assessing potential costs and profitability. TwiceFX offers a minimum deposit requirement of $250, which is relatively standard in the industry. However, the broker's fee structure raises concerns.

Heres a comparison of core trading costs:

| Fee Type | TwiceFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of clarity regarding spreads and commissions is alarming, as traders often rely on this information to make informed decisions. Additionally, TwiceFX appears to have hidden fees associated with withdrawals and inactivity, which can significantly impact a trader's bottom line. The broker's terms and conditions indicate that withdrawal requests may be subject to delays and additional charges, which is a common tactic used by unscrupulous brokers to retain client funds.

Client Funds Safety

The safety of client funds is a primary concern when selecting a forex broker. TwiceFX does not offer segregated accounts for client funds, meaning that traders' money is held in the broker's account rather than in a separate, secure account. This practice is considered highly risky, as it exposes traders to potential losses in the event of the broker's insolvency.

Furthermore, TwiceFX does not provide negative balance protection, which means that traders could lose more than their initial investment. The lack of compensation schemes or insurance for traders' funds further exacerbates the risk associated with trading on this platform. Historical data indicates that many unregulated brokers have faced issues related to fund mismanagement, leading to significant losses for clients.

Customer Experience and Complaints

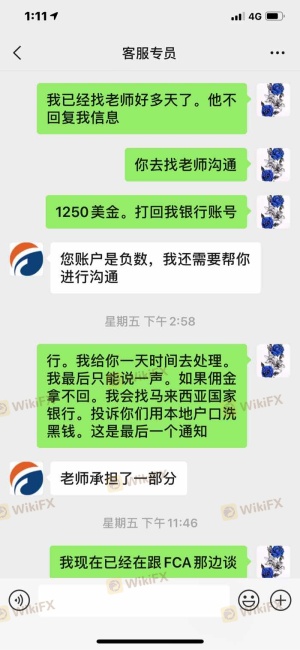

Analyzing customer feedback is essential for understanding the overall experience with a broker. Reviews of TwiceFX reveal a pattern of dissatisfaction among users. Common complaints include difficulty in withdrawing funds, poor customer service, and a lack of transparency regarding fees.

Heres a summary of the primary complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Slow |

| Fee Transparency | High | Non-responsive |

Several users have reported being unable to withdraw their funds after multiple requests, with the broker citing vague reasons for the delays. In some instances, users have experienced unexpected fees when attempting to withdraw their money, which is a classic sign of a potentially fraudulent operation.

Platform and Trade Execution

The trading platform provided by TwiceFX has received mixed reviews regarding its performance and usability. Users have reported issues with order execution, including slippage and rejections, which can significantly affect trading outcomes.

The platform's interface is often described as outdated and lacking essential features that traders expect from modern trading software. Furthermore, there have been allegations of price manipulation, with some users claiming that the quoted prices do not reflect real market conditions. This raises serious concerns about the integrity of the trading environment provided by TwiceFX.

Risk Assessment

Using TwiceFX involves several risks that traders should be aware of before committing their funds. The following risk assessment summarizes the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker |

| Fund Safety | High | No fund segregation |

| Withdrawal Issues | High | Frequent complaints |

| Platform Integrity | Medium | Allegations of manipulation |

To mitigate these risks, traders are advised to conduct thorough research before investing. Its also recommended to start with a minimal deposit, if choosing to proceed with TwiceFX, while being prepared for potential challenges in withdrawing funds.

Conclusion and Recommendations

In conclusion, the investigation into TwiceFX raises significant concerns regarding its legitimacy and safety. The absence of regulatory oversight, coupled with a lack of transparency and numerous customer complaints, suggests that TwiceFX may not be a safe trading option. Traders should exercise extreme caution and consider alternative, regulated brokers that offer robust protections for client funds.

For those looking to engage in forex trading, it is advisable to choose brokers that are regulated by reputable authorities and have a proven track record of positive customer experiences. Some recommended alternatives include brokers regulated by the FCA or CySEC, which provide comprehensive investor protections and transparent trading conditions. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

In summary, is TwiceFX safe? The evidence suggests that it poses significant risks, and potential traders should be wary of engaging with this broker.

Is TwiceFX a scam, or is it legit?

The latest exposure and evaluation content of TwiceFX brokers.

TwiceFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TwiceFX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.