Is LEVENDI FX safe?

Business

License

Is Levendi FX Safe or Scam?

Introduction

Levendi FX is a forex broker that emerged in the competitive landscape of online trading in 2019. With its base in the United Kingdom, it aims to provide trading services across various financial instruments. However, as the forex market continues to grow, so does the need for traders to exercise caution when selecting a broker. The potential for scams and fraudulent activities makes it crucial for investors to thoroughly evaluate the legitimacy and safety of their trading partners. This article aims to provide a comprehensive analysis of Levendi FX, focusing on its regulatory status, company background, trading conditions, customer experience, and overall safety. Our investigation is based on multiple reputable sources and user feedback to offer an objective perspective on whether Levendi FX is safe for trading or if it raises red flags of a scam.

Regulation and Legitimacy

One of the most critical aspects of assessing any forex broker is its regulatory status. Regulation serves as a safety net for traders, ensuring that brokers adhere to specific standards that protect investors' interests. In the case of Levendi FX, it is essential to note that the broker is not regulated by any recognized financial authority. This lack of oversight raises significant concerns regarding the safety of traders' funds and the broker's operational transparency.

Here is a summary of the regulatory information for Levendi FX:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of any valid regulatory oversight indicates that Levendi FX operates outside the protective framework typically provided by recognized financial institutions. This situation poses higher risks for traders, as unregulated brokers are not subject to the same scrutiny and accountability as their regulated counterparts. Furthermore, historical data reveals that Levendi FX has been flagged for operating under a clone license, misleading potential clients by claiming affiliation with legitimate regulatory bodies. This situation significantly undermines the trustworthiness of the broker, prompting the question: Is Levendi FX safe? The consensus among experts is that it is not.

Company Background Investigation

A thorough examination of Levendi FX's company background reveals a lack of transparency that is often associated with untrustworthy brokers. Established in 2019, the broker operates under the name Levendi Capital Limited. However, details regarding its ownership structure and management team remain scarce. Such opacity is concerning, given that reputable brokers usually provide clear information about their executives and operational history.

Moreover, the absence of a verifiable physical address or contact information adds to the unease surrounding Levendi FX. Traders are left in the dark regarding who is managing their investments and how to hold the broker accountable in case of disputes. This lack of transparency raises questions about the broker's credibility and reliability, making it challenging for investors to ascertain whether Levendi FX is safe for their trading needs.

Trading Conditions Analysis

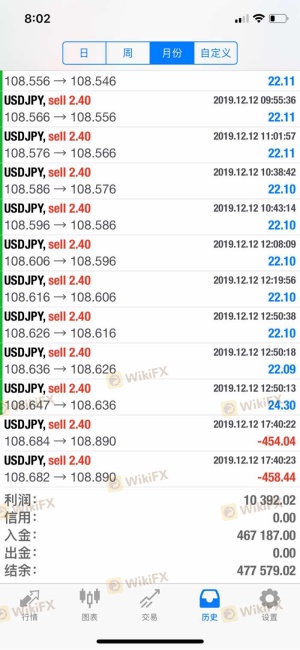

When evaluating a forex broker, understanding the trading conditions they offer is crucial. Levendi FX claims to provide competitive trading fees; however, many users have reported hidden charges and unfavorable trading conditions. The overall cost structure can significantly impact a trader's profitability, and it is essential to dissect these costs.

Here is a comparison of key trading costs associated with Levendi FX:

| Cost Type | Levendi FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Unfortunately, specific figures for spreads and commissions were not readily available, which raises further concerns about transparency. Traders have reported issues with withdrawal fees and unexpected charges that can erode their capital. These practices are often indicative of brokers that prioritize profit over client satisfaction, prompting traders to question whether Levendi FX is safe for their investments.

Customer Fund Safety

The safety of customer funds is paramount when trading with any broker. Levendi FX's lack of regulation raises significant concerns regarding its fund protection measures. Typically, regulated brokers are required to maintain segregated accounts, ensuring that clients' funds are kept separate from the broker's operational funds. This practice minimizes the risk of loss in case of bankruptcy or operational issues.

Unfortunately, Levendi FX does not provide clear information regarding its fund safety protocols, including whether it employs segregated accounts or offers negative balance protection. The absence of such measures can leave traders vulnerable to losing their entire investment without recourse. Furthermore, historical complaints indicate that users have faced difficulties when attempting to withdraw their funds, further highlighting potential risks associated with trading with Levendi FX. Given these factors, the question remains: Is Levendi FX safe? The evidence suggests otherwise.

Customer Experience and Complaints

Customer feedback is an essential component of evaluating a broker's reliability. Reviews and testimonials from users can provide insights into the company's responsiveness and the quality of its services. In the case of Levendi FX, numerous complaints have surfaced, primarily focusing on withdrawal issues and poor customer support.

Here is a summary of the most common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow or Unresponsive |

| Misleading Promotions | Medium | No Clear Response |

| Poor Customer Support | High | Unresolved |

Typical cases include clients who have reported being unable to withdraw their funds after multiple requests, often citing excuses from the broker that additional deposits are required to process withdrawals. Such practices are characteristic of scams and raise significant concerns about the broker's integrity. Therefore, it is evident that potential traders must consider whether Levendi FX is safe before committing their funds.

Platform and Execution

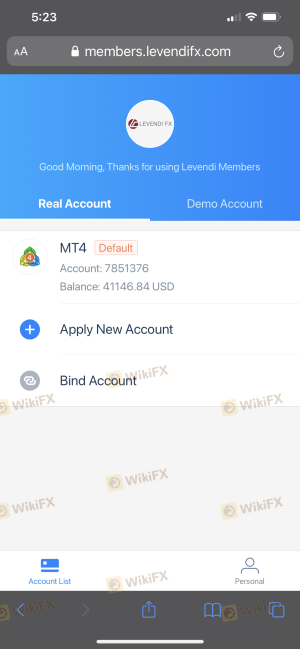

The trading platform's performance is another critical factor in assessing a broker's reliability. Levendi FX offers the widely used MetaTrader 4 (MT4) platform, which is known for its robust features and user-friendly interface. However, user reviews indicate that the platform may experience technical issues, including slippage and order rejections, which can severely impact trading outcomes.

Moreover, there are reports suggesting that the broker may manipulate trading conditions, which could disadvantage traders. Such practices are alarming and contribute to the growing skepticism about whether Levendi FX is safe for trading. A reliable broker should ensure smooth execution without undue interference.

Risk Assessment

Engaging with Levendi FX entails several risks that potential traders should be aware of. The lack of regulation, coupled with numerous complaints about withdrawal issues and customer support, creates a precarious trading environment. Here is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Fund Safety Risk | High | No clear fund protection measures |

| Customer Support Risk | Medium | Poor response to complaints |

| Trading Execution Risk | High | Reports of slippage and rejections |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and remain vigilant about their trading practices. Given the current landscape surrounding Levendi FX, it is prudent to approach this broker with caution.

Conclusion and Recommendations

In conclusion, the evidence gathered throughout this investigation strongly suggests that Levendi FX is not safe for trading. The lack of regulatory oversight, coupled with numerous complaints regarding fund withdrawals and poor customer service, raises significant red flags. Traders should be wary of engaging with this broker, as the risks associated with their operations may outweigh any potential benefits.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with a proven track record of transparency and customer satisfaction. Brokers regulated by reputable authorities such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) are generally safer options. Always prioritize safety and due diligence when selecting a forex broker to protect your investments.

Is LEVENDI FX a scam, or is it legit?

The latest exposure and evaluation content of LEVENDI FX brokers.

LEVENDI FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

LEVENDI FX latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.