ViTrade 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

ViTrade, a German brokerage brand under FlatexDegiro Bank AG, offers an array of trading instruments, including CFDs on over 600 assets, appealing primarily to experienced traders. With a minimum deposit requirement of just €1 and the potential for leveraging trades up to 1:30, ViTrade positions itself as an attractive trading option within the EU, particularly for those seeking robust market access. However, reviews show mixed sentiments regarding the quality of customer service and regulatory effectiveness. Experienced traders from Germany and other EU nations may find the proprietary platforms suitable; in contrast, beginner traders or those focused on low-cost operations may want to seek alternatives—regulatory concerns regarding BaFin and high trading fees are significant risk factors for potential users.

⚠️ Important Risk Advisory & Verification Steps

Risk Warning:

- ViTrade has received mixed reviews regarding its regulatory oversight and customer service.

- There are customer complaints about withdrawal challenges and limited payment options.

- The absence of widely trusted trading platforms like MetaTrader could deter some users.

Potential Hazards:

- Limited support channels, substantially affecting service for clients.

- The reputation of ViTrade may not seem sufficiently established, with multiple concerns raised regarding service reliability.

Self-Verification Steps:

- Visit the BaFin website to confirm ViTrade's regulatory status.

- Search for ViTrade on reputable reviewing platforms to find user feedback.

- Review community forums for discussions on withdrawal experiences and customer service.

- Cross-reference details from reliable financial news sources or advisory agencies for insights into market behavior.

- Always confirm the updated documentation and compliance of any broker before investing money.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2020 and headquartered in Germany, ViTrade operates as a trading brand under FlatexDegiro Bank AG. It maintains compliance with BaFin, ECB, and ESMA regulatory standards, which positions it favorably within the continental trading landscape. This focus on regulation offers traders a foundation of security; however, ViTrade's recent history does raise questions about its operational maturity and overall risk level.

Core Business Overview

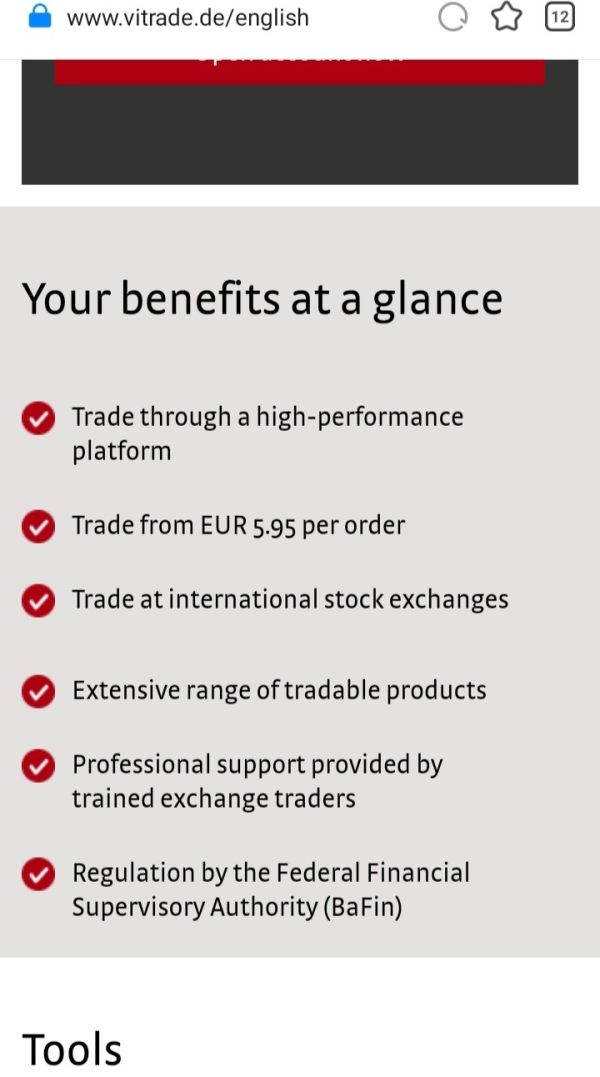

ViTrade is primarily engaged in offering trading opportunities in both securities and derivatives, including CFDs across various asset classes such as currencies, commodities, indices, and more. Investors can access around 600 CFDs, with a significant portion designated for currency pairs. Its proprietary platforms—CFD webclient and mobile app Flatex Next—facilitate trading but are structured without the widely used MetaTrader options, which limits appeal among some traders who rely on specific functionalities.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

Despite being regulated by BaFin, the effectiveness of oversight has been questioned in various reviews. Some users report an inconsistency in operational transparency, raising concerns over the broker's commitment to safeguarding investor interests.

User Self-Verification Guide

- Visit the BaFin website (BaFin.de).

- Use the search tool to look for ViTrade's registration status.

- Analyze the information on ESMA's website for any notices regarding the broker.

- Use the NFA's BASIC database to check whether there have been any compliance issues affecting ViTrade.

- Consult http://wikifx.com for an aggregated list of reviews and user feedback on ViTrade's operational history.

“Broker regulation is important to me because it ensures the safety of my funds, and ViTrade has everything in proper order in this regard.” — Anonymous Trader

Industry Reputation and Summary

Overall, ViTrade's reputation is under scrutiny due to mixed user feedback, particularly around customer support and withdrawal issues. While it possesses regulatory backing, the emergent feedback emphasizes caution and the need for thorough personal verification prior to engagement.

Trading Costs Analysis

Advantages in Commissions

ViTrade offers a comparatively low-cost commission structure for trading CFDs. Commissions start at just €5.95 per trade, which is competitive within the European market.

The "Traps" of Non-Trading Fees

Numerous customer complaints cite hidden charges, particularly with withdrawal fees, which can be as much as €30 for certain transactions, surfacing before traders realize their full account costs.

"Everything seemed fine until I tried to withdraw funds, and they charged me €30—definitely counts toward their non-transparent fees." — Anonymous User

Cost Structure Summary

The trading cost structure may benefit active traders but remains a deterrent for those less frequent in trading or those who prioritize low-cost trading environments. The inherent trade-offs should be carefully considered based on individual trading strategies.

ViTrade features proprietary platforms, including a CFD web client and a mobile app tailored for serious traders. These platforms cater to significant volumes and provide basic trading functionalities, although they miss out on the complex features found in platforms like MetaTrader.

While the platforms incorporate basic charting and analytics, many experienced traders find ViTrade lacking in the advanced analytical tools that are increasingly standard in this competitive sector.

User reviews often highlight the necessity for additional training and support for effective platform navigation. One user noted, > "The lack of common platforms like MetaTrader left me feeling handicapped in executing advanced strategies."

User Experience Analysis

Onboarding Process

The onboarding process is largely straightforward, allowing traders to create and fund accounts with ease. However, the interface can be challenging for novices, who may face hurdles during the initial setup.

Trading Experience

User experiences around the trading environment point to stability in execution, though some have cited slowness during volatile market conditions, impacting trading decisions.

User Feedback Summary

General sentiment shows that while experienced users adapt quickly, theres a learning curve for less experienced traders. Many reviews call for enhancements to overall usability and customization features.

Customer Support Analysis

Support Channels

Support is available via phone and email, with service hours extending from 8:00 AM to 10:00 PM (GMT+1) on weekdays. Lack of live chat or extensive online help adds to challenges in user support.

Common User Issues

Complaints often focus on delayed responses to inquiries and lack of follow-up assistance when issues are escalated.

Overall Support Summary

Overall, users highlight the need for immediate assistance tools, citing issues in response times as detrimental to trading experiences.

Account Conditions Analysis

Account Types

ViTrade features a simplified account structure with no differentiation across different types, which is particularly limiting for traders seeking tailored conditions.

Deposit and Withdrawal Conditions

While the minimum deposit is low, withdrawal options are limited to bank transfers, with longer processing times compared to competitors who offer quicker online payment solutions.

Overall Account Flexibility Summary

The inflexible account conditions raise concerns, particularly for high-frequency traders who may require varied account types. User feedback suggests trading experiences could be enhanced through diversified offerings.

In conclusion, ViTrade presents a unique yet challenging option for traders within Europe. As always, due diligence is paramount when selecting a broker, and current and potential users should weigh their options carefully while remaining vigilant about the inherent risks of trading with a broker that has received mixed feedback. Clarity in choosing a brokerage can mean the difference between successful trading experiences and undue stress.