Is FXCC safe?

Business

License

Is FXCC A Scam?

Introduction

FXCC, or Forex Central Clearing, is a forex broker established in 2010, primarily known for its ECN/STP trading model. With a focus on providing a transparent trading environment, FXCC positions itself as a client-centric broker, catering to both retail and professional traders. The importance of carefully evaluating forex brokers cannot be overstated, as the financial market is rife with potential pitfalls, including scams and unreliable entities. Traders must ensure that their chosen broker is legitimate, regulated, and provides a secure trading environment. This article aims to investigate FXCC's credibility through a comprehensive analysis of its regulatory status, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

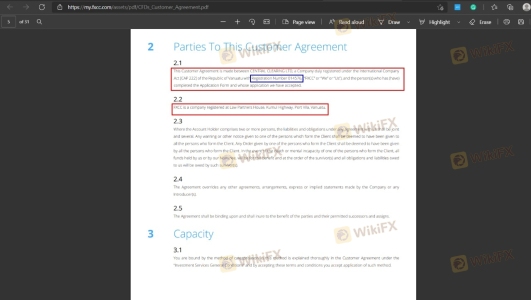

FXCC is regulated by the Cyprus Securities and Exchange Commission (CySEC) and operates under the Markets in Financial Instruments Directive (MiFID), which provides a robust regulatory framework for financial services within the European Union. Regulation is crucial as it ensures that brokers adhere to strict operational standards, safeguarding client funds and promoting transparency.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CySEC | 121/10 | Cyprus | Verified |

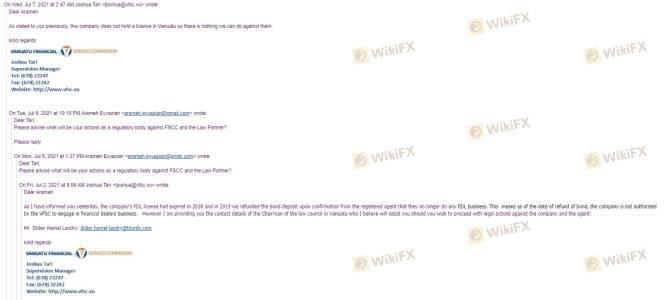

| VFSC | 14576 | Vanuatu | Verified |

The regulatory quality of CySEC is generally regarded as high, offering a safety net for traders. FXCC has maintained a clean compliance record since its inception, indicating a commitment to regulatory standards. However, the presence of an additional entity in Vanuatu, which operates under less stringent regulations, raises concerns about potential risks for international clients.

Company Background Investigation

FXCC was founded by a group of forex market professionals, leveraging their extensive experience to create a broker that prioritizes client success. The company's ownership structure is transparent, with FX Central Clearing Ltd. being the main entity behind FXCC. The management team comprises individuals with significant backgrounds in finance and trading, which adds credibility to the broker's operations.

Transparency is a key aspect of FXCC's operations. The broker provides comprehensive information about its services, including trading conditions and account types, on its official website. This level of disclosure is essential for building trust with clients, as it allows traders to make informed decisions.

Trading Conditions Analysis

FXCC offers competitive trading conditions, particularly through its ECN XL account, which features zero commissions and spreads starting from 0.0 pips. The absence of a minimum deposit requirement allows traders to start with any amount they are comfortable with, making FXCC accessible to a wide range of clients.

| Fee Type | FXCC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 0.8 pips | 1.0 - 2.0 pips |

| Commission Model | $0 | Varies |

| Overnight Interest Range | Variable | Variable |

While FXCC's trading costs are competitive, it's essential to note that the broker charges a monthly inactivity fee of $5 after three months of no trading activity. This fee structure aligns with industry practices but could be a drawback for casual traders.

Client Fund Security

FXCC employs several measures to ensure the safety of client funds. Client deposits are kept in segregated accounts, separate from the broker's operational funds, which is a standard practice among regulated brokers. Additionally, FXCC offers negative balance protection, ensuring that traders cannot lose more than their deposited amount.

Despite these security measures, it is crucial to be aware of FXCC's operational history. The broker has not faced significant financial disputes or scandals, which supports the notion that FXCC is safe for trading. However, traders should remain vigilant and conduct their due diligence when dealing with any financial institution.

Customer Experience and Complaints

Customer feedback regarding FXCC is mixed, with some traders praising the broker for its competitive spreads and efficient execution, while others have reported issues with withdrawals and customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Customer Support Issues | Medium | Limited availability |

One common complaint involves withdrawal delays, where clients have expressed frustration over the time it takes to process their requests. However, FXCC generally responds to these issues, albeit not always promptly. A typical case involved a trader who faced difficulties withdrawing funds but eventually received assistance after contacting customer support multiple times.

Platform and Trade Execution

FXCC utilizes the widely recognized MetaTrader 4 (MT4) platform, known for its reliability and user-friendly interface. The platform supports various trading tools and features, enhancing the overall trading experience. Traders have reported satisfactory order execution quality, with minimal slippage and no re-quotes, which is essential for high-frequency trading strategies.

Despite its strengths, the lack of alternative trading platforms, such as MetaTrader 5, may deter some traders looking for more advanced features. However, the MT4 platform remains a solid choice for many forex traders.

Risk Assessment

Using FXCC carries certain risks, primarily associated with its regulatory environment and customer service responsiveness. While the broker is regulated by CySEC, the presence of an offshore entity in Vanuatu could expose traders to higher risks.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Offshore operations may lack oversight |

| Customer Service Risk | Medium | Complaints about response times |

To mitigate these risks, traders should ensure they fully understand the terms and conditions of their accounts and the potential implications of trading with an offshore broker.

Conclusion and Recommendations

In conclusion, FXCC does not appear to be a scam; it is a regulated broker with a solid reputation in the forex market. However, potential clients should exercise caution and be aware of the mixed customer feedback regarding withdrawal processes and support responsiveness. For traders seeking a reliable broker with competitive conditions, FXCC is a viable option, particularly for those focused on forex and CFD trading.

However, if you require a broader range of investment options or desire a more responsive customer service experience, consider exploring other reputable brokers. Always conduct thorough research and assess your individual trading needs before selecting a broker.

Is FXCC a scam, or is it legit?

The latest exposure and evaluation content of FXCC brokers.

FXCC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXCC latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.