Is Farashat safe?

Business

License

Is Farashat Safe or a Scam?

Introduction

Farashat is a forex broker that has emerged in the competitive landscape of the foreign exchange market. Positioned as a trading platform, it claims to offer various trading services, including access to multiple currency pairs and advanced trading tools. However, the rise of online trading has also paved the way for numerous fraudulent entities, making it essential for traders to exercise caution when selecting a broker. Evaluating the legitimacy of a broker like Farashat is crucial to ensure the safety of ones investments.

In this article, we will analyze whether Farashat is a trustworthy broker or if it raises red flags that suggest it might be a scam. Our investigation will be based on a comprehensive review of its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. This structured approach aims to provide potential traders with a clear understanding of the safety and reliability of Farashat.

Regulation and Legitimacy

The regulatory environment is a pivotal factor in determining the safety of any forex broker. A well-regulated broker is typically subject to strict oversight, ensuring compliance with industry standards and protecting clients' interests. Unfortunately, Farashat does not appear to have any significant regulatory oversight, which raises concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation suggests that Farashat may not adhere to the same stringent standards as regulated brokers. This lack of oversight can lead to various issues, including potential price manipulation, difficulty in fund withdrawals, and inadequate customer protection. Furthermore, the broker's history of compliance is unclear, as there are no records indicating any regulatory body has monitored its activities.

Company Background Investigation

Understanding the company behind a broker is essential for assessing its credibility. Farashat Wealth (USA) Ltd. was incorporated in 2019 but has since faced scrutiny due to its lack of transparency. The company's ownership structure and management team are also shrouded in ambiguity, making it difficult to ascertain the qualifications and experience of those running the operation.

A thorough background check reveals that the firm has been dissolved as of March 23, 2021, which raises significant concerns about its operational continuity. This dissolution indicates that the company may have faced financial difficulties or failed to comply with regulatory requirements, further questioning its legitimacy. Transparency in operations and clear information about the management team are vital for any reputable broker, and Farashat appears to fall short in this regard.

Trading Conditions Analysis

When evaluating a broker, the analysis of trading conditions is critical. Farashat claims to offer competitive trading fees, but the lack of transparency regarding its overall fee structure is concerning.

| Fee Type | Farashat | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-3 pips |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of clearly defined fees can lead to unexpected costs for traders, making it challenging to gauge the true cost of trading with Farashat. Furthermore, if the broker employs hidden fees or charges that are not disclosed upfront, it could significantly impact profitability. Traders should be wary of brokers that do not provide a transparent fee structure, as this can be a sign of potential scams.

Customer Funds Safety

The safety of customer funds is paramount when choosing a forex broker. In the case of Farashat, there is limited information regarding the measures in place to protect client funds. A reputable broker should implement strict security protocols, including segregating client funds from company operational funds and offering negative balance protection.

Unfortunately, Farashat lacks clear information on these critical safety measures. This absence of assurance regarding the security of funds increases the risk associated with trading on its platform. Additionally, any historical issues related to fund safety or disputes have not been disclosed, leaving potential traders in the dark about the broker's reliability.

Customer Experience and Complaints

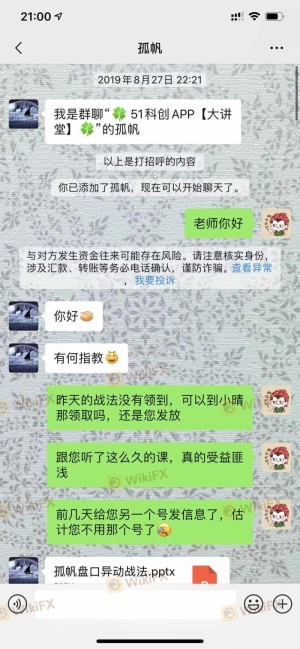

Customer feedback is a valuable source of insight into a broker's reliability and service quality. A review of available online forums and complaint boards reveals mixed experiences with Farashat.

Common complaint types include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Service | Medium | Slow Response |

| Account Management | High | Unresolved |

Many users have reported difficulties in withdrawing funds, which is a significant red flag when evaluating a broker's trustworthiness. A responsive and effective customer support system is crucial for resolving issues, and the lack of timely responses from Farashat suggests potential operational shortcomings.

Platform and Trade Execution

The trading platform's performance is another critical aspect of a brokers offering. Farashat claims to provide a robust trading environment, but user reviews indicate concerns regarding platform stability and execution quality. Issues such as slippage and order rejections can severely impact trading outcomes, especially in a volatile market.

While the platform may utilize popular software like MetaTrader 4 or 5, the overall user experience has been reported as subpar. Traders should look for brokers that ensure high-quality order execution and minimal slippage, as these factors directly affect trading profitability.

Risk Assessment

Using Farashat presents various risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Safety Risk | High | Lack of information on fund protection measures. |

| Customer Service Risk | Medium | Numerous complaints about responsiveness. |

Given these risks, traders should approach Farashat with caution. It is advisable to conduct thorough research and consider alternative brokers with a proven track record of reliability and regulatory compliance.

Conclusion and Recommendations

In conclusion, based on the comprehensive analysis, Farashat raises significant red flags regarding its legitimacy. The lack of regulatory oversight, unclear company background, and numerous customer complaints suggest that traders should exercise extreme caution when considering this broker.

For traders seeking a safe and reliable trading environment, it is recommended to explore alternatives that are regulated by reputable authorities and have demonstrated a commitment to customer service and fund protection. Always prioritize safety and transparency in your trading decisions to mitigate the risks associated with forex trading.

In summary, is Farashat safe? The evidence points to a high likelihood of potential issues, making it prudent for traders to consider other options before committing their funds.

Is Farashat a scam, or is it legit?

The latest exposure and evaluation content of Farashat brokers.

Farashat Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Farashat latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.