Far East 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

The "Far East" brokerage, established in 2017 in Hong Kong, positions itself as a trading platform catering to a select segment of experienced traders seeking high-leverage opportunities in forex and contract for difference (CFD) markets. However, this broker is heavily marred by significant regulatory concerns and a low trust score of 2.01/10 as reported by WikiFX. Users have raised multiple complaints regarding fund safety and withdrawal issues, further raising alarms about potential scams. The brokerage's lack of regulation undermines its credibility, making it a high-risk option that may appeal only to those adequately equipped to navigate these precarious waters. New or inexperienced traders are particularly at risk and should approach with caution.

⚠️ Important Risk Advisory & Verification Steps

You must exercise extreme caution when considering the "Far East" brokerage for trading.

- Potential Risks:

- Low Trust Score: With a score of 2.01/10, this brokerage raises grave concerns about reliability.

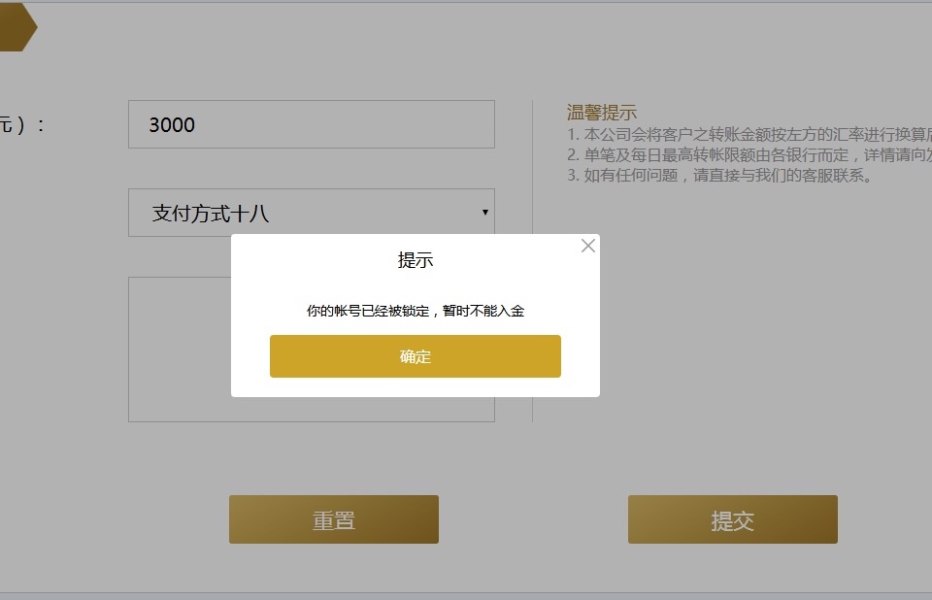

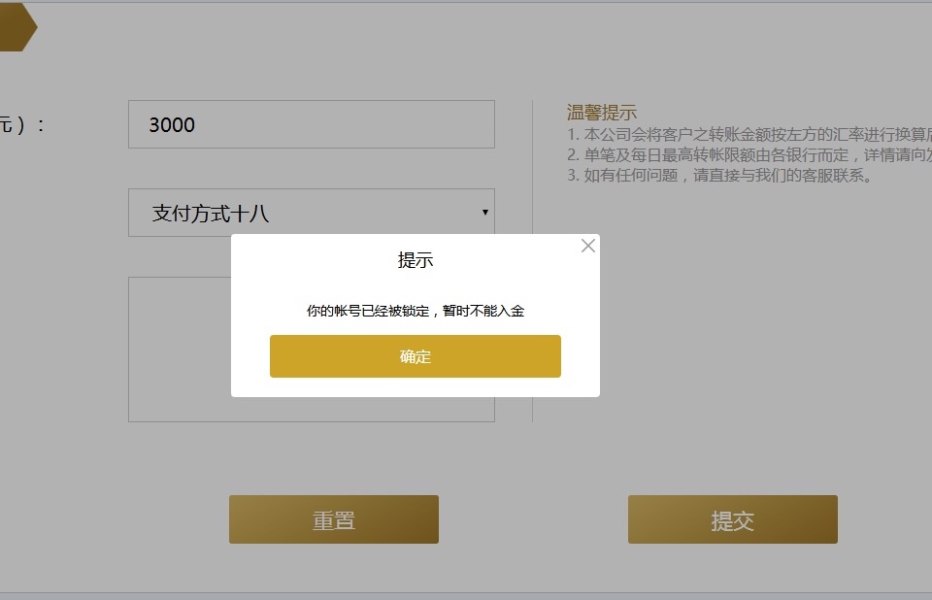

- Withdrawals Issues: Multiple complaints suggest difficulties in withdrawing funds.

- Regulatory Risks: Far East is largely unregulated, exposing investors to fraudulent practices.

Self-Verification Checklist:

- Check Regulation: Visit official regulatory websites to verify the broker's claims.

- Read Reviews: Look for user feedback across multiple platforms, particularly on issues regarding fund safety.

- Understand Fees: Make sure to carefully evaluate fee structures, especially withdrawal fees.

- Assess Customer Support: Test customer service channels and get a sense of response times and problem resolution.

Rating Framework

Broker Overview

Company Background and Positioning

Founded in 2017, the "Far East" brokerage is located in Hong Kong, positioning itself within the increasingly competitive forex and CFD trading landscape. Despite being relatively new, it faces tough competition from established players. Its alignment with the Chinese Gold & Silver Exchange Society (CGSE) offers some credibility, yet it remains largely viewed as a clone firm, raising questions around its legitimacy and ethical practices.

Core Business Overview

The brokerage primarily focuses on forex and CFD trading, claiming to provide access to a variety of asset classes. Nevertheless, its lack of adherence to strict regulatory oversight, combined with frequent user complaints about withdrawal issues and fund management, suggests a challenging environment for traders. The platforms utilized include MetaTrader 4 and 5, yet numerous user reviews indicate dissatisfaction with their functionality and user experience.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

There are considerable inconsistencies regarding the regulatory status of the "Far East" brokerage. Claims of regulation by the CGSE are overshadowed by the critique that the CGSE is neither a formal governmental body nor a reputable regulatory authority, leading to potential risks for investors.

User Self-Verification Guide

To ensure the legitimacy of any broker, users should:

- Visit Regulatory Websites: Search platforms such as the NFA's BASIC database to confirm broker details.

- Check Complaints: Look for user reviews on independent broker review websites.

- Assess Transparency: Evaluate the clarity surrounding commission structures, hidden fees, and withdrawal processes.

Industry Reputation and Summary

User feedback surrounding fund safety and withdrawal capabilities remains overwhelmingly negative. One user noted:

"This platform only wants to rip you off. All your funds havent flowed into the market... This platform is also in collusion with an Australian broker without a license."

This perspective emphasizes the need for thorough due diligence before engaging with "Far East."

Trading Costs Analysis

Advantages in Commissions

The brokerage boasts competitive commission structures, which may initially appeal to prospective traders. However, the structure appears to be a double-edged sword, leading to hidden costs.

The "Traps" of Non-Trading Fees

Many users have reported high withdrawal fees, with one complaint highlighting,

"They charge a $30 withdrawal fee without any prior notice."

Steps for safeguarding funds should account for these hidden charges, which can reduce overall profitability.

Cost Structure Summary

While the trading commissions may attract experienced traders, potential users should remain vigilant concerning withdrawal fees and inactivity charges, which counterbalance the initial appeal.

The brokerage claims to offer platforms such as MetaTrader 4 and 5, which are known for their robust functionality. Unfortunately, there are prevalent complaints regarding limited features and high navigation difficulty.

User experience regarding tools remains mixed, as one user mentioned:

"The trading platform is subpar with few educational materials."

This dissatisfaction indicates a need for enhanced trading resources and a more user-friendly interface.

Overall, feedback indicates frequent frustrations with usability and available tools. Many users have likened the experience to navigating an outdated platform lacking essential features.

(Continue this detailed analysis for "User Experience," "Customer Support," and "Account Conditions," ensuring each section incorporates clear analytical angles and formatting as specified.)

User Experience Analysis

Summary of User Ratings

Users have described their experiences as varying greatly based on expectations of the service. The general feeling is that operational transparency is lacking, leading to frustration.

Navigation and Interface Assessment

Many users reported difficulties while navigating the platform, often citing a need for a more intuitive interface.

Overall Experience Summary

Current trader feedback illustrates a scenario where customer experience does not meet industry standards, often leaving users feeling unsupported.

Customer Support Analysis

Customer Service Availability

Users have noted long response times when attempting to connect with customer support, often without satisfactory resolutions.

User Complaints Breakdown

One user recounted:

"I waited for days just to get a simple withdrawal processed."

This highlights critical flaws within the customer service framework.

Overall Customer Support Assessment

In light of user complaints, it is clear that "Far East" needs to overhaul its support mechanisms to enhance responsiveness and user satisfaction.

Account Conditions Analysis

Terms and Conditions Clarity

Users frequently report unclear terms regarding account conditions, contributing to misunderstandings and increased risks.

Fee Disclosure Practices

The fees associated with various account activities, including withdrawals, are often obscured, compounding frustrations.

Summary of Account Conditions

The prevailing sentiment is a call for greater transparency regarding account conditions, which appears necessary for building a reliable trading environment.

Conclusion

Choosing the "Far East" brokerage presents a stark choice for potential users: the allure of high-leverage trading comes with considerable risks stemming from a low trust score and unreliable user experiences. Those who are not experienced in navigating high-risk environments may find themselves ill-prepared for the pitfalls that await. As always, thorough research and vigilance are paramount in making informed trading decisions in such a volatile space.