YOCAI Review 1

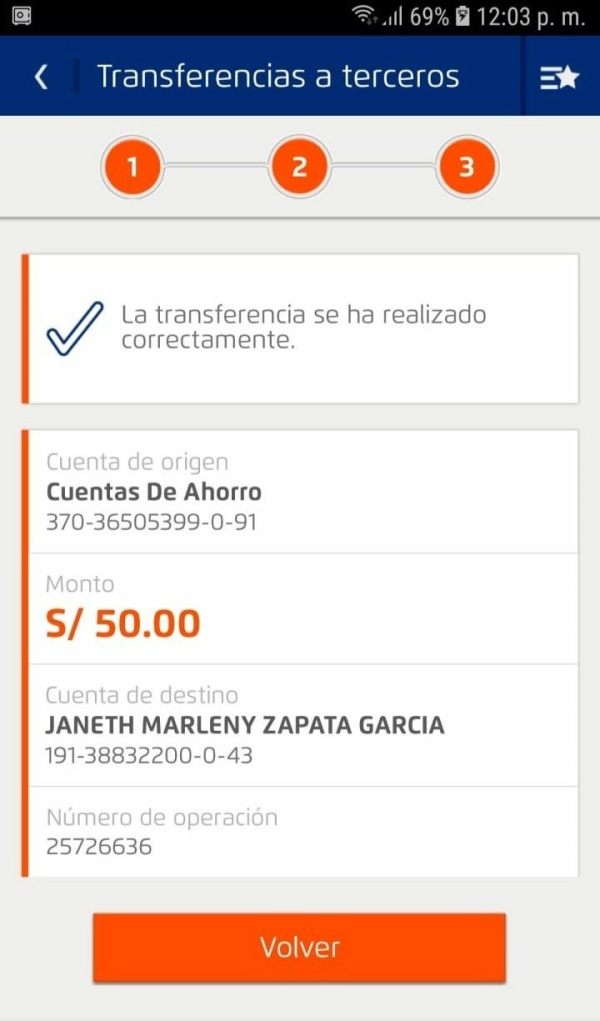

Poor me. Everything is dirty trick. I deposit my money($50)

YOCAI Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Poor me. Everything is dirty trick. I deposit my money($50)

The rise of online trading has revolutionized how individual investors approach the markets, opening numerous avenues for profit. Among them is yocai, an emerging brokerage asserting itself as a low-cost trading platform tailored for traders seeking high returns. However, this popularity is overshadowed by significant risks associated with unregulated brokers like yocai. While it appeals to beginner and intermediate traders with its promise of minimal trading costs, it operates without reputable oversight and presents serious concerns around transparency and user protection.

For those drawn to yocai by its low commission structure and the allure of high returns, it is crucial to balance the perceived benefits against the inherent risks. Users must critically assess whether the lure of potentially higher profits is worth the exposure to unregulated trading environments and the associated dangers, such as withdrawal issues and hidden fees, which have been reported by many users.

In this review, we will explore the key aspects of trading with yocai, offering insights into what traders can expect while emphasizing the essential trade-offs involved in this brokerage journey.

Beware of the following risks associated with yocai:

How to Self-Verify yocai's Legitimacy:

| Dimension | Rating | Justification |

|---|---|---|

| Trustworthiness | 2 | Unlicensed and low trust score. |

| Trading Costs | 3 | Low commissions but high withdrawal fees. |

| Platforms & Tools | 4 | Good variety of tools but usability concerns. |

| User Experience | 3 | Mixed reviews on customer service. |

| Customer Support | 2 | Reports of unresponsive support. |

| Account Conditions | 3 | Low minimum deposit but hidden fees. |

Established in recent years, yocai was designed to cater to a new generation of self-directed traders drawn by the digital trading revolution. Based outside major financial centers, its operational setup raises immediate concerns about accountability. Furthermore, the unregistered nature of its business indicates an absence of oversight from rigorous regulatory bodies, limiting its legitimacy in the eyes of prudent investors. In light of other reputable brokers operating with clear regulatory frameworks, yocais position in the market is precarious, serving predominantly a niche audience seeking low-cost trading solutions without much attention to regulatory safeguards.

yocai offers an array of financial products, including futures and options trading, primarily via its proprietary platforms likely inspired by recognized trading software like MT5 and WebTrader. While it claims to support various traded asset classes, specifics on their execution quality or available tools remain vague. Notably, users have reported concerns regarding undisclosed fees that gnaw at the benefits of low trading costs, thus necessitating a cautious approach to any engagement with the platform.

| Detail | Information |

|---|---|

| Regulation | None |

| Minimum Deposit | $5 |

| Leverage | Up to 1:100 |

| Major Fees | High withdrawal fees |

| Trading Platforms | MT5, WebTrader |

| Customer Support | Limited responsiveness |

A critical aspect of any broker's reputation is regulatory compliance. Unfortunately, yocai has been found lacking in this area, operating without licenses from any major body. This absence raises alarm over potential fraudulent activities. Given the numerous complaints lodged by users about fund withdrawal problems and hidden fees, the legitimacy of yocai merits serious scrutiny.

To help users verify the legitimacy of yocai, consider the following steps:

Echoing the issues previously mentioned, feedback concerning yocais trustworthiness is overwhelmingly negative.

"The lack of regulatory oversight and various user complaints suggest that there is a high chance of potential scams or mishaps with funds.

For those attracted to low costs, yocai does provide competitive pricing models. Beginner traders might find it appealing that commission rates are kept low compared to traditional brokerage firms. This positioning is especially alluring for individuals just starting their trading journey.

However, the low commissions may serve as bait for predatory practices. Users have voiced concerns about exorbitant withdrawal fees that often negate initial savings on trading commissions. One user mentioned:

"I thought I was saving money on trades until I tried to withdraw and was hit with surprise fees that took a big chunk of my profits."

The overall cost structure of yocai entails both positive and negative aspects that various trader types should weigh carefully. While the initial trading costs may appear beneficial, the hidden fees can quickly turn a seemingly advantageous situation into a costly one.

yocai touts a range of trading platforms, primarily utilizing versions of MT5 and WebTrader frameworks, catering to tech-savvy traders. These platforms offer a variety of analytical tools, enabling users to engage in multiple asset classes.

Despite presenting a decent assortment of tools, user experiences indicate some usability concerns. Many have reported navigating the platforms to be cumbersome, which detracts from the overall trading experience.

While yocai provides various platforms, the mixed user experiences suggest that the promise of enhanced trading tools may not fully deliver as expected.

For many traders, the user experience encompasses aspects such as interface design, ease of navigation, and the overall emotional comfort in trading. Mixed user reviews have surfaced on these elements, with many expressing frustration stemming from a non-intuitive user interface that seems to prioritize flashy features over functionality.

Despite the rising need for efficient customer support in trading, yocai has faced numerous complaints regarding its responsiveness. Many users have reported delayed responses, lack of follow-up, or inadequate solutions to their inquiries. This can lead to significant dissatisfaction, especially for new traders requiring guidance in a volatile market environment.

While yocai markets itself with a low minimum deposit requirement of $5, sharp scrutiny reveals a murky landscape with hidden fees that threaten to undercut this initial appeal. Such conditions can mislead novice traders, leading them to believe they are joining a low-entry-barrier platform only to face unexpected costs as they attempt to manage their accounts.

In summary, yocai provides a compelling yet deceptive offering to novice traders seeking low-cost options, with a string of risks lurking beneath the surface. The lack of regulatory oversight and transparency, coupled with the prevalence of user complaints, renders it a precarious choice for those looking to trade online.

Investors are encouraged to exercise caution and perform thorough due diligence before committing their funds to yocai or similar unregulated platforms. The promise of high returns must be carefully weighed against the potential for significant financial loss and operational risks, ensuring that traders are equipped with a comprehensive understanding of the brokers long-term viability.

FX Broker Capital Trading Markets Review