VOW 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive vow review gives traders an objective analysis of VOW as a forex broker option in 2025. VOW shows a mixed picture in the competitive forex brokerage landscape based on available information and user feedback. Some users have expressed positive feelings about their experience. They describe it as "surprisingly good and worth the investment." However, the overall assessment stays neutral because of limited transparency about key operational aspects.

VOW appears to position itself as a broker offering a straightforward and emotionally engaging trading experience. This approach might appeal to traders who value simplicity over complex features. The platform seems to serve users who want a more personalized approach to forex trading. However, specific details about their service offerings remain limited in publicly available information.

The target demographic for VOW appears to be retail traders who prioritize user experience and emotional connection with their trading platform over advanced technical features. The lack of detailed information about regulatory compliance, trading conditions, and platform specifications makes it challenging to provide a definitive recommendation for specific trader types. User feedback suggests that VOW may exceed initial expectations for some traders, though the sample size is small. This limited data makes it hard to draw broad conclusions about overall client satisfaction.

Important Disclaimers

Cross-Regional Entity Differences: The available information does not specify regulatory jurisdictions or regional variations in VOW's operations. Potential clients should know that forex brokers often operate under different regulatory frameworks across various regions. These differences can significantly impact trading conditions, client protections, and available services. Traders should verify the specific regulatory status that applies to their jurisdiction before opening an account.

Review Methodology: This evaluation is based on limited publicly available information and user feedback. The scarcity of detailed official data about VOW's operations, trading conditions, and regulatory status makes this review preliminary. Prospective clients are strongly encouraged to conduct additional research and request comprehensive information directly from the broker before making any trading decisions.

Rating Framework

Broker Overview

VOW operates in the forex brokerage space. However, specific details about the company's establishment date, corporate background, and primary business model are not readily available in public documentation. The lack of comprehensive corporate information raises questions about transparency. This factor is typically important for traders when selecting a forex broker.

The broker's operational structure remains unclear from available sources. This includes whether it operates as a market maker, ECN provider, or hybrid model. This information gap makes it difficult for potential clients to understand how their trades will be executed and what kind of market access they can expect. Details about the company's headquarters location, ownership structure, and corporate history are not prominently featured in accessible materials.

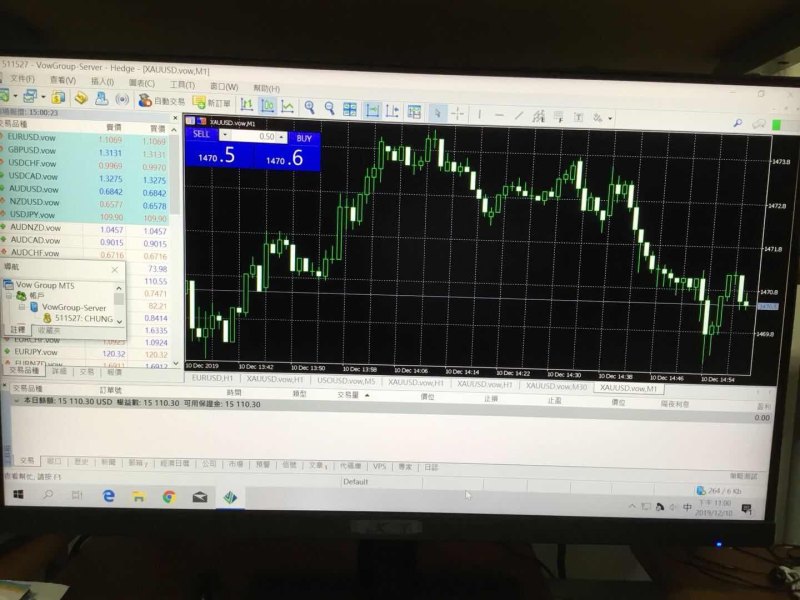

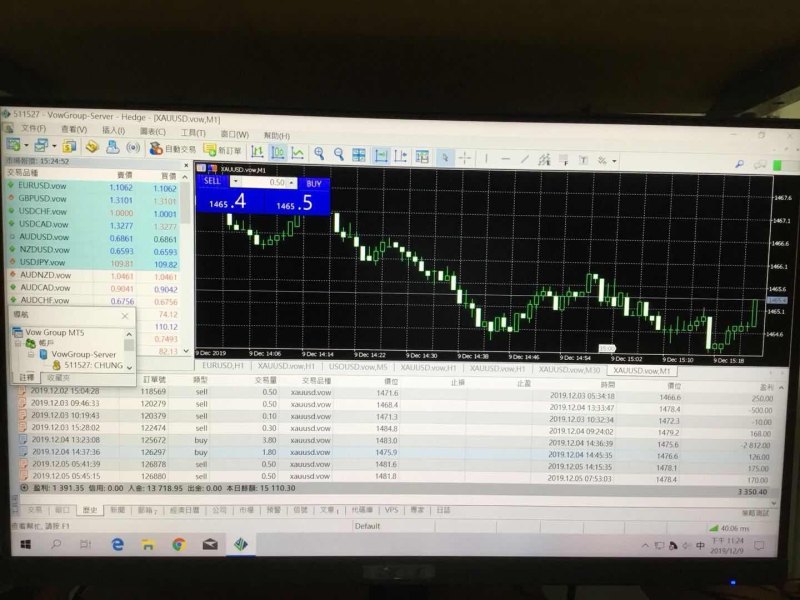

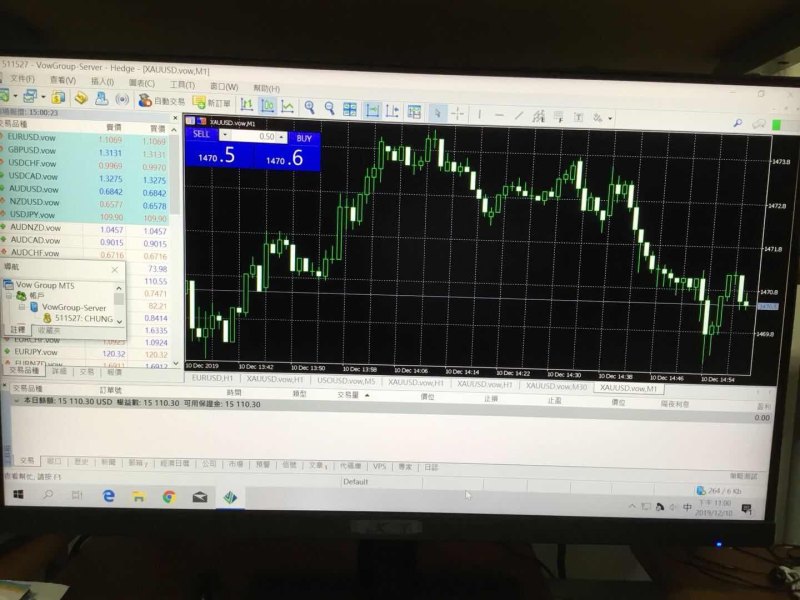

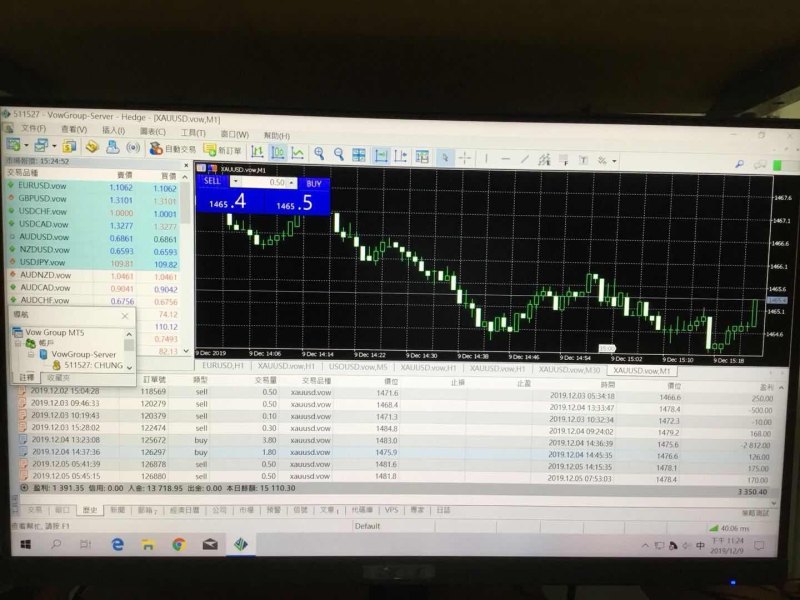

VOW has not clearly specified which trading platforms it offers or what asset classes are available for trading regarding trading infrastructure. Most established forex brokers typically provide information about their platform options, such as MetaTrader 4, MetaTrader 5, or proprietary platforms. They also list supported currency pairs, commodities, indices, and other tradeable instruments. The absence of such fundamental information in this vow review suggests either limited marketing efforts or a preference for direct client communication over public disclosure.

The regulatory landscape for VOW remains unclear. There is no specific mention of oversight by major financial regulators such as the FCA, CySEC, ASIC, or other recognized authorities. This represents a significant information gap that potential clients should address through direct inquiry with the broker.

Regulatory Jurisdictions: Available information does not specify which regulatory authorities oversee VOW's operations. This represents a critical information gap for potential clients.

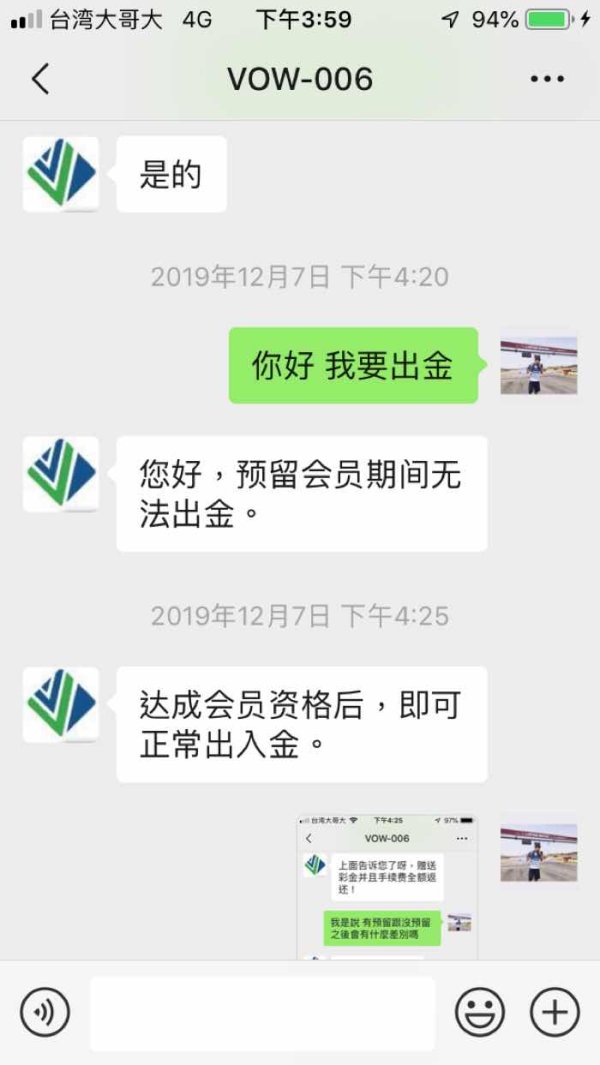

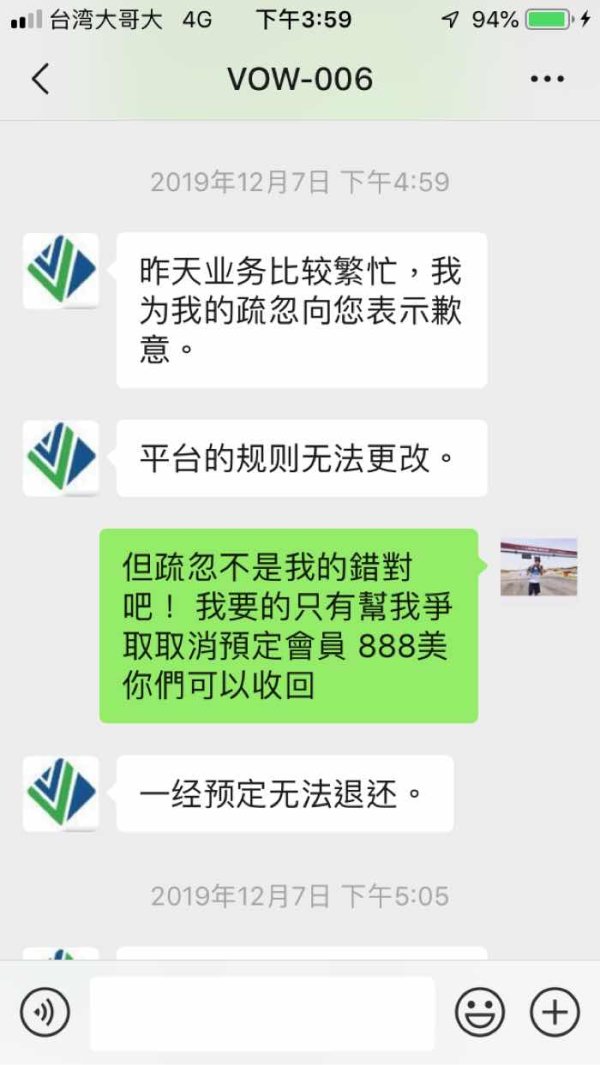

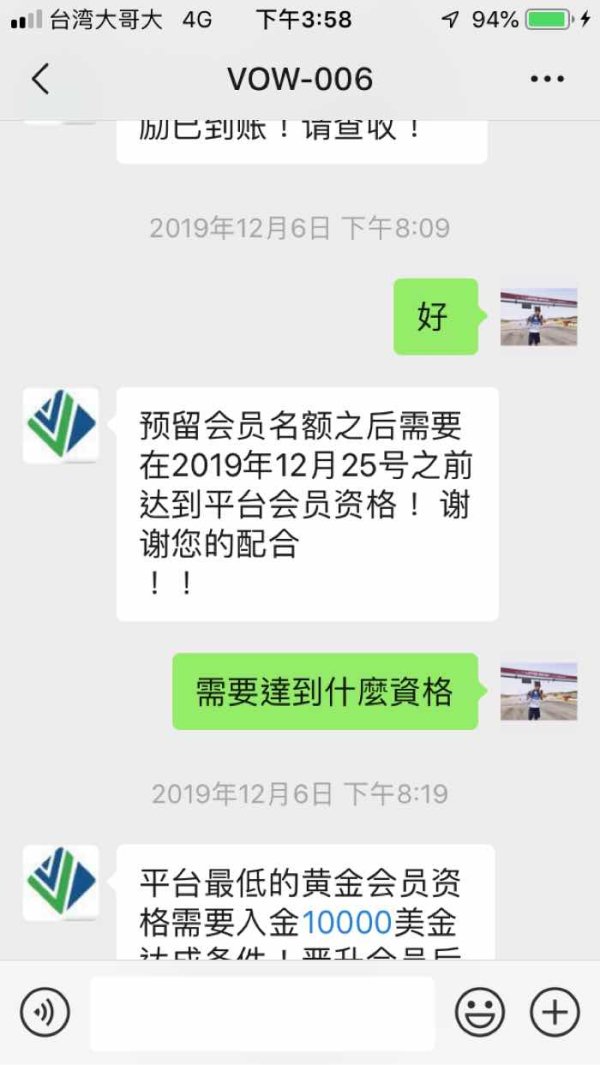

Deposit and Withdrawal Methods: Specific payment methods, processing times, and associated fees for funding accounts or withdrawing profits are not detailed in accessible materials.

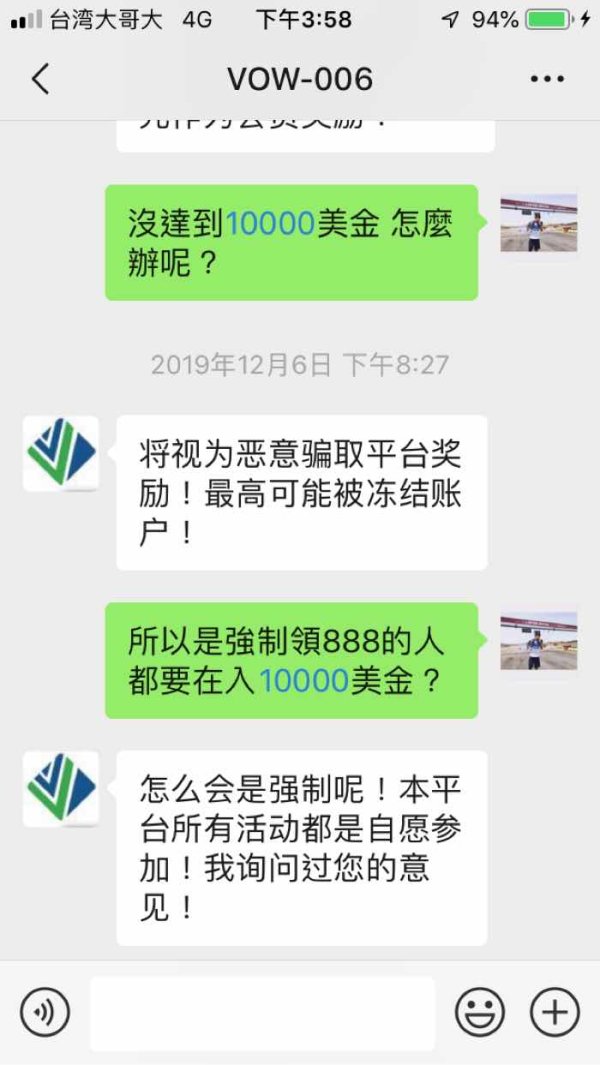

Minimum Deposit Requirements: The initial capital requirement to open an account with VOW is not specified in available documentation.

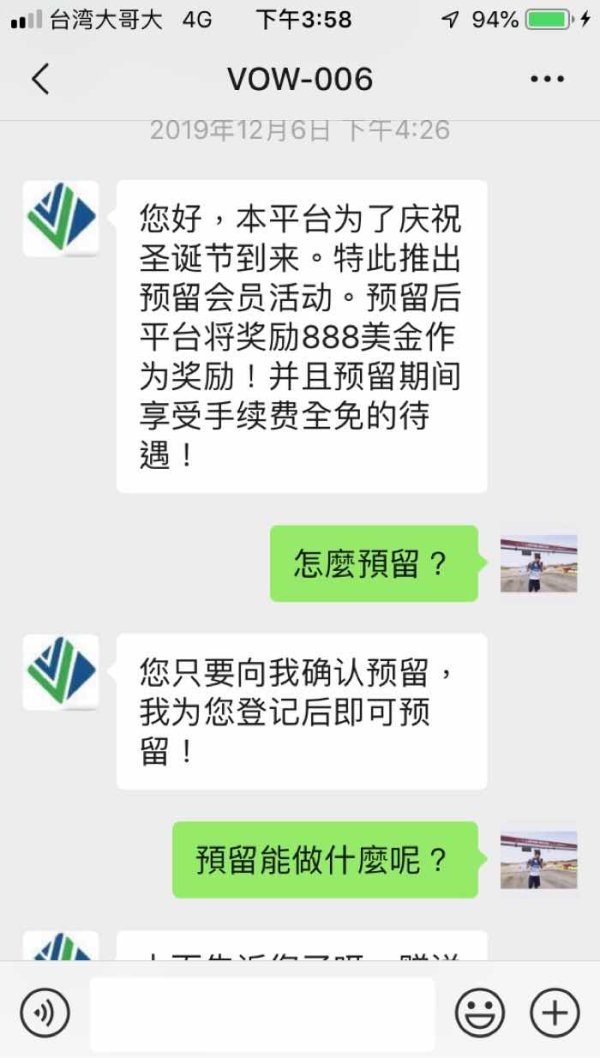

Bonuses and Promotions: No information is available regarding welcome bonuses, trading incentives, or promotional offers. These might be available to new or existing clients.

Tradeable Assets: The range of currency pairs, commodities, indices, or other financial instruments available for trading through VOW is not clearly documented.

Cost Structure: Critical information about spreads, commissions, overnight financing charges, and other trading costs is not available in public materials. This makes it impossible to assess the competitiveness of VOW's pricing.

Leverage Options: Maximum leverage ratios and margin requirements are not specified in available information.

Platform Options: The trading platforms offered by VOW, including mobile applications and web-based solutions, are not detailed in accessible sources.

Geographic Restrictions: Information about which countries or regions are restricted from accessing VOW's services is not available.

Customer Support Languages: The languages supported by VOW's customer service team are not specified.

This vow review highlights significant information gaps. Potential clients should address these through direct communication with the broker before making any commitment.

Detailed Rating Analysis

Account Conditions Analysis (Score: 5/10)

The evaluation of VOW's account conditions is significantly hampered by the lack of available information. This includes account types, minimum deposit requirements, and specific terms of service. In the competitive forex brokerage industry, transparency about account structures is typically considered essential for building client trust and enabling informed decision-making.

Most reputable forex brokers offer multiple account tiers designed to accommodate different trader profiles. These range from beginners with small deposits to professional traders requiring advanced features. They might include standard accounts, premium accounts with reduced spreads, and specialized accounts such as Islamic accounts for clients requiring Sharia-compliant trading conditions. The absence of such information in VOW's publicly available materials makes it impossible to assess how well their account structure serves different client needs.

The account opening process is also not detailed in available sources. This includes required documentation, verification procedures, and timeframes. Modern forex brokers typically emphasize streamlined onboarding processes while maintaining compliance with know-your-customer (KYC) and anti-money laundering (AML) requirements. Without clarity on these procedures, potential clients cannot adequately prepare for the account opening experience.

Account management features such as the ability to manage multiple accounts, transfer funds between accounts, or access different base currencies are not specified. These features can significantly impact the trading experience, particularly for more sophisticated traders or those managing multiple strategies.

The neutral rating of 5/10 for this vow review section reflects the impossibility of making a meaningful assessment without fundamental account information.

The assessment of VOW's trading tools and educational resources faces similar challenges due to limited available information. Modern forex trading success often depends heavily on the quality and comprehensiveness of analytical tools, research resources, and educational materials provided by the broker.

Competitive forex brokers typically offer a range of technical analysis tools. These include advanced charting capabilities, technical indicators, drawing tools, and market scanning features. Economic calendars, market news feeds, and fundamental analysis resources are also standard offerings. The availability and quality of these tools can significantly impact a trader's ability to make informed decisions and execute effective strategies.

Educational resources represent another critical area where information about VOW is lacking. Comprehensive broker education programs often include trading guides, video tutorials, webinars, and market analysis content designed to help traders improve their skills and understanding of forex markets. For newer traders especially, the quality and accessibility of educational materials can be a deciding factor in broker selection.

Automated trading support is increasingly important for many forex traders. This includes expert advisor (EA) compatibility and algorithmic trading capabilities. The ability to implement automated strategies or copy successful traders through social trading platforms has become a standard expectation among many market participants.

Without specific information about VOW's tool offerings, research capabilities, or educational resources, it is impossible to evaluate how well they serve their clients' analytical and learning needs. This results in the neutral 5/10 rating.

Customer Service and Support Analysis (Score: 5/10)

Customer service quality represents a crucial factor in forex broker evaluation. Traders often require prompt assistance with technical issues, account questions, or trading-related concerns. The assessment of VOW's customer support capabilities is constrained by the lack of available information about their service channels, availability, and quality standards.

Effective forex broker customer support typically includes multiple communication channels. These include live chat, telephone support, email assistance, and potentially social media responsiveness. The availability of these channels during market hours, particularly during major trading sessions, is essential for addressing time-sensitive trading issues.

Response time metrics are not available for VOW. These indicate how quickly the support team addresses client inquiries. In the forex industry, where market conditions can change rapidly, quick response times for urgent issues can significantly impact trading outcomes. Many top-tier brokers publish their average response times and maintain service level agreements with their clients.

The expertise level of customer support representatives is another important consideration. Forex trading involves complex financial concepts, and support staff should be capable of addressing both basic account inquiries and more sophisticated trading-related questions. The availability of specialized support for different trader levels or account types can also enhance the overall service experience.

Multilingual support capabilities are particularly important for international forex brokers serving diverse client bases. The languages supported by VOW's customer service team are not specified in available materials. This could be relevant for traders whose primary language is not English.

The neutral 5/10 rating reflects the inability to assess these critical customer service dimensions based on available information.

Trading Experience Analysis (Score: 5/10)

The trading experience evaluation encompasses platform stability, execution quality, and overall user interface effectiveness. These factors directly impact a trader's ability to implement strategies successfully and can significantly affect trading outcomes. This makes them critical components of any comprehensive vow review.

Platform stability and uptime are fundamental requirements for forex trading. Market opportunities can emerge and disappear within seconds. Reliable brokers typically maintain robust technical infrastructure with minimal downtime and fast order execution speeds. The absence of performance data or uptime statistics for VOW makes it impossible to assess their technical reliability.

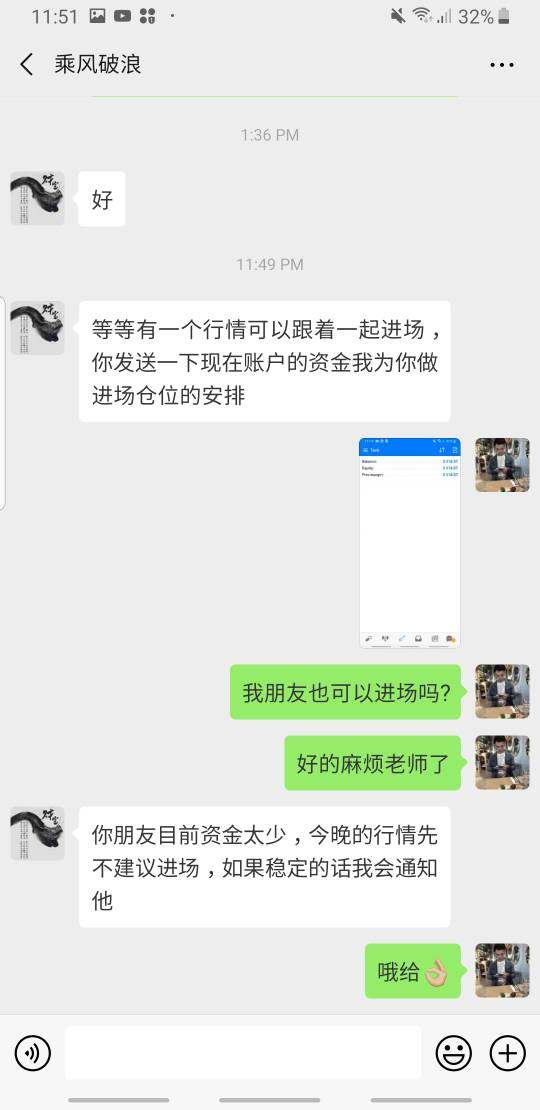

Order execution quality represents another crucial aspect of the trading experience. This includes the speed of trade execution and the frequency of slippage or requotes. Professional forex traders often evaluate brokers based on their ability to execute orders at requested prices, particularly during high-volatility market conditions. Without specific execution statistics or user feedback about order handling, this aspect cannot be properly evaluated.

The user interface design and functionality of trading platforms significantly impact trader efficiency and satisfaction. Modern traders expect intuitive navigation, customizable layouts, comprehensive charting capabilities, and seamless integration of analytical tools. The specific platforms offered by VOW and their feature sets are not detailed in available information.

Mobile trading capabilities have become increasingly important as traders seek to monitor and manage positions while away from their primary workstations. The quality and functionality of mobile applications, including feature parity with desktop platforms, can be a significant differentiator among forex brokers.

The 5/10 rating reflects the absence of concrete information about these critical trading experience factors.

Trust Factor Analysis (Score: 5/10)

Trust represents perhaps the most critical factor in forex broker evaluation. Traders must have confidence in their broker's financial stability, regulatory compliance, and ethical business practices. The assessment of VOW's trustworthiness is significantly challenged by limited transparency regarding regulatory oversight and operational details.

Regulatory compliance with recognized financial authorities provides the foundation for broker trustworthiness. Established regulators such as the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC), and others maintain strict standards for broker operations, capital requirements, and client fund protection. The regulatory status of VOW is not clearly documented in available materials.

Client fund protection mechanisms are essential trust factors. These include segregated account requirements and participation in compensation schemes. Reputable brokers typically maintain client funds in segregated accounts separate from operational capital and participate in investor protection schemes that provide coverage in case of broker insolvency.

Corporate transparency contributes to overall trustworthiness. This includes clear disclosure of ownership structure, financial statements, and business operations. The limited availability of such information about VOW raises questions about their commitment to transparency, though this may reflect their communication strategy rather than operational issues.

Industry reputation and track record provide additional trust indicators. Established brokers typically have documented histories of regulatory compliance, client service, and ethical business practices. The relative lack of publicly available information about VOW's operational history makes this assessment challenging.

The neutral 5/10 rating acknowledges these significant information gaps while avoiding negative assumptions about the broker's actual trustworthiness.

User Experience Analysis (Score: 5/10)

User experience encompasses the overall satisfaction and ease of interaction that clients have with their forex broker across all touchpoints. This ranges from initial registration through ongoing trading activities. The evaluation of VOW's user experience is constrained by limited feedback and detailed information about their service delivery.

The account registration and verification process significantly impacts initial user experience. Modern forex brokers strive to balance regulatory compliance requirements with user convenience. They often offer streamlined digital onboarding processes that minimize friction while maintaining security standards. The specific procedures and timeframes for account opening with VOW are not detailed in available materials.

Interface design and usability across all platforms contribute substantially to ongoing user satisfaction. This includes the intuitiveness of navigation, the logical organization of features, and the overall aesthetic appeal of trading interfaces. The responsiveness of platforms across different devices and operating systems also impacts user experience quality.

The efficiency of financial operations represents another crucial user experience dimension. This includes deposit processing, withdrawal procedures, and account management functions. Traders expect transparent fee structures, reasonable processing times, and multiple convenient options for managing their account funds.

Available user feedback suggests some positive experiences. At least one user describes their experience as "surprisingly good and worth the investment." However, the limited sample size of available reviews makes it difficult to draw broader conclusions about overall client satisfaction patterns or common user experience themes.

The neutral 5/10 rating reflects both the limited available feedback and the absence of comprehensive user experience data. This would enable a more definitive assessment of VOW's service quality from the client perspective.

Conclusion

This comprehensive vow review reveals significant information gaps that make definitive recommendations challenging. Limited user feedback suggests some positive experiences. However, the lack of transparency regarding regulatory compliance, trading conditions, and operational details represents a substantial concern for potential clients.

VOW may be suitable for traders who prioritize personalized service and are willing to conduct extensive research through direct communication with the broker. Traders seeking transparent, well-documented trading conditions and clear regulatory oversight may find other brokers more suitable for their needs.

The primary limitations identified include insufficient regulatory information, unclear trading terms and conditions, and limited transparency about platform capabilities and costs. Prospective clients are strongly advised to request comprehensive information directly from VOW and verify all claims independently before committing funds to trading activities.