Ae Global 2025 Review: Everything You Need to Know

Executive Summary

This Ae Global review shows serious problems with AE Global Link, a financial company in the UK that creates big risks for people who want to invest. Our research and user feedback show that AE Global has major issues that make it wrong for traders who want reliable broker services.

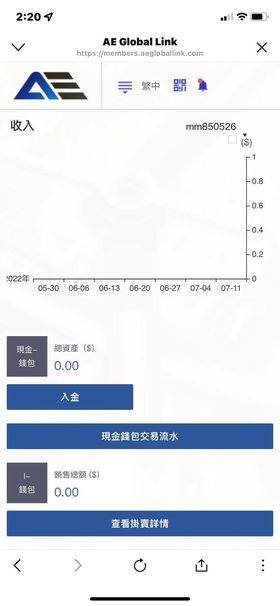

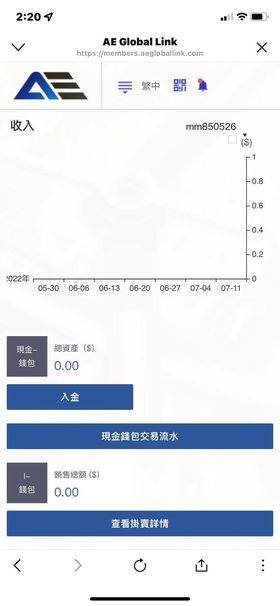

AE Global works as a financial services company that offers different investment tools like stocks, debt securities, derivatives, and real estate options. But the company has serious trust problems, with many sources saying it's an unreliable broker with big operational issues. The biggest worries are about withdrawal problems and no proper regulatory oversight.

User feedback always shows negative things about AE Global's operations, with traders reporting big issues getting their money back and poor customer service. The broker has no regulatory supervision, which creates extra risks for potential clients because there are no protections or ways to get help through recognized financial authorities.

AE Global seems to target investors who want access to different financial instruments. But given the documented issues and negative user experiences, this broker creates big risks that are worse than any potential benefits. The mix of regulatory gaps, user complaints, and operational concerns makes AE Global wrong for both new and experienced traders who want secure investment platforms.

Important Disclaimers

Regional Entity Differences: AE Global works mainly in the UK market but has no proper regulatory oversight from recognized financial authorities. This lack of supervision creates big legal and safety concerns for potential users.

Traders should know that the company's operational status is very different from properly regulated brokers, and the lack of regulatory protection means limited options for solving disputes.

Review Methodology: This evaluation uses comprehensive analysis of user feedback, market data, and public information about AE Global's operations. The assessment has not been checked through direct trading experience but uses documented user experiences and third-party reports to give an accurate picture of the broker's performance and reliability.

Rating Framework

Broker Overview

AE Global works as a financial services company based in the UK, though specific establishment dates are not disclosed in available documentation. The company positions itself as a provider of diverse investment opportunities, trying to attract traders interested in multiple asset classes.

But the broker's operational history and corporate background lack the transparency typically expected from reputable financial services providers.

The company's business model focuses on offering access to various financial instruments including equity securities, debt products, derivative instruments, and real estate investment options. This diversified approach suggests an attempt to cater to different investor preferences and risk appetites.

But the execution of these services has proven problematic based on user feedback and operational assessments.

AE Global's regulatory status presents the most significant concern for potential users. Operating in the UK without proper regulatory oversight from the Financial Conduct Authority or other recognized supervisory bodies creates substantial risks for traders.

This regulatory gap means users lack the protections typically afforded by properly licensed brokers, including compensation schemes and dispute resolution mechanisms. The absence of regulatory supervision also raises questions about the company's compliance with standard industry practices and client protection measures.

Regulatory Status: AE Global operates in the UK without adequate regulatory supervision, creating significant safety and legitimacy concerns for potential users. The absence of proper licensing from recognized financial authorities means traders lack standard protections.

Deposit and Withdrawal Methods: Specific information about payment processing methods remains unavailable in current documentation, raising transparency concerns about fund handling procedures.

Minimum Deposit Requirements: The broker has not disclosed minimum deposit thresholds, making it difficult for potential users to assess accessibility and account opening requirements.

Bonus and Promotional Offers: No specific promotional programs or bonus structures have been identified in available materials, suggesting limited incentive programs for new or existing clients.

Tradeable Assets: AE Global offers access to stocks, debt securities, derivatives, and real estate investment options, providing a diverse range of financial instruments for potential trading activities.

Cost Structure: Detailed information about spreads, commissions, and fee structures remains undisclosed, creating significant transparency issues that prevent proper cost assessment for potential users.

Leverage Ratios: Specific leverage offerings have not been documented in available materials, making it impossible to assess the broker's risk management approach and trading flexibility.

Platform Options: Trading platform specifications and technological infrastructure details remain undocumented in current research materials.

Regional Restrictions: Geographic limitations and service availability information has not been clearly specified in available documentation.

Customer Service Languages: Multi-language support capabilities remain unspecified in current broker documentation.

This Ae Global review highlights significant information gaps that raise concerns about operational transparency and client communication standards.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

AE Global's account conditions present numerous concerns that significantly impact the overall trading experience. The broker fails to provide clear information about account types, making it difficult for potential users to understand available options and select appropriate services.

This lack of transparency extends to minimum deposit requirements, which remain undisclosed despite being fundamental information for account opening decisions.

The account opening process lacks clear documentation, creating uncertainty about verification procedures and timeline expectations. Users report confusion about account setup requirements and express frustration with unclear communication during the registration process.

This opacity suggests poor operational organization and inadequate client onboarding procedures.

Special account features, such as Islamic accounts for Sharia-compliant trading, have not been documented or confirmed as available services. This limitation potentially excludes significant user segments and suggests limited attention to diverse client needs.

The absence of specialized account options indicates a one-size-fits-all approach that may not serve different trading requirements effectively.

User feedback consistently highlights dissatisfaction with account-related services, particularly regarding fund management and account maintenance issues. These complaints suggest systemic problems with account administration that extend beyond simple operational hiccups.

The negative user experiences documented in this Ae Global review indicate fundamental issues with account condition management and client service delivery.

AE Global's trading tools and resources present a mixed picture with significant limitations that impact user experience. While the broker claims to offer access to various financial instruments, specific details about trading tools, analytical resources, and platform capabilities remain largely undocumented.

This lack of transparency makes it difficult to assess the actual quality and comprehensiveness of available trading resources.

Research and analysis tools, which are essential for informed trading decisions, appear to be limited or poorly documented. Users have not reported access to comprehensive market analysis, economic calendars, or advanced charting capabilities that are standard offerings from reputable brokers.

This deficiency significantly hampers traders' ability to conduct thorough market analysis and make informed investment decisions.

Educational resources, crucial for trader development and platform familiarity, seem inadequate based on available information. The absence of documented training materials, webinars, or educational content suggests limited commitment to client development and success.

This gap particularly affects novice traders who rely on broker-provided education to develop their skills and understanding.

Automated trading support and algorithmic trading capabilities remain unspecified, limiting advanced users who require sophisticated trading tools. The lack of clear information about API access, expert advisors, or automated trading systems suggests limited technological sophistication and reduced appeal for experienced traders seeking advanced functionality.

Customer Service and Support Analysis (Score: 2/10)

Customer service represents one of AE Global's most significant weaknesses, with user feedback consistently highlighting poor support experiences. The broker's customer service channels and availability remain poorly documented, creating uncertainty about how clients can access assistance when needed.

This lack of clear communication pathways suggests inadequate customer support infrastructure and limited commitment to client service.

Response times appear to be problematic based on user reports, with many traders experiencing significant delays in receiving support for urgent issues. These extended response periods create frustration and can lead to financial losses when time-sensitive trading issues require immediate attention.

The slow response times indicate understaffing or inadequate prioritization of customer support functions.

Service quality, as reflected in user feedback, consistently falls below acceptable standards. Users report unhelpful responses, lack of problem resolution, and poor communication from support staff.

These issues suggest insufficient training, inadequate resources, or systematic problems with customer service delivery that impact the overall user experience.

Multi-language support capabilities remain unspecified, potentially limiting service accessibility for non-English speaking users. Customer service hours and availability also lack clear documentation, creating uncertainty about when users can expect to receive assistance.

These gaps in service information and quality contribute to the overall negative assessment of AE Global's customer support capabilities.

Trading Experience Analysis (Score: 3/10)

The trading experience with AE Global presents numerous challenges that significantly impact user satisfaction and trading effectiveness. Platform stability and execution speed appear problematic based on user feedback, with traders reporting technical issues that interfere with normal trading activities.

These stability problems create uncertainty and potential financial risks for users attempting to execute trades in volatile market conditions.

Order execution quality represents a significant concern, with users reporting issues including slippage and requoting problems that affect trade outcomes. These execution issues can result in unexpected costs and reduced trading profitability, particularly for strategies that rely on precise entry and exit points.

The documented execution problems suggest inadequate technological infrastructure or poor liquidity management.

Platform functionality appears limited based on available information, with users expressing dissatisfaction with available features and tools. The lack of comprehensive platform capabilities restricts trading flexibility and may force users to seek additional third-party solutions to meet their trading needs.

This limitation reduces the overall value proposition and user convenience.

Mobile trading experience remains poorly documented, raising questions about platform accessibility and functionality across different devices. In today's trading environment, mobile capabilities are essential for managing positions and responding to market opportunities.

The lack of clear mobile platform information suggests potential limitations in trading accessibility.

Overall trading environment satisfaction remains low based on user feedback, with multiple complaints about various aspects of the trading experience. This Ae Global review confirms that the combination of technical issues, execution problems, and limited functionality creates a suboptimal trading environment for users.

Trust and Reliability Analysis (Score: 1/10)

Trust and reliability represent AE Global's most critical weaknesses, with the broker facing severe credibility challenges that make it unsuitable for serious trading activities. The regulatory situation presents the most significant concern, as AE Global operates in the UK without proper oversight from recognized financial authorities.

This regulatory gap eliminates standard client protections and creates substantial risks for user funds and trading activities.

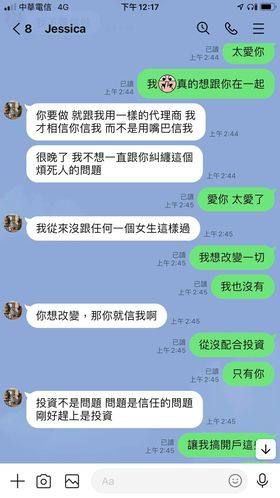

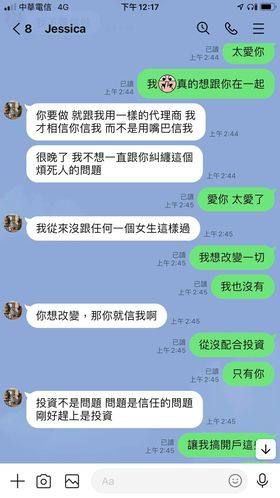

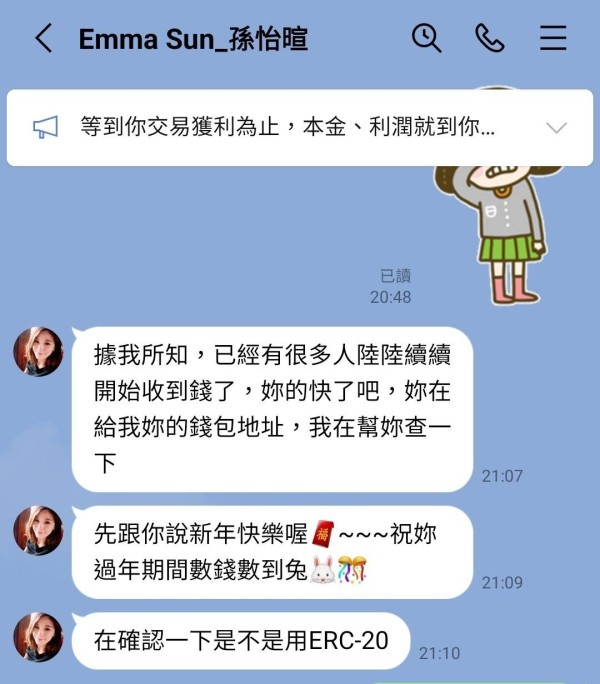

AE Global Link has been specifically flagged as a scam by multiple sources, representing an extreme red flag for potential users. This designation indicates documented fraudulent activities or severe operational problems that pose significant risks to user funds and trading activities.

The scam classification should serve as a clear warning to potential users about the dangers of engaging with this broker.

Fund safety measures appear inadequate or non-existent based on available information. The lack of regulatory oversight means standard client fund protection mechanisms, such as segregated accounts or compensation schemes, are not available to users.

This absence of fund protection creates substantial financial risks for anyone depositing money with the broker.

Company transparency remains extremely poor, with limited disclosure about corporate structure, ownership, or operational procedures. This opacity prevents users from conducting proper due diligence and understanding the risks associated with the broker.

The lack of transparency also makes it difficult to verify claims about services or assess the company's financial stability.

Industry reputation has been severely damaged by the scam designation and negative user experiences. The combination of regulatory issues, user complaints, and fraud allegations creates a reputation that makes AE Global unsuitable for any serious trading consideration.

User Experience Analysis (Score: 2/10)

User experience with AE Global consistently falls below acceptable standards across multiple dimensions of service delivery. Overall user satisfaction remains extremely low based on documented feedback, with traders expressing frustration about various aspects of their interaction with the broker.

The prevalence of negative reviews and complaints suggests systematic problems rather than isolated incidents.

Withdrawal difficulties represent the most common and serious user complaint, with multiple traders reporting problems accessing their funds. These withdrawal issues create significant financial stress and suggest either liquidity problems or deliberate fund retention practices.

The frequency and severity of withdrawal complaints make this a critical concern for potential users.

Customer service responsiveness has been consistently criticized by users, with many reporting slow response times and unhelpful interactions. These service problems compound other issues and create additional frustration for users attempting to resolve problems or access support.

The poor customer service experience suggests inadequate staffing or training in client support functions.

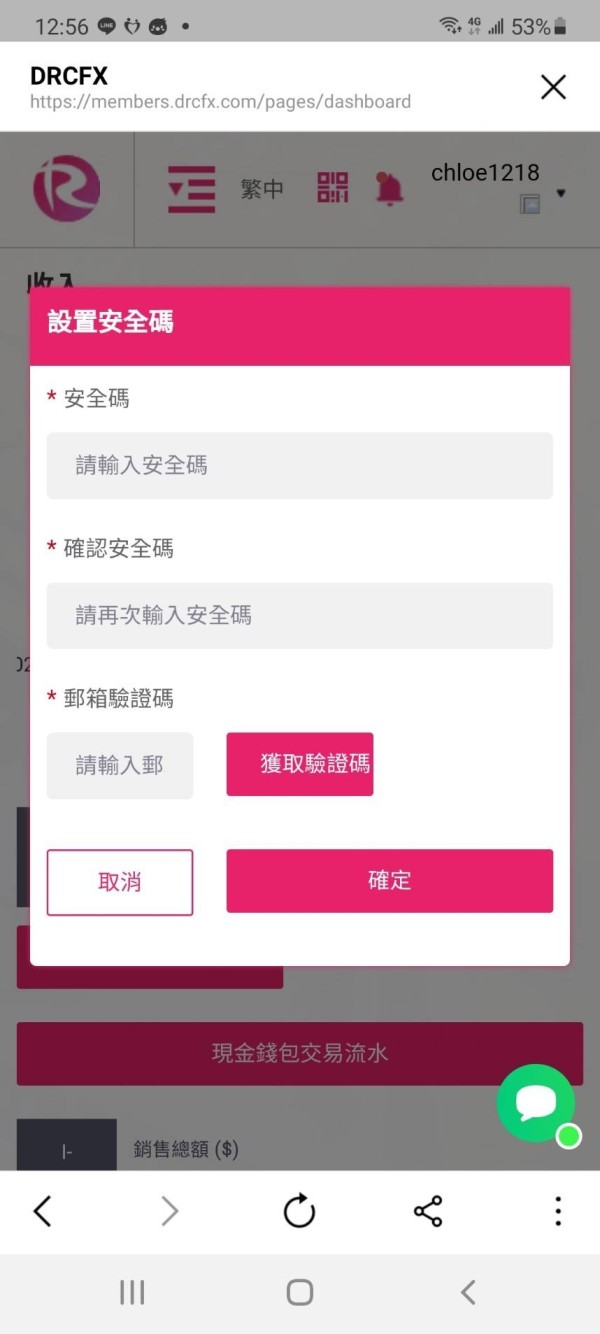

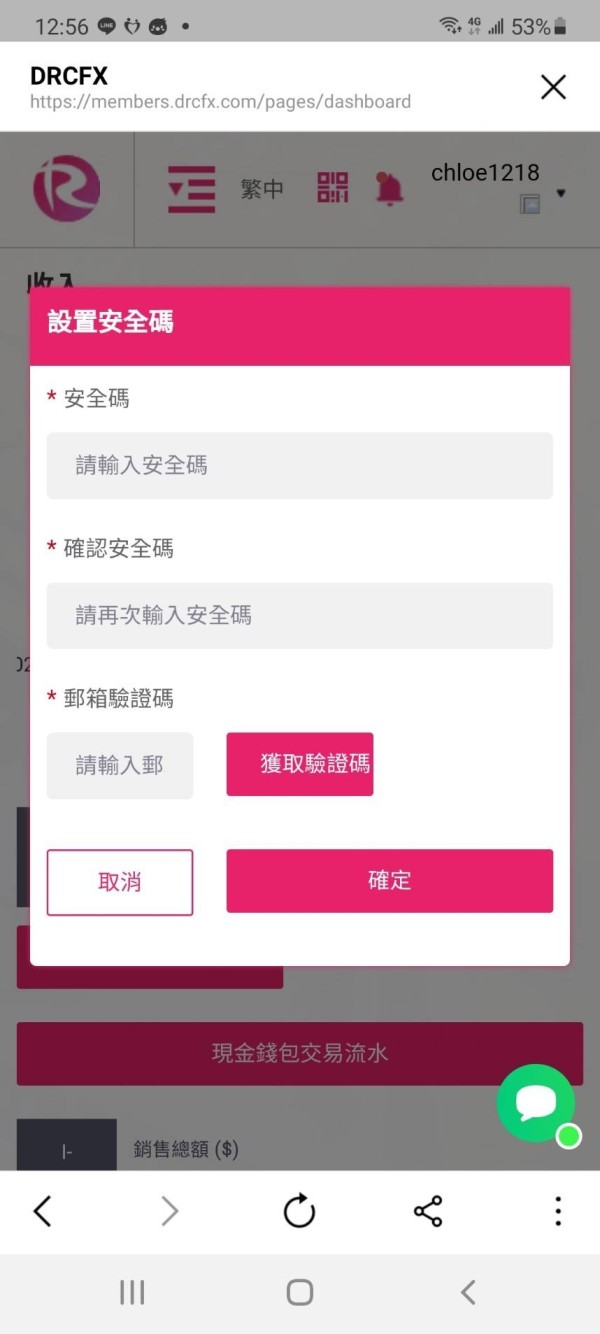

Registration and verification processes appear problematic based on user feedback, with traders reporting confusion and delays during account setup. These onboarding issues create negative first impressions and may indicate broader operational problems with account management systems and procedures.

The user profile most suited to AE Global would theoretically be high-risk investors willing to accept substantial uncertainties for potential gains. However, given the documented problems and scam designation, this broker cannot be recommended for any user type or investment strategy.

The combination of operational issues, regulatory concerns, and negative user experiences creates risks that far outweigh any potential benefits.

Conclusion

This comprehensive Ae Global review reveals a broker with fundamental problems that make it unsuitable for serious trading consideration. The combination of regulatory gaps, user complaints, withdrawal difficulties, and scam designations creates a risk profile that cannot be justified for any investment strategy or user type.

AE Global's lack of proper regulatory oversight represents the most significant concern, as it eliminates standard client protections and recourse mechanisms. The documented withdrawal problems and consistently negative user feedback further compound these concerns, creating a pattern of operational issues that suggest systematic problems rather than isolated incidents.

Based on this analysis, AE Global cannot be recommended for any trader seeking reliable brokerage services. The documented risks and negative user experiences far outweigh any potential benefits, making this broker unsuitable for both novice and experienced traders.

Potential users should seek properly regulated alternatives that offer transparent operations, reliable fund access, and adequate client protections.