fogo 2025 Review: Everything You Need to Know

Summary

This fogo review gives you a complete look at the broker FOGO. FOGO has a bad reputation in the forex industry, with many people saying it might be a scam. The broker lets you trade many different things like forex, stocks, futures, commodities, and cryptocurrencies. FOGO says it is run by FOGO GLOBAL LIMITED and claims to be regulated by the United States Money Services Business. However, many people doubt this because the details are unclear and reports conflict with each other. FOGO seems to target investors who want to trade different types of assets, but you should be very careful because of all the negative feedback. Many user reports and industry studies show that trading on FOGO is much riskier than any benefits it might offer.

Notice

FOGO claims its main office is in the United Kingdom, but the regulatory information from different regions doesn't match up. This review uses user feedback, industry standards, and public data to show big differences in regulatory oversight from one area to another. You should pay attention to these differences when deciding if FOGO is right for you. The information here comes from customer reviews and trusted market analysis, which show why you need to be very careful.

Rating Framework

Broker Overview

FOGO says it is a multi-asset trading broker run by FOGO GLOBAL LIMITED. The company doesn't say when it was started, but FOGO claims it offers many investment products including forex, stocks, indices, commodities like crude oil and gold, and cryptocurrencies like Bitcoin. However, there is very little detailed information about the company's history and where its headquarters are located. Industry experts say FOGO's marketing materials talk about having many trading options, but the lack of real data about the broker's background makes people seriously question if it's legitimate. These problems get worse because different regions treat the broker's regulations differently.

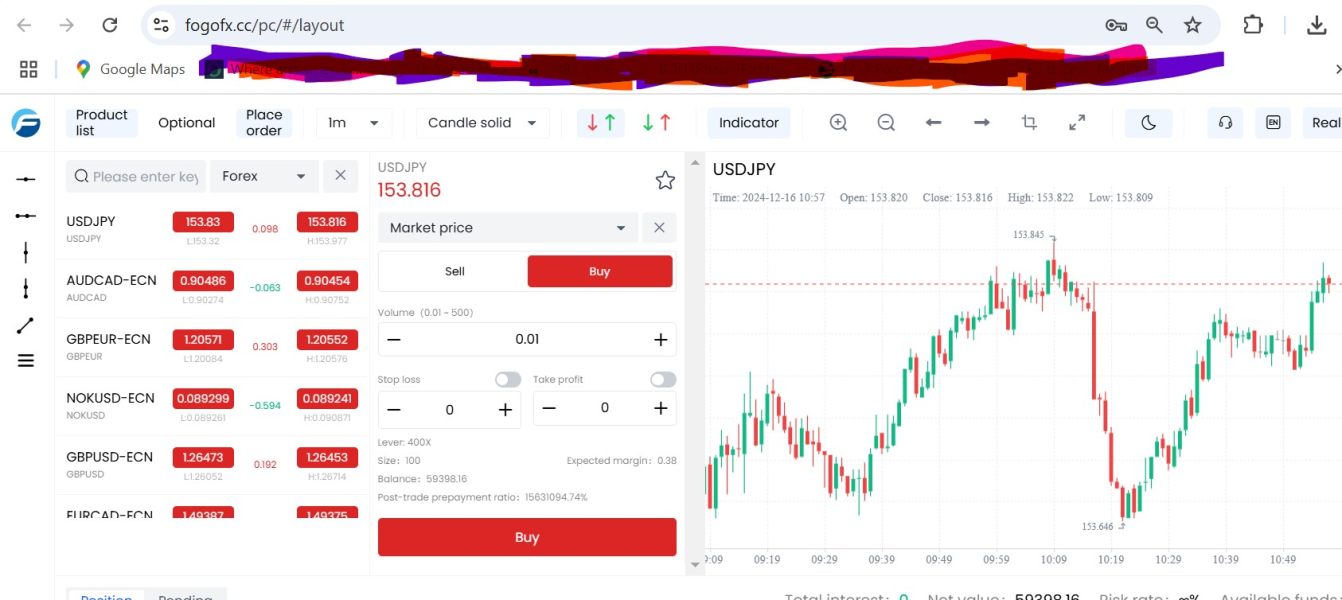

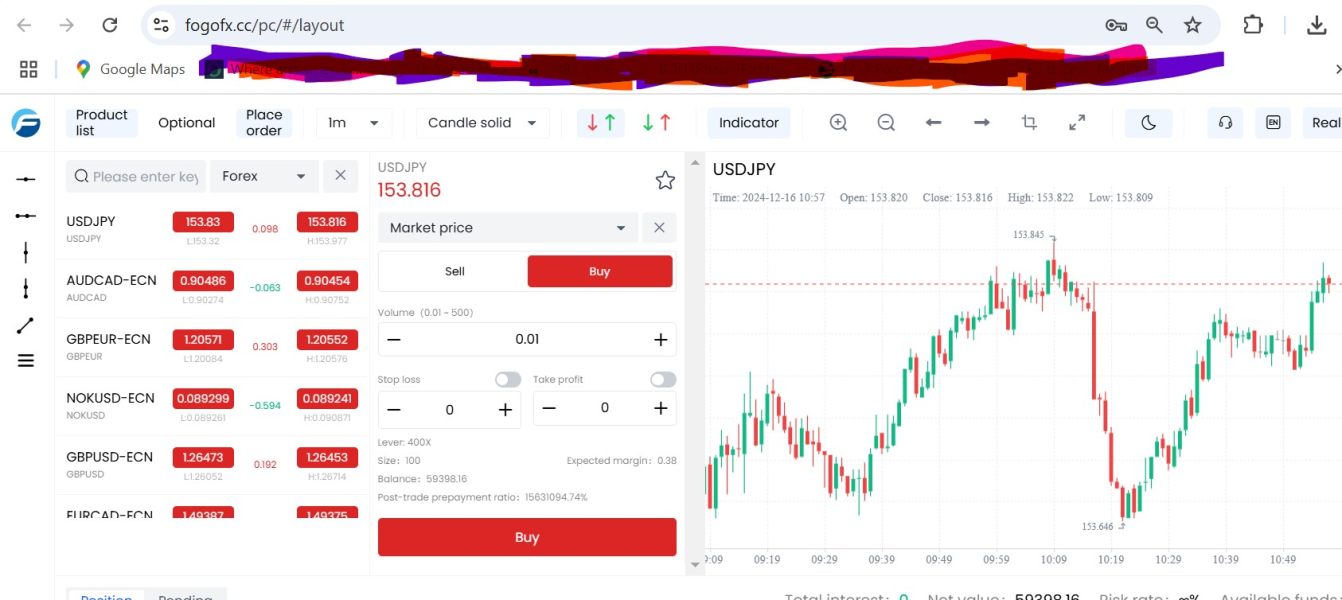

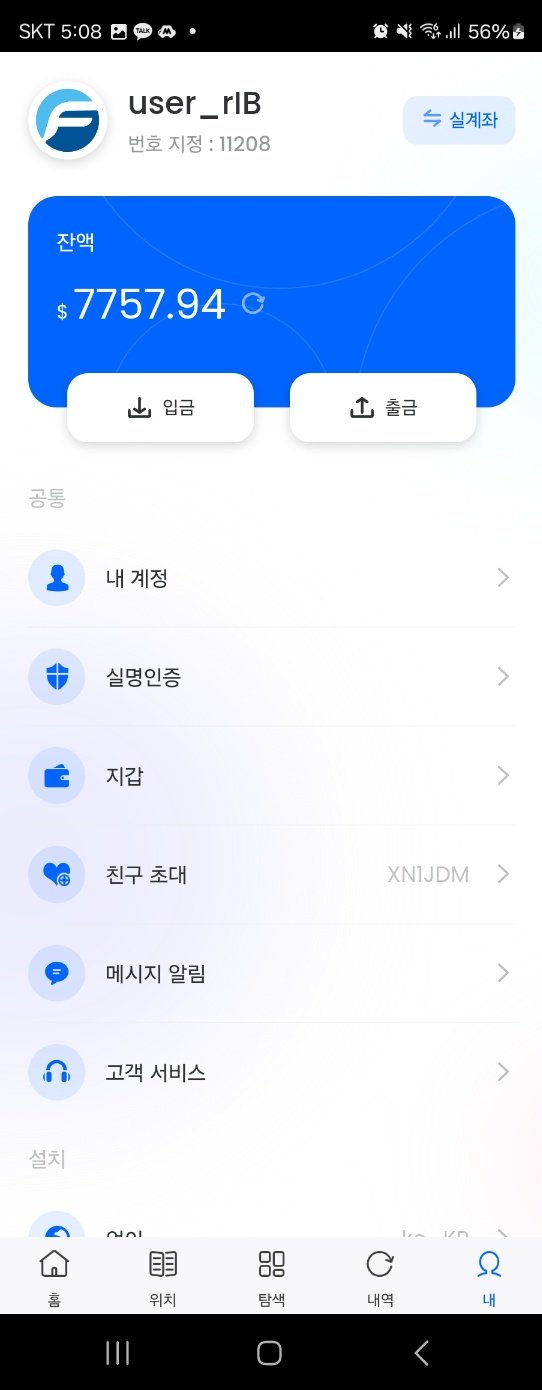

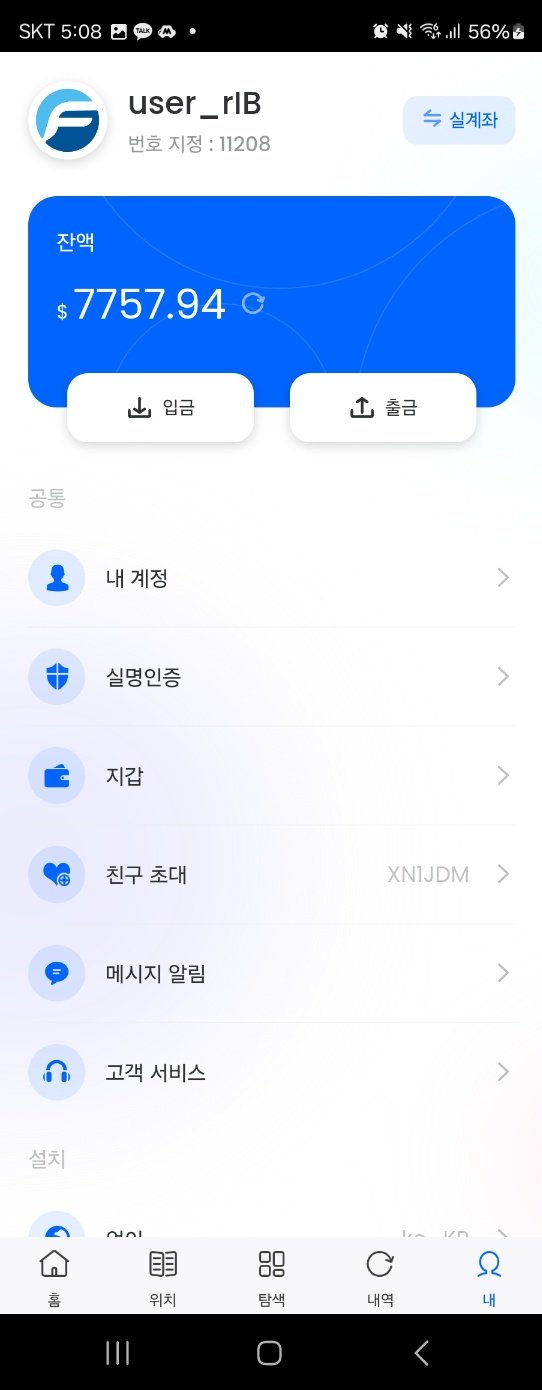

FOGO claims to be regulated by the United States Money Services Business . This claim is not supported by specific institutional identifiers or detailed oversight information that you can easily find on standard regulatory databases. FOGO mainly offers its platform to traders who want access to traditional and non-traditional assets, covering not just typical forex pairs but also stocks and cryptocurrencies. However, market opinion shows that the trading platform's details—like interface design, order execution speed, and mobile functionality—are mostly unknown, which adds to the overall uncertainty. The risk factors combined with such unclear operational details mean prospective clients should be very careful. This critical analysis reflects the findings in this fogo review.

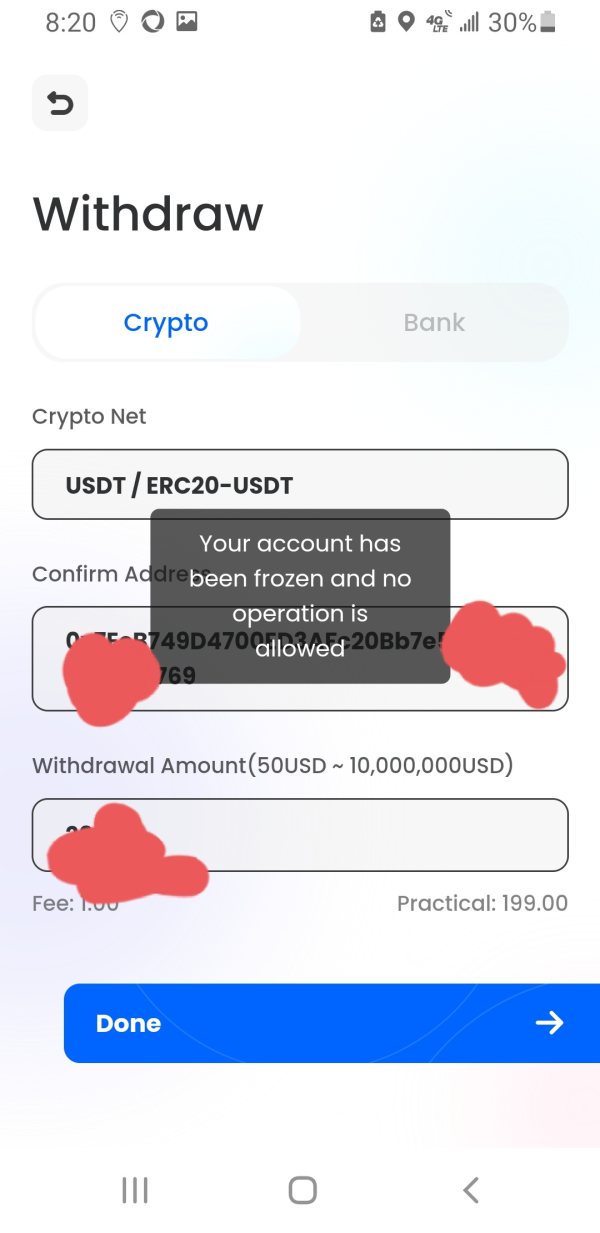

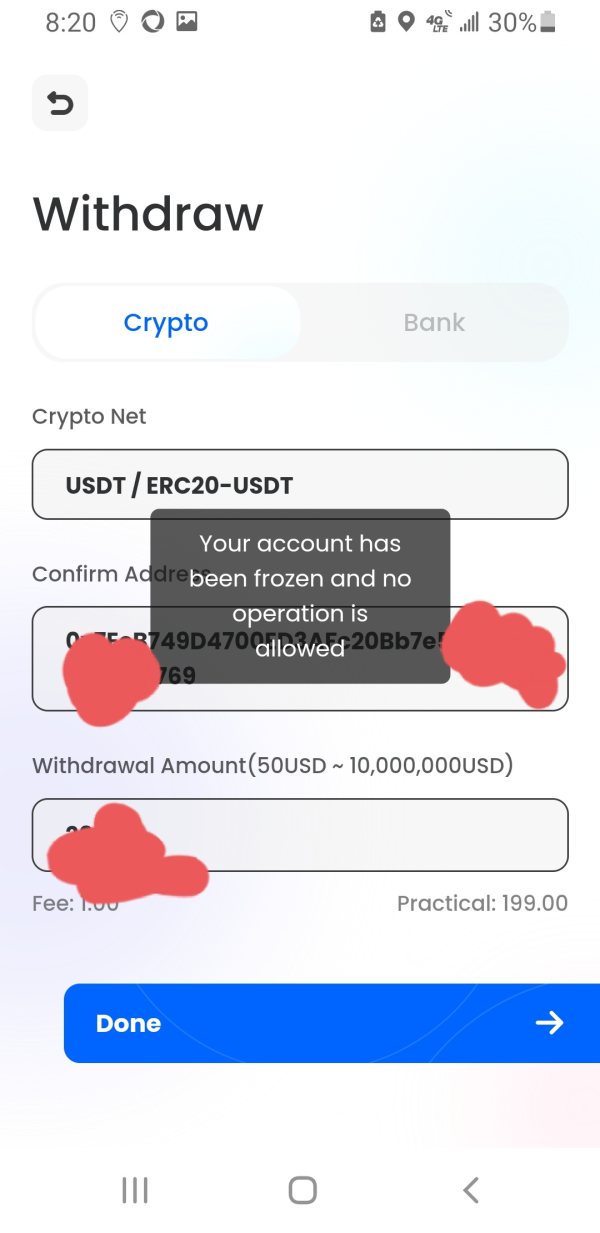

FOGO claims to be regulated by the United States Money Services Business . Despite this claim, it's hard to verify the specific regulatory body or its exact registration details. When it comes to putting money in and taking money out, the available sources don't give complete information, so potential traders have to guess about how efficient and safe fund transfers are. FOGO also doesn't say what the minimum deposit requirement is, which makes the trading environment even more uncertain.

There is no clear information about bonuses or promotional offers either. FOGO offers many financial instruments including forex, stocks, futures, commodities, and cryptocurrencies. However, detailed cost information like spreads, commissions, and potential hidden fees are not provided in the available material. Information about leverage options is also not given.

The platform details are unclear too. There's no clear evidence about what type of trading platform is used or if multiple platform choices are available. There's also little mention of regional restrictions on trading or detailed information about what languages the customer service channels support. Overall, this fogo review shows many gaps in publicly available information, which means you need to be careful and do thorough research.

Detailed Score Analysis

2.6.1 Account Conditions Analysis

FOGO has major problems with the account information it provides. There's no clear data about different account types, minimum deposit requirements, or special account features, making it hard for potential clients to figure out if this broker fits their needs. The lack of detailed account opening processes and transparency about potential fees or requirements makes people even less confident in FOGO. User feedback, which was mostly negative about account-related matters, shows that potential investors face uncertainty and confusion right from the start. Without detailed information like competitors provide, FOGO fails to create a transparent and user-friendly account setup environment. Compared to industry best practices, this part of the broker's offering is severely lacking. Overall, the account conditions give minimal reason for either new or advanced traders to use the broker, which adds to the overall opinion expressed in this fogo review.

The analysis of available tools and resources shows a worrying gap in FOGO's services. There's no real mention of innovative trading tools or technical analysis features that are important for making smart trading decisions. Educational resources, which are often essential for new traders, are clearly missing from FOGO's platform information. The lack of automated trading capabilities or algorithmic support makes the broker even less appealing, especially when compared with more modern platforms that include such features. Without proper research and educational facilities, traders don't have the necessary support to handle the complexities of modern financial markets. User complaints about insufficient analytical and research tools highlight this shortcoming. As a result, FOGO's overall offering in this critical area remains below standard, providing little value compared to industry benchmarks. This observation is consistently noted across multiple user reviews, forming a significant part of this fogo review.

2.6.3 Customer Service and Support Analysis

Customer service is one of the weakest parts of the FOGO experience. Available feedback from users shows a consistently negative picture, with many highlighting problems like delayed response times and unhelpful support channels. There's a clear lack of information about the range of communication methods FOGO offers, including live chat, phone support, or email assistance. Details about service hours and multilingual support are also missing, which makes the user experience more complicated for international traders. Cases of unresolved questions and poor complaint handling have been documented in several user evaluations. The combined impact of these problems raises serious concerns about the broker's commitment to providing adequate client support, which is crucial for keeping clients and overall satisfaction. This lack of a strong customer service system is repeatedly emphasized in various user forums and supports the cautious tone of this fogo review.

2.6.4 Trading Experience Analysis

The trading experience on FOGO has key aspects like platform stability, order execution speed, and overall user interface that remain mostly undefined. Users have expressed frustration about the lack of detailed performance metrics or technical data that might show reliable order execution processes. There's also not enough information about whether the trading environment supports advanced features like automated trading or mobile accessibility. This lack of information creates significant uncertainties about how practical the platform is for active traders. Despite the broker's claim of offering a diverse range of assets, the lack of clear details about the technological foundation of the trading platform only makes users worry more. The operational confusion in this area contributes significantly to the overall poor perception of FOGO. Such a gap between what's claimed and what's actually observed is a critical drawback noted in this fogo review.

2.6.5 Trust Analysis

Trust is probably the most critical factor for any financial services provider, yet FOGO shows alarming problems in this area. Despite claims of regulation by the US Money Services Business , there's not enough information confirming the specifics of such oversight, leading to ongoing doubts about the broker's legitimacy. Multiple reports have accused FOGO of engaging in practices that look like scams, and these accusations have seriously damaged its reputation. The lack of transparency in financial safeguards, absence of clear verification by reputable regulatory institutions, and numerous negative user experiences all contribute to a significant trust problem. Users report that their interactions with FOGO have led to serious concerns about the security of their deposited funds. Given these circumstances, prospective traders should be extremely careful. The regulatory confusion and prevailing negative sentiment about FOGO's trustworthiness are central themes in this fogo review.

2.6.6 User Experience Analysis

The user experience across the FOGO platform has been widely criticized by numerous traders. Negative feedback highlights issues like a confusing user interface, a difficult registration and verification process, and an overall lack of intuitive design. The platform doesn't seem to offer a smooth experience for fund transfers or account management, as reported by many dissatisfied users. The absence of clearly structured guidelines or navigational aids makes the trading process even more complicated, leaving users frustrated and overwhelmed. Common complaints focus on the perception that FOGO fails to deliver a stable and reliable trading environment, contributing to significant dissatisfaction among both new and experienced traders. In light of these user experiences, many have advised caution, recommending that only those with a high tolerance for risk and uncertainty consider using FOGO. These user-focused concerns form a core criticism in this comprehensive fogo review.

Conclusion

In summary, FOGO appears to be a broker with significant credibility problems. The available information shows widespread issues ranging from unclear account conditions to inadequate trading tools, poor customer support, and serious trust problems. While its multi-asset offering might appeal to some investors looking to diversify, the numerous red flags—especially the allegations of scam practices—mean that FOGO is not recommended for the average trader. Only those with a high risk tolerance and a willingness to navigate a potentially unstable platform should consider using FOGO. This fogo review therefore advises caution and thorough research before proceeding.