Activax Review 1

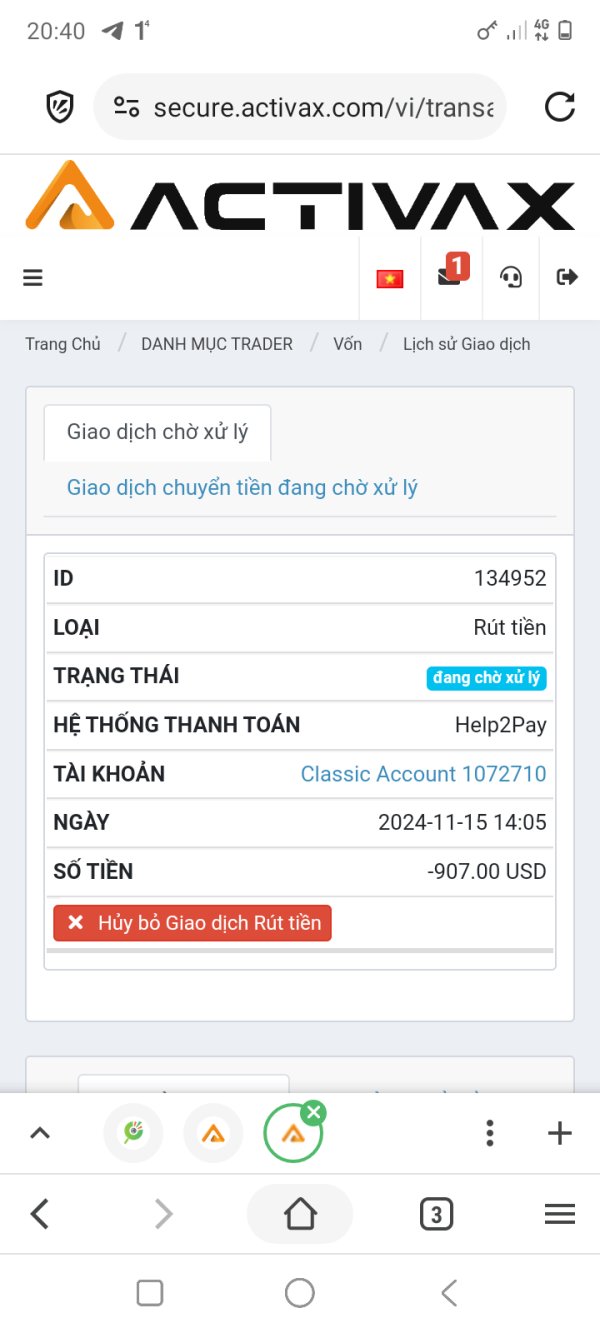

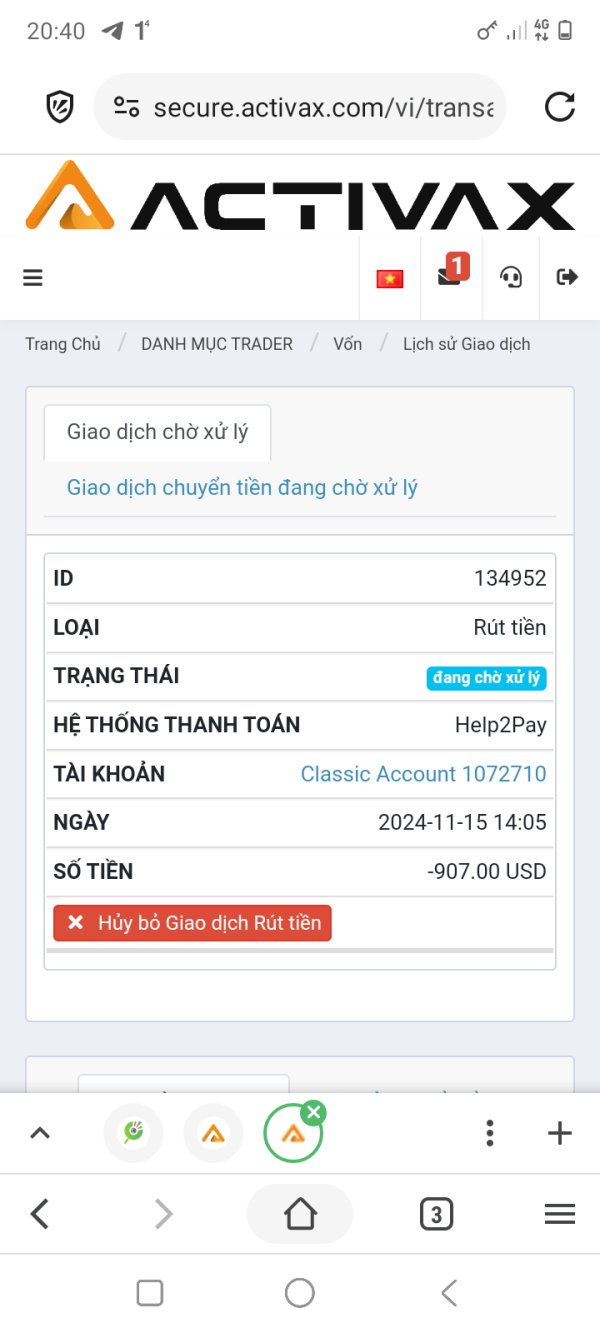

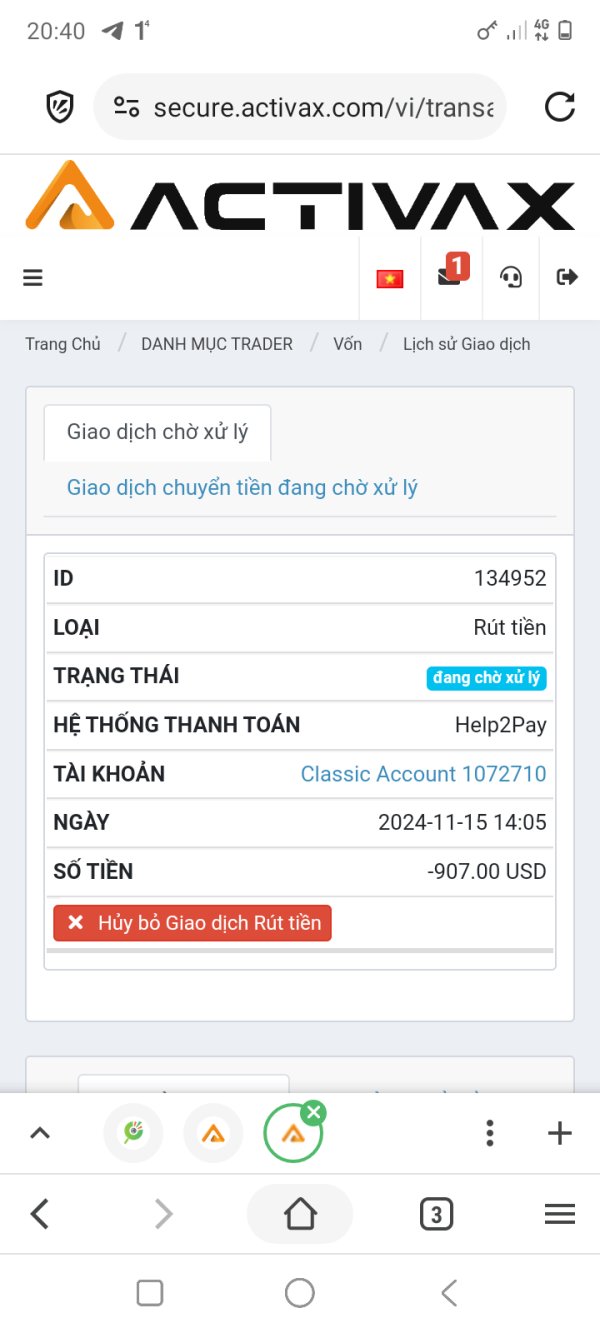

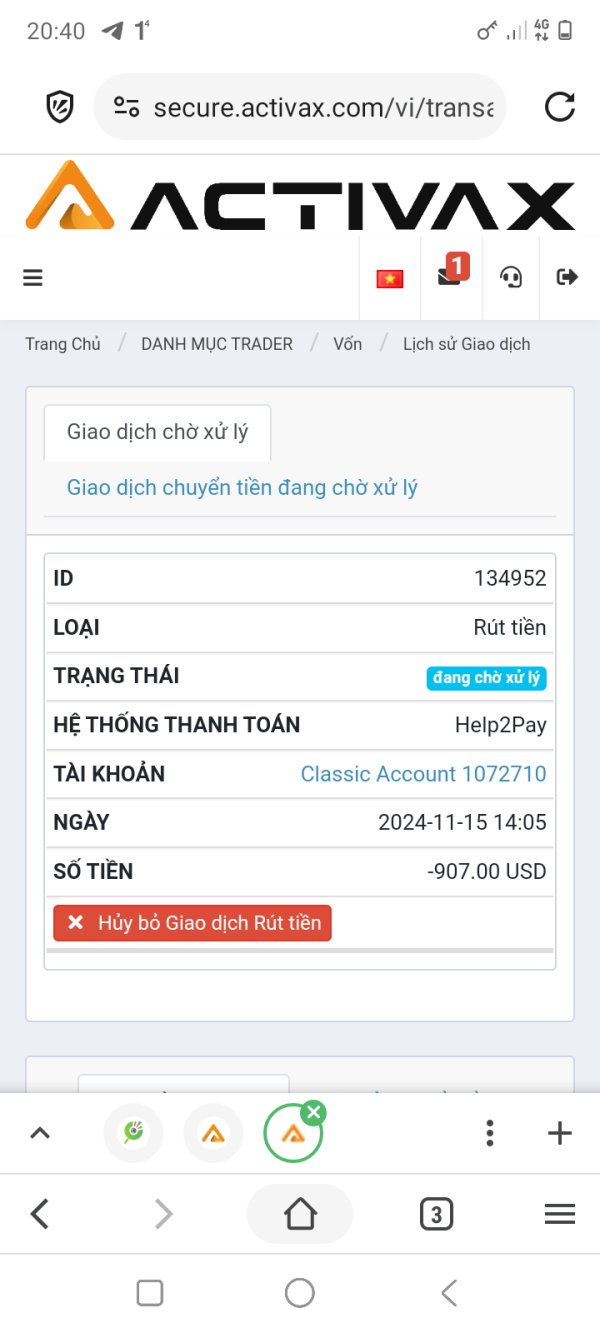

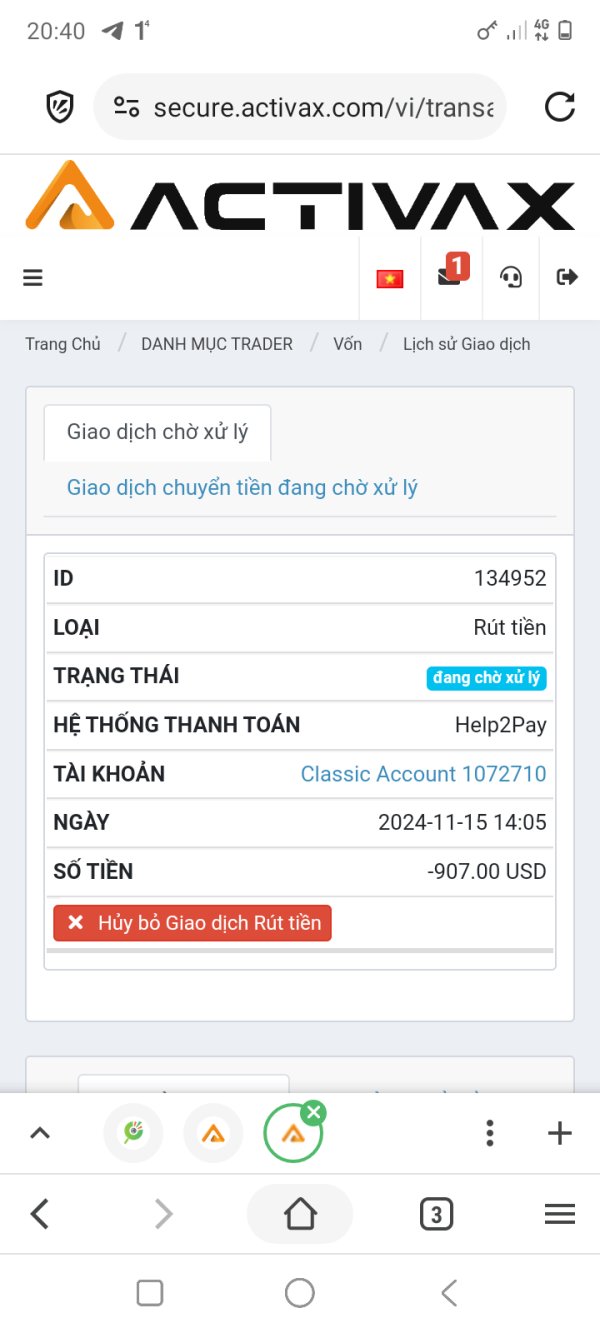

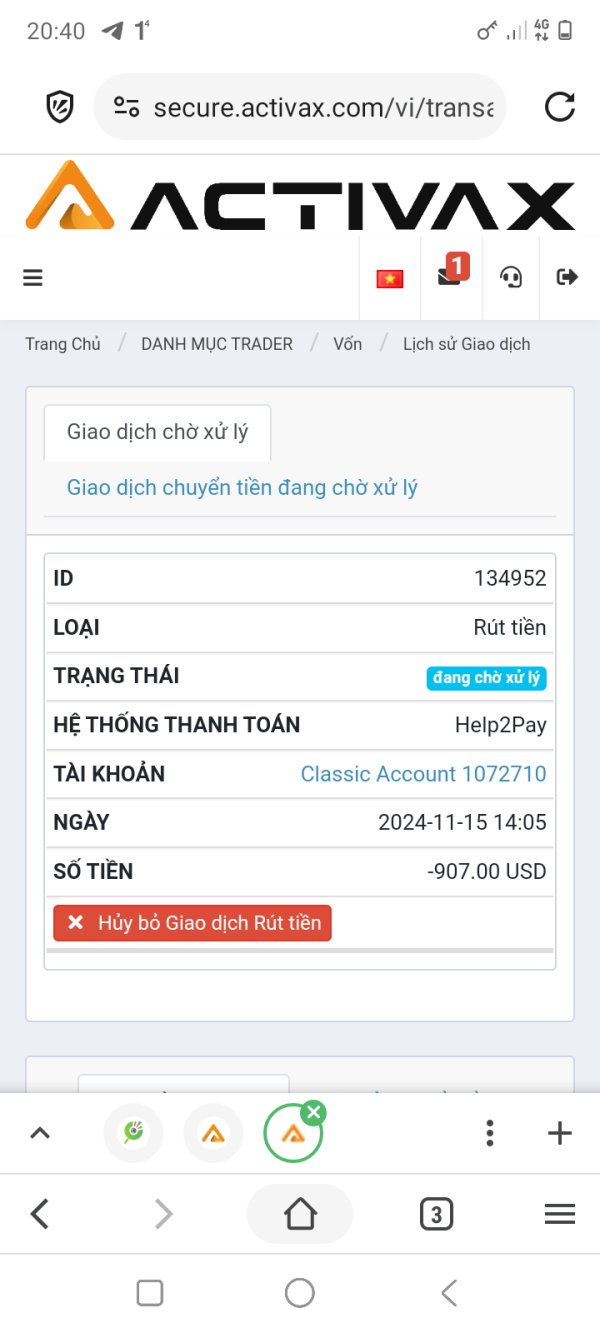

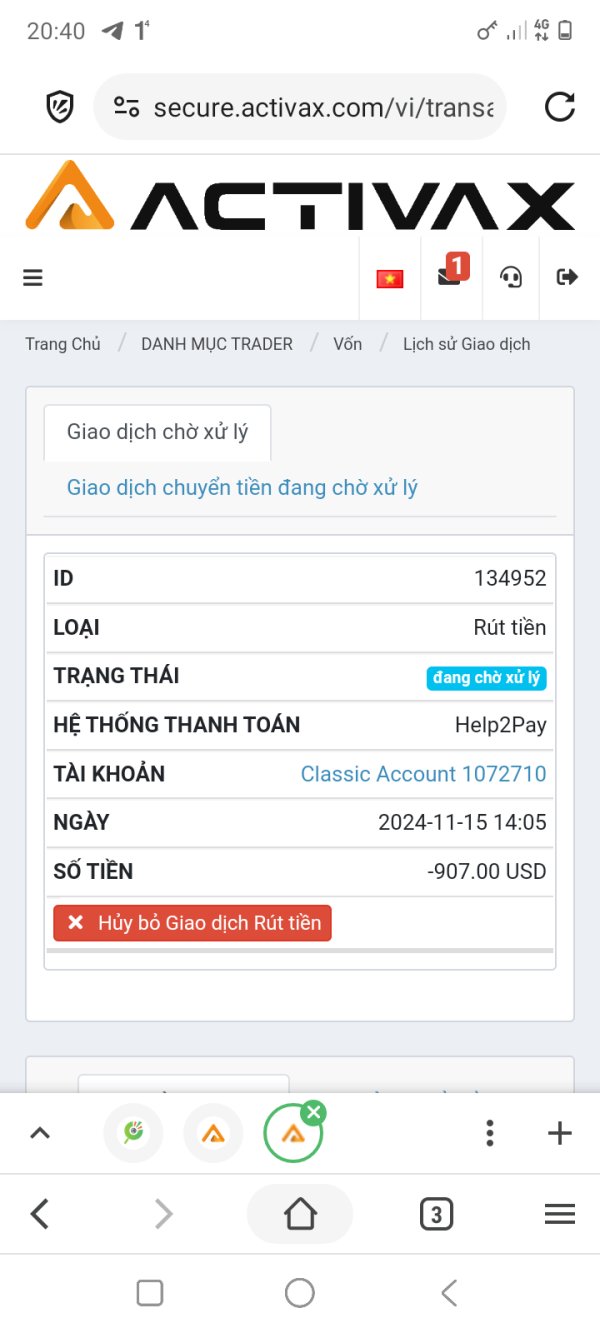

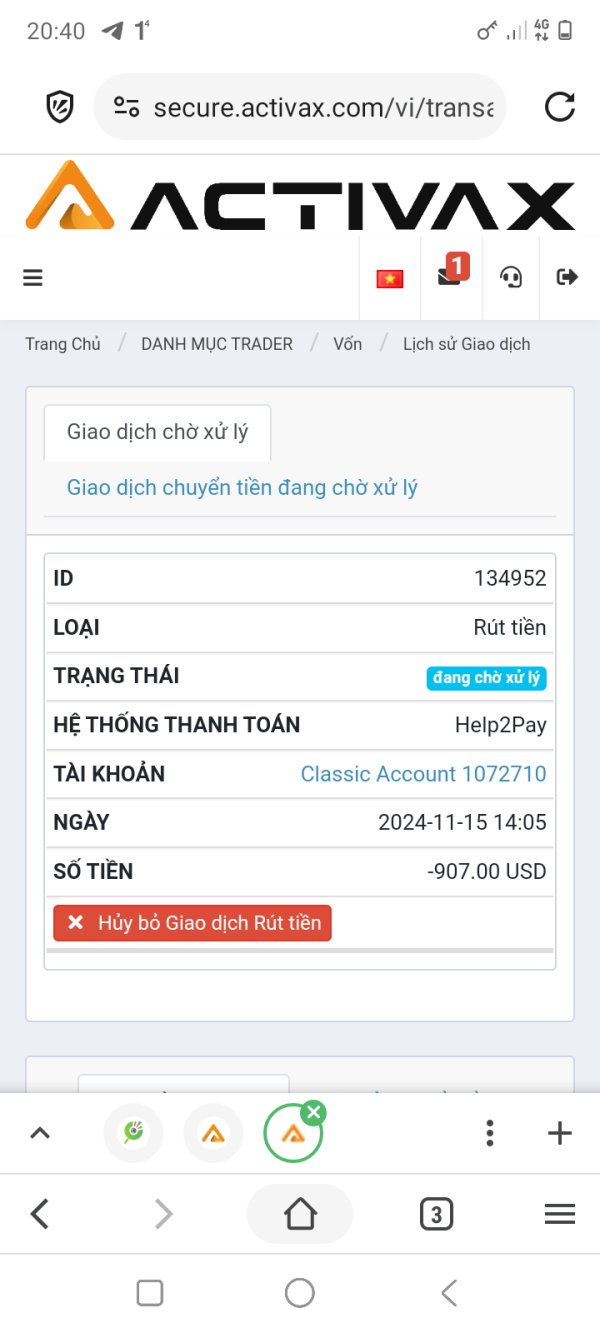

Cannot withdraw money to bank account

Activax Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Cannot withdraw money to bank account

In this activax review, we give you a detailed look at Activax, an unregulated forex and CFD broker that has raised many red flags in the trading community. Activax works without any real regulatory oversight, which makes many users question if it's legitimate and transparent. The broker offers very high leverage up to 1:500 and says it has minimum spreads starting from 0, targeting mainly aggressive, high-risk traders who want to maximize their exposure. But these attractive trading conditions are hurt by a lack of clear information on account fees, commission structures, and the trading platform itself.

User reviews consistently show dissatisfaction and concern about the minimal disclosure regarding how they operate and their security measures. So potential investors should be extremely careful given the risks involved. This activax review aims to compile available data and user feedback to offer an objective perspective on what you might encounter when trading with Activax.

Investors need to know that Activax operates without any recognized regulatory framework. This could expose users to significant legal and financial risks, especially in places with strict financial oversight. This review is based only on information available from existing summaries and user feedback, so it might not capture all aspects of the broker's operations.

Specific details about deposit and withdrawal processes, commission structures, and customer support services remain unaddressed, leaving several critical gaps. So potential clients should do additional research before engaging with Activax. The lack of regulation itself suggests that there might be underlying issues with transparency and security, which means you should be extra careful when considering any investments.

Below is a table summarizing our ratings for Activax across various dimensions:

| Dimension | Score | Rationale |

|---|---|---|

| Account Conditions | 2/10 | Critical details like minimum deposit and commission information are missing. |

| Tools and Resources | 3/10 | Absence of information regarding trading tools, educational material, or analysis resources. |

| Customer Service and Support | 3/10 | No data provided on customer service availability, contact channels, or response times. |

| Trading Experience | 5/10 | Attractive spreads from 0 and high leverage are offset by limited platform details. |

| Trust and Security | 1/10 | Severe concerns regarding legitimacy and no regulatory oversight. |

| User Experience | 4/10 | Generally negative user reviews with limited information on the trading interface. |

Activax is an online forex and CFD broker based in Saint Lucia. Despite having an accessible online presence, the broker remains unregulated, which is a major problem for many investors seeking a safe trading environment. The company focuses mainly on offering a wide range of assets including forex pairs, commodities, indices, cryptocurrencies, and even U.S. stocks.

With leverage up to 1:500 and spreads advertised as low as 0, Activax targets high-risk traders who are drawn to aggressive trading strategies and the potential for large gains. But the appealing trading conditions come with concerning opacity about fee structures, account conditions, and overall operational transparency. These factors create a recurring sentiment among users who question the broker's legitimacy and reliability.

In terms of the trading environment, Activax lacks clear information about the platform's design, trading interfaces, or technological infrastructure. The broker caters to multiple asset classes including forex, commodities, indices, cryptocurrencies, and U.S. stocks, creating an impression of versatility. However, its unregulated nature means that it does not follow any reputable financial authority's requirements, making regulatory compliance and investor protection questionable.

This activax review highlights that while the diversity of asset offerings could be seen as a strength, the absence of oversight and detailed operational information significantly hurts the broker's credibility. As a result, traders who are used to regulated environments might find Activax's higher risk profile less appealing.

used: activax review *

The following section provides a comprehensive breakdown of the available information on Activax:

Regulatory Status :

Activax currently operates in an unregulated environment, which means it is not under the supervision of any recognized regulatory authority. This absence of oversight significantly increases the risk for traders, as there is no regulatory body ensuring adherence to financial and operational standards. According to available information, there is no valid regulatory license for Activax, which contributes to widespread skepticism about its legitimacy.

Deposit and Withdrawal Methods :

Specific details about the deposit and withdrawal methods offered by Activax are not provided in the available data. This lack of clarity makes it difficult for potential traders to assess the ease and reliability of fund transfers.

Minimum Deposit Requirements :

The summary does not mention any minimum deposit requirements. The absence of this information makes it challenging to determine how accessible Activax's trading accounts are.

Bonus and Promotions :

There is no mention of bonus programs or promotions in the provided details. This omission suggests that either there are no significant promotional offers available, or the broker has not disclosed these details publicly.

Tradable Assets :

Activax provides a range of tradable assets, including forex pairs, commodities, indices, cryptocurrencies, and U.S. stocks. This variety is designed to appeal to traders with diverse interests and strategies. However, the quality and reliability of trading conditions across these asset classes remain uncertain without proper regulatory oversight.

Cost Structure :

One of the notable aspects is Activax's advertised cost structure, where spreads can start from 0. While this may seem attractive, there is no transparent information on commissions or additional fees. The combination of zero or near-zero spreads and high leverage up to 1:500 could hide costs or risks. Traders should consider that lower explicit costs do not necessarily mean lower overall trading expenses, and the lack of comprehensive fee details further complicates an accurate evaluation of its cost-effectiveness.

Leverage Offered :

Activax boasts an exceptionally high leverage option, reaching up to 1:500. While this can potentially amplify profits, it equally magnifies risks, particularly in a trading environment that is unregulated and lacks adequate investor protections.

Trading Platform Options :

Information about the specific trading platforms offered by Activax is not detailed in the available materials. The absence of platform information leaves traders uncertain about the technological efficiency, user interface, or customization options that are crucial for modern online trading.

Geographical Restrictions :

There is no clear indication of geographical restrictions, though potential legal implications in certain jurisdictions could exist due to the broker's unregulated status.

Customer Service Languages :

The available data does not specify which languages the customer support team operates in, again reflecting an overall lack of disclosure by the broker.

This segment of the activax review delivers a structured summary of the key operational parameters based on available data, while highlighting critical areas where vital information is missing.

used: activax review *

The account conditions provided by Activax are severely lacking in detail, which contributes heavily to the low rating of 2/10. In the absence of clear information about minimum deposit requirements, commission structures, and specific account types, investors are left questioning the overall transparency and practicality of opening an account. The activax review reveals that there is no disclosure on whether different types of accounts exist or the potential for tailored account features.

Additionally, the account opening and verification processes remain unspecified, which further detracts from the broker's appeal. Users have consistently expressed dissatisfaction about the ambiguous account conditions, noting that the inability to gauge costs or advantages results in a somewhat opaque trading environment. With commissions and minimum deposits not mentioned, it becomes extremely challenging for prospective clients to assess the true cost of trading. This significant omission undermines both the usability and reliability of Activax's account management offerings.

used: activax review *

When evaluating the suite of trading tools and resources offered by Activax, the picture remains incomplete and rather disappointing. The activax review indicates that there is little to no specific information about the availability of sophisticated trading tools, analytical platforms, or charting software that many brokers typically highlight as a competitive asset. There is an evident lack of details concerning research materials, educational resources, or news feeds that could support traders in making informed decisions.

The possibility of automated trading and integration of expert advisors also remains unaddressed, leaving users uncertain about the full capabilities of the trading platform. Given the competitive nature of today's financial markets, the absence of these essential tools and resources is a significant drawback. Many traders have reported frustration and disappointment due to the minimal technological and educational support available through Activax, which makes it challenging to execute well-informed trades. The overall deficiency in this category further reinforces the need for potential clients to remain cautious when considering Activax for trading.

used: activax review *

Customer service is a vital element in any reliable brokerage, yet Activax falls short in this area. The activax review highlights that the specifics about customer support channels, response times, and overall service quality are not disclosed. Without clear information on whether support is available via live chat, email, or telephone—and if so, during which hours or languages—it is challenging to gauge the reliability of the broker's assistance in resolving issues.

Users have expressed consistent dissatisfaction with the perceived lack of support, noting that unclear or unresponsive customer service adds to the overall risk of trading with an unregulated entity. Furthermore, the absence of any mention about multi-language support intensifies concerns, particularly for a broker that claims to cater to a diverse, global clientele. The combination of these shortcomings not only diminishes user confidence but also raises doubts about the broker's commitment to after-sales service—a crucial factor for traders who may need timely help in fast-paced market environments.

The trading experience with Activax is characterized by a mix of attractive conditions and significant uncertainties. On one hand, the broker offers enticing features such as spreads starting from 0 and high leverage of up to 1:500, which can appeal to aggressive traders seeking substantial potential returns. However, the activax review emphasizes that these benefits are counterbalanced by the absence of detailed information about the platform's stability, speed, and overall functionality.

There is no available information on order execution quality, trade confirmation times, or mobile trading capabilities. Such missing details can lead to a disjointed trading experience, particularly during volatile market conditions where execution speed is critical. Additionally, users have reported mixed reviews; while some appreciate the low-cost trading environment, others stress that the uncertain reliability of the platform introduces considerable risk. The net effect is an experience that, while potentially lucrative in the right circumstances, is marred by uncertainty and technical gaps that are problematic for safety-conscious or long-term investors.

Trust is paramount in the forex and CFD industry, and Activax spearheads concerns in this regard. This activax review reiterates that the broker operates without any valid regulatory oversight, a fact that immediately undermines confidence. The absence of a regulatory framework leaves traders without the standard investor protection measures and accountability typically offered by regulated entities.

Furthermore, critical details about funds' safety measures—such as segregation of client funds or insurance policies—are not provided. The overall transparency of operating procedures is also called into question, as users have frequently expressed doubt about Activax's legitimacy. Compared to other brokers that must adhere to strict guidelines, Activax's lack of regulatory approval and protective mechanisms results in a trust score that is extremely low. Investors are advised to exercise extreme caution, as any potential gains are overshadowed by the significant risk associated with using an unregulated broker.

User experience with Activax is an area marked by considerable dissatisfaction and cautionary feedback from the trading community. The activax review shows that overall user satisfaction is low, with a majority of reviews pointing to an unsatisfactory interface and convoluted registration processes. While the trading conditions such as low spreads and high leverage may initially lure experienced traders, the absence of clear information about the usability of the trading platform makes it difficult for many to navigate effectively.

Specific details on the ease of fund transfers, the efficiency of the verification process, and the clarity of the user interface remain absent. Furthermore, the difficulties encountered by users in obtaining reliable customer support further amplify the negative user experience. Ultimately, while the broker might attract those who thrive on high-risk and high-leverage trades, its overall usability and operational simplicity remain subpar compared to regulated alternatives, leaving users with a fragmented and uncertain experience that raises continued questions about its long-term viability.

In conclusion, Activax stands out as a high-risk broker tailored for traders seeking aggressive high-leverage opportunities and minimal spread trading. However, the inherent lack of regulatory oversight and significant gaps in essential operational information render this broker a risky proposition for many investors. The activax review underscores that while the high leverage and attractive cost elements might appeal to seasoned, high-risk traders, the overall lack of transparency and customer support drastically diminishes its reliability.

Potential investors should proceed with extreme caution and conduct further research before engaging with Activax.

*Optional final keyword usage: activax review *

All information is sourced from available data summaries and user feedback as of the latest updates. Please exercise due diligence and consult multiple sources before making any investment decisions.

FX Broker Capital Trading Markets Review