Is FX Swizcapital safe?

Business

License

Is FX Swizcapital Safe or a Scam?

Introduction

FX Swizcapital has emerged as a player in the forex trading market, positioning itself as a broker that offers a variety of trading opportunities in currencies, commodities, and cryptocurrencies. However, the rise of online trading platforms has also brought about an increase in fraudulent schemes, making it imperative for traders to exercise caution and perform thorough evaluations before committing their funds. Understanding the legitimacy of a broker like FX Swizcapital is crucial for protecting ones investments. This article investigates the safety and credibility of FX Swizcapital by examining its regulatory status, company background, trading conditions, client feedback, and overall risk profile.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical aspects to assess when determining if it is safe to trade with them. Regulated brokers are overseen by financial authorities that impose strict standards to protect investors. Unfortunately, FX Swizcapital does not appear to be regulated by any reputable financial authority.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of regulatory oversight raises significant concerns about the broker's legitimacy. Reports indicate that FX Swizcapital has claimed to be registered with multiple regulatory bodies, including the Seychelles Financial Services Authority (FSA) and the Financial Conduct Authority (FCA) in the UK. However, upon investigation, these claims have proven to be unfounded, as there is no evidence to support their registration. The lack of regulation exposes traders to substantial risks, including potential fraud, as unregulated brokers often operate without accountability and can engage in unethical practices.

Company Background Investigation

A closer look at the company behind FX Swizcapital reveals a lack of transparency regarding its history, ownership structure, and management team. The broker's website does not provide adequate information about its founders or the corporate structure, which is a significant red flag for potential investors. Legitimate brokers typically disclose their ownership details and provide insights into their operational history to build trust with clients.

Furthermore, the companys establishment date is relatively recent, with its domain registered in March 2024. Such a short operational history can be concerning, especially when combined with the absence of regulatory oversight. This lack of transparency can lead to doubts about the broker's credibility and the safety of client funds.

Trading Conditions Analysis

When evaluating whether FX Swizcapital is safe, it is essential to examine its trading conditions, including fees and spreads. The broker claims to offer competitive trading conditions, but without verified information, it is challenging to assess the reality of these claims.

| Fee Type | FX Swizcapital | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Reports indicate that traders have encountered issues with unexpected fees and withdrawal difficulties, which are common tactics employed by fraudulent brokers to trap clients' funds. Such practices not only compromise the trading experience but also raise questions about the broker's operational integrity.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. FX Swizcapital has not provided sufficient information regarding its fund safety measures, such as fund segregation, investor protection, and negative balance protection policies.

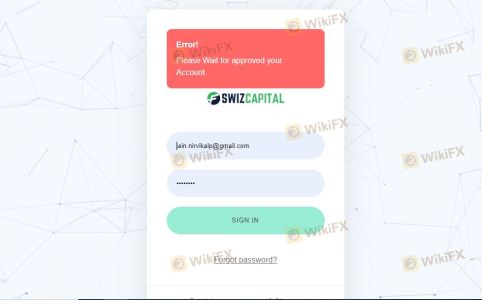

Without these critical safeguards in place, clients' investments are at risk. Additionally, there have been reports of users experiencing difficulties accessing their accounts and withdrawing funds, which further underscores the concerns surrounding the broker's commitment to safeguarding client assets.

Client Experience and Complaints

Analyzing customer feedback is crucial in assessing whether FX Swizcapital is safe. Numerous complaints have surfaced regarding withdrawal issues, with many users reporting delays or outright refusals when attempting to access their funds.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Access Issues | High | Poor |

| Unresponsive Customer Support | Medium | Poor |

These complaints indicate systemic issues within the broker's operations and highlight a lack of effective customer support. Such patterns are often indicative of a broker that may not have the best interests of its clients in mind.

Platform and Execution

The trading platform offered by FX Swizcapital is another critical factor in determining its safety. Traders have reported issues with platform stability, including slippage and order rejections, which can significantly impact trading performance.

A reliable trading platform should provide a seamless experience with minimal disruptions. However, the reports of technical issues raise concerns about the broker's commitment to providing a robust trading environment.

Risk Assessment

Based on the analysis, the overall risk associated with trading with FX Swizcapital is significant.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status exposes traders to fraud risks. |

| Financial Risk | High | Issues with fund withdrawals and unexpected fees. |

| Operational Risk | Medium | Technical issues reported on the trading platform. |

To mitigate these risks, potential investors are advised to conduct thorough research, consider using regulated brokers, and avoid committing large sums of money to unverified platforms.

Conclusion and Recommendations

In conclusion, the investigation into FX Swizcapital raises several red flags that suggest it may not be a safe trading option. The lack of regulation, transparency issues, and numerous complaints about withdrawal difficulties indicate that traders should exercise extreme caution.

For those looking to engage in forex trading, it is advisable to consider alternative, regulated brokers that offer transparent operations and a proven track record. Always prioritize platforms that provide clear information about their regulatory status and have established customer support systems.

In summary, is FX Swizcapital safe? The evidence suggests that it is not, and potential traders should be wary of engaging with this broker.

Is FX Swizcapital a scam, or is it legit?

The latest exposure and evaluation content of FX Swizcapital brokers.

FX Swizcapital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FX Swizcapital latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.