Is Activax safe?

Pros

Cons

Is Activax A Scam?

Introduction

Activax is a relatively new player in the forex market, positioning itself as a broker offering a variety of trading instruments, including forex, stocks, indices, commodities, and cryptocurrencies. With a claimed operational period of 1-2 years, Activax aims to attract traders with enticing features, such as a user-friendly platform and no minimum deposit requirement. However, the forex market is notorious for its scams and unregulated brokers, making it imperative for traders to conduct thorough evaluations before committing their funds. This article aims to assess the legitimacy and safety of Activax through a comprehensive investigation, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk factors.

Regulation and Legitimacy

Regulation is a cornerstone of a broker's credibility, as it ensures that the broker adheres to specific standards of conduct and offers a level of protection to traders. In the case of Activax, the broker currently operates without any valid regulatory oversight, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that Activax is not subject to the scrutiny and compliance checks that regulated brokers must undergo. This lack of oversight can expose traders to a range of risks, including the potential for fraud and mismanagement of funds. Furthermore, the broker's claims of offering a wide range of trading assets without a regulatory framework are suspicious and warrant caution.

The importance of regulation cannot be overstated; it serves as a safety net for traders, ensuring that the broker operates transparently and fairly. Without this, traders are left vulnerable, with limited recourse in the event of disputes or financial mishaps. Therefore, the unregulated status of Activax is a red flag that should not be ignored.

Company Background Investigation

Activax is operated by Activax Ltd, which is reportedly incorporated in St. Lucia. The company's brief history and lack of substantial information about its management team add to the skepticism surrounding its operations. The absence of transparency regarding its ownership structure and the individuals behind the broker raises questions about accountability and trustworthiness.

Furthermore, the company's limited communication channels, primarily relying on email support, can hinder effective customer service and issue resolution. This lack of accessibility is concerning, especially for a broker that claims to prioritize customer satisfaction. A reputable broker typically offers multiple channels for customer support, including phone and live chat options, to ensure that clients can get timely assistance when needed.

The management team's professional background is also a critical factor in assessing a broker's reliability. However, Activax does not provide adequate information regarding the experience and qualifications of its leadership, which is essential for establishing trust. A transparent broker should openly share details about its team, including their expertise in the financial industry and their roles within the company.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is crucial, as it directly impacts the trading experience and potential profitability. Activax claims to offer a competitive fee structure, but the lack of transparency regarding its fees and spreads raises concerns.

| Fee Type | Activax | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | From 1.0 pips | 1.0 pips |

| Commission Model | $0 | Varies |

| Overnight Interest Range | N/A | Varies |

While Activax advertises spreads starting from 1.0 pips, it is essential to consider that these spreads can widen significantly during periods of high volatility, making trading more expensive than initially anticipated. Additionally, the broker's commission-free policy may seem appealing, but it is crucial to verify whether hidden fees exist that could affect overall trading costs.

The absence of detailed information about overnight interest rates and other potential fees further complicates the evaluation process. Traders should always be aware of any hidden costs that could erode profits, and the lack of clarity in Activax's fee structure raises concerns about potential surprises down the line.

Customer Funds Safety

The safety of customer funds is paramount in the forex trading landscape. Activax's unregulated status raises significant concerns regarding the security of traders' investments. A reputable broker typically employs various measures to protect client funds, including segregated accounts, investor protection schemes, and negative balance protection policies.

Unfortunately, Activax does not provide clear information on whether it implements these safety measures. The absence of such safeguards can expose traders to substantial risks, including the potential loss of their entire investment in the event of financial instability or mismanagement.

Moreover, the lack of historical data regarding any past security issues or controversies further complicates the assessment of Activax's safety. Traders should be extremely cautious when dealing with unregulated brokers, as they may not have the necessary protocols in place to ensure the protection of client funds.

Customer Experience and Complaints

Customer feedback is a vital component in evaluating a broker's reliability and service quality. Reviews of Activax indicate a mix of experiences, with some users praising its user-friendly platform and diverse trading options, while others express frustration over withdrawal issues and lack of customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

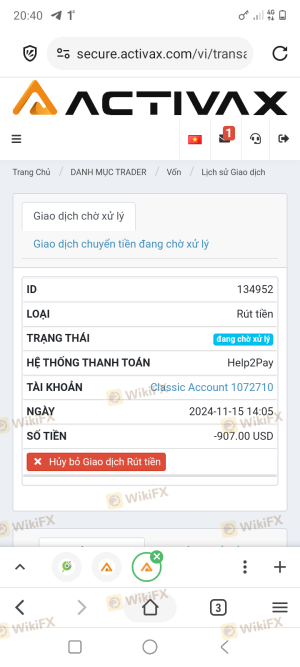

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Unclear Fee Structure | Medium | Poor |

Common complaints include difficulties in withdrawing funds, with some users reporting that they were unable to access their money after requesting withdrawals. This is a serious concern, as it undermines the fundamental trust that traders place in their brokers. Additionally, the lack of effective customer support has been highlighted as a significant issue, with many users feeling that their concerns went unaddressed.

A couple of notable cases involve traders who faced prolonged delays in receiving their funds, leading to frustration and distrust in the broker. These experiences highlight the importance of choosing a broker with a solid reputation for customer service and a transparent withdrawal process.

Platform and Trade Execution

The trading platform is a crucial aspect of a broker's offering, as it directly affects the trading experience. Activax claims to provide a user-friendly platform with advanced features, but the lack of independent reviews and performance metrics complicates this assessment.

Traders have reported mixed experiences regarding order execution quality, with some noting instances of slippage and rejections. These issues can significantly impact trading outcomes, especially for those employing high-frequency or scalping strategies. Additionally, any signs of platform manipulation or unfair practices should be taken seriously, as they can indicate deeper issues within the broker's operations.

Risk Assessment

Using Activax presents several risks that potential traders should consider. The lack of regulation, unclear fee structures, and complaints regarding fund withdrawals all contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No valid regulation or oversight |

| Financial Risk | Medium | Unclear fee structures and policies |

| Operational Risk | High | Poor customer service and withdrawal issues |

To mitigate these risks, traders should approach Activax with caution. It is advisable to start with a small investment, if at all, and to thoroughly test the platform using a demo account before committing significant funds.

Conclusion and Recommendations

In summary, the investigation into Activax reveals several troubling signs that suggest it may not be a reliable trading partner. The absence of regulation, unclear fee structures, and numerous customer complaints raise significant red flags.

Traders should exercise extreme caution when considering Activax, as the potential for financial loss is high given the current circumstances. It is recommended to explore alternative brokers that are well-regulated, have a proven track record of reliability, and offer transparent trading conditions. Brokers such as ActivTrades or others regulated by top-tier authorities may provide a safer trading environment for both novice and experienced traders.

Is Activax a scam, or is it legit?

The latest exposure and evaluation content of Activax brokers.

Activax Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Activax latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.