Oranco Group 2025 Review: Everything You Need to Know

Executive Summary

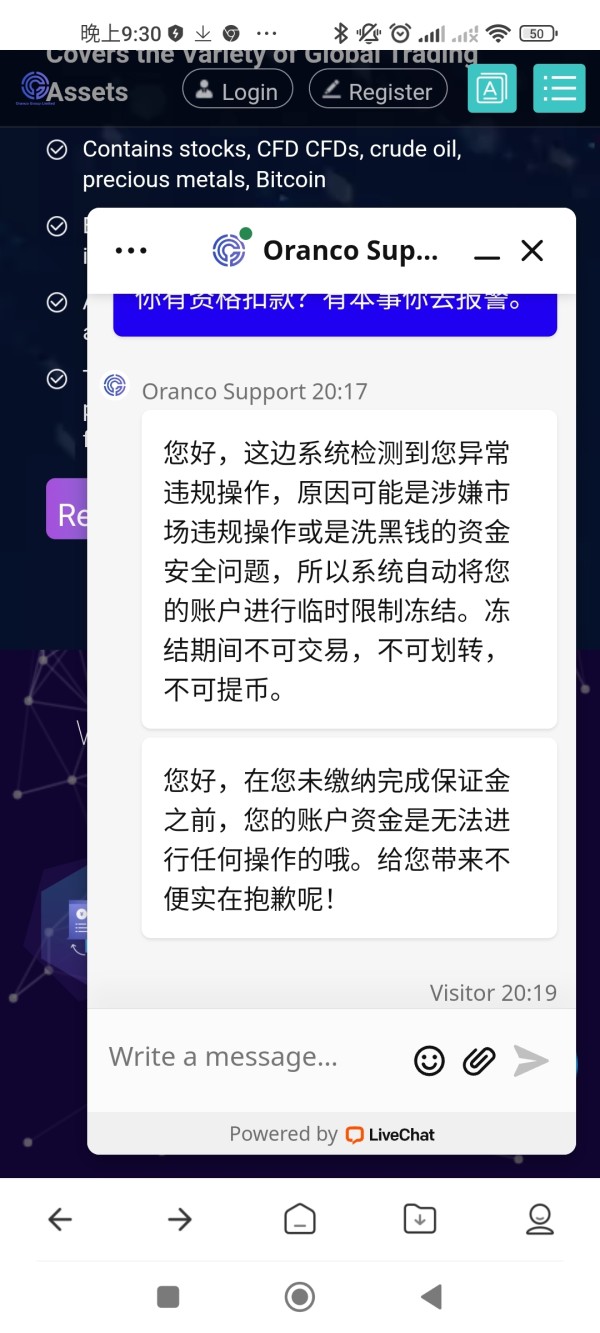

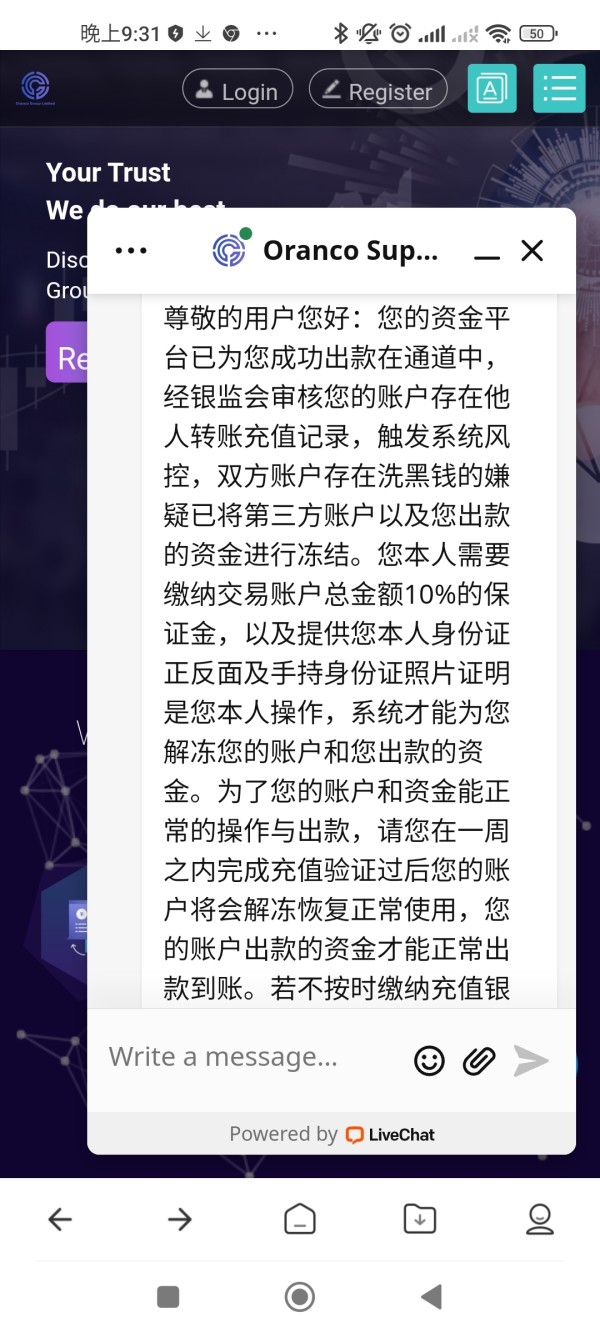

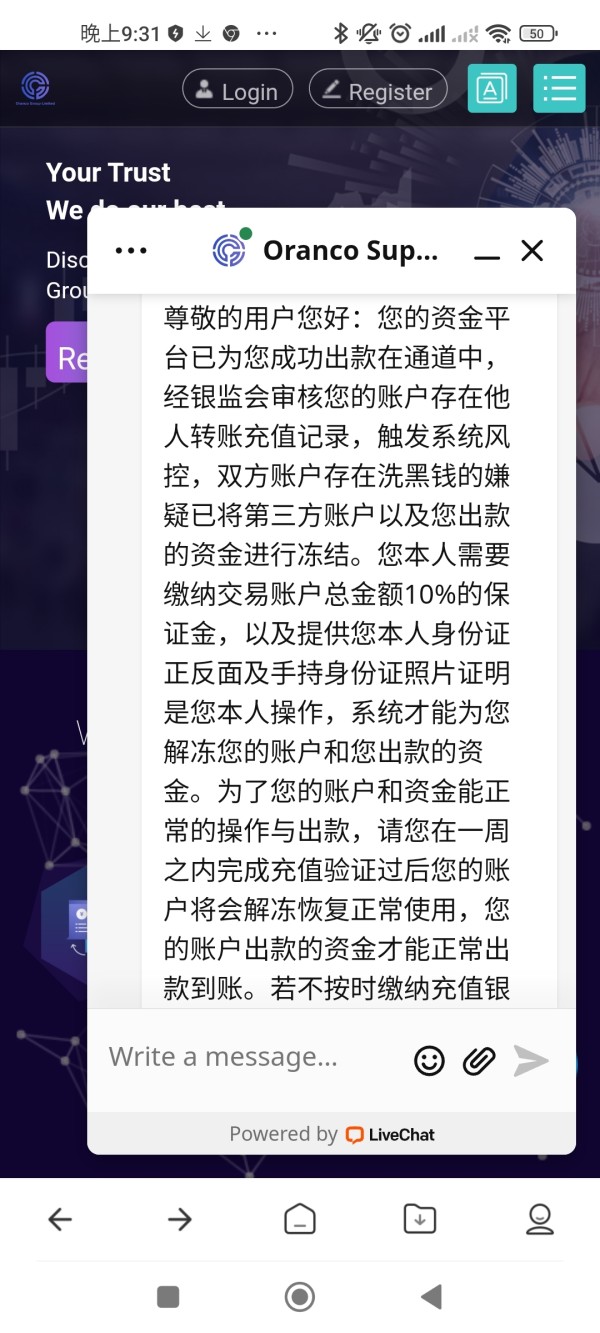

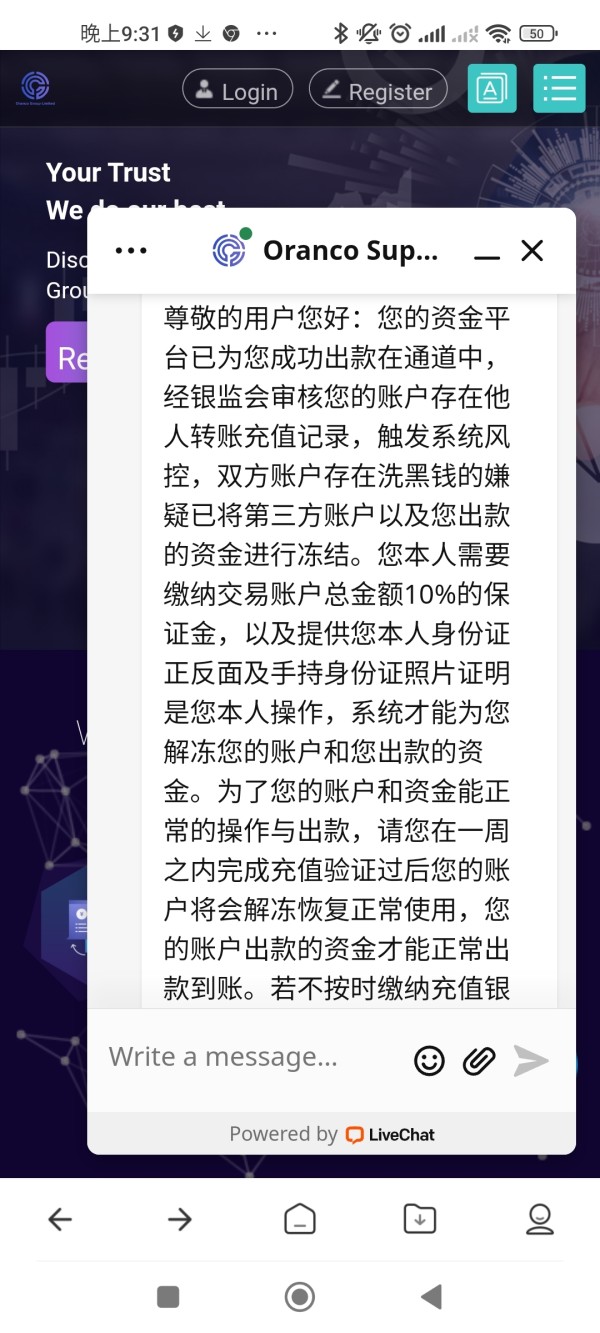

Oranco Group is an unregulated forex broker. The company operates with major concerns about transparency and legitimacy that traders should know about. Despite some positive online feedback from users, big questions remain about the company's legal status and regulatory compliance that cannot be ignored.

The broker claims to have been operating since 2018. They offer various trading instruments including forex and CFDs to retail traders who want to access these markets. However, the lack of proper regulatory oversight and limited transparency in their operations raises red flags for potential clients who value safety and security.

This oranco group review reveals a mixed picture. Some traders report satisfactory experiences with their services, while industry watchdogs and regulatory tracking platforms express concerns about the broker's legitimacy that should worry potential clients. The company primarily targets traders seeking forex and CFD trading opportunities in competitive markets.

The absence of clear regulatory protection makes it a high-risk choice for most investors. Our comprehensive analysis examines all available information to provide traders with an objective assessment of what to expect from this broker and whether it meets their needs.

Important Disclaimers

Oranco Group does not provide specific regulatory information across different regions. This means the legality and operational standards may vary significantly depending on your location and local laws. Traders should be particularly cautious as the broker's regulatory status remains unclear or potentially non-existent in major financial jurisdictions worldwide.

This review is based on available user feedback, industry reports, and publicly accessible information. We analyzed this data with the goal of providing an objective assessment that helps traders make informed decisions. However, due to limited transparency from the broker itself, some information gaps exist that potential clients should consider before making any trading decisions or investments.

Rating Overview

Broker Overview

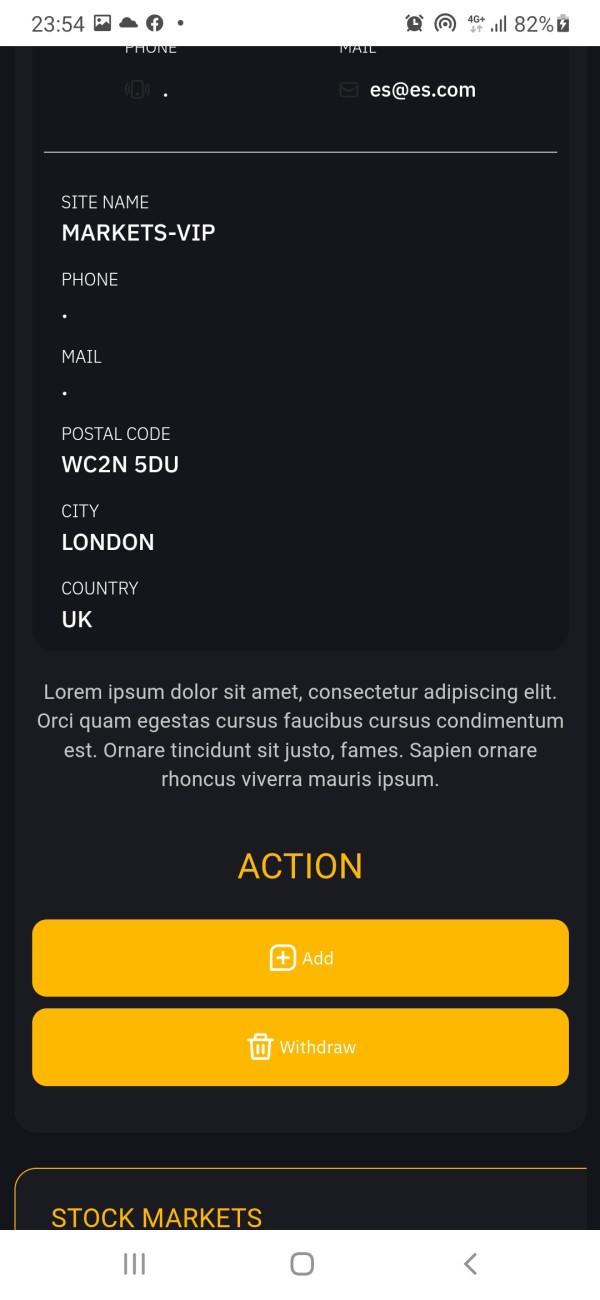

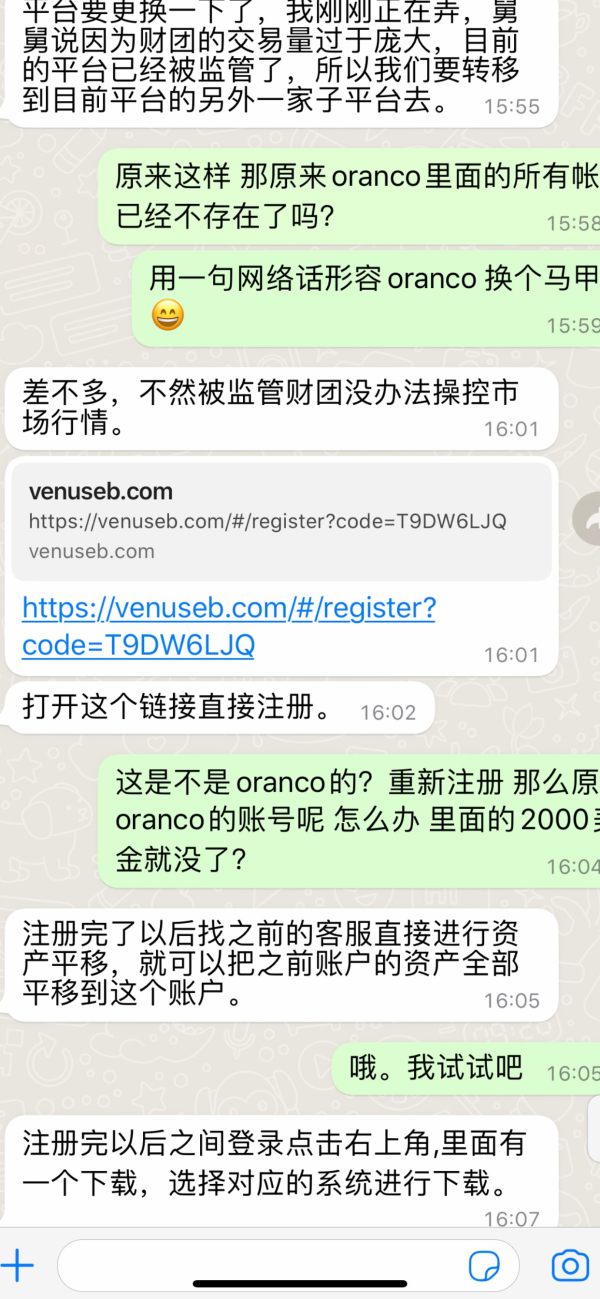

Oranco Group claims to have begun operations in 2018. They position themselves as a provider of forex and CFD trading services to retail clients who want access to financial markets. However, the company's background lacks the transparency typically expected from established financial services providers that operate in regulated environments.

The specific location of their headquarters has not been clearly disclosed in available materials. This immediately raises questions about corporate transparency and accountability that serious traders should consider carefully. This lack of basic corporate information is concerning for traders who prioritize working with regulated and transparent brokers that follow industry standards.

The broker's business model appears to focus on providing access to foreign exchange markets and contracts for difference. Specific details about their market-making or ECN approach remain unclear from available documentation. According to available information, Oranco Group targets individual traders seeking exposure to currency markets and other financial instruments available through their platform.

The absence of detailed information about their trading platform technology, liquidity providers, and risk management protocols suggests either poor communication practices or potential operational limitations. Serious traders should carefully consider these factors before choosing this broker for their trading activities.

Regulatory Status: Available information does not mention specific regulatory regions or oversight bodies. This is a significant concern for trader protection and fund security that cannot be overlooked.

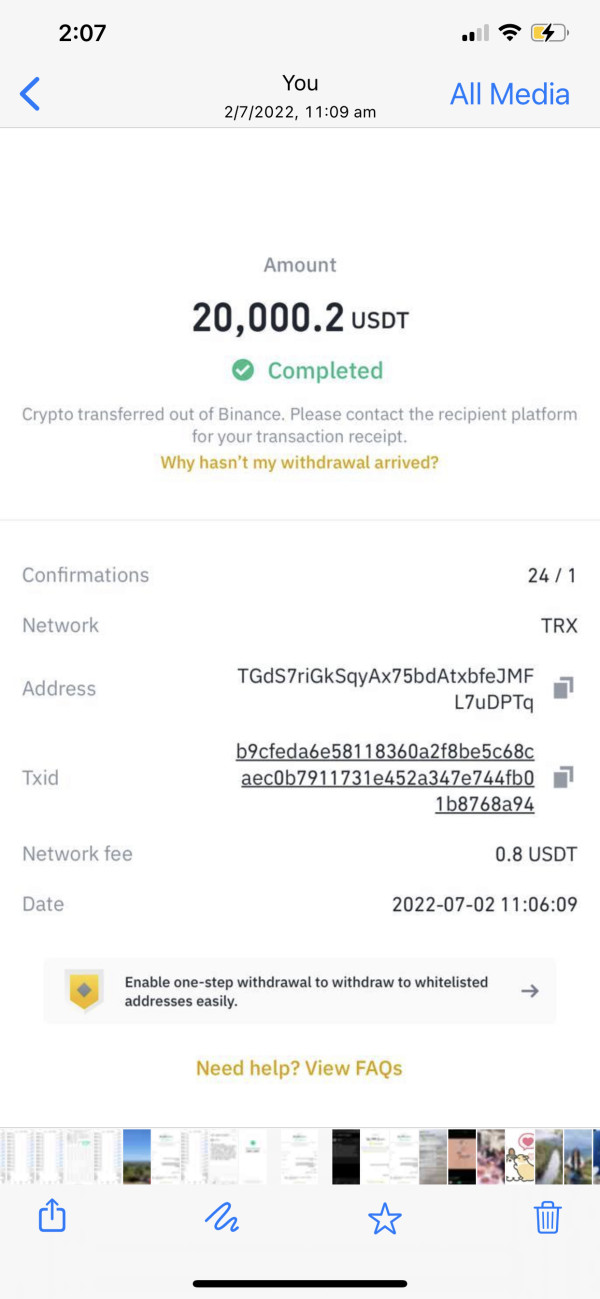

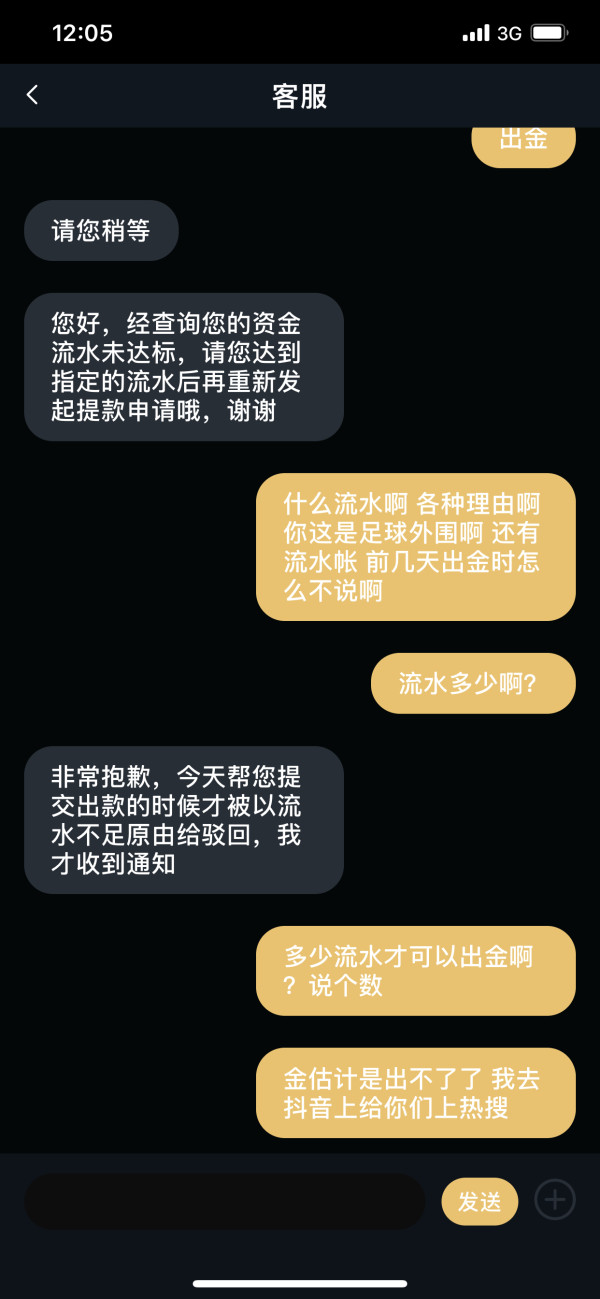

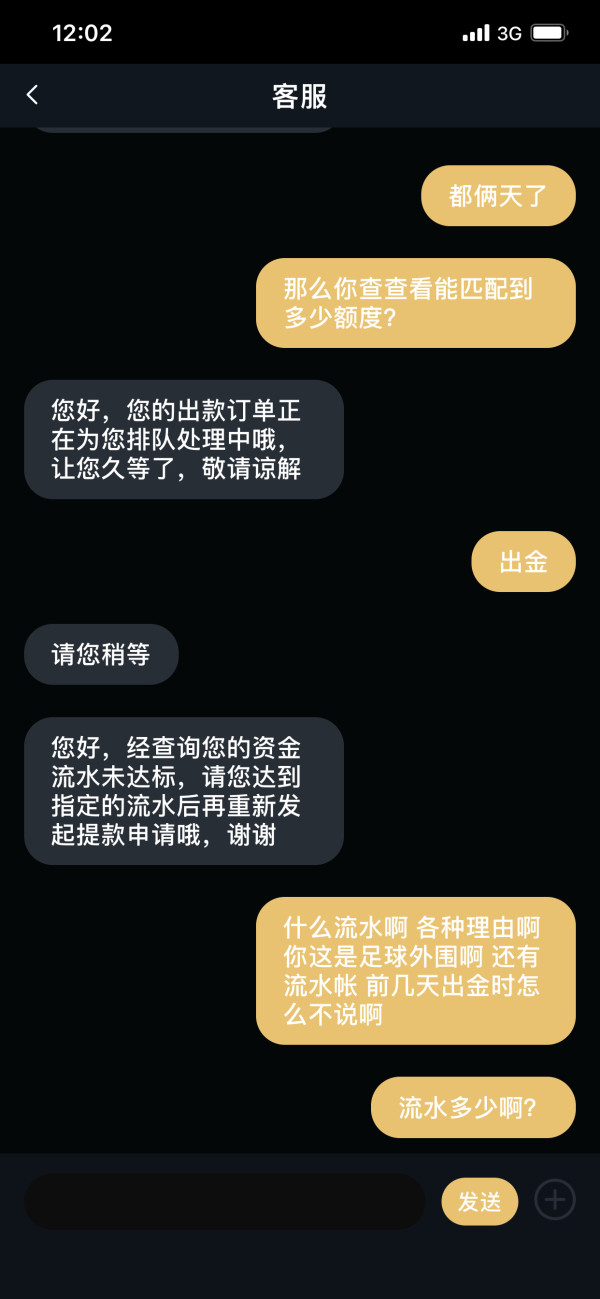

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods has not been disclosed in available materials. This makes it difficult for potential clients to assess convenience and security of fund management operations.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with Oranco Group is not specified. Available documentation does not provide clear guidance on initial investment requirements for new traders.

Bonuses and Promotions: No specific information about promotional offers, welcome bonuses, or ongoing trading incentives has been identified. The available materials do not detail any special offers or promotional programs for new or existing clients.

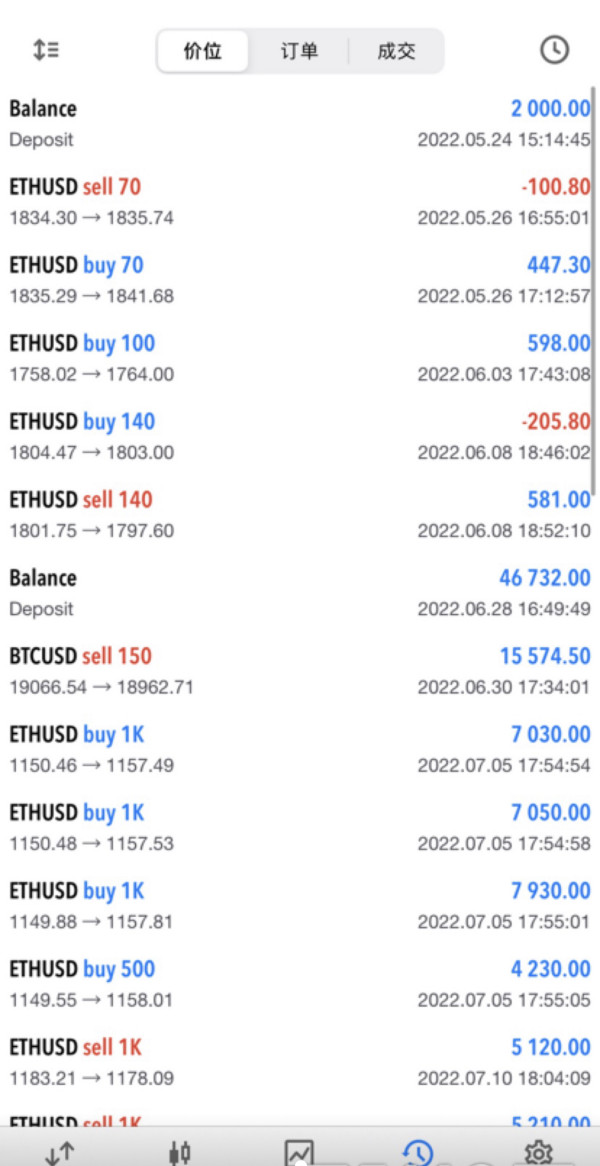

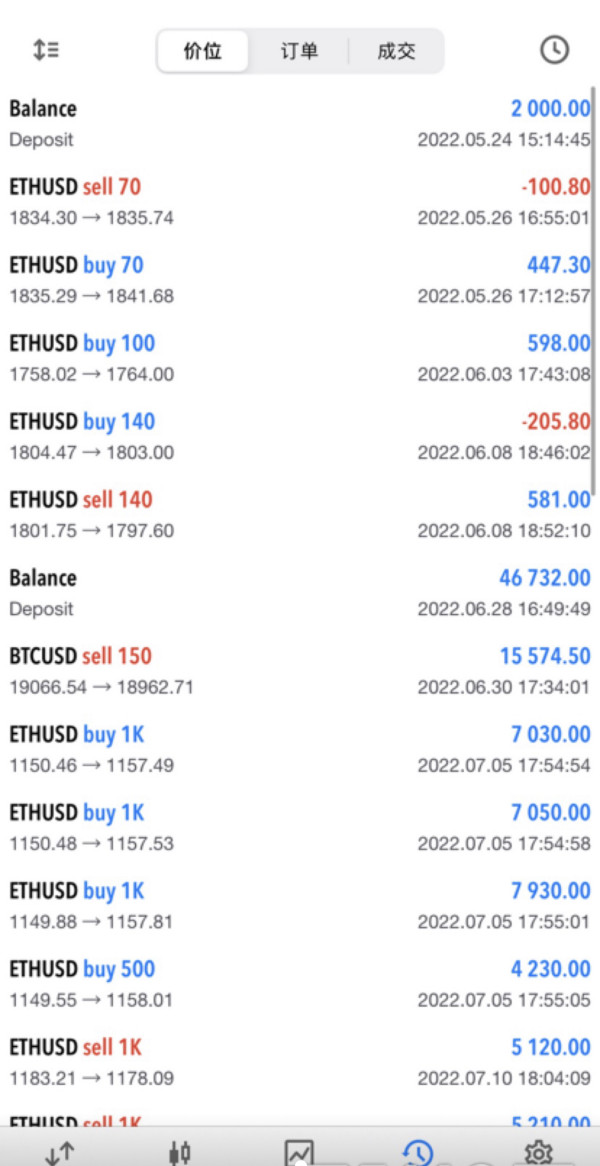

Tradeable Assets: The broker offers forex and CFD trading to their clients. The specific range of currency pairs, commodities, indices, and other instruments remains unclear from available sources and documentation.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs has not been clearly disclosed. This makes it impossible to assess the competitiveness of their pricing compared to other brokers in the market.

Leverage Ratios: Specific leverage offerings for different account types and asset classes are not mentioned. Available materials do not provide clear information about maximum leverage ratios or risk management requirements.

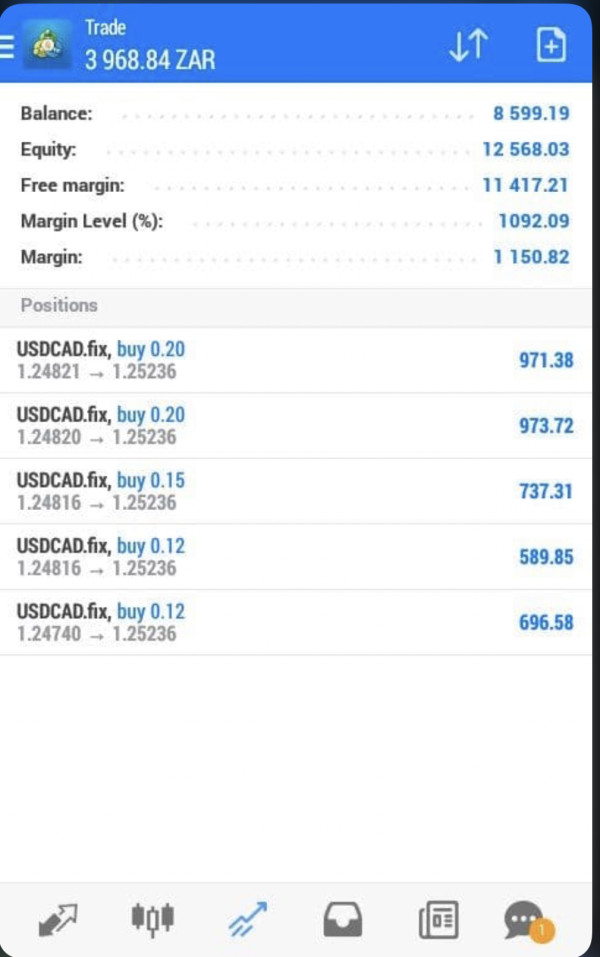

Platform Options: The trading platforms available through Oranco Group are not specifically detailed in accessible documentation. Many brokers in this category typically offer MT4 or MT5 access, but this has not been confirmed for Oranco Group.

Geographic Restrictions: Information about countries or regions where services are restricted or prohibited is not available. Current documentation does not specify territorial limitations or regulatory restrictions that may apply.

Customer Support Languages: The range of languages supported by customer service teams has not been specified. Available materials do not detail multilingual support capabilities or communication options for international clients.

Detailed Rating Analysis

Account Conditions Analysis (3/10)

The account conditions offered by Oranco Group receive a poor rating. This is due to the significant lack of transparency in available information that potential traders need to make informed decisions. Specific account types, their features, and associated benefits are not clearly outlined in accessible materials.

This makes it impossible for potential traders to make informed decisions about which account might suit their needs. The absence of clear information about minimum deposit requirements further complicates the evaluation process for prospective clients who want to understand their options. Account opening procedures and verification requirements remain unclear throughout available documentation.

This could indicate either streamlined processes or potentially inadequate compliance measures that might cause problems later. The lack of information about special account features, such as Islamic accounts for traders requiring Sharia-compliant trading conditions, suggests limited accommodation for diverse trader needs and preferences. This oranco group review finds that the opacity surrounding basic account information significantly undermines confidence in their service offerings.

Without clear details about account tiers, associated benefits, or progression requirements, traders cannot properly assess compatibility. The absence of transparent pricing and fee structures for different account types further diminishes the attractiveness of their offerings compared to more established, regulated competitors in the market.

The trading tools and resources provided by Oranco Group receive a below-average rating. This is due to insufficient information about their analytical and educational offerings that traders typically expect from modern brokers. Available materials do not detail the specific trading tools, technical analysis resources, or market research capabilities that traders can access through their platform.

This lack of transparency makes it difficult to assess whether the broker provides the sophisticated tools that active traders typically require. Educational resources, which are crucial for developing traders, are not mentioned in available documentation that we could access. The absence of webinars, tutorials, video libraries, or written educational content suggests either limited educational support or poor communication about available resources.

Research and analysis tools, including economic calendars, market commentary, and technical analysis features, are not specifically described. Available materials do not provide details about these important trading support features that most traders consider essential. Automated trading support and expert advisor compatibility remain unclear from available sources and documentation.

For traders who rely on algorithmic strategies or copy trading features, this information gap represents a significant limitation. The overall impression suggests that Oranco Group may not prioritize providing comprehensive trading tools and educational resources that are increasingly expected standards in the competitive forex brokerage industry.

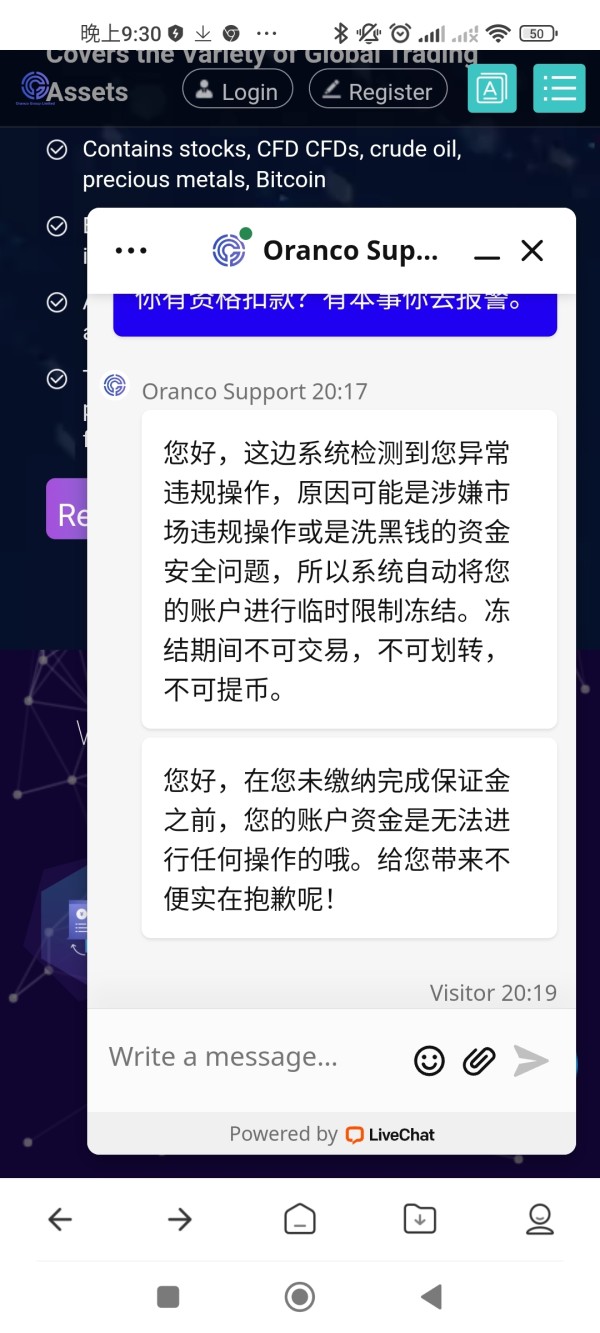

Customer Service and Support Analysis (5/10)

Customer service and support capabilities receive an average rating. This assessment is based on limited available feedback that suggests mixed experiences among users who have interacted with their support team. While some user feedback mentions response times from customer service, specific details about service quality, professionalism, and problem resolution effectiveness are not comprehensively documented in available materials.

The range of customer support channels available to traders is not clearly specified in accessible documentation. This makes it uncertain whether clients can access support through live chat, email, phone, or other communication methods that modern traders expect. Response time expectations and service availability hours are not detailed in accessible documentation.

This could lead to frustration for traders operating in different time zones or requiring urgent assistance during market hours. Multilingual support capabilities remain unclear, potentially limiting accessibility for non-English speaking traders who need help in their native language. The absence of detailed information about support team expertise and their ability to handle complex trading-related inquiries suggests either limited service capabilities or inadequate communication about available support resources.

Overall, the lack of transparency about customer service standards and capabilities contributes to uncertainty. Traders cannot be sure about the quality of support they can expect when they need assistance with their accounts or trading activities.

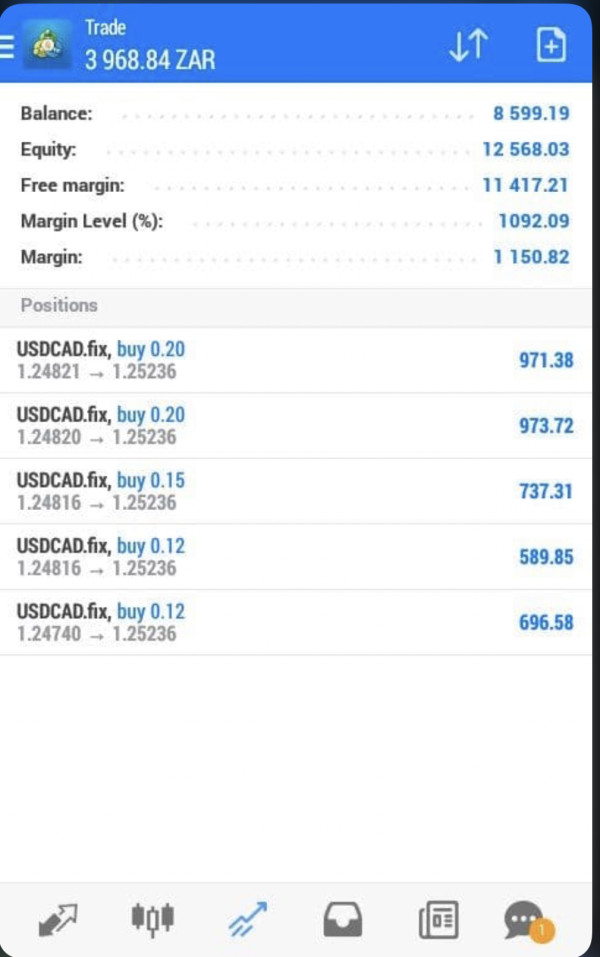

Trading Experience Analysis (4/10)

The trading experience offered by Oranco Group receives a below-average rating. This is due to insufficient information about platform stability, execution quality, and overall trading environment that traders need to evaluate. Available materials do not provide specific details about order execution speeds, slippage rates, or platform reliability during high-volatility market conditions.

This information gap makes it impossible to assess whether the broker can provide the consistent execution quality that serious traders require. Platform functionality and user interface quality are not detailed in available sources that we could access for this review. Mobile trading capabilities, which are essential for modern traders who need market access on the go, are not specifically mentioned in accessible documentation.

The absence of information about advanced order types, charting capabilities, and analytical tools suggests potential limitations. Platform sophistication appears questionable based on the lack of detailed technical specifications and feature descriptions available to potential clients. Trading environment factors such as typical spreads, liquidity depth, and market access during news events are not transparently disclosed.

This oranco group review finds that the lack of detailed information about core trading experience elements significantly undermines confidence. Their ability to provide a professional trading environment that meets contemporary trader expectations and industry standards remains questionable based on available evidence.

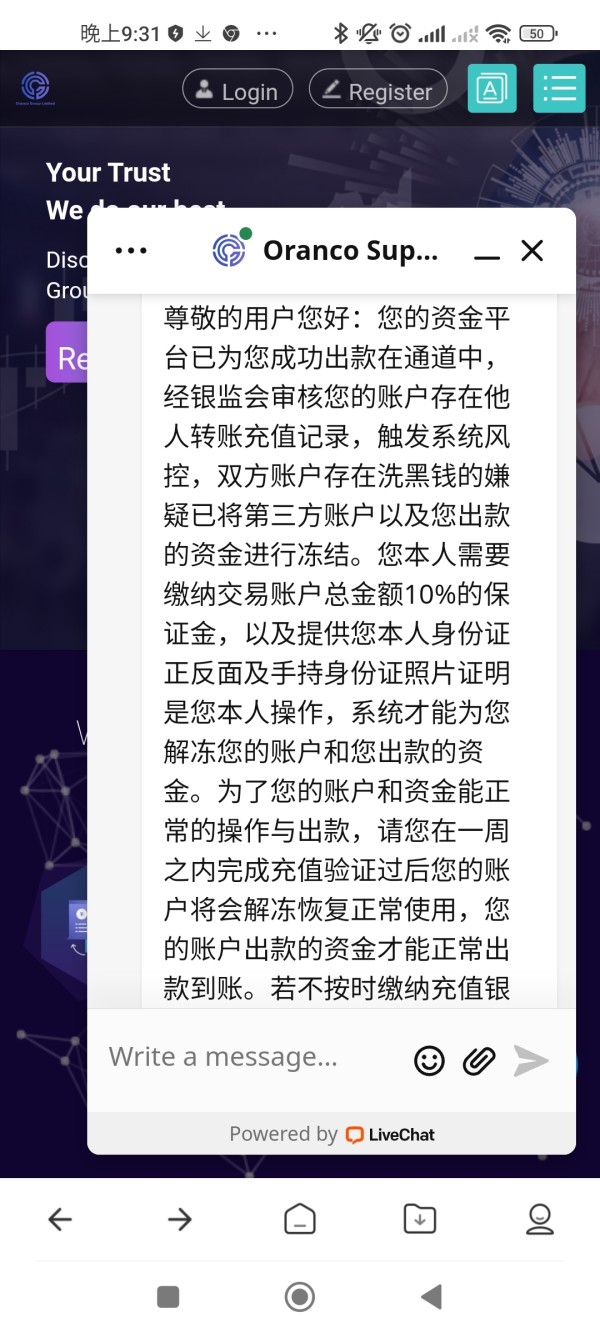

Trust and Reliability Analysis (2/10)

Trust and reliability receive the lowest rating in this comprehensive assessment. This is due to fundamental concerns about regulatory oversight and corporate transparency that affect all aspects of trader protection. The absence of specific regulatory authority supervision and licensing information represents a critical weakness that affects all aspects of trader protection and fund security.

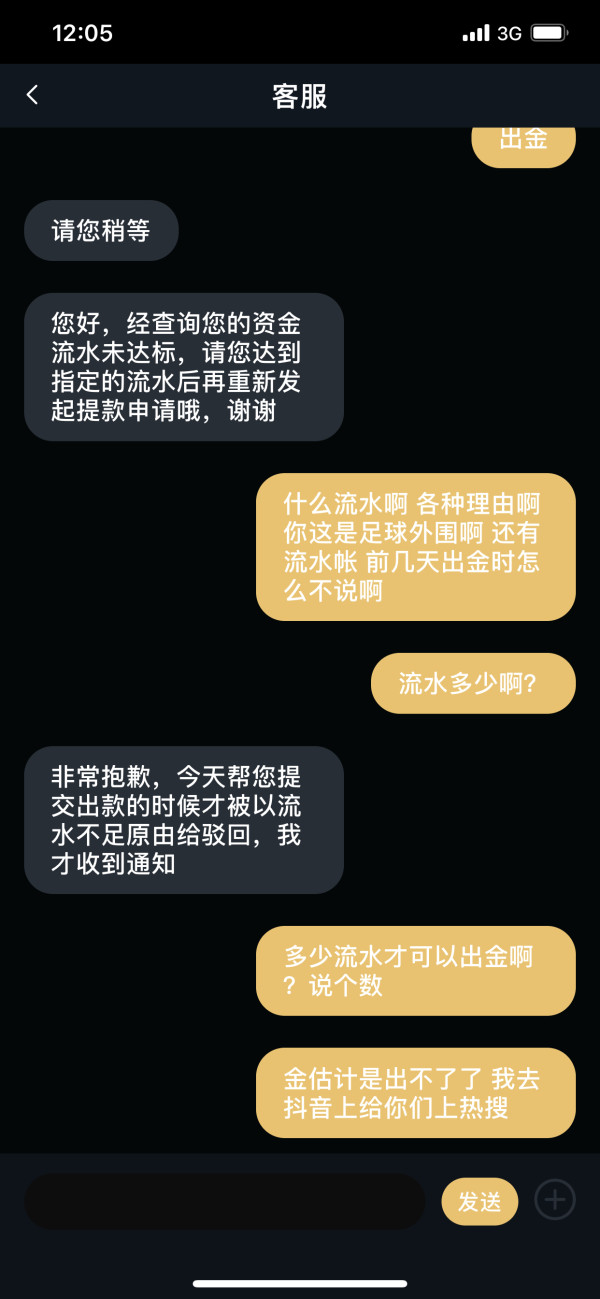

Without proper regulatory oversight, traders have limited recourse in case of disputes or operational issues that may arise. Fund security measures, including segregated client accounts, deposit insurance, and third-party auditing, are not detailed in available materials that potential clients can review. This lack of transparency about client fund protection is particularly concerning given the unregulated status of the broker.

Corporate transparency issues, including unclear headquarters location and limited disclosure about company ownership and management, further undermine confidence. These factors raise serious questions about their operational legitimacy and long-term stability as a financial services provider. The broker's industry reputation among regulatory bodies and professional trading communities appears questionable.

Available assessments from industry watchdog platforms suggest concerns about their legitimacy and operational standards. The absence of positive recognition from established financial industry organizations or regulatory commendations suggests limited credibility within professional trading circles that evaluate broker quality and reliability.

User Experience Analysis (4/10)

User experience receives a below-average rating in this comprehensive evaluation. This assessment is based on mixed feedback and limited information about interface design and operational convenience that affects daily trading activities. Available user feedback suggests divergent experiences, with some traders reporting satisfactory interactions while others express concerns about various aspects of the service.

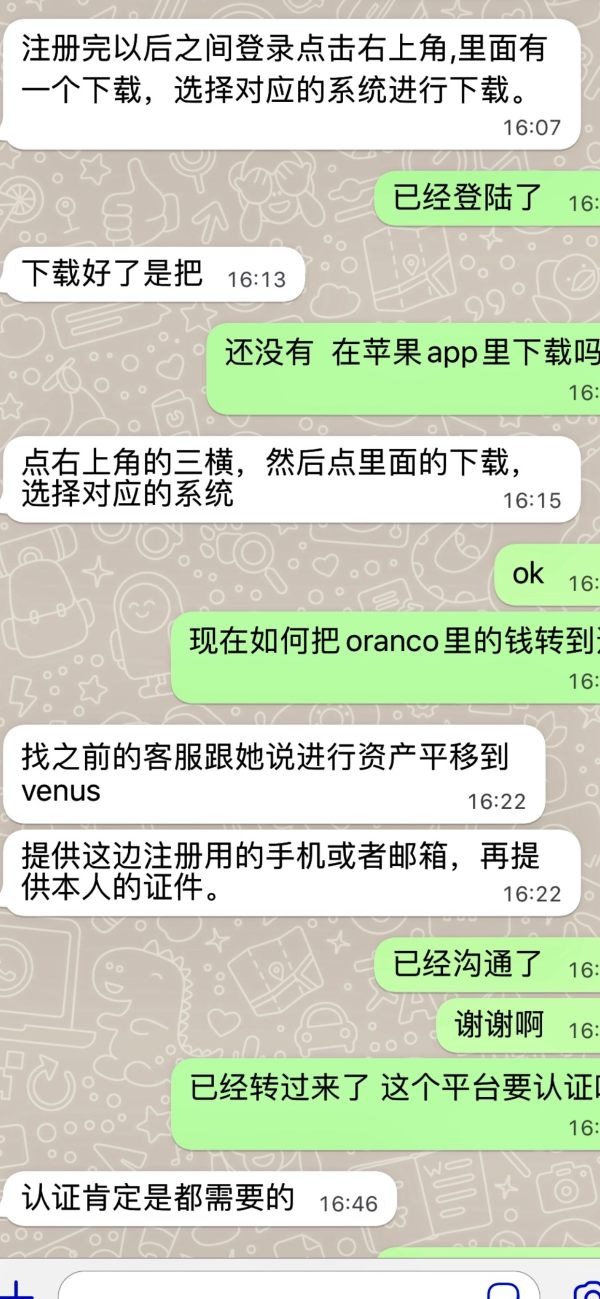

This inconsistency in user satisfaction indicates potential reliability issues in service delivery that could affect trader satisfaction. Interface design and platform usability are not specifically detailed in available materials that potential clients can review before making decisions. Registration and account verification processes are not clearly described in accessible documentation.

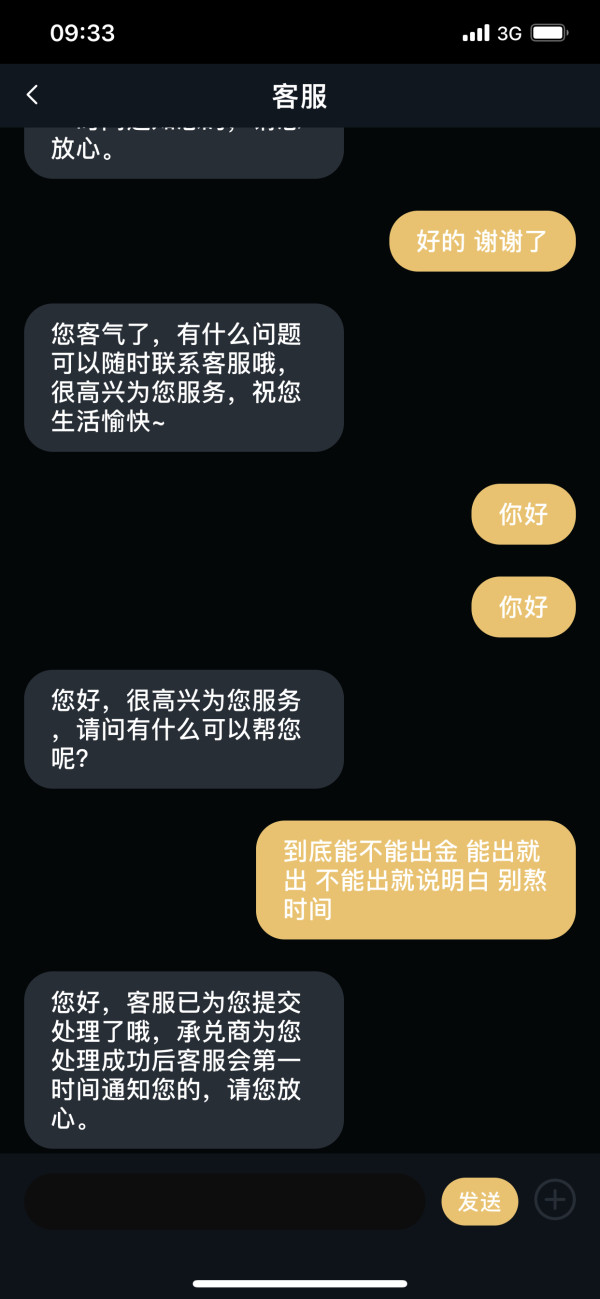

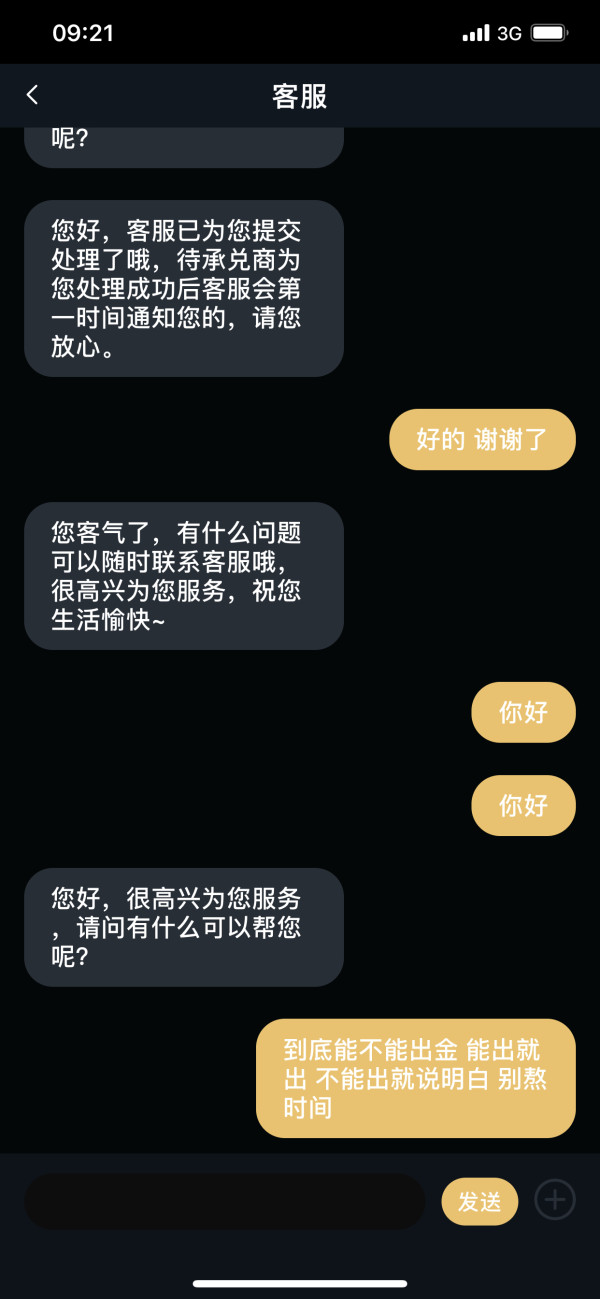

This could indicate either streamlined procedures or potentially inadequate compliance measures that might cause future complications. Fund management operations, including deposit and withdrawal experiences, lack detailed documentation in available sources that traders typically consult. Common user complaints mentioned in available feedback suggest ongoing issues that may affect overall satisfaction levels.

The absence of detailed user testimonials and case studies makes it challenging to identify specific strengths or weaknesses. Their service delivery model lacks transparency that would help potential clients understand what to expect from their trading experience with this broker.

Conclusion

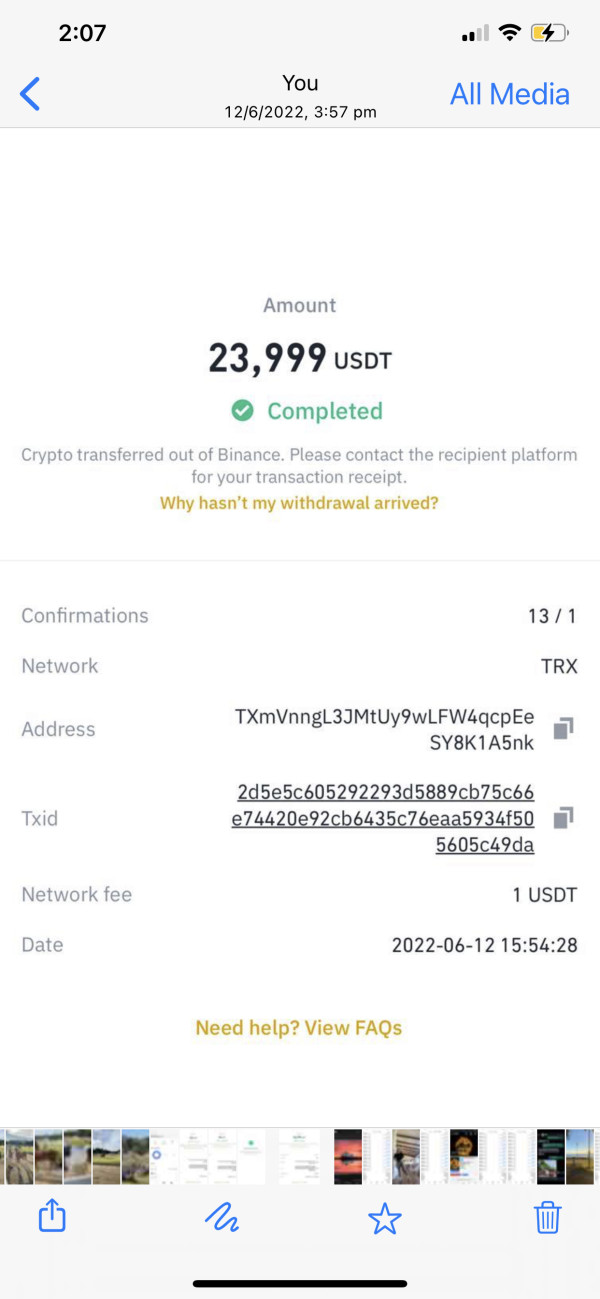

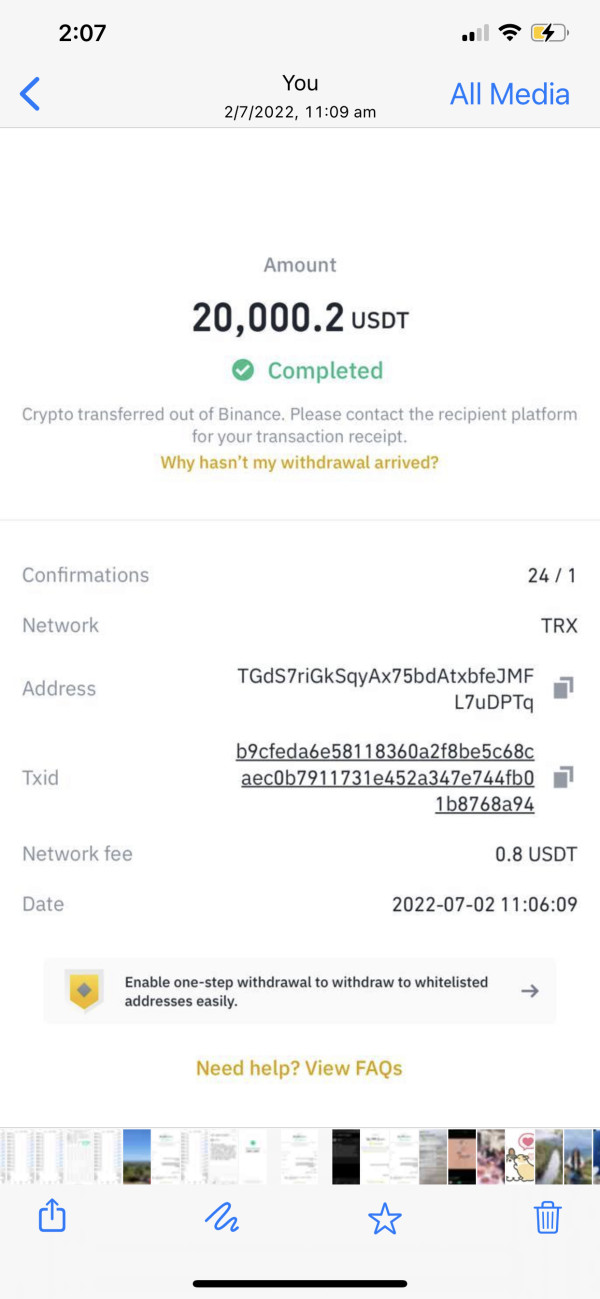

This comprehensive oranco group review reveals significant concerns about the broker's legitimacy, transparency, and regulatory compliance. Potential traders should carefully consider these factors before making any decisions about opening accounts or depositing funds with this broker. As an unregulated forex broker operating without clear oversight from established financial authorities, Oranco Group presents substantial risks.

These risks may outweigh any potential benefits for most traders who prioritize safety and regulatory protection. The lack of transparency regarding basic operational details, regulatory status, and corporate information raises fundamental questions about their reliability and trustworthiness that cannot be easily dismissed. The broker may only be suitable for traders willing to accept considerable risks associated with unregulated financial services.

Even risk-tolerant traders should question whether the limited available benefits justify these substantial concerns and potential downsides. The primary advantages appear to be some positive user feedback from clients who have used their services. The significant disadvantages include lack of regulatory protection, insufficient transparency, unclear fee structures, and limited information about trading conditions and platform capabilities that most traders consider essential.