NIC ASIA Review 1

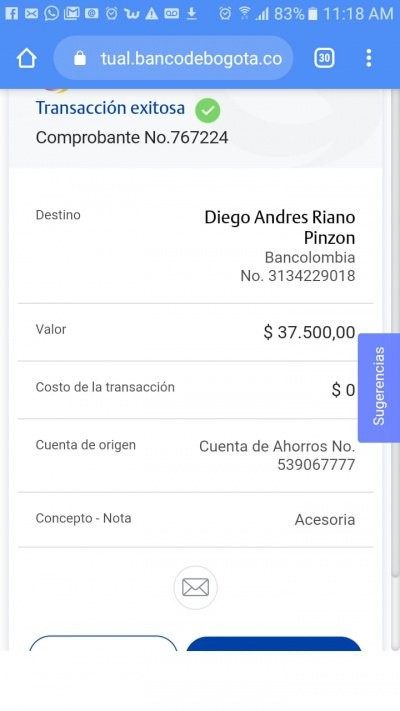

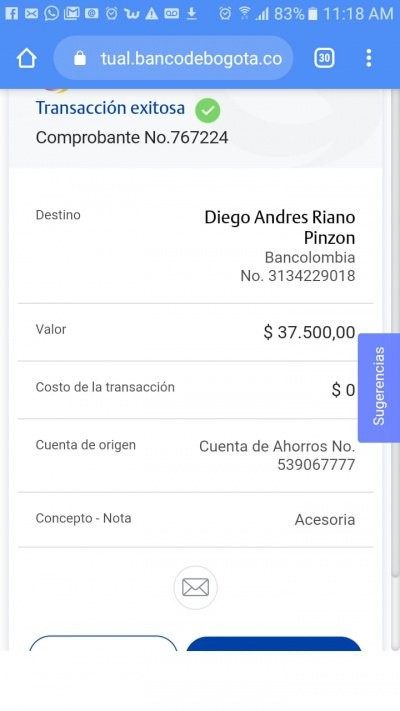

They stole 37.500 pesos from me and did not pay me the profits.

NIC ASIA Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

They stole 37.500 pesos from me and did not pay me the profits.

This Nic Asia review gives you a complete look at the financial services provider based on user feedback and market data. NIC Asia Bank has become a major player in regional banking. Their MoBank mobile app has over 1 million downloads on Google Play Store, which shows many people use it. The bank shows mixed results across different areas, with employee satisfaction ratings that change between platforms - 4.2/5 on AmbitionBox but 3.1-3.3/5 on Glassdoor.

The bank works well for retail investors and people who prefer mobile banking. It offers digital banking through their popular mobile platform. However, we found limited information about specific trading conditions, rules, and detailed services that you would expect from a complete brokerage review. This review aims to give you an honest assessment based on public data while noting the limits in detailed operational information.

This review uses mainly user feedback data, mobile app performance numbers, and public information about NIC Asia Bank's services. You should know that we could not find much regulatory information and detailed trading conditions in our sources. Our assessment uses employee reviews from job platforms, app download numbers, and limited public documents about the bank's services.

Potential clients should do extra research and check current regulatory status, trading conditions, and service availability directly with the bank before making any financial decisions.

| Dimension | Score | Rating Basis |

|---|---|---|

| Account Conditions | 6/10 | Limited information available on account types and requirements |

| Tools and Resources | 6/10 | Mobile platform with 1M+ downloads suggests basic functionality |

| Customer Service | 6/10 | Mixed employee satisfaction ratings indicate variable service quality |

| Trading Experience | 6/10 | Mobile app popularity suggests adequate user experience |

| Trust and Reliability | 6/10 | Established institution but limited regulatory transparency |

| User Experience | 7/10 | High mobile app adoption indicates positive user reception |

NIC Asia Bank works as a financial institution that provides banking and investment services in the Asian market. We could not find specific founding details in available sources, but the bank has built a strong digital presence. Their MoBank mobile app has achieved notable success with over one million downloads. The bank focuses on providing easy financial services to retail customers, with special attention to mobile banking solutions.

The bank offers capital market services through NIC Asia Capital Limited, which shows they handle stock trading and investment services. According to available information, they provide demat account services and stock trading abilities, making them a complete financial services provider. This Nic Asia review shows an organization that has successfully moved to digital banking trends while keeping traditional banking services. However, detailed information about their specific brokerage operations, trading platforms, and complete service list remains limited in public sources.

Regulatory Framework: We could not find complete regulatory information in available sources, though the bank operates capital market services through NIC Asia Capital Limited.

Deposit and Withdrawal Methods: The reviewed materials did not specify detailed information about funding methods.

Minimum Deposit Requirements: Available documentation did not show specific minimum deposit amounts.

Promotional Offers: We could not find details about current bonus or promotional structures in accessible information.

Available Assets: The bank offers stock trading services and operates demat accounts, which means equity market access. Additional asset classes were not specifically listed.

Cost Structure: The reviewed sources did not outline detailed fee schedules and trading costs, so you need to ask the bank directly.

Leverage Options: Available materials did not detail specific leverage ratios and margin requirements.

Platform Selection: The main platform appears to be the MoBank mobile application, though we could not find extensive documentation about additional platform options.

Geographic Restrictions: Service availability appears focused on Asian markets, though we could not find details about specific country restrictions.

Customer Support Languages: The reviewed materials did not specifically outline language support options.

This Nic Asia review finds significant information gaps that potential clients should address through direct communication with the bank.

The account conditions evaluation for NIC Asia shows limited public information about specific account types, minimum deposit requirements, and account features. Based on available data, the bank offers demat account services through their capital markets division, which shows basic investment account functionality. However, we could not find complete details about account tiers, special features, or Islamic account options in the reviewed sources.

The account opening process appears to use standard procedures through approved depositary participants, with NIC Asia Bank serving as one such participant. This suggests a regulated approach to account establishment, though we could not find specific documentation requirements and verification timelines. The mobile-first approach, shown by the MoBank application's popularity, suggests that account management may be streamlined for digital users.

Without detailed information about account minimums, maintenance fees, or special account features, this Nic Asia review can only provide a moderate assessment of account conditions. The bank's focus on retail customers through mobile banking suggests competitive account structures, but you need to verify specific terms through direct inquiry.

The tools and resources evaluation centers mainly around NIC Asia's mobile banking platform, MoBank, which has achieved significant market adoption with over 1 million downloads. This level of user adoption suggests that the platform provides adequate functionality for basic banking and potentially trading operations. The application's success shows user satisfaction with available features and interface design.

However, we could not find detailed information about specific trading tools, research resources, analytical capabilities, or educational materials in the reviewed sources. The bank's capital markets division suggests some level of investment research and market analysis capabilities, but the scope and quality of these resources remain unclear from available documentation.

The absence of detailed information about automated trading support, advanced charting tools, or complete market research limits our ability to provide a thorough assessment. The mobile platform's popularity suggests basic functionality meets user needs, but advanced traders may require additional information about available tools and resources before making platform decisions.

Customer service evaluation for NIC Asia presents mixed indicators based on available employee satisfaction data. The variation in ratings between platforms - 4.2/5 on AmbitionBox versus 3.1-3.3/5 on Glassdoor - suggests inconsistent service quality experiences or different evaluation criteria across platforms. This difference may reflect varying aspects of customer service delivery or different user expectations.

The widespread adoption of the MoBank mobile application suggests that users find adequate support for basic banking operations through digital channels. However, we could not find specific information about customer service availability, response times, multilingual support, or service hours in the reviewed sources. The mobile platform's success implies that self-service capabilities may be well-developed.

Without complete data on customer service channels, escalation procedures, or problem resolution effectiveness, this assessment remains necessarily limited. The mixed employee satisfaction ratings suggest potential variability in service quality that prospective clients should investigate through direct experience or additional research.

The trading experience assessment for NIC Asia relies mainly on indirect indicators, particularly the success of their mobile banking platform and their involvement in capital markets through NIC Asia Capital Limited. The MoBank application's achievement of over 1 million downloads suggests that users find the mobile experience satisfactory for their banking and potentially trading needs.

However, we could not find specific information about trading platform stability, order execution quality, trading interface functionality, or advanced trading features in the reviewed sources. The bank's provision of demat account services shows basic trading capability, but details about execution speed, slippage, or platform reliability remain undocumented.

The mobile-first approach suggested by the application's popularity may appeal to traders who prioritize accessibility and convenience over advanced trading tools. However, without detailed platform specifications, execution statistics, or user feedback specifically related to trading operations, this Nic Asia review cannot provide a complete assessment of the actual trading experience quality.

The trust and reliability evaluation for NIC Asia faces significant limitations due to limited publicly available regulatory and transparency information. While the bank operates capital markets services and provides demat account functionality, we could not find specific regulatory oversight details, licensing information, or compliance frameworks in the reviewed sources.

The bank's established presence in the banking sector and the widespread adoption of their mobile platform suggest some level of market confidence and operational stability. However, without detailed information about regulatory compliance, audit procedures, fund segregation policies, or investor protection measures, a thorough reliability assessment remains challenging.

The mixed employee satisfaction ratings and the bank's focus on retail banking suggest a traditional banking approach to operations, which may provide some stability assurance. However, prospective clients should seek complete regulatory and compliance information directly from the bank to make informed trust assessments.

User experience evaluation shows the strongest positive indicators among all assessed dimensions, mainly driven by the remarkable success of the MoBank mobile application with over 1 million downloads. This level of adoption suggests that the platform successfully meets user expectations for accessibility, functionality, and ease of use. The mobile-first approach appears well-suited to the target demographic of retail investors and digitally-oriented customers.

The application's popularity shows successful interface design and user-friendly features that resonate with a broad user base. However, we could not find specific details about registration processes, verification procedures, user interface design, or common user complaints in the reviewed sources. The high download numbers suggest positive word-of-mouth and user satisfaction, though detailed user feedback analysis was not accessible.

The focus on mobile banking and retail customers suggests that the user experience is optimized for convenience and accessibility rather than advanced trading functionality. This positioning appears successful based on adoption metrics, making the platform potentially suitable for users prioritizing ease of use over sophisticated trading tools.

This Nic Asia review reveals an institution with strong mobile adoption and established market presence, but limited publicly available information about specific trading conditions and regulatory frameworks. The organization appears well-positioned for retail investors and mobile-first users, as evidenced by their MoBank application's impressive download numbers exceeding 1 million users.

However, the significant information gaps regarding detailed trading conditions, complete regulatory status, and specific service offerings limit our ability to provide a complete assessment. Prospective clients should conduct thorough due diligence and seek detailed information directly from the bank before making investment decisions.

FX Broker Capital Trading Markets Review