Is Oranco Group safe?

Business

License

Is Oranco Group Safe or a Scam?

Introduction

Oranco Group has emerged as a player in the forex trading market, claiming to offer a range of trading services, including forex and cryptocurrency trading. However, as the forex market continues to attract both seasoned traders and newcomers, the importance of evaluating the legitimacy and safety of trading platforms cannot be overstated. Many traders have fallen victim to scams, leading to significant financial losses. Therefore, it is crucial to approach any broker, including Oranco Group, with a critical eye. This article aims to provide a comprehensive analysis of Oranco Group, using a structured evaluation framework that encompasses regulatory status, company background, trading conditions, client fund safety, customer experiences, platform performance, risk assessment, and final recommendations.

Regulation and Legitimacy

The regulatory status of a broker is one of the most significant factors in determining its safety. A well-regulated broker is expected to adhere to strict guidelines that protect investors, ensuring transparency and accountability in their operations. In the case of Oranco Group, claims have been made regarding its registration and regulation, but these assertions are met with skepticism.

Regulatory Information

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0544702 | USA | Not Verified |

Despite claiming to be regulated by the National Futures Association (NFA) in the United States, a thorough search reveals that this license cannot be verified. The absence of credible regulatory oversight raises significant concerns about Oranco Group's legitimacy. Without proper regulation, the broker may not be subject to the same level of scrutiny as regulated entities, making it a risky option for traders. The lack of transparency regarding its regulatory status is a red flag that potential investors should take seriously.

Company Background Investigation

Understanding the history and structure of a trading company is essential for assessing its credibility. Oranco Group claims to operate from Hong Kong, but details about its ownership structure and management team are largely absent. The absence of publicly available information regarding the companys executive team and board of directors is concerning. This lack of transparency can indicate potential issues with accountability and governance.

Furthermore, the company has reportedly changed its business name multiple times, which raises questions about its stability and intentions. Traders often rely on established companies with a proven track record, and Oranco Group's elusive history does not inspire confidence. A detailed examination of the company's background reveals a pattern of ambiguity that potential clients should be wary of.

Trading Conditions Analysis

The trading conditions offered by a broker significantly impact a trader's experience and profitability. Oranco Group presents itself as a competitive option, but a closer examination of its fee structure reveals potential pitfalls.

Core Trading Costs

| Fee Type | Oranco Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | Low |

| Commission Model | Unfavorable | Standard |

| Overnight Interest Range | High | Variable |

Traders have reported high spreads and unexpected fees, particularly during withdrawal attempts. These costs can erode profits and make trading less viable, especially for retail traders who often operate on tight margins. The lack of clarity regarding commissions and overnight interest rates further complicates the trading landscape for users. It is crucial for traders to understand all potential costs before engaging with Oranco Group, as hidden fees can lead to unexpected financial burdens.

Client Fund Safety

The safety of client funds is paramount in the trading industry. Oranco Group's policies regarding fund security are particularly concerning, as the broker operates without a clear regulatory framework that mandates strict fund protection measures.

Traders must ask whether their funds are held in segregated accounts, which would protect them in the event of the broker's insolvency. Additionally, the lack of information about investor protection schemes raises further doubts about the safety of funds deposited with Oranco Group. Historically, unregulated brokers have been known to engage in practices that jeopardize client funds, making it essential for potential investors to consider these risks seriously.

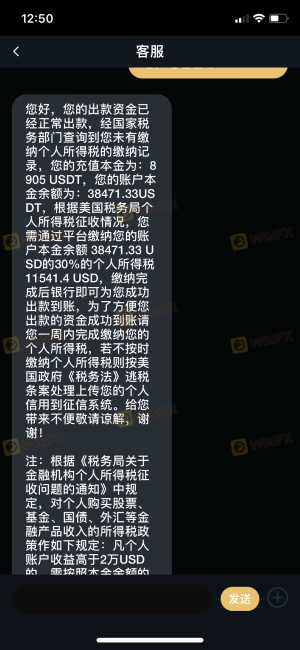

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. Unfortunately, Oranco Group has garnered a significant number of negative reviews from clients, indicating widespread dissatisfaction with its services.

Types of Complaints

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | High | Poor |

| High Fees | Medium | Inconsistent |

Common complaints include difficulties with fund withdrawals, poor customer service, and unexpected fees. Many users have reported that their withdrawal requests were denied or subjected to excessive fees, which is a significant concern for anyone considering trading with Oranco Group. The overall negative sentiment surrounding customer experiences should serve as a warning to prospective traders.

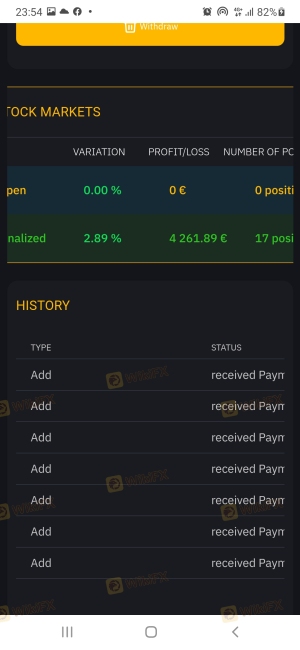

Platform and Trade Execution

A broker's trading platform is the gateway to the market for traders. Oranco Group claims to use the widely recognized MetaTrader 4 (MT4) platform; however, reports of execution issues have surfaced.

Traders have cited problems such as slippage and order rejections, which can severely impact trading outcomes. Additionally, the platform's stability and user experience have been called into question, with many users expressing frustration over technical issues that hinder their trading activities.

Risk Assessment

Engaging with Oranco Group presents several risks that potential traders should be aware of.

Risk Summary

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | High fees and poor withdrawal practices. |

| Operational Risk | Medium | Platform stability and execution issues. |

To mitigate these risks, traders are advised to conduct thorough research, limit their initial investment, and consider using regulated brokers with a proven track record.

Conclusion and Recommendations

In conclusion, the evidence suggests that traders should exercise extreme caution when considering Oranco Group as a trading partner. The lack of regulation, negative customer experiences, and questionable business practices raise significant red flags.

For traders seeking reliable options, it is advisable to consider well-established brokers that are regulated by reputable authorities. These brokers offer the necessary protections and transparency that can safeguard traders' investments and enhance their trading experiences.

In summary, Is Oranco Group safe? The overwhelming evidence points to the conclusion that it is not a safe option for traders.

Is Oranco Group a scam, or is it legit?

The latest exposure and evaluation content of Oranco Group brokers.

Oranco Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Oranco Group latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.